The 2024 annual report of Philippine construction-and-mining giant DMCI Holdings has an arresting AI-designed cover depicting a stack of grey concrete blocks, geometrically arranged in the form of a futuristic building site. The company says the visual represents its “solid foundation and enduring strength" as well as its “long term vision". But the image could well be a nod to the new challenge that DMCI Chairman and President Isidro Consunji has taken upon himself.

Last December, the 102-billion-pesos ($1.8 billion revenue) company completed its biggest acquisition to date, paying $660 million (including debt) for Mexican giant Cemex’s loss-making cement unit in the Philippines. This deal, which marked Cemex’s exit from the country after more than a quarter of a century, paved the way for DMCI’s entry into a sector that the company had been eyeing for years.

For Consunji, cement was the missing piece in the company’s portfolio of infrastructure assets, which, apart from the family’s legacy construction business, includes mining, energy, water and property development. The 76-year-old tycoon, who’s notched a respectable track record of reviving ailing businesses, exudes confidence. “We hope to turn it around within two to three years," he says from DMCI’s headquarters in a modest five-storey building on the edge of Makati’s business district.

The Cemex unit is among the top five cement producers in the country with two factories and an annual production capacity of 7.2 million tonnes. (This was recently expanded from 5.7 million tonnes.) It’s up against deep-pocketed rivals, such as Holcim Philippines, Eagle Cement, a subsidiary of billionaire Ramon Ang’s San Miguel, and Republic Cement, owned by the wealthy Aboitiz family.

Declining sales and rising energy costs pushed it into the red three years ago, a trend that has continued since, including in the first quarter of 2025 when it reported a net loss of 868 million pesos. Consunji says his game plan to make the unit more efficient and eventually profitable includes leveraging synergies with group companies. For example, as part of DMCI, the unit can procure coal and electricity on better terms from group companies and in turn, DMCI’s housing and infrastructure projects will be customers for its cement.

![]()

Elaborating on his positive outlook, Consunji points to the imminent benefits of scale from the recent capacity upgrade by the company, now renamed Concreat Holdings Philippines—a play on his family name and ‘create’. The addition of a new production line was started by Cemex but was completed in April this year under DMCI’s watch.

Concreat’s capacity expansion may appear mistimed with the current supply glut in the Philippines. Cheap imports have flooded the market, clobbering cement prices. Domestic factories are operating on average at just over half of their installed capacity, according to the Concrete Manufacturers Association of the Philippines. Some factories have been forced to temporarily shut down. John Gatmaytan, chairman of Manila’s Luna .Securities, says, “The outlook for the cement sector is not rosy, mainly due to dumping from China and Vietnam."

![]()

However, Consunji says he’s looking ahead and positioning Concreat for upcoming opportunities. According to DMCI, the per-capita consumption of cement in the Philippines is 304 kg, less than half of that in Vietnam. He expects cement demand to get a boost from the government’s Build Better More programme that targets increased outlays on infrastructure projects, such as the 33-km Metro Manila subway estimated to cost 489 billion pesos. Total government spending on infrastructure is projected by the Department of Finance to at least double to 2 trillion pesos by 2028, from 1 trillion pesos this year.

“DMCI will be one of the major beneficiaries of the government’s plan to boost infrastructure spending," says George Ching, senior research manager at COL Financial. The Manila-based brokerage has a buy rating for DMCI and a 12-month share price target of 13.60 pesos, 22 percent above its June 27 closing price of 11.18 pesos.

![]() Photo COURTESY OF DMCI HOLDINGSw

Photo COURTESY OF DMCI HOLDINGSw

Consunji is also counting on increased cement offtake by property arm DMCI Homes, which along with other developers, is looking to address the country’s housing shortage, notably in provincial areas where demand is still robust compared with Metro Manila. The country will have an estimated housing backlog of 10 million homes by 2028, up from 6.5 million in 2024, according to a forecast by the Department of Human Settlement and Urban Development, the central housing authority.

