The Jane Street Saga: Will retail activity take a hit?

There are growing concerns that the Sebi crackdown on the US-based trading firm for alleged manipulation may impact trading volumes in the derivatives segment

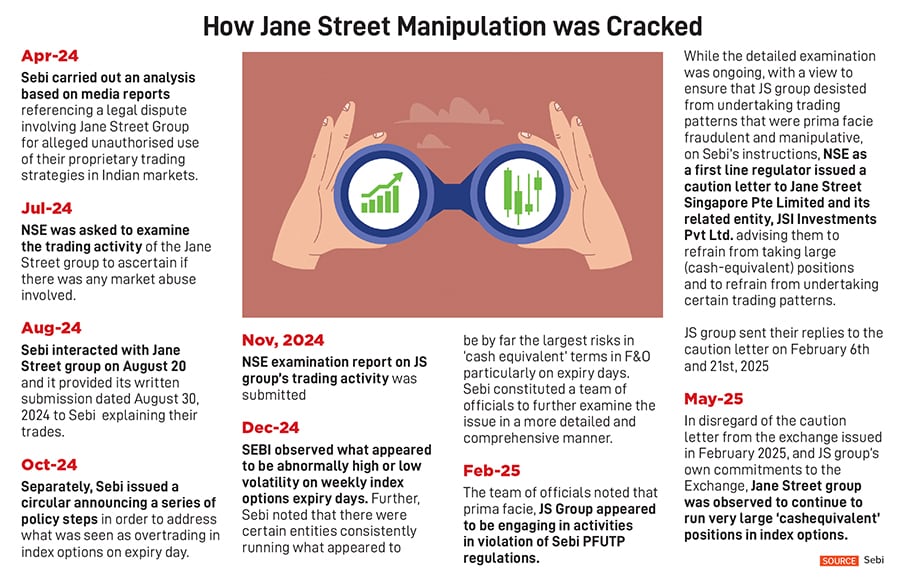

Market regulator Securities and Exchange Board of India’s (Sebi) crackdown of the US-based trading firm Jane Street on alleged manipulation in India’s cash and derivatives market is feared to impact trading volumes in the Asian sub-continent. On July 3, the market regulator barred Jane Street group companies from accessing Indian securities. Sebi has also ordered seizure of Rs 4,844 crore estimated as ‘unlawful gains’ earned by the JS group from the alleged violations.

“As Jane Street was a large player, this may impact volume that could partly be offset by any uptick in proprietary activity," says Prakhar Sharma, analyst, Jefferies.

Jane Street, a high-frequency trader (HFT), participated in the cash & derivatives markets as a foreign portfolio investor (FPI) as well as a member, hence, its contribution in market volume will be considered in FPI as well as proprietary categories.

“Given that the inquiry was already underway, we understand its activity levels have declined over the past few months," says Sharma. He sees three possibilities as an outcome of the crackdown. Firstly, proprietary traders or HFTs will see a manageable impact due to Jane Street’s exit from India as a decline in its turnover may be made up by proprietary traders and HFTs, potentially reducing manipulative factors.

Secondly, there should not be a counter-party risk on Jane Street contracts as trades are covered by the clearing corporations and Jane Street has three months to unwind open positions. Lastly, hedge funds largely operate with larger positions in Single Stock Futures (SSFs) and their trading in options is limited.

Therefore, Sharma feels the key unknown is whether this instance can lead to a knock-on impact on trading volumes. The most crucial factor to watch out now will be trends over the next week on derivatives volumes, especially the index derivatives expiries on Tuesday and Thursday.

In a 105-page long interim order, Sebi says, “JS Group was undertaking an intentional, well-planned, and sinister scheme and artifice to manipulate the cash & futures markets and hence manipulate the BankNifty index level, to entice small investors to trade at unfavourable and misleading prices, and to the advantage of the JS Group."

However, Jane Street has reportedly rejected Sebi’s allegations informing its employees that it will contest the ban by Indian market regulator stating it was “beyond disappointed" by Sebi’s “extremely inflammatory" accusations.

