Investors cool on defence and manufacturing funds amid market volatility

Even as there is emphasis by the government on manufacturing and defence in India, investors are losing interest in mutual fund schemes themed on those

Theme-focussed funds rode on optimism as the government prioritised manufacturing, defence, and innovation through policy incentives and budgetary support. But investor appetite for mutual funds with these themes now seems to be waning, resulting in low inflows or redemption pressure.

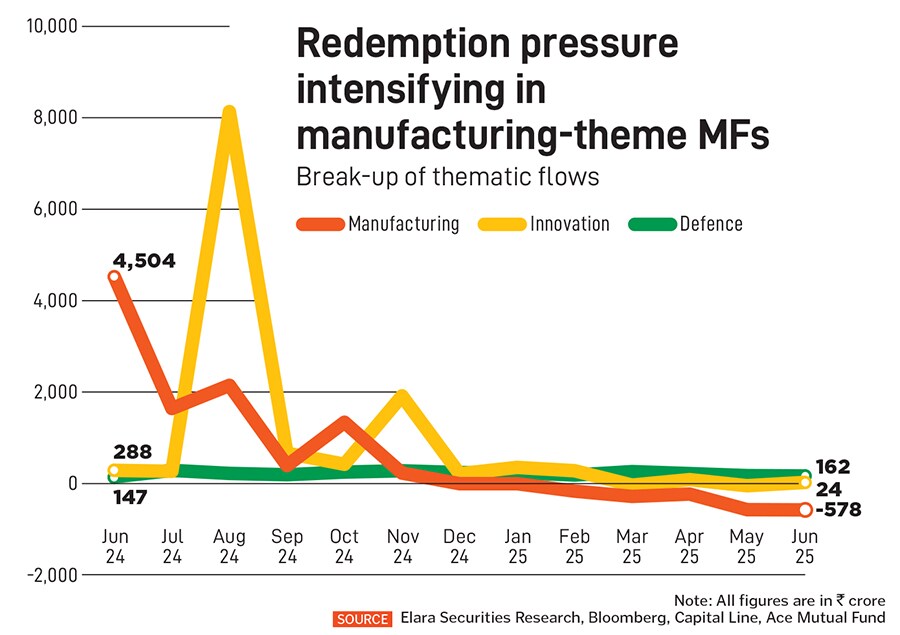

Redemption in manufacturing (within thematic schemes) was at a seven-month high in June at ₹578 crore, shows latest data from the Association of Mutual Funds in India (AMFI). This compares to a redemption of ₹573 crore in May.

Net inflows into manufacturing have been consistently under intense redemption pressure. In June last year, manufacturing-themed focussed funds received a net inflow of ₹4,504 crore. However, net inflow into these funds thereafter declined month after month to gradually turn into a redemption of ₹7 crore last December. (Redemption is partial or full exit of investors from mutual fund schemes.)

“The most pronounced investor enthusiasm since 2023 was seen in manufacturing, innovation, business cycle and infrastructure-themed funds. However, manufacturing has already witnessed redemptions over the past few months, and inflows into other categories have also decelerated," says Sunil Jain, analyst, Elara Capital.

Net inflows into defence-themed funds, too, have slowed to ₹162 crore in June from ₹168 crore in previous month. This compares to a net inflow of ₹258 crore in July and ₹147 crore in June last year.

According to Jitendra Sriram, senior fund manager-equity, Baroda BNP Paribas Mutual Fund, some part of the redemption in the manufacturing category could probably be attributed to the flat performance of Nifty India Manufacturing index (on a one-year basis) as broader markets have seen slightly better returns. “In our view, the longer-term case for manufacturing remains intact, with the government taking numerous initiatives to lift the share of manufacturing within the GDP like production linked incentives (PLI)," he says.