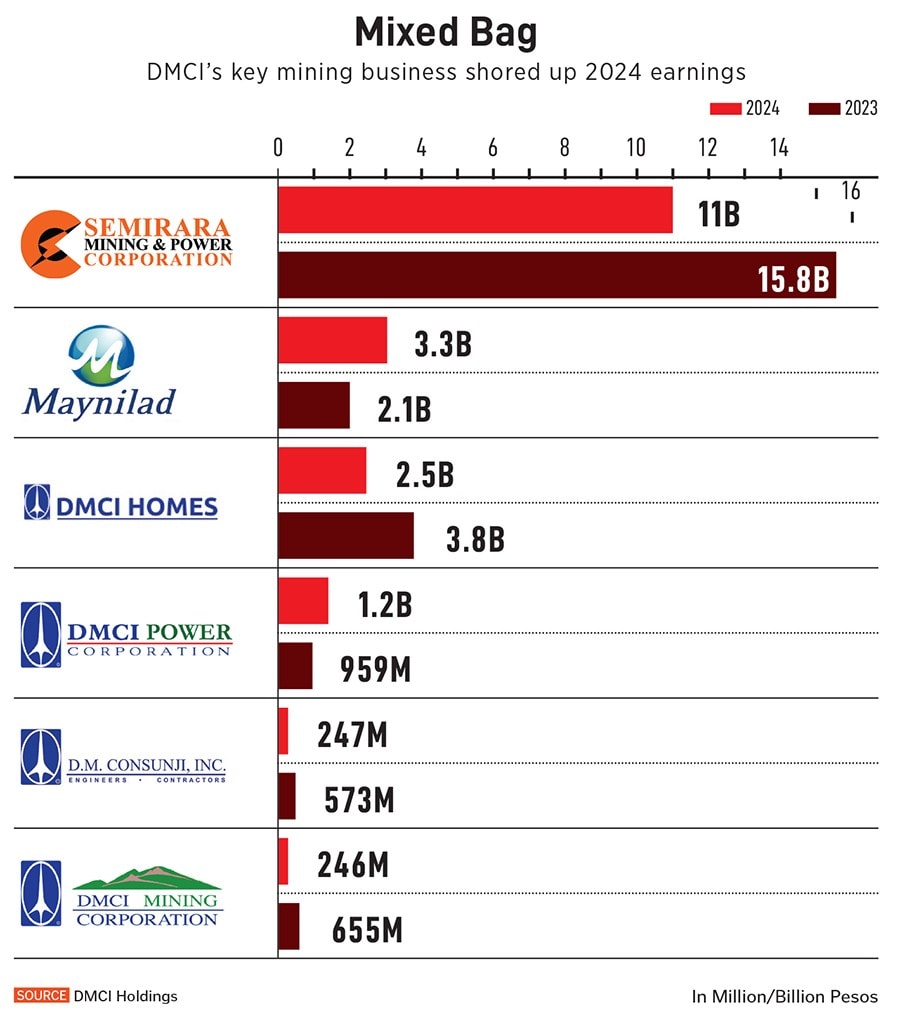

For the past two years, DMCI has been buffeted by the cyclical nature of the commodities business. Both revenue and net profit have declined by double digits mainly due to weaker coal, nickel and electricity prices. The company reported a 17 percent drop in revenue and a 23 percent fall in net profit for 2024, with both slumping by a similar range in 2023.

