How India’s World Cup win got brands batting for WPL

As sponsors queue up to partner with WPL franchises, India’s victorious campaign brings not just visibility for women’s cricket, but also commercial viability

Since her international debut in 2021, Renuka Singh Thakur has emerged as India’s pace-bowling spearhead, delivering stingy spells that choke the flow of runs. Yet, for much of that time, her on-field impact rarely translated into recognition off it. “Earlier, most of us wouldn’t get recognised aside from perhaps Smriti [Mandhana] and Harman di [captain Harmanpreet Kaur],” Singh Thakur says ahead of the start of the fourth season of the Women’s Premier League (WPL). But that has changed since India’s victorious campaign at the ICC Women’s ODI World Cup. “Now, wherever we go, people ask for selfies and autographs. It’s a nice feeling,” smiles the 30-year-old, who conceded just 28 runs in her eight overs in the final of the World Cup.

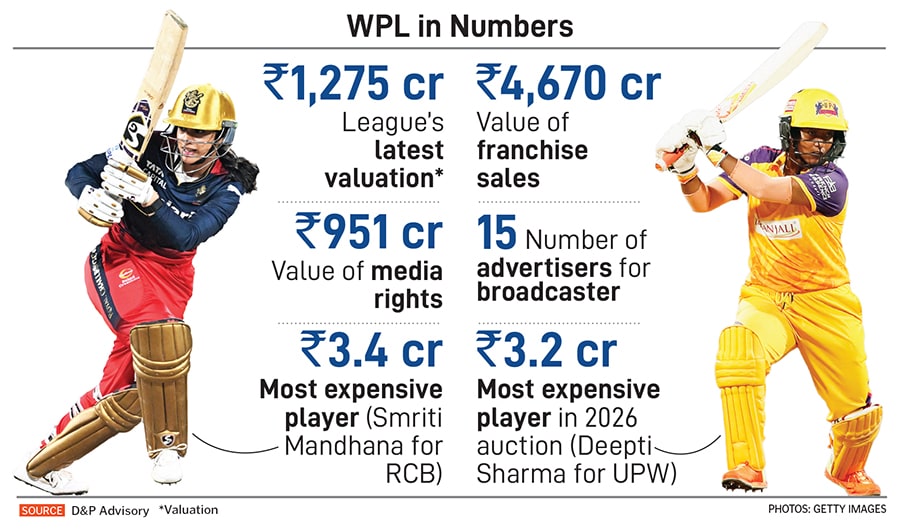

Singh Thakur’s story resonates with a generation of cricketers that has long hovered on the fringes of the conversation. Three weeks after the team’s triumph, Deepti Sharma, the Player of the Tournament, was snapped up by UP Warriorz (UPW) for a record Rs 3.2 crore at the WPL auction, a 23 percent hike from her previous pay cheque of Rs 2.6 crore. Even youngsters like N Shree Charani, 21, who finished her first World Cup with 14 wickets from nine matches, pocketed a whopping Rs 1.3 crore from Delhi Capitals (DC), more than double the Rs 55 lakh they had paid for her in WPL 2025.

This is where the victory has been seismic for women’s cricket—in shifting the paradigm for a sport that has always been considered an add-on to the men’s game. Its knock-on effect was felt in the immediate aftermath, when the BCCI (Board of Control for Cricket in India) onboarded three new commercial partners for WPL—ChatGPT, Bisleri, and Kingfisher—at a combined value of Rs 48 crore. And, as the league commences its fourth season from January 9, it continues to benefit from the upswing.

Consider that, for the first time in its four-year history, Sharma’s franchise UPW, fielding a new-look side led by seven-time World Cup winner Australian Meg Lanning, managed to close all its jersey sponsorship deals a full month before the tournament began. “Even in the IPL (Indian Premier League, the men’s T20 franchise league), you will see teams closing last-minute deals. But we wrapped them up a month ago,” says Kshemal Waingankar, the COO of Capri Sports that owns UPW. “And the value of each deal has gone up by at least 20 percent.”