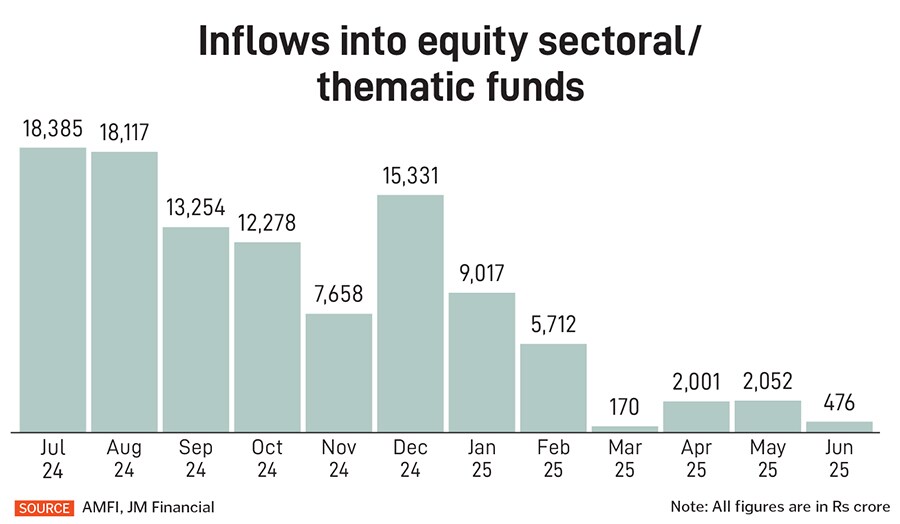

Looking at it from a larger perspective of investor sentiment, net inflows into overall thematic and sectoral funds have also declined, slipping to ₹476 crore in June, shows AMFI data. This compares to a net inflow of ₹2,052 crore in thematic and sectoral funds in May and a whopping ₹18,386 crore in July last year.

In the last few years, the government has been pushing schemes like the ‘Make in India’ campaign to incentivise home-grown products in India or promoting Atmanirbhar Bharat.

A look at the performance of the defence and manufacturing index is indicative of the interest shown by investors. For instance, the Nifty India Defence index jumped 37 percent from January to June period, gaining 2 percent in June. In contrast, benchmark Nifty rose 8 percent in the first six months of the year, adding 3 percent in June.

However, MF schemes based on such themes are losing allocation of money by investors. Amey Belorkar, senior vice president, IDBI Capital Markets & Securities, notes a few reasons for the slowdown. First, short-term profit booking after an initial surge in stock prices across listed defence and manufacturing firms. Second, limited understanding among retail investors about the gestation periods and procurement cycles involved in defence projects. Third, muted marketing of defence as an investment theme compared to technology or banking.

“The long gestation nature of defence projects contrasts with the shorter timeframes most mutual fund investors are comfortable with. The ecosystem is still evolving—both in terms of domestic vendor capabilities and integration with global original equipment manufacturer (OEMs)," he says, adding that, after the initial enthusiasm, market participants are seeking tangible execution and delivery.

However, he sees the slowdown in inflows as a temporary pause rather than a reversal. “Investor confidence isn’t necessarily lost—it’s recalibrating," says Belorkar, adding that awareness, patience, and alignment of mutual fund offerings with the real business cycles of these sectors is needed. He expects a strong rebound in mutual fund allocations to these themes once policy execution aligns with capital flows and earnings visibility improves. “As strategic orders (especially exports) start converting into deliveries and revenues, investor confidence should return," he says. That apart, steep valuations have also led mutual fund investors to reassess and adjust their positions in schemes focussed on manufacturing and defence.

According to Sriram, defence as a sub-theme within manufacturing got a massive leg-up on valuations after the border skirmishes in April and May. “Emergency procurement, stock refilling by the services and certain large awards catalysed the sector leading to a sharp up move in stocks probably a little ahead of the lift-up in earnings. This may have prompted certain investors to take profits and deploy elsewhere," he says.

Meanwhile, the Nifty India Manufacturing index jumped 5 percent in January to June, while gaining 3 percent in June.

“A small subset of investors could be more momentum driven or seeking more instant gratification which could explain this shorter-term holding horizon," says Sriram. Defence can be a narrow theme as it is very specific with largely one buyer—the services, while manufacturing encompasses auto, industrials, chemicals, healthcare, energy, commodities etc which logically makes it less volatile than a narrower segment.

“In our view, the percentage of the total industry corpus in defence and manufacturing is still small," says Sriram.

Deputy Chief of Army (Capability Development and Sustenance) Lt-Gen Rahul Singh during the ‘New Age Military Technologies’ exhibition in New Delhi in JulyImage: Arun Kumar/ The India Today Group via Getty Images

Deputy Chief of Army (Capability Development and Sustenance) Lt-Gen Rahul Singh during the ‘New Age Military Technologies’ exhibition in New Delhi in JulyImage: Arun Kumar/ The India Today Group via Getty Images

Being the fourth-largest defence spending country, India is also one of the fastest growing defence markets. As part of the government’s Viksit Bharat 2047, which envisions India as a developed nation by 2047, India will develop multifarious capabilities across the board, including defence.

