Urban Consumption: Concerns over low income, jobs remain

Tax breaks, falling inflation and rising FMCG sales will boost urban consumption, however, larger concerns over income and jobs remain

India’s urban consumption has fallen prey to stagnant wages and tighter lending conditions since FY24, but experts indicate that income tax cuts, falling inflation and a long-pending proposal to rationalise GST rates may provide a short-term spurt.

“The cut in income taxes, interest rates and a GST (rejig) would give a boost to urban consumption," says Paras Jasrai, associate director, India Ratings and Research.The FY26 Budget provided relief for individuals earning up to ₹12 lakh per annum, exempting them from paying income tax under the new regime—a measure aimed to spur consumption.

The government is also working to streamline the Goods & Services Tax by eliminating the 12 percent slab, which would entail reducing rates on many products to 5 percent. The reform is yet to make much progress.

There are some signs of a pickup in the economy and optimism around a sustained recovery. In Q1FY26, fast-moving consumer goods (FMCG) sales in urban India grew 7.7 percent, marginally outpacing rural growth of 7.1 percent for the first time in six quarters, according to market intelligence firm Bizom. “The tide seems to be turning FMCG sales were driven by demand for branded commodities, personal care and dairy products," Jasrai says.

One of India’s largest FMCG firms, ITC echoes the sentiment. “Going forward, we expect consumption expenditure to pick up, progressively led by continued recovery in rural demand backed by a good monsoon, along with improvement in urban demand as inflation stabilises and tax cuts announced in the Union Budget boost disposable incomes," an ITC spokesperson told Moneycontrol.

Kamal Nandi, business head & EVP, appliances business of Godrej Enterprises Group, bets on the income-tax relief to spur consumption in consumer durables. “We hope to see more gains in refrigerators and washing machines going beyond the premium segment as well. The income tax-led relief announced earlier this year is expected to drive up dispensable income, especially in the mid-premium audience segment, coupled with good monsoons which should boost agricultural income, aiding the mass segment also," he said.

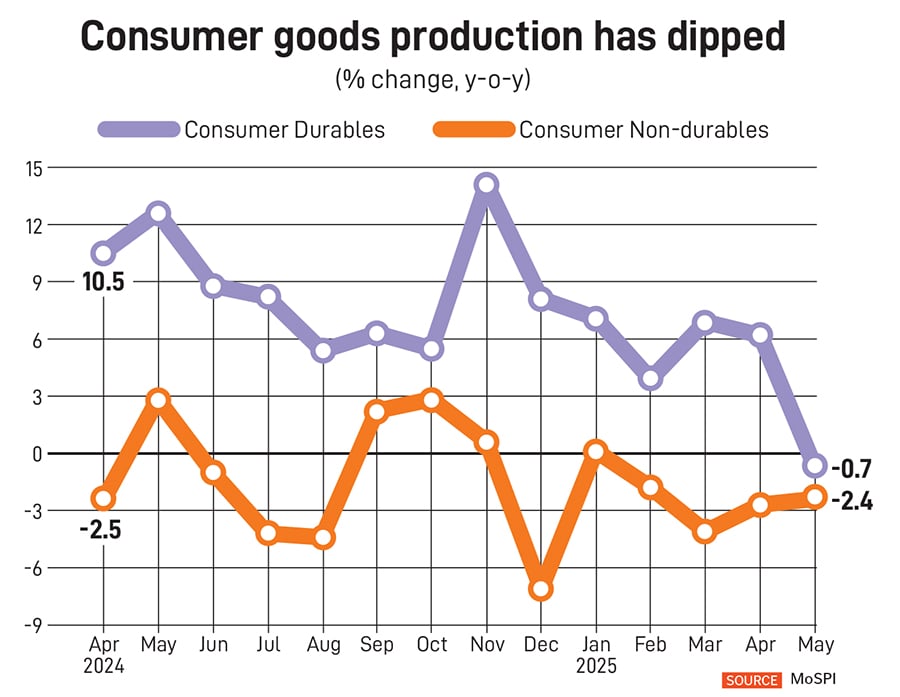

To be sure, consumer durables production, which includes household items like washing machines, cars, air conditioners, slipped into contraction in May, while the non-durables sector has been in negative territory for four consecutive months. In May alone, non-durable production (food and beverages, personal care and clothing and footwear) declined 2.4 percent year-on-year.