The numbers may appear counterintuitive to a recent report by D&P Advisory, which pegs the tournament’s valuation at ₹1,275 crore, a 5.6 percent decline from last year’s ₹1,350 crore. But the rising prices at the auction table and the scramble for sponsorship inventory suggest that commercial confidence in the WPL is bucking every trend, and that headline valuations may lag real-time market sentiment.

“Valuation corrections are part of any growing league, but they haven’t translated into a loss of brand interest. If anything, the conversations have become more mature. We’ve seen brand enquiries grow by around 2x compared to last season, and while deal values have stabilised, premium partnerships have seen an increase of around 15–20 percent, especially where brands are opting for deeper integrations,” says Karan Yadav, the chief commercial officer of JSW Sports, the sports marketing and management vertical of the JSW Group.

In just four years, the WPL has transitioned from being a cause that needs support to a product that has the potential to fetch a sumptuous return on investment. The shift is evident in the number of brands that have queued up to join its ecosystem—from 50 in its first season in 2023 to 70-plus this year, says Atrayee Chakraborty, SVP, strategy, Mudramax, a media buying agency. Sources in the industry estimate that broadcaster JioStar, too, has doubled its ad sales revenue compared to last year, with a 10–15 percent markup in pricing in each category.

The focus, confirms Bhairav Shanth, the co-founder of sports marketing agency ITW Universe, has conclusively moved from the empowerment narrative to one of celebrating the cricketers. “There has been a 10–15 percent increase in the asking price for marquee associations, like the front-of-jersey branding—the most premium real estate on a team’s shirt—for top teams. Companies like L’Oréal Professionnel Paris, the title sponsor for UPW, have been onboarded at a 20–25 percent premium over last season’s rates,” adds Shanth.

The viewership of the World Cup offers a glimpse into why brands are betting big on the eyeballs that the WPL can bring. About 446 million tuned in to watch the multi-nation tournament on streaming platform JioStar, surpassing the combined audience of the previous three editions. But the biggest validation of the women’s game came from the 185 million who watched the India vs South Africa final, equalling the number for the men’s T20 World Cup final in 2024 and finally shutting down a question that many cricketers have had to field early in their careers: “Do women even play cricket?”

Advertiser interest in the WPL confirms that the World Cup is not being seen as a one-off. Broadcaster JioStar has racked up 15 advertisers before the start of the tournament, compared to 10 last season. Anup Govindan, head of sports sales, says the slate underscores how far women’s cricket has come in a short time. “The depth and diversity of advertisers reflect the growing confidence in the league’s ability to deliver reach, scale and impact,” he adds. “What is particularly exciting is that brand participation is not limited to a few expected categories. Alongside FMCG and beverages, we are seeing traction from categories like BFSI (Tata Capital), fintech and payments (Bhim UPI), auto (TVS Eurogrip), EV (Vida) and AI (OpenAI).”

Even for teams, while women-centric categories like beauty and cosmetics have marked their presence—all five franchises have tie-ups with them—brand portfolios have expanded beyond them. For instance, 2024 champion Royal Challengers Bengaluru (RCB) has a tie-up with Grew Solar, a green energy brand, while commercial tyre company BKT has joined the roster for two-time champion Mumbai Indians (MI), led by World Cup-winning captain Harmanpreet Kaur.

“What’s encouraging is that brands are no longer looking at women’s cricket as an experiment or a short-term investment. They’re approaching it with longer-term intent, clearer objectives and deeper integrations,” says Sunil Gupta, the CEO of DC.

This has led to longer partnerships and more integrated storytelling across the year, not just during the tournament window of 23 days or through plain-vanilla logo placements. Yadav of JSW Sports estimates a 33 percent rise in multi-season partnerships. At least 50 percent of UPW’s dozen tie-ups this year are multi-year deals, while six of MI’s sponsorship portfolio of nine are returning partners. Says an MI spokesperson: "All the new partnerships fall under different categories, making the roster very diverse. From welcoming De Beers for their first sports partnership to expanding our five-year relationship with BKT into the women's team...the growth in our portfolio proves that our platform offers a world-class environment for brand storytelling in women's sport."

Adds Gupta of DC: “We have close to a dozen tie-ups that are content- and campaign-driven. While not every deal is about a sharp jump in headline value, there’s a clear trend towards structured, multi-year, multi-asset partnerships.”

