Can lab-grown diamonds' affordability make it outshine rarer, natural gems?

Man-made or lab-grown diamonds are gaining significant traction among Gen Z and millennials, particularly due to their affordability and sustainability

Lisa Mukhedkar was 19 when she first wore her mother’s diamond solitaires for a wedding. And she was hooked. But much as she coveted one of her own, she couldn’t justify the sky-high price tag. “And there was no other option. When I last looked at it a few years ago, it was ₹36 lakh. For that kind of money, I could buy an apartment," says Mukhedkar, now 56.

In 2023, in what she calls a “life-changing moment", Mukhedkar discovered lab-grown diamonds (LGDs). For ₹3.5 lakh, she bought earrings that would have cost her nearly 12x had they been natural diamonds. In the man-made gems that married aspiration with value proposition, Mukhedkar sniffed a business opportunity.

With Kumar Saurabh, a former client at a retail design company she had co-founded in 2006, Mukhedkar co-founded Aukera, and opened its first store on Dickenson Road, the jewellery street of Bengaluru. “We sat next to Malabar and other natural diamond retailers such as Caratlane, Bluestone, Tanishq, and Joyalukkas," she says, adding that in one-and-a-half years, the company has now scaled up to 15 stores across three cities. The company also recently raised $15 million in a Series B funding round led by Peak XV Partners, with continued backing from existing investors including Fireside Ventures, Sparrow Capital.

“LGDs are gaining significant traction, particularly among millennials and Gen Z," says Dipayan Mukherjee, senior manager, research, Netscribes, a global data and insights firm. “Their appeal lies primarily in affordability—one can get a much larger and higher-quality LGD for the same price as a smaller natural diamond. There is also a growing preference for what is being perceived as a more ‘ethical’ and ‘sustainable’ option," he adds.

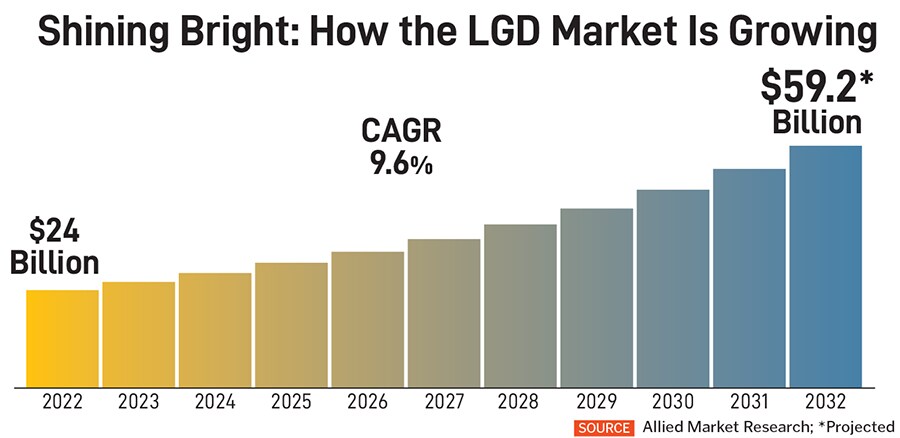

Globally, the LGD market is expected to reach $56 billion by 2031 from $22 billion in 2021, growing at a CAGR of 10 percent, says Allied Market Research (see infographic). The growth will be in tandem with the scale-up of the certification industry, driven by the increasing consumer demand for certified diamonds—as the LGD market expands, certification bodies will play an increasingly important role in providing grading services to ensure the quality and authenticity of these gems.