Reacting to the Jane Street ban, Tuhin Kanta Pandey, chairman, Sebi, has said that the markets regulator was watching it as a surveillance issue. “Surveillance at both at the exchange and Sebi level will continue going ahead," he said at an event after the order was passed on Jane Street.

Meanwhile, Madhabi Puri Buch, former chairperson, Sebi, has slammed criticism that the market regulator was slow to act against Jane Street. Describing the claims of regulatory inaction as a "false narrative", in a note, Buch said that Sebi’s intervention began well before the matter became public. “In actuality, identification of index manipulation by Jane Street and initiation of numerous actions, including a cease-and-desist instruction to Jane Street, were carried out by Sebi between April 2024 and February 2025," Buch said. Her term as Sebi chief ended on February 28, 2025.

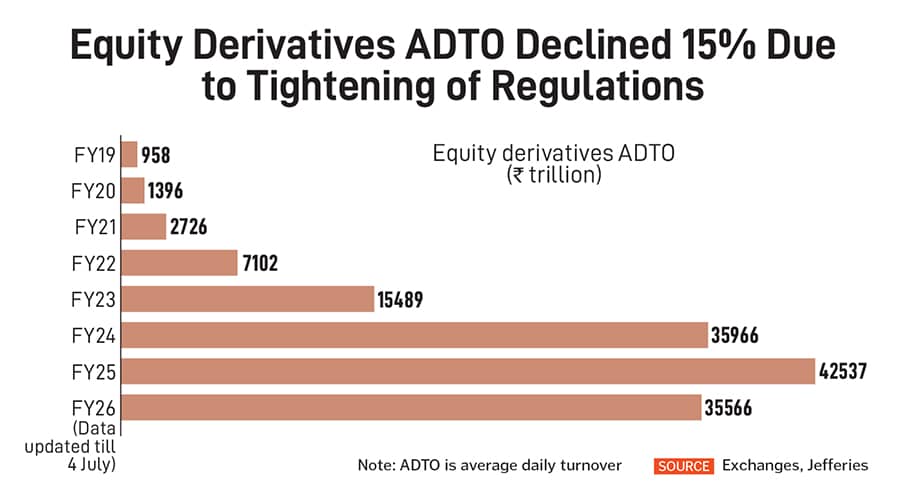

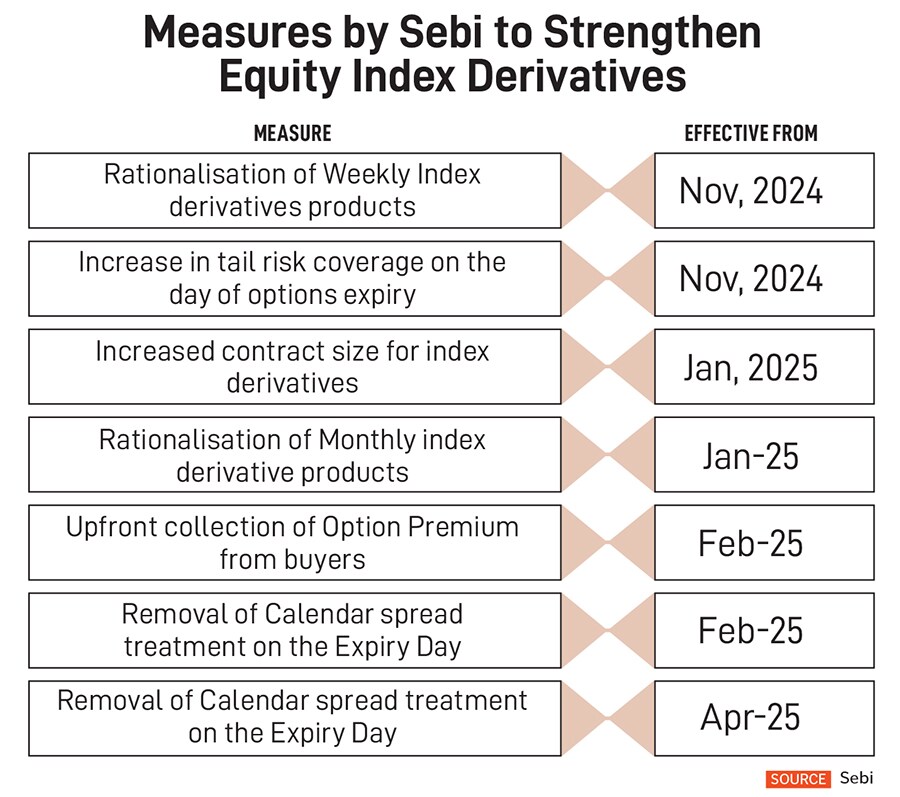

India’s two exchanges BSE and NSE are the largest derivatives markets globally with a high volume of average daily turnover and the increasing retail participants has been a cause of concern for the market regulator. In the last few years, Sebi has introduced various mechanisms and measures in the derivatives segment to safeguard investors and clam down retail participation, considered to be risky due to steep losses.

There are multiple reasons for the growth of F&O trading volume, such as the rise of online trading, especially driven by people having spare time during the Covid-19 pandemic and dabbling in trading through online brokers and platforms introduction of weekly options first on BankNifty, then Nifty indices, and in the recent past on FinNifty, MidcapNifty and Sensex indices. Also, trading platforms and online brokers like Zerodha and Upstox have helped grow the market, where tools for simulation on F&O strategies is provided to retail investors who never had the chance earlier to dabble in such stuff, which was the exclusive space of institutional players.