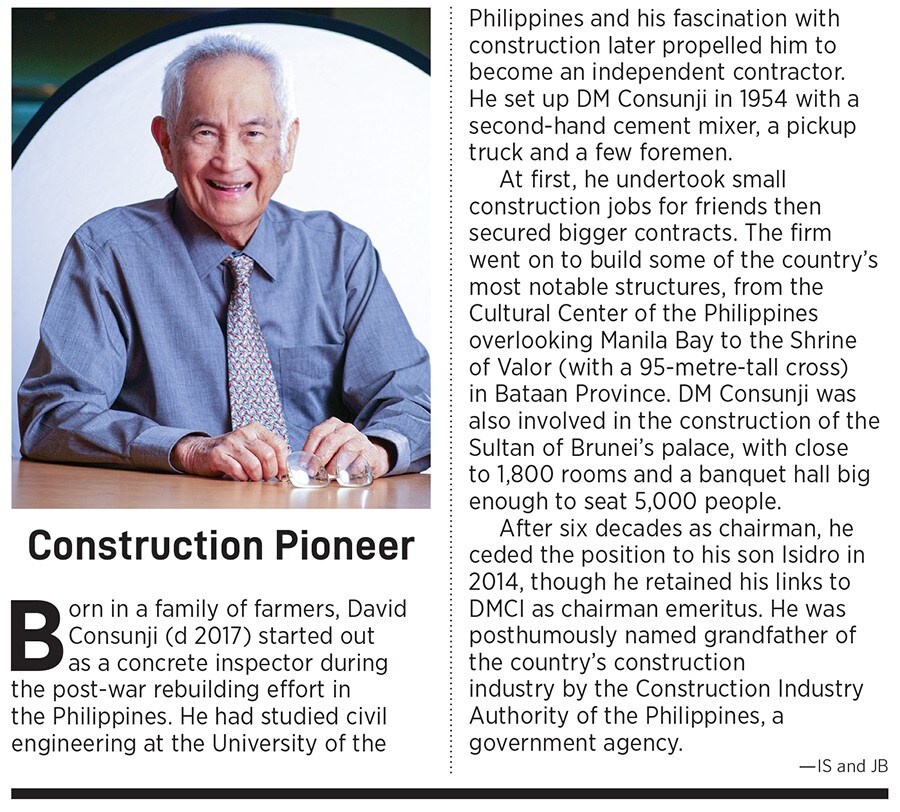

Consunji has navigated rough terrain before. Through it all, he’s preserved his family’s place among the country’s wealthiest, which his late father and DMCI founder David Consunji had secured in his lifetime.

Consunji Sr joined the ranks of the Philippines’ richest in 2007 with a modest fortune of $210 million. Five years later, he became a billionaire, a status he held until his death in 2017. The patriarch’s fortune was divided among his eight children and is now listed under Isidro Consunji, who’s the eldest son and represents the family’s net worth of $3.4 billion, which puts them at No 5 on the 2024 list of Philippines’ 50 richest. (Neither Consunji nor his siblings are individual billionaires.)

![]() A Concreat cement plant PHOTO Courtesy of DMCI Holdings

A Concreat cement plant PHOTO Courtesy of DMCI Holdings

Consunji admits that as a young man, he had no desire to follow in his father’s footsteps. He enrolled for an economics degree at Ateneo de Manila University, which at the time was an all-boys’ institution. But he soon opted to transfer to civil engineering studies at University of the Philippines, a co-educational college that was his father’s alma mater. What drew him wasn’t the course but the chance to hang out with girls, he says candidly. “I told my father that I had changed my mind. He didn’t ask why. He was happy since that is what he wanted."

During a semester break, Consunji started working in DMCI’s motor pool, overseeing the rentals of trucks and cranes. His job included doing the rounds of the city’s Chinatown district and sundry junkyards to buy spare parts. In 1971, the newly qualified civil engineer was dispatched by his father to Mindanao, an island in the south, to help with reviving a problematic logging business, which took him two years to fix. (Today, the family owns durian orchards in the area through its privately owned Dacon Holdings.)

To prepare himself for bigger responsibilities, Consunji took a two-year sabbatical for MBA studies at Manila’s Asian Institute of Management, then went back to work with his father. Within three years, he spotted his first acquisition target, a logging company in financial distress. He took management control by acquiring shares against the cost of supplying heavy machinery, enlisting a business school classmate to assist him in turning it around. Backed by his father, he bought two more struggling lumber firms before returning to Manila to help manage the family’s construction business.