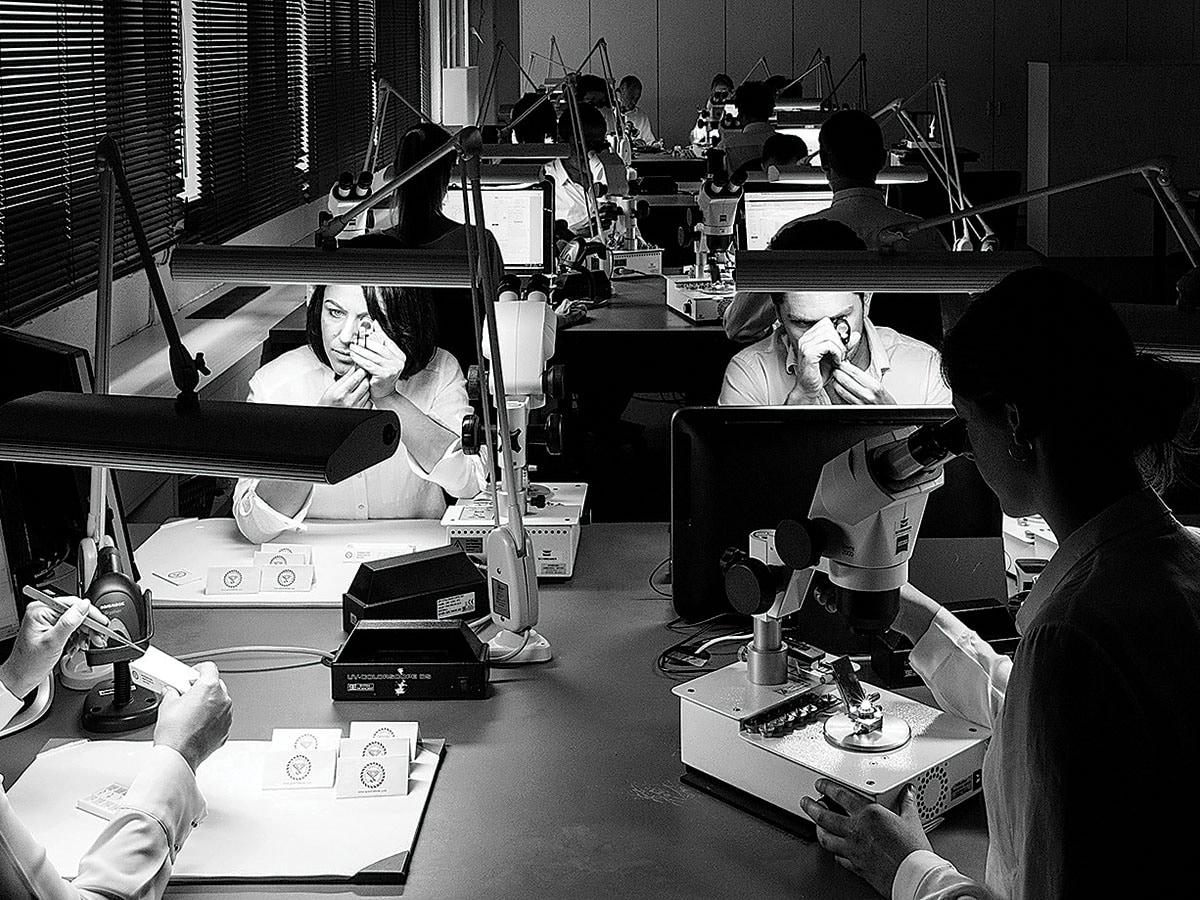

The International Gemological Institute is a pioneer in LGD certification since the early 2000s and currently commands about 65 percent of the global LGD certification market share. “The global certification business was estimated to be $550–650 million in 2023, with a penetration of 65–70 percent. This is expected to grow to $1–1.1 billion, with a penetration of 75–80 percent by 2028. This growth will be driven primarily by the LGD segment, which is expected to grow at 20 percent year-over-year," says Tehmasp Printer, MD and CEO, International Gemmological Institute India.

Pooja Sheth Madhavan, the founder and MD of Limelight Lab Grown Diamonds, the largest vertically-integrated LGD brand with 35 exclusive operational stores, says, “India, today, is at the same inflection point as the US was in 2018. We feel there’s going to be an exponential burst of the demand for lab-grown diamonds in India." Madhavan adds that the consumer acceptance for LGDs is increasing, especially for engagement rings and bridal jewellery. “Consumers don’t want to spend so much on jewellery that sits in the locker."

