More data access, and a new way of lending

The coming together of bureau data, identity proof, and income verification has resulted in a massive expansion of loans in the last decade. Now, lenders want to take it to smaller towns, scaling with

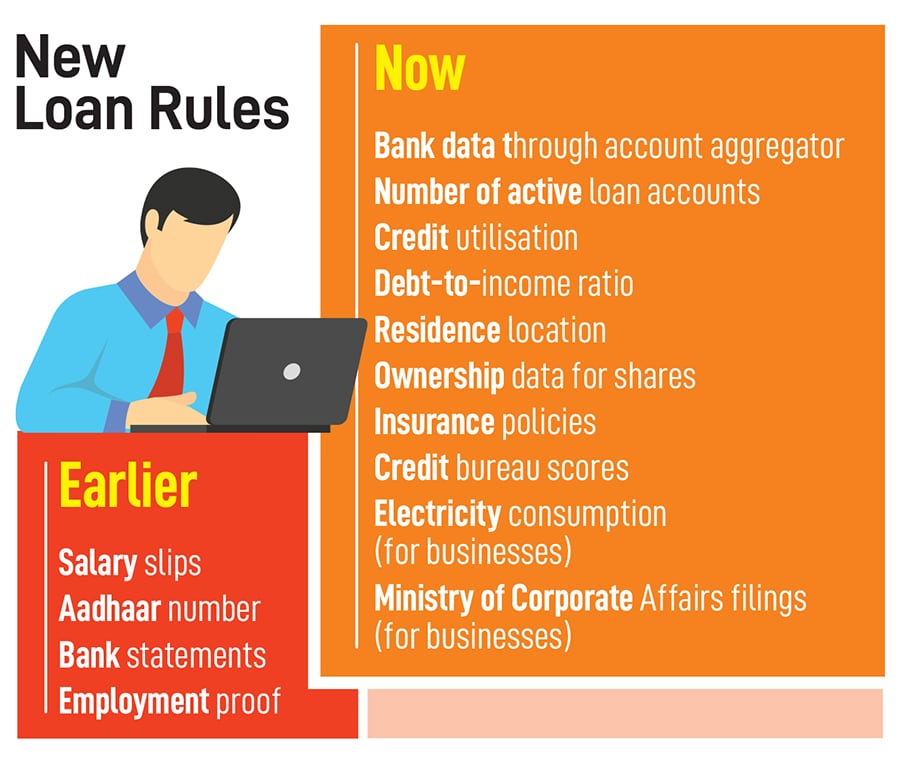

Make a loan to a salaried employee and the underwriting process is straightforward. A salary slip provides income proof, an Aadhaar number checks the person’s identity and credit bureau scores contain information on past behaviour. All a lender has to do is run it through a set of algorithms and a decision comes back in under a minute.

The coming together of bureau data, identity proof and income verification resulted in a massive expansion of loans in the last decade. Personal loan portfolios rose 16.4 percent a year from Rs6,91,177 crore in 2011 to Rs59,52,299 crore in 2025, according to data from the Reserve Bank of India (RBI).

As Joydip Gupta of Scienaptic, an AI-focussed credit decisioning platform, explains, “This opportunity has been tapped out. Now lenders are going beyond the traditional catchment area to smaller towns and self-employed people." In the past, lenders have had to work at understanding income patterns across professions to make loans—Gruh Finance (which later merged with Bandhan Bank) pioneered this by making mortgages available to self-employed people. Its credit officers would spend time with vegetable vendors, rickshaw pullers, labourers and make loans after estimating their income.

The question for lenders now is two-fold. First, how can this be done at scale with the use of technology? Second, how can the use of additional data points allow risk to be maintained at acceptable levels. The risk part is crucial as a large number of these loans are made through non-banking finance companies and fintechs that borrow from banks, and need to go outside the traditional catchment areas of banks to lend at a higher yield.

While Indian lenders are cagey in talking specifics on the models, they are using companies like Scienaptic AI, which is processing 20 million loan applications a month with a cumulative value of Rs25,000 crore.

The US market where Scienaptic also operates offers some clues on how the process operates. An application for an auto loan would start by looking at credit scores, but quickly move on to checking for bankruptcy filings, debt to income ratio, credit utilisation across multiple lenders and so on. Cash flow analysis is something lenders have started doing in detail. Bank statements are checked for average balance, average inflow and outflow every month, total number of transactions and so on. “These models allow us to approve customers that wouldn’t have otherwise had access to credit," says Chandan Pal, chief marketing officer at Scienaptic AI.

This is where the account aggregator (AA) framework in India is starting to have an impact. Once a borrower gives consent, a lender can access bank data as well as data on investments. As of March, 179 million consent requests have been made through the AA framework, according to data from Sahamati, an industry collective that represents account aggregator companies. “In flow-based lending, once a lender sees the intensity of transactions, it is possible to get an idea of a person’s or small business’s ability to pay," says Firoz Anam, an industry expert. For self-employed individuals as well as small businesses, this has become the preferred mode of underwriting now.

In addition, lenders now have access to credit bureau records as well as data from the Ministry of Corporate Affairs. Then there are GST filings that provide a clear indicator of the health of a business. In some states, electricity meters are monitored—a sudden dip in consumption would be a red flag. Land records in some states are also digitised and this data is also taken into account.

Gupta says that for small unsecured loans of, say under Rs100,000, decisions are made within seconds. For loans between Rs100,000 and Rs300,000, it could take a few hours for a small business loan like a shop renovation, the time taken is two to three days.

While this is still not routine in India, in a market like the US, a borrower file also contains information on the age of the oldest loan and its servicing record as well as the number of loan inquiries. This helps the lender assign a score and decide whether to disburse the loan or not. “We are now able to identify members who may have had limited or no credit history but demonstrate strong repayment capacity. It has opened up new opportunities to say ‘yes’ to more members, without taking on additional risk," says Chad Wilcox, senior vice president of lending at the Credit Union of Colorado, in an email response.

For any lender getting early insights into how a portfolio is doing is key to maintaining credit quality. If a borrower has started defaulting on other loans or has started asking for more loans across lenders or reduced deposits in their bank accounts, these could all point to the possibility of loan payments being missed in the future. These numbers are monitored at a portfolio level and provide lenders an advance peek into where credit quality is headed and allow them to intervene earlier if needed. Steps like this become important for say, microfinance lending in India, where early warnings would allow for a slowdown in disbursals.

While lenders work to refine their models, there are also large language models being worked on. For instance, photos of a factory may allow lenders to assess the turnover generated every month. Or satellite data on rainfall may allow them to show whether a particular crop would suffer from poor yields in a certain year, and increase or cut lending to agriculture accordingly. A lot of these models are still in their infancy but once lenders master working with traditional data sources, this could be the next frontier for lending in India.

First Published: May 16, 2025, 12:31

Subscribe Now