Therefore, economists caution that, for a sustained recovery, structural constraints related to low incomes and job creation must be addressed.

“Household consumption remains cyclically constrained, with households carrying high debt and facing slower income growth. Urban consumption is likely to remain moderate for the next few quarters. Tax cuts may have a limited impact—low inflation will benefit rural consumers more," says Dhiraj Nim, economist at ANZ.

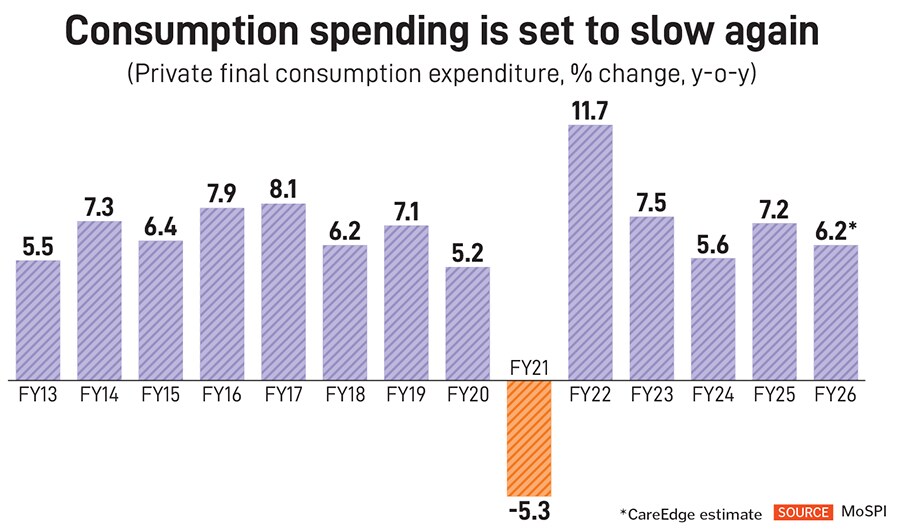

Slower income growth is a drag on urban consumption causing a patchy consumption cycle. Private Final Consumption Expenditure (PFCE) rose to 7.2 percent in FY25 from 5.6 percent in the previous fiscal, but growth is expected to slow in FY26, lower than the 6.7 percent average over the last three years.

CareEdge sees a growth of 6.2 percent in FY26 compared to an average of 6.7 percent in the last three years. Rajani Sinha, chief economist, warns that while there are some positives in the near-term, longer-term concerns remain. “Employee costs for corporations have moderated, specifically in the IT sector. IT has been the backbone of urban economy headcount has been flattish in FY25," she says.

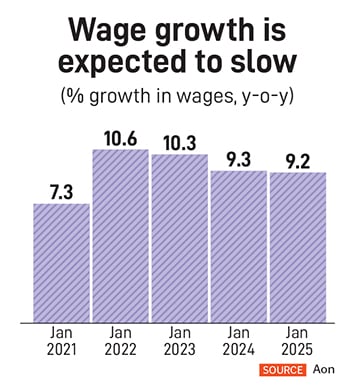

The capacity to spend is intrinsically tied to growth in income, which has been tepid—particularly in urban India. India Ratings and Research projects real wage growth to decline to 6.5 percent in FY26, down from 7 percent in FY25. “There was a softness in urban demand last year, led by slowdown in urban wage growth since H2 of FY24. Moreover, the household savings buffer, created during the pandemic, had been spent, resulting in household savings as a percentage of GDP declining to lower than pre-Covid-19 levels. The softness in urban demand is reflected in both consumer durables and non-durable goods production," according to Gaura Sengupta, chief economist, IDFC First Bank.

Sengupta doesn’t expect wage growth to rebound significantly in FY26. “RBI’s policy easing and drop in inflation will provide some support. However, as long as companies’ profit growth remains moderate... pickup in urban wage growth will remain moderate," she adds.

