Change agents: Cari Tuna and Dustin Moskovitz’s AI safety bet

Long before ChatGPT’s debut, philanthropist Cari Tuna and Facebook co-founder Dustin Moskovitz were directing millions into AI safety research, shaping the sector far before the AI boom

Artificial intelligence (AI) is like nuclear energy, says Cari Tuna.

Early accidents led to nuclear being “essentially regulated out of existence” in the US, stalling the industry for decades, she explains. If there had been more thoughtful regulation earlier, those accidents could have been avoided, and there might have been more room for innovation—and more progress toward mitigating climate change. “With hundreds of billions of dollars going into making AI more capable, there is immense competitive pressure to push the technology forward as quickly as possible,” says Tuna. “But in order to manage the risks, you need coordination across companies and across countries… as the pace of AI development continues to accelerate, we think it might be hard for society and institutions to keep up.”

That’s where philanthropy can step in. A decade ago, the billionaire couple—Tuna, 40, and Facebook co-founder Moskovitz, 41—donated $1 million to California-based non-profit Future of Life Institute to help reduce AI risk. Then they poured $30 million into OpenAI’s non-profit in 2017 through their foundation, and Moskovitz invested in Anthropic’s $124 million funding round in 2021, “before it was obvious that these [AI] labs would make money,” Tuna says, a sharp contrast to the companies’ now-voracious appetites for funding and sky-high valuations. Back then, both labs preached a laser focus on AI safety. Neither the couple nor their foundation own a stake in OpenAI. Their Anthropic stake (worth an estimated $500 million in mid-November) was moved into a non-profit vehicle in early 2025 so they could invest any “significant financial return” back into philanthropy and “dispel any perception of conflict of interest,” she says.

Their early focus on AI stems from the powerhouse tech couple’s embrace of effective altruism, although Tuna prefers to “emphasise the ideas over the label”. The movement got a lot of unwanted attention because of its ties to now-jailed crypto titan Sam Bankman-Fried, but it essentially uses evidence and reason to identify the most effective ways to help others with a big focus both on proven, cost-effective short-term solutions and on long-term, potentially catastrophic risks—like AI. In fact, when they backed OpenAI and Anthropic, both were in their early stages and founded in part on effective altruist principles to create safe AI models that “benefit all of humanity”.

Much has changed in the world’s embrace of AI with massive deals being struck every day between the biggest of tech companies, the savviest investors and governments around the world. But Tuna and Moskovitz aren’t distracted from their mission, ramping up grants that could help make AI models safer—often trying to shape work from the likes of OpenAI and Anthropic via research, policy advocacy and even lobbying.

The couple’s evidence-based giving is not limited to AI. In fact, the largest share of the couple’s giving so far has gone to cost-effective global health interventions (including malaria, vitamin A deficiency and clean water, all of which have taken on increased urgency amid the Trump’s administration’s cuts to the US Agency for International Development). Tuna and Moskovitz have said they want to give away the vast majority of their entire fortune as quickly as they can, although that’s proving to be challenging since it keeps growing. They’ve already donated more than $4 billion, including more than $600 million in fiscal 2025. They have another $11 billion—Moskovitz’s personal fortune—and approximately another $10 billion already in their private foundation, Good Ventures, plus more in donor-advised funds.

While Moskovitz has made the money, Tuna has been working on giving it away. She has spearheaded the couple’s philanthropy since 2011 while her husband built up his second startup, Asana, which makes project management software; he just stepped down as CEO in May, and it’s not clear what he’ll do next. Most of the couple’s giving flows through Good Ventures and donor-advised funds; almost all grants are recommended by San Francisco-based Coefficient Giving—which Tuna spun out of charity evaluator GiveWell in 2017.

Tuna is working now on getting more donors to hop on board and turn Coefficient Giving, which she chairs, into a multi-donor vehicle, not just Tuna’s and Moskovitz’s foundation. To reflect that shift, the organisation, formerly known as Open Philanthropy, rebranded as Coefficient Giving in November. (“Co” reflects its status as a multi-donor organisation, “efficient” emphasises its focus on cost effectiveness, and “coefficient” is a math term for the number that multiplies a value.) More than $200 million in commitments to Coefficient Giving’s initiatives this year have come from fellow billionaires, including Stripe co-founder Patrick Collison and Lucy Southworth (Google co-founder Larry Page’s wife). They’ve helped seed two themed $100-million plus funds: the Lead Exposure Action Fund (LEAF), launched last year, and the Abundance and Growth Fund, launched in March. LEAF has so far distributed $40 million, including a $17 million grant to Pure Earth, to help it identify spices, ceramics and other causes of lead exposure in India and other countries.

