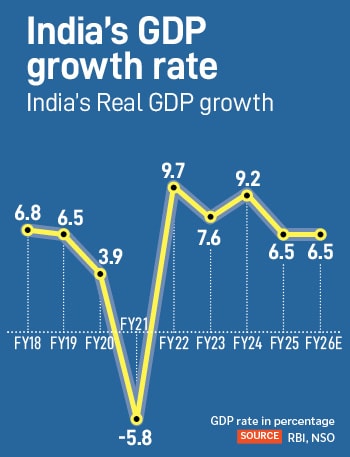

At a time when India’s policymakers and export-oriented companies are concerned over future trade and growth with the United States—in the wake of the threat of a further hike in trade tariffs from President Donald Trump—the central bank has kept the GDP growth forecast for FY26 unchanged at 6.5 percent, at the latest monetary policy meeting on Wednesday.

While keeping interest rates unchanged at 5.5 percent, RBI Governor Sanjay Malhotra said the central bank had already factored in global uncertainties and lowered the growth forecast in previous policy meetings. The RBI had cut interest rates at its previous three policy meetings by 100 basis points. “There are still more uncertainties, and it is difficult at this stage to predict their impact. We will look at incoming data and there is not sufficient data to revise GDP growth at this stage," the governor told the media on Wednesday. He also said he did “not foresee" the possibility of retaliatory tariff from India against the US.

Malhotra also dismissed concerns of whether inflation would get impacted if imports became expensive in coming months. India’s main import is oil from several countries, including Russia. “If the mix changes, what is its impact on prices, what is the global commodity prices of crude, it will depend on all that. And the other thing it will depend on is how much of its impact, downwards or upwards, is actually taken by the government in the form of excise duties and other tariffs. So, we don’t see any major impact, as of now, because of this on inflation…," he told the media.

India’s decision to buy oil from Russia has irked

President Trump, who has threatened to further increase trade tariff on India in the next 24 hours (August 7). India has called this threat unjustified and unreasonable.

Economists are not too concerned about whether the RBI will react immediately to a further increase in trade tariffs from the US.

Madan Sabnavis, chief economist at Bank of Baroda, said there is a limit to which interest rates can impact growth. “We foresee a 10-15 percent fall in exports and we do not expect the tariff to impact growth in a substantial way," he told Forbes India. He has projected India’s GDP growth at 6.4 percent for FY26.

HDFC Bank’s principal economist Sakshi Gupta said that “de facto, the space for the RBI to cut interest rates further remains, given the inflation projection for the next three quarters. However, the decision to cut rates would depend on how GDP growth progresses. The tariff impact cannot be seen unilaterally," she told Forbes India.

![]()

She said that 25 percent trade tariff or higher will be a drag on growth. However, the positive momentum which we are seeing in some sections of domestic activity, combined with monetary easing, has been delivered.

“At this stage to assess if we will see the downside risk of growth is uncertain. There is the pace to cut rates further but unless the tariff situations worsen considerably and sustains, in the absence of that, from a monetary policy rate perspective, we are at the bottom or close to the bottom," she added.

Gupta has projected India’s GDP growth for FY26 at 6.3 percent, lower than RBI’s own forecast. “In the case where tariffs remain elevated at current levels and or are further raised, we see a downside risk of 20-25 basis points to our GDP growth forecast for the year," she said in a note to clients.

Kranthi Bathini, equity strategist at WealthMills Securities, also allayed concerns over higher trade tariff. “Our energy requirement is very important and we have various options open. We need to watch how the trade issues escalate or de-escalate. The impact of the tariff looks volatile in the short term but I do not expect a significant impact in the medium to long term," he told Forbes India.

She said that 25 percent trade tariff or higher will be a drag on growth. However, the positive momentum which we are seeing in some sections of domestic activity, combined with monetary easing, has been delivered.

She said that 25 percent trade tariff or higher will be a drag on growth. However, the positive momentum which we are seeing in some sections of domestic activity, combined with monetary easing, has been delivered.