Stealth Mode IPOs: Why Indian companies are embracing confidential DRHP route

More companies are confidentially filing DRHPs as they prefer gauging investor interest and market conditions before going all in with their IPOs

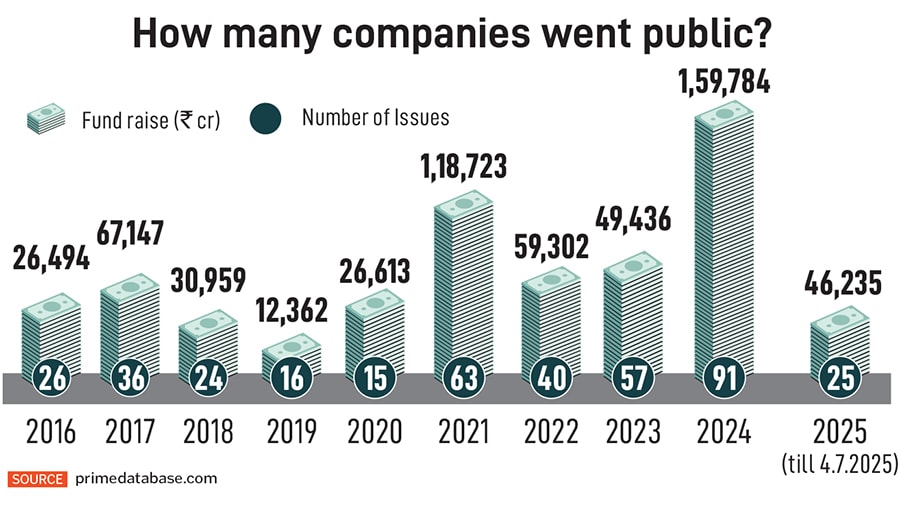

A growing number of companies are preferring to remain confidential about their businesses while filing draft red herring prospectus (DRHP) to go public on Indian stock exchanges. The Securities and Exchange Board of India (Sebi) had given companies the option to remain confidential while seeking its approval for IPOs almost 3 years ago, but companies had been slow to adopt it. However, in the past few months, particularly in May and June, there has been a significant increase in such filings.

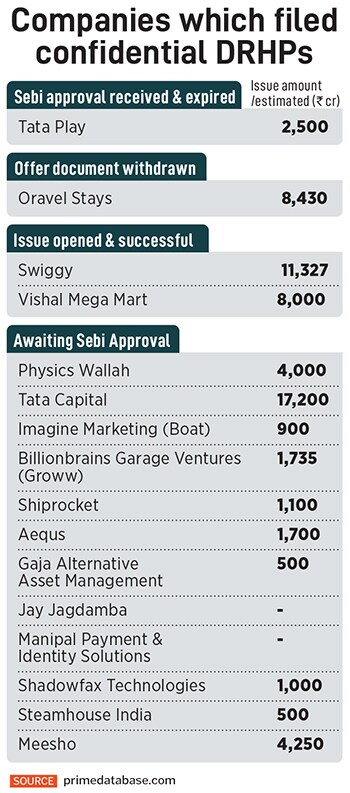

In 2025 so far, 12 companies have filed DRHPs confidentially, representing 75 percent of the total issues opting for the stealth route, shows a Forbes India analysis based on data provided by Prime Database of these, the highest number of filings (five) were in June. Some of these companies are Tata Capital (₹17,200 crore), Meesho (₹4,250 crore), Physics Wallah (₹4,000 crore) and Billionbrains Garage Venture (the parent company of Groww, ₹1,735 crore). Between December 2022 and 2024, only four companies had opted for this route.

The trend is indicative of firms recalibrating their IPO strategies amid volatile market conditions and rising investor scrutiny. Opting to file DRHPs confidentially allows companies to shield sensitive business information from public view and remain ahead of the competition, especially in the new-age category of business.

“We are seeing confidential DRHP filings or pre-filings gain traction among issuers, especially new-age companies. While it may seem there is a lag in companies adopting this route, data points to a relatively quick adoption of the confidential filing mechanism," says Adeepto Saha, executive director, Deloitte India.

He explains that it takes 15 to 24 months for companies to prepare and execute IPOs. This means companies that started their IPO journeys in early 2023 would see their public listings in mid-to-late 2024. The new mechanism has encouraged some companies to explore an IPO sooner, as it allows them to gauge valuations, qualified investor interest, and the regulatory view of the company, while keeping sensitive business information such as key performance indicators (KPIs) and operational disclosures confidential.

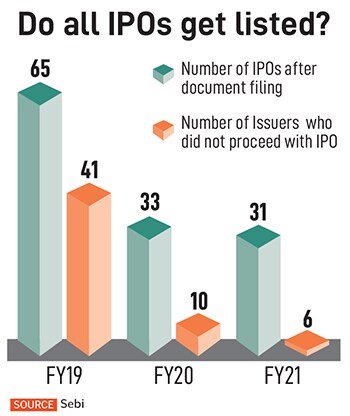

“Confidential filings allow companies that see sub-optimal demand during roadshows to pull out of the process before committing to a listing, as opposed to making that commitment at the time of filing a DRHP under the regular process," says Saha.

“Confidential filings allow companies that see sub-optimal demand during roadshows to pull out of the process before committing to a listing, as opposed to making that commitment at the time of filing a DRHP under the regular process," says Saha.

As per Sebi’s mandate, a company has to launch its IPO within 12 months from its approval. However, it is extended to 18 months for those opting for the confidential route.