“It’s quite rare to be a very successful foundation, and then also go on to influence other people’s money to a significant extent,” says Alexander Berger, CEO of Coefficient Giving. Although Tuna doesn’t usually talk to grantees or solicit funds herself, Berger and Tuna have weekly walking meetings to discuss everything from strategy to outreach to how quickly they can distribute funds in the next couple of years. “When we started, there really wasn’t anywhere for a donor like us… with billions of dollars to give away over decades, who is open to any cause or way of working, in the service of helping others as much as we can,” says Tuna. Adds Berger: “We want to build a resource that’s ready for the next set of donors.”

Born in Minnesota and raised in Evansville, Indiana, by doctor parents, Tuna says her parents moved houses to get her into the “best public schools they could because they really believed that education was the key to success in life”. She then went on to Yale to study political science and work for the college paper before landing a job in business journalism in 2008.

Tuna was working for The Wall Street Journal (covering enterprise tech and the California economy) on an entry-level reporter’s salary “watching the number in [her] bank account go down” when a mutual friend—fellow journalist Jessica Lessin, who is now CEO of tech news outlet The Information—set the then 24-year-old up on a blind date with Moskovitz in 2009. “We’ve spent nearly every day together since,” she says.

She quit journalism in 2011, when she and Moskovitz “got serious” to work on philanthropy full-time. The ex-reporter’s first step: Interviewing hundreds of experts over the course of a year, many of whom told her to fund causes she’s passionate about. She ignored that advice. One problem, in her view: “If most donors are coming from relatively wealthy and healthy circumstances, then philanthropy is going to miss some of the biggest opportunities to help others, especially the most disadvantaged people.”

Still the year-long interview process did yield some benefits, helping her hone in on the main criteria for choosing which causes to work on: Importance, neglectedness and tractability, she explains. How many people does it affect? How many other people are working on this cause? Is there an opportunity for philanthropy to make real progress on this issue?

Tuna—who grew up with a Muslim dad and Methodist Christian mom, married a Jewish man and now practices Buddhist meditation—views her access to such vast wealth as accidental. Thus she insists she feels spiritually motivated to give in a rational, math-based way that benefits the most people possible, often unrelated to well-funded causes she personally cares about like breast cancer research, she says. These ideas led Tuna to the ideas behind effective altruism, which relies heavily on evidence and massive troves of data to most cost effectively benefit as many people as possible—often measured in life years saved. So she worries more about identifying causes like malaria, clean water and deworming—what she calls “the most important decision a philanthropist makes”—rather than which specific non-profits get her money.

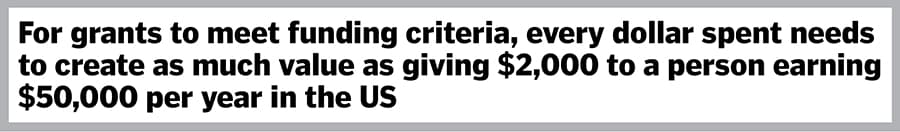

For the foundation’s grants in the global health space (its largest and longest-running ones), Coefficient Giving often does back-of-the-envelope math that converts the above factors to “disability-adjusted life years”, their metric for the number of years of human life saved via a particular grant. For grants to meet funding criteria, every dollar spent needs to create as much value as giving $2,000 to a person earning $50,000 per year in the US.

In the extreme case, “if your goal is to save lives, then being a mediocre malaria charity that works in Sub-Saharan Africa is going to save more lives than being the best charity working on a super obscure disease in America”, says Otis Reid, managing director of Coefficient Giving’s Global Health and Wellbeing work.