By 1995, when the family was ready to list holding outfit DMCI Holdings, Consunji had earned his stripes and was promoted to the position of president. Along with his father, he oversaw the sale of a 34 percent equity stake in an IPO that raised 3.5 billion pesos. Diversification was one of their top priorities and to fund that they tapped the public markets again two years later with an issue of preference shares that garnered 2.3 billion pesos. The capital raising proved to be well-timed.

The Asian financial crisis that soon followed provided DMCI an opportunity to acquire distressed businesses. The company bought a 40 percent stake in cash-strapped coal producer Semirara Mining, named after the remote island in the province of Antique where its mines were located. By 2004, DMCI’s golden jubilee year, Semirara was on a stable footing and DMCI increased its stake to 95 percent.

“It took us all of seven years to turn around the company," recalls Consunji. “We were learning. It was trial and error." One major cost-saving move involved switching from the continuous, open-pit coal extraction method that deployed expensive “bucket-wheel" excavators to the more conventional but less environment-friendly system of using trucks and shovels.

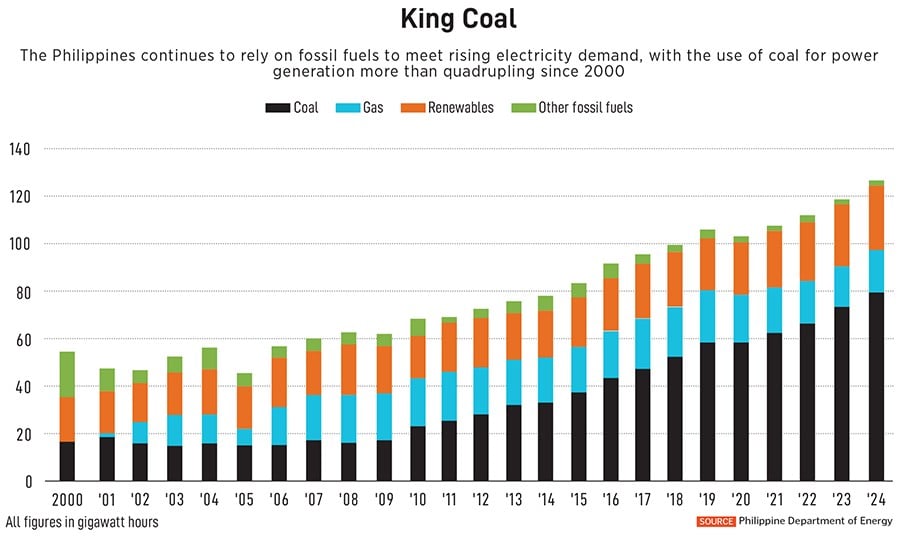

A commodities boom and exports to China turned Semirara into a cash cow for DMCI today, the company accounts for 97 percent of the country’s total domestic production of coal. Last year, despite weaker coal prices that dented earnings, it contributed more than half of DMCI’s net profit of 19 billion pesos.

The company was renamed Semirara Mining and Power in 2009 after it acquired an unprofitable coal-fired power plant operation in Calaca, Batangas Province, from the government for $362 million. With a capacity of 600 MW, the plant was badly maintained and grossly underutilised, producing only 160 MW of power. Consunji undertook an extensive upgradation, costing 9.9 billion pesos over about 15 months, that involved installing new turbines to crank up power production, which now stands at 540 MW.

“The operational side wasn’t that difficult," Consunji discloses. “It was changing the culture that was challenging. People had no profit-and-loss responsibility when it was government-owned. We had to reorient their thinking: You have to make money for each activity you do, there must be value-added."

Over the years, Semirara’s mining and power operations have faced criticism from the green lobby for their adverse environmental impact. Following the 300 MW expansion of the Calaca power plant in 2016, activists protested about the pollution in the area. “We understand the environmental concerns associated with coal," DMCI says. The company says it planted 2.8 million trees over nearly 700 hectares around the coal mines.