Sebi allowing pre-filing of DRHPs is in sync with global market practices, as it is widely prevalent in the US, the UK and Canada, with a significant majority of technology companies opting for this route.

The offer documents should contain all disclosures as previously required for filing of DRHPs under the Issue of Capital and Disclosure Requirements (ICDR) regulations. Under the 2022 regulations, Sebi allowed pre-filing as an optional mechanism. The issuer has to make a public announcement about the pre-filing of the offer document but does not have to make any other details related to the issue available to the public.

According to Abhimanyu Bhattacharya, partner, Khaitan & Co, the confidential filing route was primarily for new-age issuers to ‘test the waters’ (as Sebi calls it) prior to committing to launch a public offer. IPO transactions by new-age issuers were slow when this route was introduced by Sebi.

Tata Play was the first company to opt for the confidential route in December 2022. It had received Sebi’s nod to raise ₹2,500 crore via IPO, but decided not to go public the Sebi approval expired 18 months later. Next was Oravel Stays’ (owner of Oyo) proposal to raise ₹8,430 crore in 2023, but the offer document was withdrawn later. In 2024, Swiggy and Vishal Mega Mart successfully listed on the stock exchange after filing DRHPs confidentially Swiggy raised ₹11,327 crore while Vishal Mega Mart’s issue size was ₹8,000 crore.

Pranav Haldea, managing director of Prime Database Group, says that companies appear to have gained comfort by observing how early movers navigated the process successfully. “That provided a leg-up to more companies opting for pre-filing," he says. “That collective confidence has helped accelerate the trend in recent months, as more firms recognise the strategic benefits of staying under the radar while preparing to go public." He feels more companies will opt for confidentially filing DRHPs for IPOs in future.

As opposed to the popular claim that mostly new-age companies and startups opt for pre-filing of DRHPs, Forbes India found that of the 16 companies that have so far opted for pre-filing, eight are traditional or legacy businesses. These are direct-to-home service provider Tata Play, non-banking financial company (NBFC) Tata Capital, hypermarket chain Vishal Mega Mart, financial services company Billionbrains Garage Venture, aerospace parts manufacturer Aequs, private equity firm Gaja Alternative Asset Management, manufacturer and exporter of stainless steel long products Jay Jagdamba, and steam supplier Steamhouse India.

DRHP documents have a lot of disclosures, including business overviews, financials, KPIs and business strategies. “Many of these are critical and sensitive from a competition standpoint. In the era of cut-throat competition, especially for new-age companies that thrive on the slightest competitive edge to win, it may be prudent to file confidentially and go public with information only with a certainty of the transaction," says Bhavesh A Shah, managing director and head, investment banking, Equirus Capital.

Those opting for confidentially pre-filing offer documents can also evaluate investment interest from qualified institutional buyers (QIBs) during the confidential review period. Saha says the issuer can choose to ‘test the waters’, and then choose to pull the plug, address deficiencies and revisit the markets to list.

Many startups and new-age companies are first-of-their-kind businesses with no publicly listed, directly comparable companies. This makes any option to discover public-market valuations and Sebi’s confidential comments a valuable one. “This is especially true for companies with PE and VC shareholders, where promoter and promoter group disclosures can be complex and sensitive," Saha elaborates.

In contrast, legacy companies typically belong to well-established sectors where there are several listed peers with publicly available business information, KPIs, published research reports, and transparent valuations. These companies tend to differentiate themselves by their ability to execute better and/or deploy capital more effectively. “Such differentiators take time and expertise to develop thus, public disclosures pose limited risk of competitors quickly emulating their strengths," says Saha.

Legacy businesses are also generally better understood by investors and typically do not see the need for evaluating investor interest.

Does secrecy indicate insecurity? “No, that is not necessarily true," says Bhattacharya. He says the confidential route is a well understood route for issuers to gauge investor interest prior to committing to an offering of its securities. This route has been used in other jurisdictions for a considerable period of time. For example, in the US, issuers before or after confidentially submitting or publicly filing a prospectus, are allowed to meet QIBs, and other institutional accredited investors (IAIs) to gauge their interest in the offering.

Saha agrees. “A company’s failure to file a uDRHP [updated DRHP] and proceed with a listing can be perceived as a faux pas that can hang over them. Can we blame companies for trying to minimise such risks to their businesses and reputation?" he adds.

The confidential pre-filing is enabling more companies to explore IPOs. It allows them to pull out of an IPO process mid-way and encourages the management to address any gaps before trying again, rather than soldiering on through the IPO for the sake of reputation. If investor interest does not match expectations, Sebi issues observations that need time to resolve or if the markets fall, companies can choose to not go ahead with the IPO, while keeping sensitive business information confidential.

“Especially companies that have been private for long and who are shy of public attention can take a trade-off call of information disclosure versus the benefits of listing," says Shah.

“Especially companies that have been private for long and who are shy of public attention can take a trade-off call of information disclosure versus the benefits of listing," says Shah.

A feature of the confidential filing procedure is also the requirement of a 21-day public notice period, should the company decide to go ahead with the IPO, during which the offer documents must be made available publicly for comments. “This step allows members of the public, including competitors and vendors, to review and comment on the offer documents. It is aimed at protecting all groups of public market investors," Saha says, adding that this can increase execution risks by exposing a transaction to external market conditions for a longer period.

“Confidential filing is a lengthier process and adds to the timeline of doing an IPO. With extended timelines the cost of the resources, internal and external, spent by the company goes up to that extent," Shah adds. Typically, confidentially filing DRHPs increases overall transaction costs by about 20 percent, he says.

First Published: Jul 14, 2025, 14:27

Subscribe Now