How Bajaj Finance is building bridges for its workforce

With 90 percent of its employees in remote places, Bajaj Finance goes the extra mile to connect 1,800 locations with the headquarters

Under Rajeev Jain’s leadership, Bajaj Finance has garnered 34 million customers to date

Under Rajeev Jain’s leadership, Bajaj Finance has garnered 34 million customers to date

Image: Vikas Khot[br]A meeting with Bajaj Finance’s managing director Rajeev Jain during the peak of the NBFC crisis, which the sector had been going through last year, revealed his biggest concern. Towards the end of the conversation—after talking at length about how he managed the company’s asset liability mismatch—Jain, in November 2018, said the biggest challenge he faced was to “retain talent”.

Being the largest non-banking financial company by market capitalisation and being focussed in the consumer finance space, nearly 90 percent of Bajaj Finance’s workforce (over 16,000 employees out of 18,300) are on the ground and often in remote parts of India, selling consumer finance loans. Branch or people disconnect with the headquarters can be a real issue, at the 1,800 locations the company has.

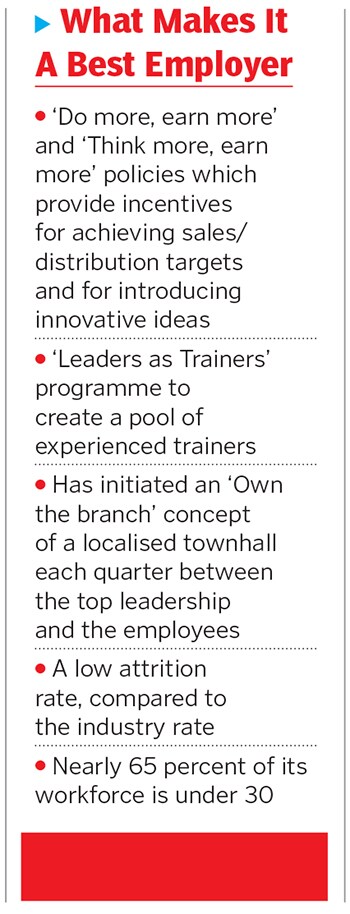

Bajaj Finance is trying to solve this through a recent programme called ‘Own the branch’, where the senior management meets employees—in clusters of 30 or more—at localised townhalls. There are 146 such clusters created by the company where meetings take place each quarter.

“We address queries and it helps us engage with a large distribution force,” says Anupam Sirbhaiya, chief HRO. The company has introduced a business platform which combines social media and internal videos to disseminate information to branches in rural India so that they have a constant connect with the top leadership.

Bajaj Finance also adopts a ‘Do more, earn more’ programme, Sirbhaiya said, which offers quarterly incentives for sales and distribution staff for their ability to convert clients and loans booked. This programme has been extended to ‘Think more, earn more’ where employees are offered financial rewards for innovative ideas they have introduced and run successful pilots of.

Under Jain’s leadership since September 2007, Bajaj Finance—with a clear strategy to focus on mass-affluent customers and cross-sell its products—has garnered 34 million customers to date. It is the top lender in consumer electronics, digital and lifestyle products, helping fund one out of every four flatscreen TV sets sold in the country.

The company has an attrition rate of 18 percent, according to Aon’s data, while India’s banking industry is estimated to have an attrition rate of around 18-25 percent.For a pan-India presence, one of the unique offerings Bajaj Finance has includes an IJP (internal job postings) which provides employees, at least 15 months old in the organisation, with the option of lateral movement. In FY19, about 27 percent of employees exercised it.

A strong brand and visibility means that Bajaj Finance has acquired enough attention from millennials. Of the total workforce, about 12,000 are below the age of 30. This brings a new set of challenges for the company leadership. In rural India the young professional seeks to improve earning standards and build a career while in urban India they seek to find fulfillment in the job.

One of Jain’s—and holding company Bajaj Finserv’s MD & CEO Sanjiv Bajaj’s—strategies has been to push its managers to constantly innovate and urge them to think of the business like an entrepreneur, rather than just an employee.

Bajaj Finance has an employee engagement percentage of 89 percent—compared to an average of 73 percent for the industry and an engaging leadership index of 93 percent (industry average of 76 percent), Aon’s internal data shows.

Another key HR initiative is “Leaders as Trainers” which aims to create an internal talent pool of expert trainers and to deliver knowledge- and skill-based training within the organisation.

The programme also benefits the associated facilitators by improving their leadership and people development skills.

“Every organisation wants the right message to be sent out to the vast taskforce. Also no company can afford a disconnected taskforce or a branch. Which is where practices such as ‘Own the branch’ are very important and useful,” says Anjali Raghuvanshi, chief people officer, Randstad India, a leading HR firm. “Companies also need to leverage on technology to ensure alignment of goals. But it needs to be frequent and be a platform where employees not just listen but also speak up.’

First Published: Aug 07, 2019, 09:36

Subscribe Now