Rebellions had made a name for itself with its energy-efficient AI computer chips with a range of applications, from high-frequency trading to supporting large language model tools like OpenAI’s ChatGPT. After launching the company in 2020, Park raised $225 million over five funding rounds to bankroll its Atom chip series that had become the chips of choice for South Korea’s data centres. And Rebellions’ next generation of low-power-consuming chips, designed for electricity-guzzling AI hyperscalers, was on its way. But Park was well aware that he couldn’t wing it on his own to realise his global ambitions.

Meanwhile SK Telecom—a crown jewel in the business empire controlled by Chey Tae-won (No 36 among Korea’s 50 Richest)—had its own AI chip startup Sapeon Korea, which was slugging it out with Rebellions in the domestic market with its X330 chip. Ryu and Park concluded that by joining forces they would not only create a national chip champion, but one with enough heft and scale to take on deep-pocketed global rivals overseas, including the industry’s undisputed leader, American tech giant Nvidia.

“Only a few AI chip players can survive. In this fast-changing market, we need to consolidate all of Korea’s top talent within a single company," says Park. “I don’t want to waste time and energy to compete inside Korea," he adds.

Capturing even a sliver of the worldwide market would be a game-changer. As companies race to adopt generative AI tools trained on vast amounts of data, demand for AI chips has exploded in the past two years. Global sales are expected to top $92 billion in 2025, up 29 percent from $71 billion in 2024, per US tech consultancy Gartner.

In December, the all-stock deal was sealed, with Sapeon issuing 2.4 shares for every Rebellion share, to create South Korea’s first AI chip unicorn valued at 1.3 trillion won, the equivalent of $1 billion at the time ($900 million today). The combined entity, which retained Rebellions’ management team and name, is the biggest South Korean supplier of AI chips. Its blue-chip client list includes the cloud divisions of SK and internet giants Kakao (controlled by Kim Beom-su, No 7) and Naver (Lee Hae-jin, No 19).

“Merging [with Sapeon] is one of the smartest moves," says Mohamed Zeeshan Hassan, chief investment officer of Wa’ed Ventures, the venture arm of Saudi Arabia’s state-owned oil giant Saudi Aramco. “Korea is already a small market and you have to compete with global players. Why would you compete with your neighbour?"

The new alliance gave Park, who retains a nearly 10 percent stake in the merged entity according to regulatory filings, access to HBM3E, an advanced high bandwidth memory chip that significantly increases data-processing speed and is made by the group’s memory chip arm SK Hynix. “There’s a shortage in foundry [manufacturing] capacity," says Park, “and a shortage of HBM." Apart from SK Hynix, the other two global suppliers of the cutting-edge chip are Samsung Electronics and Boise, Idaho-based Micron.

Still, increasing sales at home, much less international growth, is a tricky proposition. Persuading data centres to source AI chips from companies other than Nvidia, the world’s dominant supplier with approximately 90 percent market share, according to UK research firm Futurum Intelligence, is almost as difficult as making the chips themselves. Nvidia (market cap: $2.8 trillion) reported $35.6 billion in data centre chip sales in its fourth quarter ended January 2025, nine times that of its closest rival, California-based chipmaker AMD (market cap: $156 billion), which generated $3.9 billion in comparable revenue in the last three months of 2024.

Rebellions, a minnow by comparison, is targeting 100 billion won in revenue, roughly $68 million, in 2025. According to the latest available filings, the company posted 2.7 billion won in revenue in fiscal 2023 (sales the previous year weren’t available), with a net loss that widened to 13.7 billion won from 8.1 billion won in 2022.

![]()

A chip company with global ambitions has to first prove that its chip has a clear advantage over Nvidia. In early 2026, Rebellions will start mass production of its eponymously named Rebel chip, designed for energy-efficient inference—industry lingo for when an AI model is being used—at scale. This is a big deal as a ChatGPT request through an AI server consumes 10 times more electricity than a Google search, according to the International Energy Agency.

Based on company performance tests, Park claims the new processor will offer three times the power savings for AI workloads compared with Nvidia’s most energy-efficient AI chip, the H100, the first in its Hopper series, launched in late 2022. Another key advantage, the CEO says, is Rebel’s 144 gigabytes of HBM3E memory capacity, a big leap over H100’s 80 gigabytes of HBM3. For example, he explains, it would require two H100s to power Meta’s Llama 3.1 large language model, compared with just one Rebel chip.

“In terms of total cost of ownership [purchase price plus operating costs], Rebel is cheaper than H100 for inference," says Park. The H100’s peak power consumption is 400W, while the Rebel chip can deliver one petaflop (1,000,000,000,000,000 calculations per second) of performance while using only 350W of power. However, Park concedes, “If you want to do both training and inference, H100 is the right solution."

![]()

The company was unwilling to disclose how many Rebel chips it plans to produce, citing confidentiality agreements with customers. Nvidia is readying its own next-gen AI chip, the B200, for mass delivery this quarter. It says the latest offering in its Blackwell range, successor to Hopper, will have up to 30 times the inference performance and 25 times the energy efficiency of the Hopper chips plus 192GB of HBM3E. Still, this power-packed chip is expected to be more expensive to run, giving Rebellions an opportunity to position the Rebel chip as an economical alternative.

Recruiting top-tier talent has been a key factor in Rebellions’ success, says Ki-Jun Kim, CEO of Kakao Ventures, who first met Park in 2019 and decided to invest 2 billion won in Rebellions within an hour of their conversation. Park’s stringent recruitment standards, such as hiring design engineers with experience at top semiconductor companies, helped Rebellions earn a reputation as “the rocket ship everyone wants to join" in South Korea, says Kim.