The rise of content-driven partnerships is propelled by the soaring social media prowess of the teams. Despite a middling performance over the last three seasons, Gujarat Giants (GG) saw a 4x spurt in its following over the last eight months, led by Instagram, where numbers have risen to 109K from 18K last December. The three-week period after the World Cup and prior to the auction saw some of their most intense engagement, says Sanjay Adesara, the chief business officer of Adani Sportsline, which owns GG. Brands are keen to lean into this momentum.

“Brands are now considering tie-ups in the way they run them during the IPL. They are looking to maximise value from partnerships—how much time they get with players, how performance is measured, and what the commercial approach looks like. They have taken a thoroughly professional approach towards the WPL, which shows they are serious about the league,” says Waingankar of Capri Sports.

Beyond legacy brands with long-standing associations with sport, the WPL has also emerged as a gateway for younger, first-time advertisers to tap into its growing audience. “The tournament is increasingly being used as a lower-risk entry point into cricket, offering national visibility and cultural relevance at significantly lower investment thresholds than men’s properties,” says Chakraborty of Mudramax.

One such example is Ekaya Banaras—a high-end Banarasi sari venture founded by Palak Shah, a fourth-generation textile business scion—which marked its maiden foray into sports sponsorship by designing the jersey for UPW. How does a handcrafted ethnicwear brand find salience among a cricket audience? The fit is more organic than it first appears. Both brands are rooted in Uttar Pradesh, and both are led by women—Shah for Ekaya and Jinisha Sharma, director at Capri Sports, which owns UPW. But beyond geography and leadership, says Shah, the partnership is driven by shared ethos rather than sales logic. “We did it for the love of women’s cricketers trying to break stereotypes, just like we are doing in the male-dominated world of handlooms. And I would be lying if I said the World Cup win had nothing to do with it,” says Shah. “I am not looking for this association to move the marketing needle. It’s a no-agenda sponsorship. We did this just for what women’s cricket has come to represent.”

In effect, says Adesara of Adani Sportsline, the World Cup victory has done more for women’s cricket than the 1983 triumph did for the men’s game. “Consumption of women’s cricket had already begun with three seasons of the WPL, so when the World Cup win came, the impact multiplied manifold,” he says. “Safe to say that by the end of WPL Season 4, the consumption and engagement of women’s cricket will have more than doubled from what it was in Season 1.”

The after-effects of the World Cup have not been limited to Indian cricket alone, but have spilled over into the global game, with top international cricketers like Ashleigh Gardner, Laura Wolvaardt and Sophie Devine emerging as household names alongside Deepti Sharma and Shafali Verma. Gardner, who will skipper GG in the WPL, echoed the thrill of playing in packed venues during the recent World Cup—a welcome shift from the half-empty stadiums she had experienced on earlier tours of India with the Australian national team. “We know in a country like India, people live and breathe cricket. But for a long time, it’s been the men’s team. As a female athlete, it’s awesome to see that the women are now the people’s heroes,” Gardner told Forbes India.

Every sport grows on the back of its icons. In the US, where football had long remained an afterthought, Lionel Messi’s arrival at Inter Miami transformed Major League Soccer almost overnight, with stadium footfall jumping by 20 percent and global streaming doubling during his first 10 matches. Closer home, with his cult-like following, Sachin Tendulkar ushered in cricketing perestroika—by becoming the first cricketer to sign a ₹100 crore endorsement deal, he rewrote the sport’s commercial possibilities, and Indian cricket has not looked back since.

Now in its fourth year, the WPL still has a long way to go. But with the momentum generated by the World Cup win, the league appears to be fast-tracking the creation of its own icons—and with them, its commercial future. “Sport is a long-term game. We are not expecting commercial viability to come in two to three seasons, and it’s difficult to pin down a timeline,” says Adesara of Adani Sportsline. “That said, we feel it’s going to be much faster than the IPL.” Emerging from a milieu where generations have debated the rightful place of women, it is quite the leap.

First Published: Jan 09, 2026, 10:47

Subscribe Now