About 13 percent of India’s total national budget is allocated to the defence sector with 25–30 percent earmarked for capital expenditure. For FY26, capex budgetary allocation for defence stands at $21 billion. The budgetary allocation will facilitate equipping the armed forces with cutting-edge, niche technology, lethal weapons, fighter aircraft, ships, platforms, UAVs/drones and specialist vehicles.

India is among the top five defence spending nations in the world, top three for foreign raw material procurement (imports) and a rising exports giant (exports to 84 countries). India’s defence production surged to ₹1.3 trillion in FY24 compared to ₹74,100 crore in FY17. Of this, PSUs make up a larger mix (70–80 percent), and private firms’ share has steadily risen to 20–30 percent currently.

Indian defence stocks across the spectrum have re-rated explosively over the past two–three years on back of improved visibility.

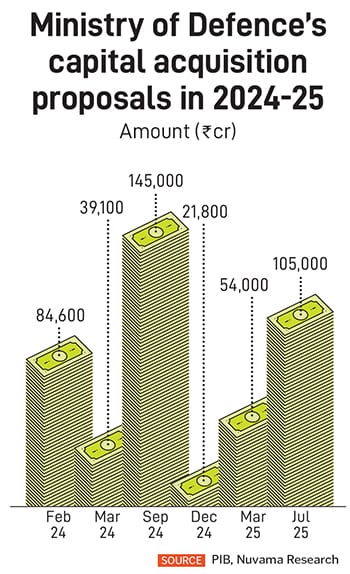

“The ammo came from the government’s indigenisation drive, exports-focussed growth (increased NATO defence spending plans) and recent retaliation against a neighbouring country, which added fuel to the fire. This is evident in robust ordering momentum (across value chain) and better execution (not yet broad-based). Most private defence stocks are trading at a premium to DPSUs given their higher earnings’ CAGR and superior returns profile," says Vijay Bhasin, Nuvama Institutional Equities.

Bhasin feels that increased geopolitical uncertainty (Europe, Middle East, East Asia) disrupting global supply chains is leading India to ascribing even greater importance to localisation in the years to come, which will unveil a golden pipeline for the private defence industry.

India’s defence capex budget for FY26 is ₹1.8 trillion compared to ₹1.4 trillion in FY22 as defence capex (actuals) rose at a 7–8 percent CAGR over the last five–six years. Over FY17–22, defence production expanded at a strong 8.2 percent CAGR. The government has set a defence production target of ₹3 trillion by FY29 in sync with its aggressive approach towards import embargo of defence equipment.

Sriram feels that all the segments (manufacturing, defence) are intertwined with the core economic growth, so, whenever there is any cycle in the local economy (for instance, the slower growth in FY25 because of electoral cycles etc), we would see a corresponding slower growth trajectory here. “Sharp spurts in raw materials could be the other factor imparting margin volatility," he adds.

The government is keen to step up manufacturing hubs. Apart from multiple schemes for incentivising manufacturing, it is also emphasising on training people (Skill India initiative, apprenticeship programme etc).

The government is keen to step up manufacturing hubs. Apart from multiple schemes for incentivising manufacturing, it is also emphasising on training people (Skill India initiative, apprenticeship programme etc).

“Defence is more a sub-segment of this, capitalising on Make in India, Aatmanirbhar initiatives and now gradually exploring the export potential. Infrastructure will largely include asset operators (ports, airports, roads etc.) and certain construction services, though we believe manufacturing would be slightly more broad-based and less volatile than defence or infrastructure," says Sriram.

However, Belorkar feels that the sectors face several challenges even as the long-term outlook remains robust. Lengthy sales cycles and procurement bottlenecks, particularly in defence, can delay scale-up, he says.

Second, regulatory complexity and capex intensity in manufacturing and infra demand sophisticated structuring and milestone-based capital deployment. Last, talent

and technology integration remain areas that require continuous investment and ecosystem support. “These challenges are being progressively addressed through collaborative government-industry frameworks, defence corridors, and innovation clusters," Belorkar elaborates.

Despite the challenges, he believes institutional and mutual fund interest will revive, but the re-entry will be gradual, and data driven. Key triggers may include consistent quarterly performance by defence and manufacturing companies, order book visibility, especially post-election policy continuity or enhancement and improved disclosures and investor education around the strategic nature and resilience of these businesses.

First Published: Aug 05, 2025, 17:04

Subscribe Now