West Asia crisis: Is India insulated?

The closure of the critical oil corridor Strait of Hormuz will lead to a steep increase in oil prices affecting all countries as prices tend to be linked across markets

As the regional conflict in West Asia escalated with the US striking Iran, there are likely to be severe consequences on oil prices, the global economy and investment strategies around the world. On June 21, the US made airstrikes on three of Iran’s nuclear facilities: Fordow, Natanz, and Isfahan, which flared up geo-political tensions in the region.

In retaliation, Iran may close the critical oil corridor Strait of Hormuz (SoH), which remains one of the key energy choke points, through which almost 20 percent of global oil and liquified natural gas (LNG) are traded. SoH is the only marine entryway into the Persian Gulf, with Iran on one side and Oman and the UAE on the other. It also links the Persian Gulf to the Gulf of Oman and the Arabian Sea in the Indian Ocean.

Any escalation in the geopolitical situation could significantly impact global energy supplies and prices. The closure of this critical oil corridor will lead to a steep increase in oil prices affecting all countries even if it is not imported from the Gulf region as prices tend to be linked across markets.

According to Mark Haefele, chief investment officer, Global Wealth Management, UBS, there are two key questions: First, will energy exports including oil shipments from the Middle East be interrupted? Second, will other major countries intervene?

“Oil is the main conduit for the transmission of Middle East tensions to the global economy and broader financial markets, and in the very short term, oil prices are likely to rise as investors price the risk that the conflict escalates further and supplies are disrupted," he adds.

An increase in the prices of oil will have a significant impact on India’s economy and corporate income as the country is a major importer. The Israel-Iran tensions that started in June threatened to drive oil prices to $100/ per barrel due to the probable closure of SoH. Crude oil prices have been subdued largely on elevated OPEC+ spare capacity and Liberation Day tariff shocks from the Trump administration, sparking concerns over economic growth, which prompted cuts in the oil demand forecast.

In the Indian context, the three markets that need to be looked at are stocks, currency and bonds, says Madan Sabnavis, chief economist, Bank of Baroda.

“Markets are jittery expecting the worst, though the economy looks fairly firmly placed as of now," he says. The Reserve Bank of India (RBI) too will be monitoring developments for the next policy. “The stance is already neutral and if this situation remains, one can be sure that it may not change in the near future," Sabnavis says.

As the Iran-Israel conflict rages on, oil prices are up 21-25 percent since the end of May. Unless the conflict worsens and impacts the wider Middle Eastern region, analysts at Kotak Institutional Equities do not see much impact on demand or supplies and expect oil prices would likely trace back if the conflict ends soon.

“The recent oil price spike is primarily driven by market worries about the Iran-Israel conflict. While risks have increased on shipping in SOH, so far there is no impact on supplies. Prior to the conflict, oil markets were well supplied. Rather, OPEC+’s planned reversal of voluntary cuts was an overhang," Anil Sharma, analyst, Kotak Institutional Equities, says.

At higher than $70 per barrel the US could see further increases in production, Sharma adds. He does not expect oil prices to remain elevated for long and maintains an oil price assumption of $70 per barrel for FY2026 and FY27.

The SoH was never blocked during earlier wars in the region and analysts are optimistic that blocking the oil corridor is extremely unlikely this time as well. “The US and Western countries are likely to take strong measures against any such disruptions given the huge risk it can pose to global oil and gas prices and, hence, inflation," Dayanand Mittal, analyst, JM Financial Institutional Securities, says.

Mittal expects Brent may remain in the $70-80/bbl range in the near term amidst heightened geopolitical tensions. However, he expects Brent to stabilise at $70/bbl in the medium term once the tensions ease.

Rating agency Icra expects crude prices to average between $70-80/bbl for FY2026.

Typically, a $10 per bbl increase in the average price of crude oil for a fiscal will typically push up net oil imports by $13-14 billion during the year, enlarging the current account deficit by 0.3 percent of the GDP, says Icra. “Accordingly, if the average crude oil price rises to $80-90/bbl in FY2026, then the current account deficit (CAD) is likely to widen to 1.5-1.6 percent of gross domestic product (GDP) from our current estimate of 1.2-1.3 percent of GDP. This would also exert pressure on the USD/INR pair during the fiscal," the rating agency says.

Fuel items have a significantly lower weight in retail inflation compared to wholesale inflation. According to Icra’s estimate for every 10 percent increase in crude oil prices, the WPI inflation will rise by 80-100 basis points, against the 20-30 bps uptick in the CPI inflation, assuming transmission into retail selling prices (RSPs) of fuels. “The quantum of the impact on the CPI inflation trajectory will particularly depend on the extent of the change in RSPs of petrol, diesel and LPG undertaken by the oil marketing companies (OMCs)," it explains.