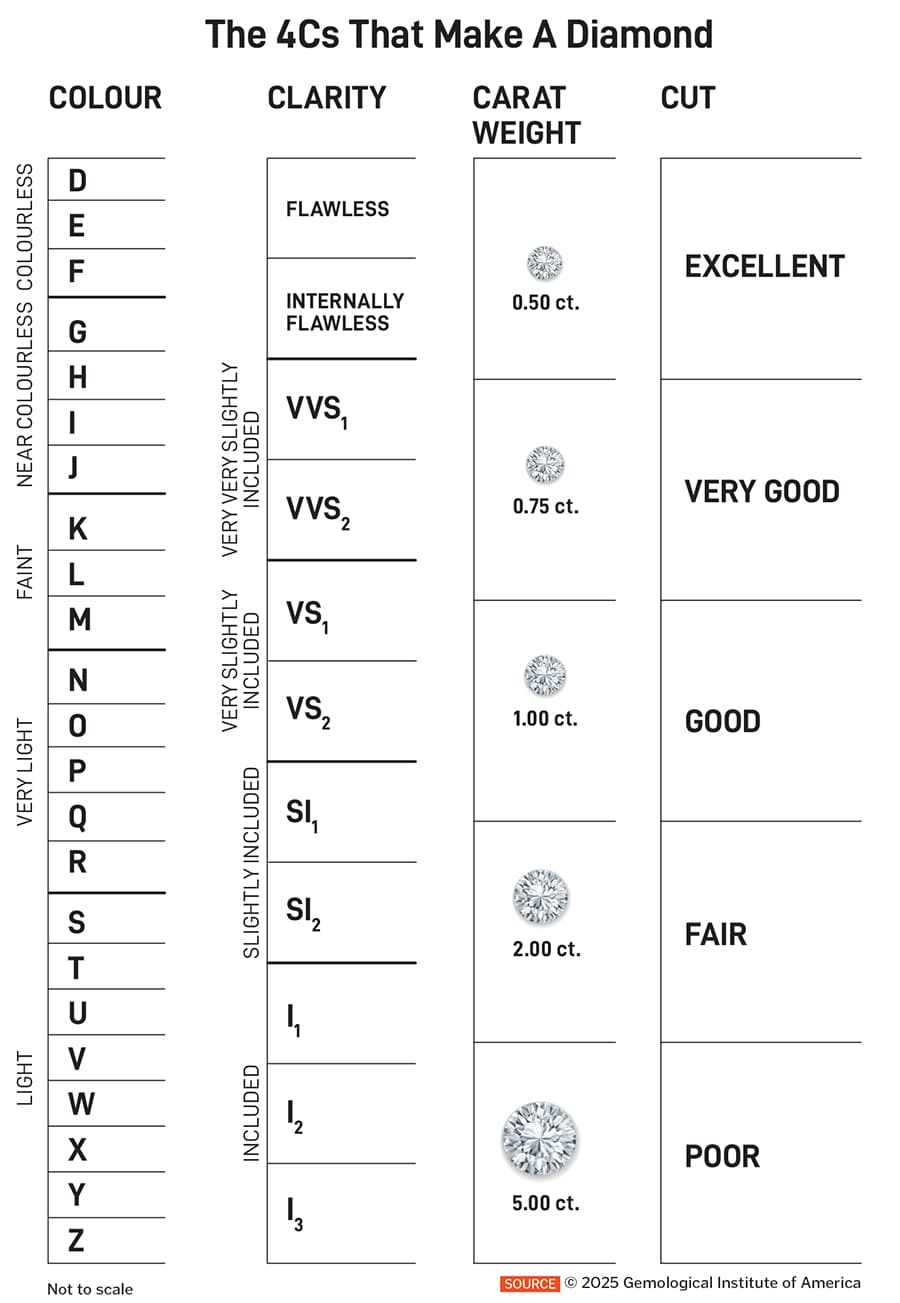

She explains that a one-carat natural diamond ring of VSGH quality (see box)—one with minimal imperfections and that is nearly colourless—might cost between ₹5 and ₹6 lakh, whereas a superior VVSEF quality LGD (that has very minor flaws) of the same size can be acquired from Limelight for ₹75,000-80,000. The technological advancements in producing LGDs, particularly those grown by the CVD method (Chemical Vapor Deposition that gives higher clarity and fewer inclusions), are typically Type IIa diamonds, which means they are ‘pure carbon’ without nitrogen or boron impurities, leading to a ‘far superior’ shine and brightness compared to most natural diamonds.

As LGDs can be produced in laboratories, their production and supply have ramped up considerably, leading to a drop in prices. According to data from the Gem and Jewellery Export Promotion Council (GJPEC), India has emerged as the largest LGD exporter globally in 2023, accounting for 28.6 percent of the world’s exports. This focus is not just on jewellery but also on the broader industrial applications of LGDs in areas like computer chips, satellites, 5G networks, defence, and medical industries.

“Out of the 1.4 billion people in India, there are around 30 million women who have the potential to buy diamond jewellery," says Prasad Kapre, a diamond industry advisor. “Of these, currently, 4 to 5 percent end up buying diamonds in a year for the rest, the sweet spot of jewellery purchase is about ₹35,000, with which they end up buying plain gold jewellery or gold and cubic zirconia jewellery." That’s why LGDs are a gamechanger—by lowering the entry barrier, they’ve opened up a hitherto untapped consumer base.

The Indian government, recognising the potential of the LGD market, has come behind the industry. Known traditionally as a leading centre for cutting and polishing natural diamonds, with a vast skilled workforce, India has been able to quickly adapt and become a major player in LGD production, particularly in the CVD method. “The government is actively supporting the industry through research grants and incentives to reduce import dependence on the machinery and seeds required for growing LGDs," says Mukherjee.