According to Nithin Kamath, founder and CEO, Zerodha, the crackdown on Jane Street could possibly be bad news for both exchanges and brokers. “F&O volumes might reveal just how reliant we are on these prop giants," he said in a social media post on LinkedIn.

“Prop trading firms like Jane Street account for nearly 50 percent of options trading volumes. If they pull back— which seems likely —retail activity (35 percent) could take a hit too," Kamath adds.

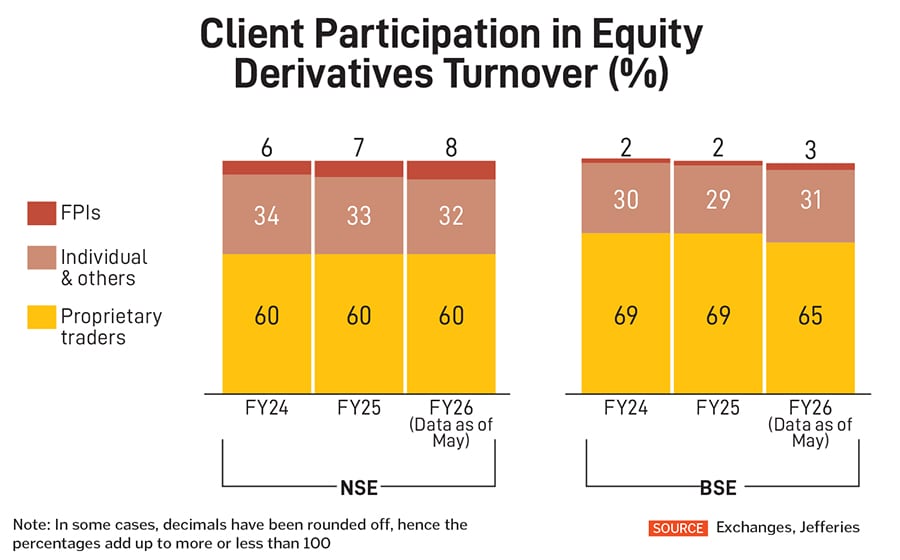

Exchange data shows FPIs form 3-8 percent of equity derivatives turnover and prop traders form 60-65 percent of the total while the rest is individuals and others.

According to the Sebi order, between January 2023 and March 2025, Jane Street made a profit of Rs 43,289.33 crore from Index Options alone. At the same time, it incurred cumulative losses of Rs 7,687.21 crore in stock futures, index futures and cash.

The most profitable trading day January 17, 2024 (with profit to the tune of Rs 734.93 crore) was selected for detailed scrutiny. In this context, a comprehensive examination of all trades executed by the Jane Street group across cash, futures, and options segments was carried out by Sebi to understand the nature, timing, and potential interlinkages.

“The detailed analysis of the trades of this day revealed the existence of a strategy (intraday index manipulation strategy) which appears to have been similarly deployed by the JS group in 15 days out of 18 days covered," says Sebi in the order.