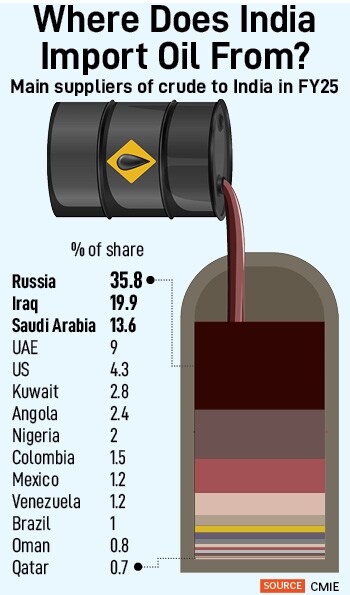

India imports a lot of oil from Russia, though Iraq offers the lowest prices. In this new situation, these concessions may or may not be available. What can hence be done is to see how a 10 percent increase in India’s purchase price can drive indicators. “At the beginning of the year, the assumption was that oil will be around $80 and hence anything more than this amount will raise a red flag," says Sabnavis.

India consumes around 15 crore kilo litres of petrol and diesel on an annual basis. Any cut in excise duty to reduce the burden on the consumer can intuitively mean Rs 15,000 crore per rupee of reduction, he adds.

So, a 10 percent increase in oil prices may not have much of an impact on the economy where the fundamentals are robust. “But if it is over $100 for a prolonged period of time it would mean virtually a 25 percent increase over base case assumption and can have a major impact on these variables," Sabnavis stresses. The impact on the GDP will be driven primarily by how inflation behaves and affects consumption.

According to Haefele, retaliatory Iranian attacks on US bases, US allies, and energy infrastructure in the wider region are a clear risk. “A second key concern is whether US involvement draws other countries into the conflict, with Russia a particular concern given that it could see potentially long-lasting disruptions to oil markets as a way of strengthening its own hand in negotiations with the US over the future of Ukraine," he says.

In a base case scenario, Haefele does not expect the escalation in the conflict to lead to a prolonged disruption to oil supplies in a way that could imperil global growth or cause significant challenges for central banks. As such, he believes that the near-term downside in stocks could represent an opportunity for investors who are under allocated to equities to build positions.

He expects the US dollar may rally in the very short term as investors seek safe havens amid geopolitical uncertainty. As for gold prices, Haefele sees the yellow metal as an important portfolio hedge against rising geopolitical risks.

Sanjeev Prasad, director & co-head of Kotak Institutional Equities, is worried that the emergence and escalation of the Iran-Israel conflict may have negative consequences for the Indian economy and market. This is especially as the rich valuations of the Indian market, sectors and stocks leave very little scope for any negative developments. “The impact on the economy will be felt through higher oil prices, while the impact on the market will be felt through lower earnings and/or lower multiples (higher cost of capital)," he adds.

“Higher oil prices could weaken one of the central arguments for high valuations of the Indian market," Prasad says.

If the situation deteriorates, some sectors such as basmati rice may see increased impact and will require monitoring, while others like fertilisers and diamonds—both cut and polished—may also see some impact, according to Crisil Ratings. If crude oil prices continue to be elevated over longer periods, it could impact India Inc’s profits. Also, prolonged and increasing uncertainties can result in a rise in air/sea freight cost and insurance premiums for export/import-based sectors.

India’s direct trade with Israel and Iran is minuscule at less than 1 percent of the total trade involving India last fiscal. While India’s major export to Iran is basmati rice, trade with Israel is more diversified, and includes fertilisers, diamonds and electrical equipment.

India’s direct trade with Israel and Iran is minuscule at less than 1 percent of the total trade involving India last fiscal. While India’s major export to Iran is basmati rice, trade with Israel is more diversified, and includes fertilisers, diamonds and electrical equipment.

Iran and Israel accounted for 14 percent of India’s basmati rice exports in fiscal 2025. “But because basmati rice is a staple, the impact on demand because of the ongoing tensions is likely to be limited. Additionally, India’s ability to export to other countries in the Middle East, the US and Europe reduces demand risk. But a prolonged crisis can lead to possible delays in payment from counterparties in these regions, elongating the working capital cycle," Crisil says.

For domestic diamond polishers, Israel is mainly a trading hub, accounting for 4 percent of the total diamond exports last fiscal. Additionally, 2 percent of all rough diamonds imported are from Israel.

In the fertiliser sector, Israel is a major global producer of muriate of potash and was one of the larger exporters to India last fiscal. However, the share of MoP (as a final product or as an ingredient in other fertilisers) remains low at less than 10 percent of domestic fertiliser consumption.

In specialty chemical companies, about 30 percent of the operating cost is crude linked. Similarly, the paint sector could see some pressure on margins as 30 percent of its production cost is linked to crude, where competitive intensity could limit the ability to pass on elevated input prices to customers and impact profitability to some extent, says Crisil.

According to Prasad, earnings upgrades for upstream oil producers will be negated by downgrades for the downstream oil PSU companies and consumers of oil-related commodities.

The top 10 consuming countries accounted for around 60 percent of total consumption of oil. With the focus on electric vehicles and renewables, there has been a tendency for several countries to lower their dependence on oil. Therefore, there has been a slow underlying current of shift in the sources of energy deployed by a number of countries. India has a large share with 5 percent and is the third largest consumer. India imported 244 million tonnes of crude oil in FY25 and the CAGR in the last 10 years was 2.6 percent.

First Published: Jun 23, 2025, 18:29

Subscribe Now