Startup IPO frenzy: Why most unicorns don't measure up to market realities

What begins as a bold leap into public markets quickly turns into a tough challenge for unicorns to sustain their valuations beyond the hype. So, what goes wrong?

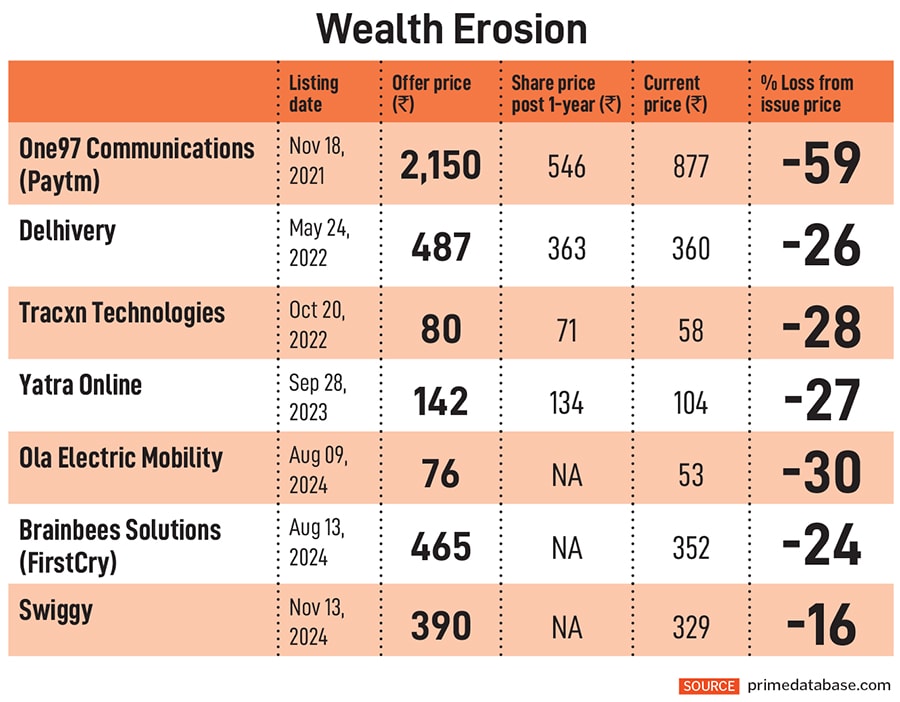

Despite the initial excitement around startups going public, the frenzy soon gives way to fatigue as investor appetite turns sour and wealth creation promises struggle to keep pace with lofty valuations. What begins as a bold leap into public markets can quickly reveal harsh realities, where hype meets scepticism and unicorns risk turning into financial sinkholes.

As market realities set in, the once-celebrated unicorns face the tough challenge of sustaining their valuations beyond the hype. So, what goes wrong?

“The relatively early-stage nature of some of these companies can create deviations from consensus expectations," says Prateek Indwar, MD and head, capital markets, InCred Capital, a financial services firm. He adds that the global markets have experienced disruptive geopolitical and economic events in the recent years, often creating volatility. As a result, we often see significant post-listing valuation corrections in many of these initial public offerings (IPOs).

In the last few years, several new-age technology companies (NATC)have gone public despite being loss-making at the time of their IPOs. Typically, these companies outline a clear roadmap to profitability, and the market values them on their business model, market dominance and forward-looking projections. “There has been a significant bottomline growth reported by some of these companies even though sometimes profitability may be different from consensus expectations," Indwar says.

The 2021 wave of IPOs by NATCs including Nykaa (FSN E-Commerce Ventures), Zomato, Paytm (One97 Communications) and Policybazaar (PB Fintech) initially fuelled optimism among investors.

