Banks post poor earnings in Q1 FY26

The June-ended quarter has been sluggish with banks reporting poor margins and low demand for loans

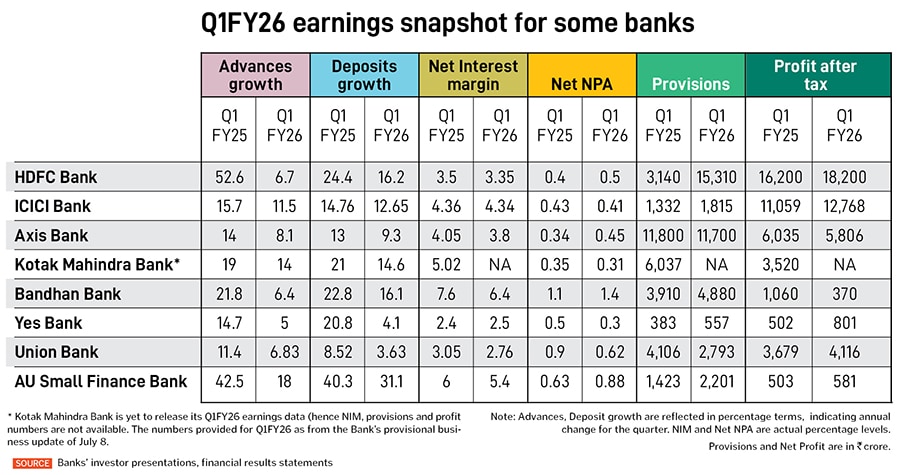

At a time when the Reserve Bank of India (RBI) is pushing for growth through several interest rates cuts, FY26’s June-ended quarter has been weak for several of India’s lenders. Data announced so far from banks indicate that demand for loans has been slow, margins have been poor and provisions for bad loans and slippages have increased (see chart).

After the earnings announcement, HDFC Bank and Axis Bank have been downgraded by ICICI Securities research to an ‘Add’ investment rating from a ‘Buy’, while Nuvama Institutional Equities has downgraded Axis to a ‘Hold’ rating, as its net interest margins (NIM) and net NPAs (non-performing assets) for the June-ended quarter fell. Motilal Oswal Financial Services has downgraded Union Bank to a ‘Neutral’ rating from a previous ‘Buy’.

Equirus Securities has revised the investment rating for AU Small Finance Bank to ‘Add’ from ‘Long’, HDFC Bank’s and ICICI Bank’s investment ratings remain unchanged at ‘Long’ and ‘Add’, respectively. Union Bank has been lowered to a ‘Reduce’ from ‘Add’ rating.

When interest rates come down, the loan book for most banks—linked to the external benchmark lending rates (EBLR)—gets repriced automatically. For most banks, the proportion of the loan book linked to EBLR would be around 60 percent. But in the case of deposit rates, they tend to adjust with a lag. So, there is a pressure on the interest margins for banks.

“Q2 will be the most difficult for banks because of the impact of the RBI 50 bps rate cut seen in June… so loan book for banks will get repriced in three months," says Prashant Kumar, CEO of Yes Bank. Kumar has got a six-month extension in his term from the RBI, starting October 6.

While EBLR loans quickly adjust to policy rate changes, deposit rates, especially fixed-term deposits, tend to adjust with a lag, creating margin pressure.

Anand Dama, Emkay Global Financial Services head of BFSI, tells Forbes India: “Net interest margins are expected to remain sluggish for most banks over the next two quarters with some hope of recovery in the fourth quarter. However, if there are further rate cuts, then the recovery could be delayed."

Nitin Aggarwal, head-BFSI (institutional equities) at Motilal Oswal Securities, says: “NIMs have declined sharply across most banks (ICICI Bank though reported a controlled 7 bp decline) and we expect margins to hit a trough in Q2FY26, following which we could start to see a recovery."

Rohan Mandora, associate director of Equirus Securities, agrees with Aggarwal. “NIMs are likely to remain under pressure for another quarter as the full pass-through of repo rate cuts flows through to yields on advances. We expect NIMs to bottom out for most banks by 2QFY26 as 3QFY26 will see benefits coming from cash reserve ratio, cuts coupled with lower cost of funds from term deposits repricing."

Axis Bank’s chief financial officer Puneet Sharma explained the future trend to analysts at an interaction on July 17. “We think about margins on a through-cycle basis. We do not think of margins on a sequential quarter basis. The cycle should be measured broadly in terms of the duration of our assets and liabilities."

“And if you put them in the 15-month, 18-month range, over a period of 15 to 18 months, the rate cycle shows you a drop… you will first see a drop in margins and then a recoupment of margins," he adds.

Post the earnings data, HDFC Bank’s CEO Sashidhar Jagdishan told analysts the bank was ready to “get back into momentum from a slowing down which was seen last year. We see healthy demand for loans from the rural sector". He was also optimistic that urban India consumption, which has been slowing, could start to improve with the onset of the festive season in August.

Rural, retail, MSME and corporate lending are starting to see a pick-up in demand for loans, the bank’s management said.

Sanjay Agarwal, founder, MD & CEO, AU Small Finance Bank, told analysts that the policy environment has “turned supportive"—with easing inflation, surplus liquidity and forthcoming CRR cuts. But he cautions that the “economic momentum remains uneven, and signs of demand recovery are still emerging across sectors".

Emkay’s Dama says credit growth will take time to revive. The unsecured loan segment remains stressed, and it will keep growth depressed and credit cost high.

Motilal Oswal’s Aggarwal says that though credit growth has been largely muted in Q1, a recovery can be expected in the coming quarters. “We estimate a growth of 11.5 percent for FY26 as we expect demand environment to improve aided by lagged impact of reduced tax rates, reduction in borrowing costs and some uptick in corporate demand as credit substitution via bond-market wanes," he says.

Equirus’s Mandora forecasts credit growth to improve in seasonally strong 2HFY26 supported by a favourable monsoon which will drive up rural demand, income tax cuts putting higher cash flows in the hands of the salaried and transmission of repo rate cuts even on fresh loan rates improving affordability on credit.

Hence margins will need to be watched closely as will asset quality levels for specific banks (including small finance banks and pure microfinance firms), which have a substantial microfinance exposure. Aggarwal, however, says “large private banks appear relatively well placed and we may selectively see some recovery in unsecured loan growth for these banks over the second half of the fiscal".

First Published: Aug 05, 2025, 11:01

Subscribe Now