While acknowledging the government’s efforts to boost renewable energy, Consunji says he doesn’t foresee demand for conventional power reducing anytime soon. “Electricity prices would shoot up if we completely transition to renewable energy sources," he avers. “We still need fossil fuels."

Semirara is now reviving plans to build a 700 MW coal-fired plant inside the Calaca power complex, which would be its single biggest power-generating faciilty and cost $1.4 billion. The project was shelved in 2019 in the wake of regulatory changes and delays in the construction of additional capacity by the state-owned transmission company.

DMCI initiated a 291-billion-pesos five-year plan through 2027 for its coal operations that includes the development of a new mine (adjacent to its operating mine) and boosting coal production to 20 million tonnes from 16 million tonnes. Semirara Island’s reserves are estimated to be depleted within 12 to 15 years based on latest studies.

Meanwhile, the outlook for DMCI’s property business is somewhat cloudy due to oversupply of urban housing. In Metro Manila, there are as many as 70,000 unsold condos, according to property consultant Colliers Philippines. Consunji is optimistic that DMCI Homes’ inventory of about 2,800 units in the city (as of end-March), will be sold within 18 months, helped by a rent-to-own programme to make them more accessible. “There are plenty of buyers who can afford the monthly payments but don’t have enough cash for the down payment," he says.

DMCI Homes’ seven upcoming residential projects with over 3,000 units are mostly located outside Metro Manila. They include Moriyama Nature Park, a Japanese onsen-inspired project of “resort homes" covering a 40-hectare expanse in Laguna, a province south of Manila known for its hot springs.

Betting on sustained demand from makers of batteries for electric vehicles, DMCI is also building a $1.5 billion high-pressure acid leaching nickel processing plant with an annual production capacity of 60,000 metric tonnes. DMCI’s partner in the project is Nickel Asia, owned by the Zamora family. “Hopefully, the glut in nickel supply would have eased by the time the plant is ready in three years," Consunji says.

![]()

He also foresees increasing profit contributions from Maynilad Water Services, a joint venture with Metro Pacific Investments, backed by Indonesian billionaire Anthoni Salim and Japanese investment giant Marubeni, which supplies water to over 10 million people in western Metro Manila. The utility has been steadily increasing its contribution to DMCI’s bottom line. Maynilad Water’s net profit rose nearly 60 percent to 3.3 billion pesos in 2024, or about 17 percent of DMCI’s total net profit, compared with nearly 9 percent the previous year.

Maynilad is now gearing up for an October IPO to raise 38.6 billion pesos to substantially upgrade its facilities. “There are still many things that can be done to improve Maynilad but it’s constrained by red tape in getting local government permits to replace old pipes and install new ones," according to Consunji.

More than a decade ago, Consunji stepped back from day-to-day management, handing over operational charge to various family members and professional executives. His cousin Herbert, DMCI’s chief financial officer, now has dual responsibility as Concreat’s president and CEO. Consunji’s sister Cristina has been running Semirara since 2019 as president and CEO, while his brother Jorge runs the construction side overseeing bids for government infrastructure contracts. Two other sisters, Edwina Laperal and Luz Consuelo Consunji are executive directors.

![]()

The third generation has entered the scene. Consunji’s nephew Tulsidas Reyes is president of DMCI Mining while Alexander Gotianun (the son of Cristina and Jonathan Gotianun, a scion of the family behind Filinvest Development) is in charge of special projects at Concreat. Consunji’s son Victor, who’s a civil engineer, is developing boutique housing projects outside DMCI.

So far, Consunji says there’s been no formal discussion about succession and he’s agnostic about whether the next chairman is a family member or a professional. Consunji tries to draw on lessons he gleaned from his father, who he says wasn’t dictatorial and encouraged people to collaborate. His dictum: “No one among us is as good as all of us."