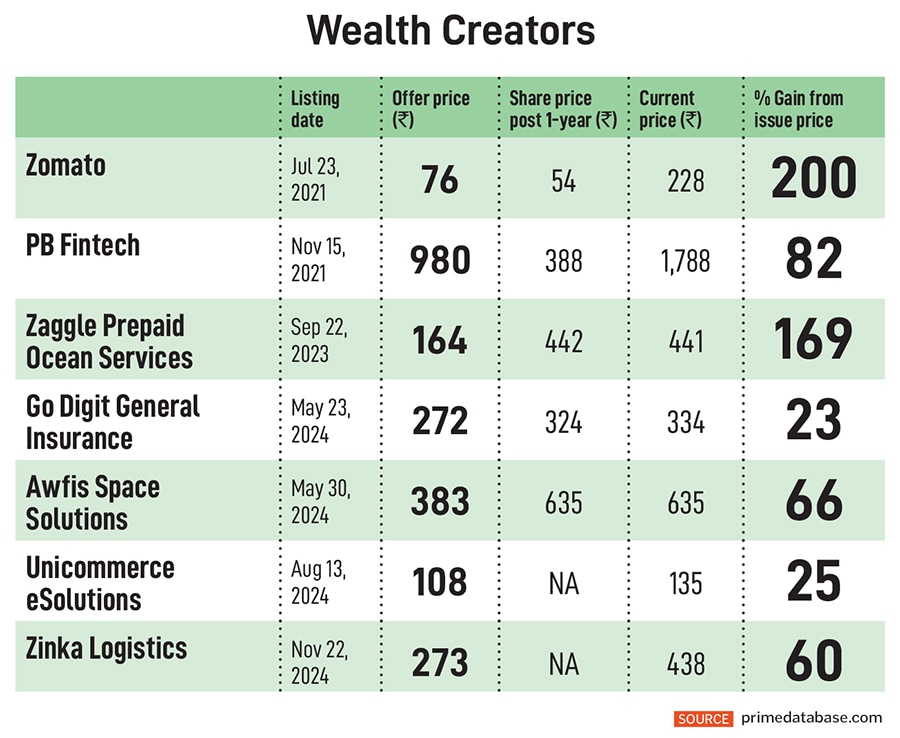

However, their performance in the secondary markets has been disappointing, leading to severe value erosion for shareholders. Only Zomato and PB Fintech have managed to weather the cycle of market storm, earnings volatility and investor exodus.

Paytm has faced one of the sharpest declines. Investors in the IPO of the Vijay Shekhar Sharma-led One97 Communications lost almost 70 percent of their investments within 18 months of the company going public. Even at the current market price, shares of One97 Communications are down nearly 60 percent from their issue price of ₹2,150 during its IPO in November 2021. One of the largest issues, One97 Communications raised ₹18,300 crore through the IPO that was subscribed 1.48 times.

That prompted a deeper scrutiny of valuations and business prospects for IPO-bound companies, especially in the category of startups, unicorns and NATCs. Gradually, investors are learning to separate the hype from ground realities.

“More than valuation mismatch after they go public, there could be a substantial mismatch in valuations with respect to private [funding] rounds, which may have been done at high valuations in the new-age space," says Bhavesh A Shah, managing director and head, investment banking, Equirus Capital, a financial service firm.

Shah explains the ‘say’ and ‘do’ ratio is an important metric for any company, contemplating an IPO, to follow. “When the company does not deliver the performance [‘do’] on the basis of what it may have got investors to believe to expect [‘say’], public market investors will quickly lose confidence in such companies. This is applicable to all companies, not just NATCs," he adds.

However, this phenomenon of NATCs or unicorns failing to deliver mouth-watering returns after going public is not specific to India. “To a large extent, this reflects the nature of these companies and of public markets. Many of these business models are recent and the global capital markets have gone through a process of discovering the appropriate revenue, profitability and return on capital projections for such companies," says Indwar of InCred.

It would be unfair to paint all startup IPOs with the same brush a few have defied the trend, navigating market challenges, delivering on promises and creating wealth for public shareholders. Take, for example, Zaggle Prepaid Ocean Services, Unicommerce e-Solutions (promoted by Kunal Bahl and Rohit Bansal), Go Digit General Insurance, Awfis Space Solutions and Zinka Logistics Solutions.

