AU Small Finance Bank's Big Leap: Sanjay Agarwal's blueprint to break into India

Eight years after it received its licence, AU Small Finance Bank is working towards reaching the top tier in India's banking hustings

By 2015, when the Reserve Bank of India (RBI) granted its first set of 10 small finance bank licences, AU Financiers, as it was then known, was already a seasoned non-banking financial company (NBFC).

Its founder, Sanjay Agarwal, a first-generation entrepreneur, had built the business from the ground up. For two decades, he’d made commercial vehicle loans in Rajasthan. When loans went bad, he’d go personally to collect on them.

Along the way he’d survived the 1998 NBFC bust cycle. When the opportunity came in 2003, he’d worked as a direct sales agent for HDFC Bank, seeing first-hand the systems and processes that would make it the number one private sector bank. Lastly, as the business grew, he’d raised money from both Indian investors (Motilal Oswal Private Equity) and global private equity firms (Warburg Pincus).

While AU Financiers did well, its founder was also acutely aware of the limitations of the NBFC model. Raising money was a challenge and the best brains in the business preferred to work for banks. Customers would also eventually gravitate to banks for lower rates. “There is only so much we could have done as an NBFC," says Agarwal, who was searching for a way out.

Meanwhile, in Mumbai, the mandarins on Mint Street were working on fostering their pet cause—greater financial inclusion. Commercial banks had done their bit but with corporates not permitted in banking, a way had to be found to take banking deeper into rural India. The solution they came up with was to be a boon to the likes of AU.

Set up as deposit-taking institutions, small finance banks would have to meet two key criteria: 25 percent of branches in rural India, priority sector lending of 75 percent (since reduced to 60 percent). In effect, these banks were to be modelled on raising liabilities from urban India and deploying them in rural India.

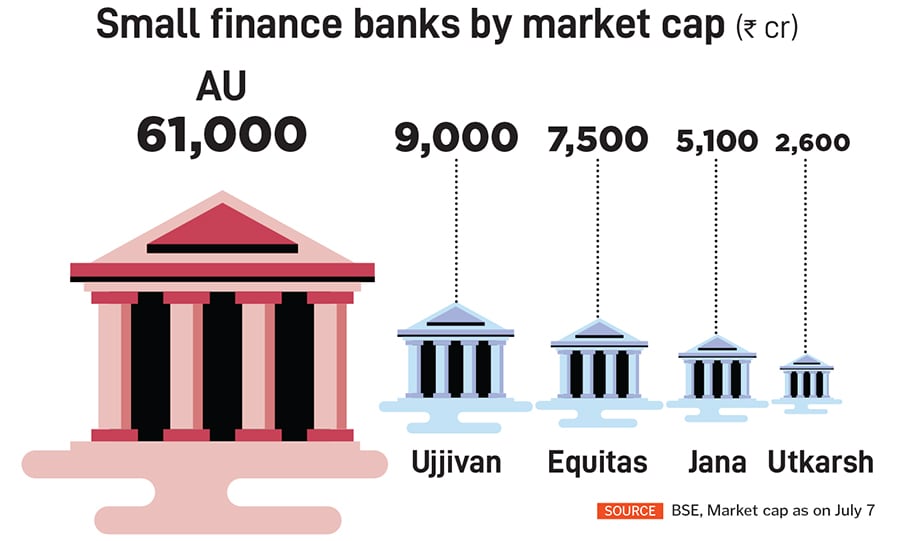

Since getting its licence, AU Small Finance Bank has proved its mettle and has emerged as the frontrunner with a market cap of ₹61,000 crore—way ahead of the second largest Ujjivan at ₹9,000 crore.

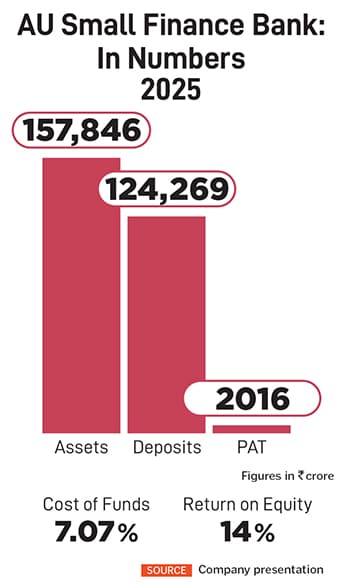

Over the last five years, its deposit base has compounded at 36 percent, from ₹26,164 crore in 2020 to ₹124,269 crore. In the same period, assets have also moved up 30.2 percent a year, from ₹42,143 crore to ₹157,846 crore. Along the way, it acquired Fincare Small Finance Bank and entered the microfinance space.

Agarwal knows he has a chance at challenging tier 2 banking names and is going about it in a systematic manner. In a 2021 interview with Forbes India, he had spoken of his vision to get to a ₹100,000 loan book in three to five years. That is a target he’s met. AU now needs to both deepen (by offering more products) and broaden its franchise (expanding its branch network). Its application for a universal banking licence is in process and a favourable outcome would give it a shot at successfully challenging tier 2 banks.

In May, a ₹371 crore commercial real estate deal may have gone largely unnoticed in the media, but among banking circles it set the cat among the pigeons. AU Bank bought 74,000 sq ft of office space on the Western Express Highway in Mumbai. The office space had earlier been leased to UPL, an agri product and crop protection player. Now AU’s branding would be prominently visible to every visitor going from the airport to the city. “Apart from free advertising, it is a very strong ‘we have arrived’ statement," says a banking industry veteran, who says that the bank is gradually getting noticed in conversations.