Besides January 17, 2024, the ‘intraday index manipulation’ pattern of trading in BankNifty shares/futures/options was observed by Sebi on 14 other days.

The market regulator also found a different pattern from the earlier ‘intraday Index manipulation pattern" on July 10, 2024, and two other days, all of which were on BankNifty expiry day.

A different strategy (extended marking the close strategy) was observed on the other three days. “The latter strategy was also seen to have been deployed on three other days post the examination period in Nifty index options, during May 2025," Sebi says.

The order says that subsequent analysis revealed that the JS group engaged in sharply timed buy-side or sell-side activity in futures and stock segments during the closing window, when they held pre-existing large positions in weekly expiring index options.

“Prima facie, Jane Street Group strategically built or retained short Call or long Put positions in BankNifty options expiring the same day, and subsequently executed large and aggressive sell-side trades in underlying index constituents in stocks and futures in order to depress the BankNifty index in the closing minutes. The resultant lower expiry value directly increased the profitability of their disproportionately large outstanding BankNifty index options positions,’ it elaborates.

Consequently, on February 6, the National Stock Exchange (NSE) issued a cautionary letter to Jane Street Singapore Pte Limited and its related entity, Jane Street group Investments Pvt Ltd. The letter noted that the group had been consistently engaging in trading patterns that raised serious concerns over market integrity, particularly around the expiry of index derivatives.

Established in 2000, Jane Street group is a global proprietary trading firm employing more than 2,600 people in five offices across the United States, Europe, and Asia and trades in 45 countries.

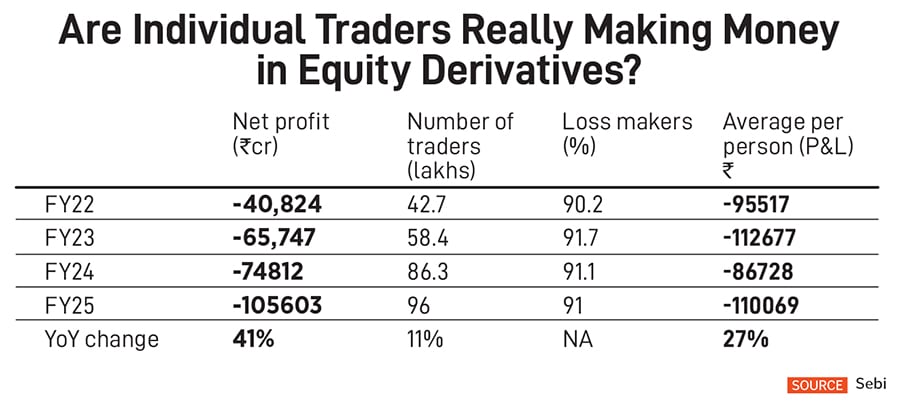

According to a study released by Sebi on July 7, at aggregate level, nearly 91 percent of individual traders incurred net loss in the equity derivatives segment (EDS) in FY2025.

The study shows that the net losses of individual traders widened by 41 percent to Rs 1,05,603 crore in FY25 from Rs 74,812 crore in FY24 (after accounting for transaction costs). The number of unique individual traders in EDS declined to around 42.7 lakh in the fourth quarter of FY25 from around 61.4 lakh in first three months of the fiscal.

During the first three quarters of FY25, the aggregate net loss across the individual traders and the average net loss per person were rising. However, in the fourth quarter of FY25, there was a reduction in losses of individual traders—both at aggregate as well as per person level.

During the period FY2020 to FY 2025, average daily traded value in overall EDS (options in premium terms) and the cash market (CM) grew at a CAGR of 23 percent and 25 percent respectively.

From December 2024 to May 2025, the number of overall unique traders dealing in EDS (across NSE and BSE) declined 20 percent compared to the previous year and grew 24 percent compared to the similar period two years back. “Traders with a total turnover less than Rs 1 lakh witnessed high degrowth compared to the previous year. The same bucket witnessed the highest increase in unique investors in EDS compared to two years ago," says Sebi.

First Published: Jul 11, 2025, 12:24

Subscribe Now