Shares of fintech Zaggle Prepaid Ocean Services have risen around 169 percent from its issue price of ₹164 during its IPO in September 2023. Though it missed the listing pop, debuting on the exchanges flat, it made a spectacular rally thereafter, gaining around 160 percent in a 12-month period. Besides other factors, what worked in its favour is that it has clocked profitability since 2020. It closed FY25 with a net profit of ₹87.5 crore on a revenue of ₹1,302.6 crore.

“New-age companies have created immense disruption in their respective businesses and have been able to solve real problems or create conveniences with their innovative business models. We have all been users of such services," says Shah. These businesses have done well in rewarding private investors who took bets on such companies early on with a long-term horizon.

Public market investors are used to judging companies on the basis of quarterly performances and profits. So, when companies are not able to deliver the profits on a quarterly basis, the investors quickly move.

A case in point is Ola Electric Mobility. Bhavish Aggarwal’s company was the first pure electric vehicle manufacturer to go public in India and was one of the largest NATC IPOs with an issue size of ₹6,146 crore. Subscribed 2.85 times during its share sale in August 2024, the issue went through a nightmarish ride on the stock exchanges.

At current levels, its shares are down around 30 percent from issue price, with negative returns in a six-month period. Just a month after listing, its shares had rallied 51 percent but lost steam gradually. The company has been losing market share as well as its grip over expenses, while reporting unimpressive earnings.

It is the valuation of the company at the time of the IPO and its post-issue performance that are not in line with expectations of investors, Shah says. “Losing confidence of public market investors is a serious challenge for companies, and it needs several quarters of performance delivery before regaining the trust of investors. Till that time, it would be very difficult for any company to raise any additional funds from public markets."

Most of these companies are priced on future profit expectations. However, as timelines for achieving targeted profitability and projections stretch after listing, valuations get recalibrated and fall from their peaks. However, for those companies that decisively progress toward targeted scale and profitability, there will be value discovery, says Indwar.

Though private market investors allow for variations in timelines and can be understanding in terms of the path to profitability, public markets do demand clearer visibility to profitability. “This is just the nature of the public markets," he adds.

According to him, IPOs of NATCs have been one of the most powerful and defining trends of the Indian capital markets in recent years. Within this overall picture, given that this is still a relatively new trend where the market is interacting with companies whose business model may be still evolving, there can be individual cases that fall short of expectations.

“This has been largely successful to the extent that many such companies, which were earlier planning to list in overseas markets, are now comfortable exploring a listing in India. This has made India one of the top global markets for new-age company listings," Indwar adds.

Pranav Haldea, MD, Prime Database Group, says it is unfair to expect shares of NATCs to only rise after listing. “We should evaluate the performances of these companies vis-à -vis other listings around the same time, which will present the true picture. It is a free market, no one is forced to buy shares of these NATCs during the IPO process," he says.

Due to the volatility in equities, primary markets have slowed down significantly. In 2025, there have been 16 issues so far, raising a cumulative ₹27,671 crore, shows Prime Database. This compares to a record fundraising via IPOs at ₹1,59,784 crore through 91 companies in 2024. However, the pipeline appears strong.

There are more than 60 companies that have already received the market regulator’s approval to go public to raise around ₹1,05,875 crore cumulatively. In addition, there are around 70 companies that have filed for IPO approvals (raising ₹1,08,703 crore).

“The IPO pipeline for startups and tech unicorns remains strong. The approach will keep becoming more mature and seasoned. India has over 100 unicorns, many of which will eventually need access to public capital. Investors, too, have become more discerning, prioritising sustainable models over high-burn growth," says Indwar.

Some of the new-age companies that have already received approvals to launch IPOs are Jaro Institute of Technology Management & Research, Bluestone Jewellery & Lifestyle and IndiQube Spaces. A few others, such as Imagine Marketing (which owns the boAt brand of electronics), Physicswallah and Urban Company have filed documents with the Securities and Exchange Board of India and are waiting for approval.

First Published: Jun 23, 2025, 11:59

Subscribe Now