India’s banking landscape is littered with banks that either did not grow fast enough or lost their way. As a result, they’ve found it hard to scale up due to a lack of customer trust. Divya Sehgal, a partner at True North, sees this vast middle in India’s banking sector waiting to be tapped. Outside of the top four private sector banks—HDFC, Axis, ICICI and Kotak—it is hard to think of a private sector bank that has the potential to challenge them. Over the years, Yes Bank, IndusInd, RBL, Federal Bank, IDFC First have shown promise, but have either been bogged down by slow growth, asset quality or corporate governance issues. None of them quote at AU’s 3.5 times book valuation.

It was Agarwal’s experience in building AU Financiers that has stood him in good stead. For starters, he knew that to succeed as a bank he’d have to build a strong deposit franchise. “The day we became a bank we were very clear that the reason we became a bank was to build a deposit franchise," he says. The savings account product was revamped with a 7 percent payout and current accounts with point-of-sale terminals offered to merchants.

Importantly, both Agarwal and his lieutenant Uttam Tibrewal, executive director, knew that building the deposit franchise would be a slow and painstaking affair. Initially customers would refuse to listen to them due to the small finance bank tag.

They started getting their first level of success around 2020-21 when some accounts started shifting. These were not primary banking relationships but secondary accounts where customers were testing their services. As IDFC First Bank (and before it Yes Bank and Kotak Mahindra Bank) had successfully shown, bringing in CASA (current account, savings account) by offering higher interest rates and proper branding is possible. AU’s CASA ratio rose from 16 percent in 2020 to 29 percent in March 2025. At the same time, AU broadened its offerings to include services like credit cards.

On the asset side, Agarwal had been clear that he would stay away from unsecured lending. “If I can’t repossess my security, then it is not a business I am interested in," he says. This is a philosophy he has had since 1995. At AU, his main lines of business continue to be vehicle financing, which make up a third of the book, mortgage-backed loans that make up another third, and commercial loans 21 percent.

Unsecured lending—personal loans, microfinance, credit cards—together make up a minuscule 8.6 percent. “The only area we don’t lend to is corporate finance. That is a function of our cost of funds. As that comes down, we can lend there too," says Tibrewal. Gross NPAs have stayed in check with at 2.28 percent in March 2025.

As AU expands its franchise, the market is already re-rating it for the next leg. At a market cap of ₹61,000 crore, the bank trades at a price to book multiple of 3.5 times higher than each of its larger rivals— HDFC, ICICI, Kotak or Axis. Both its deposit franchise (expanding rapidly since it roped in Bollywood actor Aamir Khan as a brand ambassador) and asset engine are expanding rapidly.

Going forward, three factors will play a key role in determining how it challenges the top tier banks in India. First, is the cost of funds. At 7.07 percent, this is higher than the 10-year G-sec by 80 basis points. This means that about 30 percent of its deposits are at a negative yield.

Going forward, three factors will play a key role in determining how it challenges the top tier banks in India. First, is the cost of funds. At 7.07 percent, this is higher than the 10-year G-sec by 80 basis points. This means that about 30 percent of its deposits are at a negative yield.

Agarwal points to other banks like Yes Bank and Kotak that had to offer a higher savings account rate to attract deposits in 2012 when savings bank rates were deregulated by the RBI. Now Kotak offers 2.75 percent on savings accounts and has a CASA ratio of 43 percent. AU expects to have a similar journey. As of now, its cost of funds is 200 basis points higher than its rivals, plus its branch-led model adds to customer acquisition costs.

Second, is making rapid course corrections. Its experience with credit cards is instructive where the bank admits it did take some missteps in sanctioning cards. The spending limits assigned were on the higher side and while the product team that marketed the cards was stable, there was a lot of churn on the credit team. Since then, course corrections have been made. “We have been cracking down on ways to take out money through rent, school fees and so on," says Vivek Tripathi, chief credit officer at AU Small Finance Bank.

What AU does with its microfinance book remains to be seen. The sector has seen an extended downcycle and the bank has run the book down by 10 percent in the year ended March 2025. Sehgal of True North says the business will result in disproportionate profitability in an upcycle, but that is not the time to get excited and go for scale. Similarly, one just has to ride out the down cycle. Regardless, the Fincare acquisition gave AU access to a branch network in southern India and a set of customers that it can sell its products to.

Third, the shift to Mumbai. It is often said that it is impossible to create a national bank without being headquartered in Mumbai. This was something Agarwal realised once he received his licence. Over the years he has put in place a policy to shift personnel from Jaipur to Mumbai. In 2018, Tibrewal shifted and the team in Mumbai has swelled from 70 to 800 employees. “This one decision contributed a lot to the growth of the bank." Agarwal for the most part operates out of the financial capital and says hiring (and retaining) talent is a lot easier.

If the last five years are anything to go by, AU has set itself up well for the next decade. Agarwal is cognisant of the fact that the reputation of the bank is paramount and there mustn’t be even the whiff of a failure of governance. He points to how it keeps engaging with employees, customers, regulators, investors and the board to make sure everyone’s interests are aligned. The bank is hoping for a five-year run like HDFC Bank had from 2010 to 2015 when its book grew 30 percent every year. If AU manages that, it would have a good chance at being counted and spoken about with the top tier of Indian banking.

First Published: Aug 08, 2025, 17:32

Subscribe Now