GDP: A good growth number brings relief

GDP growth surprised on the upside but there's still plenty of room for caution ahead

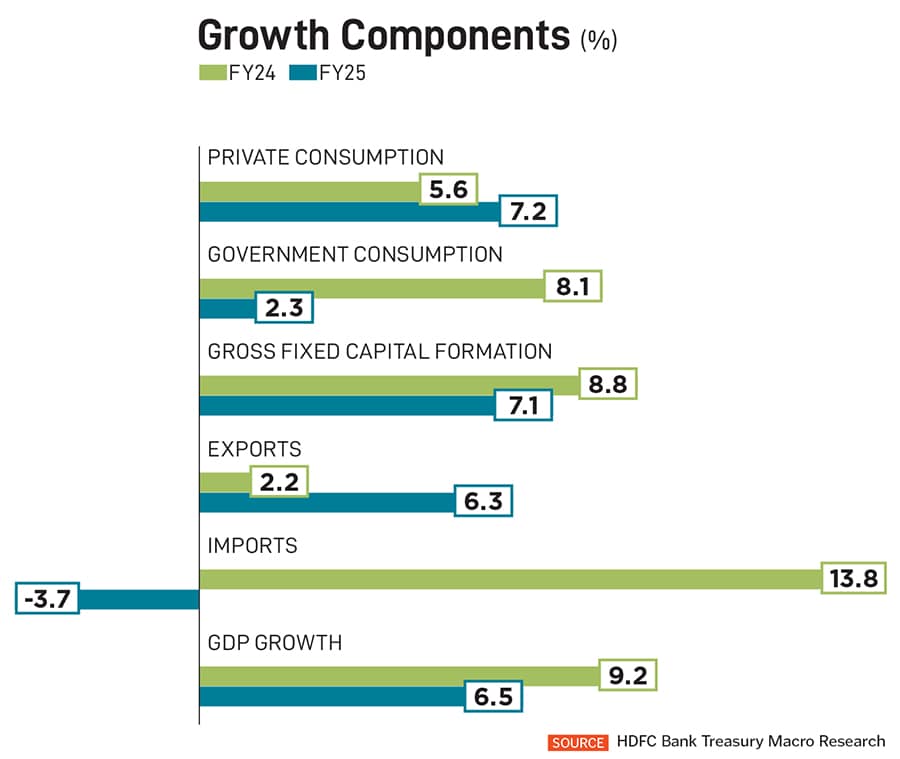

Economic growth in India was expected to show signs of a pick-up and the fourth quarter numbers released on May 30 didn’t disappoint. After slowing in the first half of the year, Q4 recorded 7.4 percent growth, taking the annual number to 6.5 percent.

Still, it is lower than the 9.2 percent in FY24 and was primarily on account of the slowdown in capital expenditure in FY25. The first half saw the election cycle and the formation of the new government, resulting in lower spending. In FY25 the actual government spend on capex was ₹10.52 lakh crore lower than the ₹11.11 lakh crore budgeted.

Rural demand and services also held up well. “We have seen two successive cropping patterns with good output," says Sakshi Gupta, principal economist, HDFC Bank. In March, Mahindra & Mahindra saw tractor sales rise by 34 percent over last year, to 34,934 units.

On the other hand urban consumption continued to report sluggish demand. This is expected to change as low inflation, lower interest rates and a tax cut should spur urban demand too. In Q4, private consumption fell, growing at 6 percent versus 8.1 percent in Q3.

Lastly, services activity also held up in Q4, expanding at 7.4 percent. Spending was buoyed by the Maha Kumbh in February that saw demand for travel and hospitality rise across the country. Demand for air travel continues to be strong. InterGlobe Aviation, which operates IndiGo airlines, posted a Q4 profit of ₹3,067 crore, up 61 percent form ₹1,894 crore. The growth was aided both by rising passenger numbers as well as lower fuel prices.

The FY25 GDP is ultimately a number in the past and it masks the fact that there are several storm clouds on the horizon. First, economic activity will continue to be muted on account of the gap between the GDP and GVA (gross value added) number. In April 2025, the Index of Industrial Production dropped to 2.7 percent compared to 3 percent in March 2025 and 5.2 percent in April 2024.

While the GDP number includes indirect taxes and subsidy payouts, the GVA number excludes these components and provides a truer picture of growth. GVA came in at 6.4 percent. “The tepid pace of expansion in industrial volume growth as well as the deterioration in the performance of several service sector indicators is expected to have weighed on GVA growth in these segments," said Aditi Nayar, chief economist at ICRA in a press release.

While the GDP number includes indirect taxes and subsidy payouts, the GVA number excludes these components and provides a truer picture of growth. GVA came in at 6.4 percent. “The tepid pace of expansion in industrial volume growth as well as the deterioration in the performance of several service sector indicators is expected to have weighed on GVA growth in these segments," said Aditi Nayar, chief economist at ICRA in a press release.

The Q4 GDP numbers would also be devoid of the uncertainty in global trade caused by the imposition of tariffs by the US on April 2. There could have been some instances of exports shipping in advance of the April tariff imposition resulting in export numbers rising in Q4.

“The impact of tariffs has so far been tangential, but the trade outlook remains choppy," wrote Aurodeep Nandi and Sonal Verma of Nomura in a note. Where tariffs settle remains key for growth in FY26. With the global uncertainty, Gupta of HDFC doesn’t see private sector capex doing well in FY26 and so government spending will likely have to be front loaded.

These uncertainties, coupled with a low consumer price inflation, prompted the Reserve Bank of India to cut repo rates by 50 basis points, and the cash reserve ratio was cut by 100 basis points on June 6. What remains to be seen is if this is enough to lift growth in the current year.

First Published: Jun 19, 2025, 11:44

Subscribe Now