In June 2023, at a private dinner at the White House, Prime Minister Narendra Modi gifted a 7.5-carat LGD to the then First Lady Jill Biden. The PM often refers to them as ‘green diamonds’, highlighting their sustainability and alignment with the ‘Make in India’ and ‘Atmanirbhar Bharat’ initiatives.

The narrative of LGD sustainability, however, isn’t without its critics. While producers like Limelight claimed that 90 to 95 percent of them are on renewable energy, the natural diamond industry argued that LGD production is energy-intensive, requiring high temperatures and pressures, and often relies on fossil fuels.

Disha Shah, founder and designer of DiAi Designs, acknowledges that LGDs are not the most eco-friendly gemstones, but maintains they are much more sustainable compared to natural diamonds due to the immense energy and water required for mining and extraction of the rough diamond. Madhavan concurs, “A one-carat mined diamond shifts 250 tonnes of earth and emits 57 kg of carbon. Now the technology is producing the exact same diamond. Do you really want to cause that damage?" She adds: “Also, consumers have understood that diamonds are not a store of value. Unlike gold, which is an exchange-traded commodity, diamond prices are controlled monopolistically. This has led to a recent crash in prices for natural diamonds, which is why the gem might not offer long-term appreciation in value."

In addition, since LGDs are created in a laboratory setting, they offer greater control over size, shape, and colour, enabling innovative and personalised designs. Shah of DiAi Designs, whose family is in the business of cutting and polishing natural diamonds, says, “Every grain that comes out of a natural diamond while cutting is sacred because it is so expensive, so it is harder to experiment with the cutting of shapes etc., while, with an LGD, there is less ‘diamond loss’, so you can make anything you desire."

Limelight Lab Grown Diamonds has 35 stores across india

Limelight Lab Grown Diamonds has 35 stores across india

Natural diamonds have been at the heart of jewellery design for centuries, inspiring iconic pieces and classic settings. Designers work with the unique characteristics of each natural stone, which can lead to exquisite, one-of-a-kind creations.

And despite the rise of LGDs, David Kellie, CEO of the Natural Diamond Council (NDC), is of the view that when it comes to jewellery, people want scarcity and individuality. He says natural diamonds will continue to become more desirable as they get scarcer. “It gets more and more challenging to recover natural diamonds because they are a natural phenomenon. And the rarer they get, the more expensive they are to recover," he adds.

At an online press meet, Jodine Bolden, director of education and training at the De Beers Institute of Diamonds, London, emphasised their unique characteristics: “Only natural diamonds are rare, unique, timeless and valuable. They are formed over 3.5 billion years ago." She contrasts this with LGDs, which are produced in 40 to 70 hours, are mass market and low cost, pretty much like cubic zirconia.

“There are so few things in this world that are natural and one-of-a-kind, that aren’t just produced at scale. And people, more than ever, appreciate things that are unique and individual because otherwise how can anything have meaning if these can be produced by their tens of thousands in a factory?" says Kellie.

In its recently released Diamond Facts Report, the Natural Diamond Council said LGD prices have dropped significantly, with a 1.5-carat stone declining 86 percent since 2015 while natural diamonds have shown, on an average, a 2 percent increase year-on-year in rough diamond prices since 2007. Madhavan explains: “Five years ago, when there was less competition, LGDs were sold at significantly higher margins because there was no benchmark. As competition increased, prices rationalised to a more normalised situation. So, the fall in LGD prices was more price correction than oversupply."

She adds there is a lot of misrepresentation between the pricing of natural diamonds and LGDs. Often, the trade-level (wholesale) pricing of LGDs is disclosed for retail comparison with natural diamonds, which is not a like-for-like comparison. “Trade prices cannot be directly considered as what the consumer should pay—the value chain involves various markups and overheads just like is the case for natural diamonds too," she says.

Another case against natural diamonds is that they aren’t always clean, and are often marred by ‘blood diamonds’—those that are extracted in conflict zones and used to fund insurgency. But the natural diamond industry says it has adopted rigorous measures—like the United Nations-mandated Kimberley Process Certification Scheme—to guard against these trickling into the market. “It’s their job to make sure conflict diamonds don’t get into the supply chain, and also to ensure that the value of natural diamonds cannot be used to fund rebel movements around the world," says Kellie of the Natural Diamond Council.