Despite being a relatively small nation of some 50 million people, South Korea has top semiconductor talent. It’s home to two of the world’s largest memory chipmakers—Chey’s SK Hynix and Jay Y Lee’s (No 2) Samsung Electronics—as well as key industry suppliers, including equipment maker Kwak Dong Shin’s (No 22) Hanmi Semiconductor and chemicals producer Chung Ji-wan’s Soulbrain. Supportive government policies have helped nurture the country’s dense tech ecosystem of conglomerates and startups, where, for example, Soulbrain’s biggest customer is Samsung while Hanmi supplies SK Hynix.

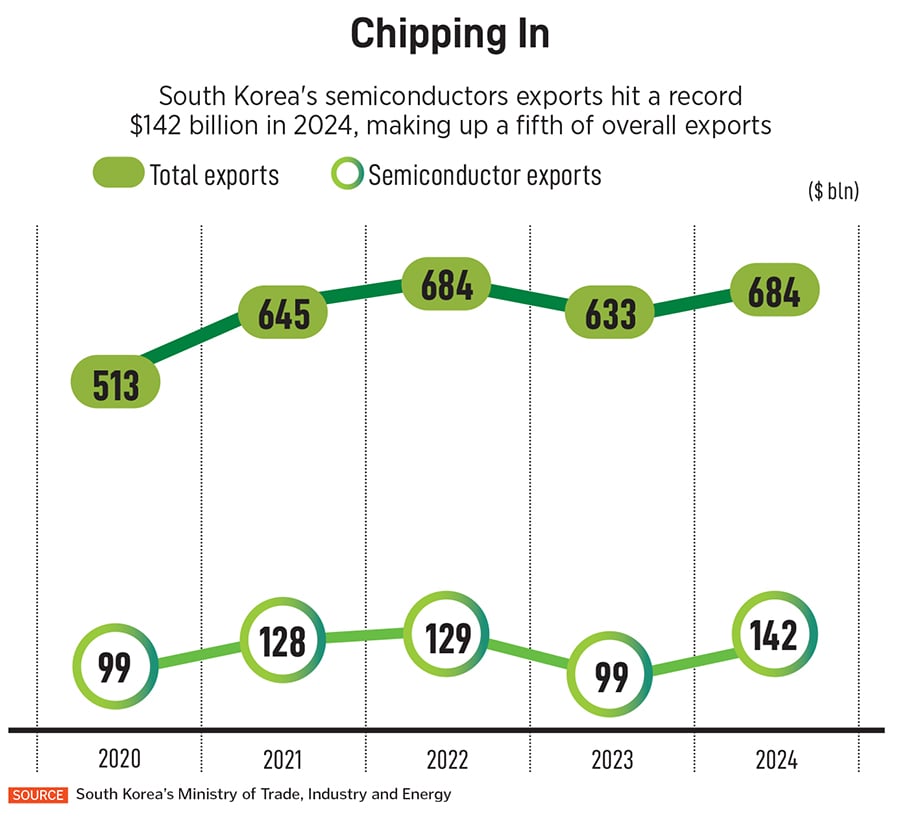

Semiconductors are also the largest export category for the trade-reliant country, contributing approximately a fifth to its annual exports of $684 billion, with the US market accounting for 19 percent of the country’s total. While semiconductors have been spared US President Donald Trump’s tariff axe, at least for now, they cannot escape it altogether as they are embedded in products, such as AI servers that may face additional US import duties.

After finishing a bachelor’s degree from Korea Advanced Institute of Science and Technology (KAIST) in 2006, Park moved to the US, where he studied electrical engineering and computer science at MIT. That led to jobs at Intel, Samsung Mobile and Elon Musk’s Starlink—where he was a chip design engineer—before Park landed at Morgan Stanley in New York in 2018. While developing quant models for the bank’s high-frequency trading system, he figured that orders could be executed even faster if the machines were built with customised chips.

![]()

Two years later, he returned home to start Rebellions with Jinwook Oh, a KAIST alumnus and former principal designer at IBM’s research lab in New York, who became Rebellions’ chief technology officer. Securing 5.5 billion won as seed funding from backers such as Kakao Ventures, they built a prototype, the Ion chip, in 2021, and from there developed their first commercial AI offering, the power-lean Atom series, launched in 2023 and touted as a cost-saving alternative for data centres.

Another niche for Rebellions is offering an all-in-one solution instead of solely selling chips, says Park. “A lesson I learnt from our customers is that they want a turnkey hardware service," he explains. “Just plug and play." When a hyperscaler buys AI chips, installation requires technical expertise—skills that are in short supply, Park posits. Very few chip companies go beyond selling the hardware to preserve their gross margins.

In November, Rebellions partnered with Taiwanese electronics assembler Pegatron to develop AI servers powered by the Rebel chip. That was followed by a collaboration with California-based Penguin Solutions, announced in March, to help customers set up, or plug, clusters of AI chips into their server infrastructure. “AI chip designers don’t want to partner with others to avoid profit sharing and keep margins high," Park says. “But I love to share," he adds, “because the market is getting larger, larger and larger."

The bigger challenge is finding new customers overseas. Park struck his first deal with Saudi Aramco last August to supply its data centres with AI chips (the oil giant’s Wa’ed Ventures had invested $15 million in Rebellions a month earlier—its first investment in South Korea), and by year-end had secured orders from the US, Japan and Thailand. An IPO (initial public offering) as early as 2026 could also be on the cards, he says, depending on sales this year.

Yoo Hoi-jun, dean of KAIST’s Graduate School of AI Semiconductor, is optimistic. Rebellions is pushing the frontier in high-speed memory and AI optimisation, he says by email. Within the AI community, “they call it one of the most exciting names to watch in the global chip space".