An over-six-year low retail inflation in June has prompted calls for one more rate cut by India’s central bank. While the RBI lowered rates by 50 basis points last month, a change in stance to neutral signalled limited room for further easing.

The salaried class, especially, has seen stagnating increments. A February report by global professional services firm Aon projects salaries in India to rise by 9.2 percent in 2025, slower than 9.3 percent in the previous year. Increments have steadily declined from 10.6 percent in 2022, which was driven by post-pandemic attrition during the Great Resignation, a phenomenon post Covid when employees voluntarily resigned, the report said.

“For the past 18 months, organised food players, especially big ones, have been feeling the impact of demand tapering. This trend has intensified in the last six months, primarily due to a slowdown in wage growth," says RS Sodhi, president, Indian Dairy Association.

Aditi Nayar, chief economist, ICRA, notes the middle-income group is increasingly under financial strain. She points to rising dependency ratios further adding to financial strain, something that Sodhi also flags.

“Households are likely allocating more resources towards health and education, cutting back on food and apparel," Sodhi notes.

Credit trends mirror this weakness. Personal loan growth slowed to 8.3 percent in May, while credit card loan expansion dipped to 8.5 percent.

The Reserve Bank of India’s latest consumer sentiment index also reflects continued pessimism. In May, consumer confidence in urban areas deteriorated further to 95.4 from 95.5 in March, staying below the 100 mark that separates optimism from pessimism.

“The fall in income capacity of the urban sector has hit its consumption profile, albeit with a lag, partly as tighter lending standards started impacting leveraged consumption while incomes normalised or eased… We do not see an immediate turnaround here, even though we reckon there has been mild stability in private sector hiring in some sectors," says Madhavi Arora, chief economist, Emkay Global, in a note on July 16.

India’s rural demand has been on a recovery cycle with most betting on a good monsoon season to work as a catalyst for this trend. “Even as urban demand is expected to recover, rural India is increasingly becoming a key engine of FMCG growth, driven by higher incomes, connectivity and awareness," the ITC spokesperson cited above says.

Sodhi, too, says the accelerator for consumption will be rural demand. “Prospects of a good monsoon can give a good push and that may spill over to urban India as well. Cooling inflation and lower interest rates could bring back consumption in urban areas in the next six to nine months to pre-mid-2023 levels."

Sodhi, too, says the accelerator for consumption will be rural demand. “Prospects of a good monsoon can give a good push and that may spill over to urban India as well. Cooling inflation and lower interest rates could bring back consumption in urban areas in the next six to nine months to pre-mid-2023 levels."

However, there are some worrying signs in rural recovery. The Federation of Automobile Dealers Associations (FADA) in June pointed out that dealer sentiment appears tilted towards a slowdown for July, expecting sales to either contract or stay flat.

Sales in the two-wheeler segment, a key indicator of rural consumption, fell nearly 13 percent in June versus May, while growth tapered to less than 5 percent on-year. FADA says that while early monsoon showers and renewed rural activity have spurred interest in the two-wheeler space, heavy rainfall, variant shortages and price increases effective July are moderating conversions.

An earlier-than-expected monsoon did impact sales in appliances too, at least in certain segments. “Air conditioners took the larger hit of close to 15-percent degrowth versus refrigerators at an estimated 6 to 7 percent for the industry. This industry-wide dampening was largely a result of summer showers and lower-than-expected temperatures—geographically speaking only the North zone saw high demand given its extreme weather conditions," Godrej’s Nandi says.

While rural India is still expected to take the lead in improving India’s overall consumption story, it may need to do more of the heavy lifting to compensate, if the urban counterpart continues to face a pronounced slowdown. “The income effect will still be the dominating force, even as the rate-easing cycle, looser lending norms, and income tax cuts may help urban (leveraged) consumption at the margin. Despite macro tailwinds, rural pick-up will need to be much more decisive for offsetting the slowing urban trends," Emkay’s Arora says.

First Published: Aug 05, 2025, 11:46

Subscribe Now