“Our role is to ensure the consumer understands the positive impact of natural diamonds. For example, in Botswana, natural diamonds contribute significantly to the nation’s economy, making up around 30 percent of the country’s GDP. It’s 80 percent of their foreign currency. That means the kids get free education, they get roads and schools," he adds. It has made Botswana, Kellie adds, one of the most prosperous nations in Africa compared to where they were 50 years ago, when diamonds weren’t mined there.

De Beers, the world’s leading diamond company, is also investing in the India market, announcing plans to open 15 ‘Forevermark’ stores this year and another 100 in the next five years with a revenue target of $1 million.

During his maiden visit to India in May, De Beers CEO Al Cook projected that the country’s natural diamond market—currently valued at just under $10 billion—is set to double by 2030.

The International Gemological Institute will continue to uphold the 4Cs standards for diamonds

The International Gemological Institute will continue to uphold the 4Cs standards for diamonds

Image: courtesy International Gemological Institute

“The ongoing tussle between mined diamonds and LGDs is taking away consumer confidence from the category itself," says Kapre. He argues that both need to appeal to the “emotional side" of the consumer’s brain—of fulfilling their ‘diamond dream’. “There are over one million people working in the diamond industry, whether lab grown or natural. The industry has generated employment," he adds.

The Indian diamond industry is also a significant contributor to the country’s foreign exchange earnings, with cut and polished diamonds being a major export. “Diamonds are an integral part of the Indian economy and it’s going to stay like this," he says.

Meanwhile, the June 2025 ICRA report on the Indian Cut and Polished Diamond (CPD) industry states that Indian CPD exports experienced a 20-year low in FY25, contracting 17 percent to $13 billion and projects a further decline of 7-10 percent in FY26, with exports estimated to be around $12 billion.

“This throws a curveball for India’s diamond industry, after what has already been a tough FY2025. This puts pressure on jewellery brands, especially those who lean heavily on natural diamonds," says Mukherjee of Netscribes. “We are looking at squeezed profit margins because global demand just isn’t what it used to be, and those shifting US tariffs aren’t helping. Natural diamonds are probably going to feel this sting more acutely. This is in addition to the rise of more affordable LGDs and a continued slump in major markets like the US and China. LGDs, even with their own price adjustments, are still managing to snag more market share in this landscape."

But Neil Sonawala, managing director of Zen Diamond, disagrees. “While the broader landscape undergoes shifts in perception and production, we see this not as a moment of uncertainty but as a reaffirmation of our roots. Natural diamonds are rare, finite, and carry an emotional weight that no alternative can replicate." Following the opening of two outlets in Mumbai in two years, the company is looking to foray into Bengaluru next and is looking to establish 100 stores across India by 2030.

In June, one of the most significant moves to differentiate the two products came from the Gemological Institute of America, the authority that created the universally recognised ‘4Cs’ (cut, colour, clarity, carat) for diamonds in the 1950s.

Tom Moses, GIA’s executive vice president and chief research and laboratory officer, said in the statement, “More than 95 percent of LGDs entering the market fall into a very narrow range of colour and clarity. Because of that, it is no longer relevant for GIA to describe man-made diamonds using the nomenclature created for the continuum of colour and clarity of natural diamonds." This move aimed to reaffirm the rarity for natural diamonds and would likely accelerate the market segmentation, it further said, adding that it will use descriptive terminology such as ‘premium’ or ‘standard’ for LGDs.

But the International Gemological Institute will continue to uphold the 4Cs standards not just out of convention, but out of respect for the consumer’s right to transparency. IGI also incorporates their proprietary advanced tool like Light Performance Analysis to measure how each diamond interacts with light to provide insight into its brilliance, fire, and scintillation, which is the measure of the diamond’s ‘sparkle’.

De Beers, a staunch proponent of natural diamonds, closed its Lightbox LGD jewellery venture in May. The company is now redirecting its synthetic diamond efforts through its Element Six division, focusing on technological advancements like quantum technology for sensors and semiconductors, even exploring investment in India’s semiconductor sector.

Despite the move to reaffirm rarity for natural diamonds to likely accelerate the market segmentation, Printer says, “We believe both types of diamonds will coexist harmoniously, as today’s discerning consumers often develop unique preferences for lab-grown or natural diamonds at different stages of their lives." He adds, “LGDs are emerging as a strong market disruptor, and we anticipate transformative shifts in both segments in the years ahead."

While natural diamonds would solidify their position as the ultimate luxury, heritage, and investment choice, and their scarcity would likely support their long-term value, LGDs are projected for continued growth and accessibility and would dominate the accessible luxury and fashion jewellery segments.

First Published: Aug 08, 2025, 18:43

Subscribe Now