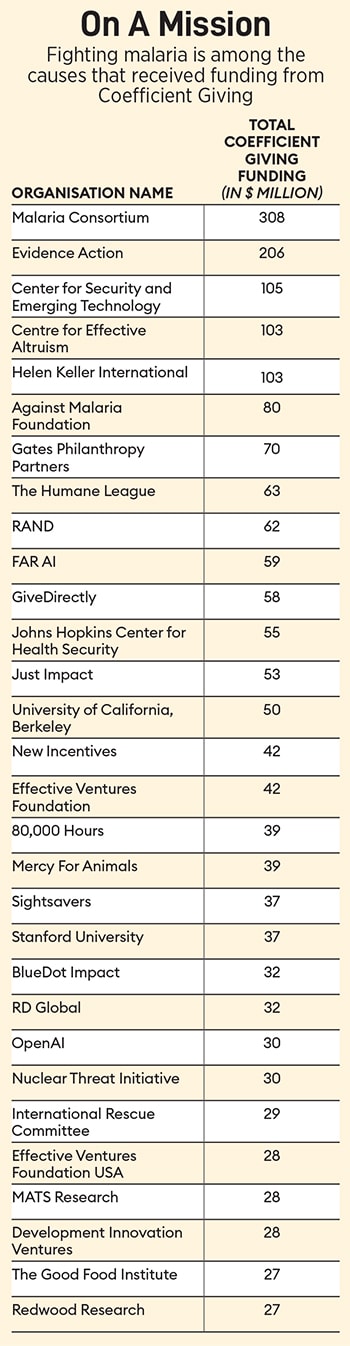

Biggest recipients of such global health-related grants from Tuna and Moskovitz include the Malaria Consortium ($308 million in total funding), Evidence Action ($206 million in funding for deworming, clean water and other interventions) and Helen Keller Intl ($103 million, mostly for vitamin A supplements to reduce child mortality).

James Tibenderana, CEO of the Malaria Consortium, says data, evidence and transparency set Coefficient Giving’s approach apart. “The amount of data they asked from us was huge,” says Tibenderana. “The intervention has to be cost-effective.” The mathematical approach isn’t perfect, though. When Tibenderana was initially negotiating a funding arrangement in 2015, he had to convince them that malaria medicine for young children was as valuable as mosquito nets for adults, even though children don’t work and therefore don’t provide as much economic value per GiveWell’s model. GiveWell ended up including a “moral factor”, and Malaria Consortium has so far distributed 370 million doses of malaria treatments and 32 million insecticide-treated nets.

Similarly, Danielle Bayer, chief growth officer of Evidence Action, points out Coefficient Giving conducted dozens of hours of research and interviews with subject matter experts before committing. Still, some programmes like a seasonal migration programme in Bangladesh are a bust and get shut down. “You don’t feel dinged because something didn’t work… you course-correct,” says Shawn Baker, executive vice president of partnerships at Helen Keller.

While global health remains Coefficient Giving’s largest overall funding category, part of why the organisation (then Open Philanthropy) spun out from GiveWell was to focus funding on what is, in Tuna’s words, “more speculative and unproven”. Take AI safety, where Coefficient Giving’s largest recipients are the Center for Security and Emerging Technology, RAND and FAR.AI, all of which seek to impact AI policy and safeguard advanced AI models.

“Many AI companies invest more in safety than they are required to do, and deserve credit for doing so, but at the same time they are all investing vastly less in safety than the world needs,” says Adam Gleave, CEO of FAR.AI, which has used $59 million from Coefficient Giving to make AI systems more safe and secure.

Organisations funded by Coefficient Giving have doled out at least $3 million to lobbyists this year, similar amounts to both OpenAI and Anthropic, while Coefficient Giving itself has chipped in roughly $110,000 per quarter on lobbying this year.

Still, despite an increasing number of eyes on—and dollars toward—AI these days, Tuna stresses that she takes a portfolio approach to giving, funding a wide range of causes using every tool in the box, encompassing direct giving, policy advocacy and investing. (Most of Good Ventures’ impact investing cheques are for drug development; among the foundation’s largest holdings are Impossible Foods, its first impact investment, as well as investments in tech giants Taiwan Semiconductor Manufacturing Co, ASML, Nvidia and Microsoft.) “Progress and safety don’t have to be at odds,” Tuna says. “If anything summarises my approach, it’s that it’s not just one thing.”

First Published: Feb 14, 2026, 01:15

Subscribe Now(This story appears in the Feb 06, 2026 issue of Forbes India. To visit our Archives, Click here.)