It was in an era when India was yet to reign supreme in its space programme, and access to global technology was still scarce. Much of the country’s nuclear programme was self-nourished after sanctions put by the Western world. Former President late APJ Abdul Kalam was heading the country’s premier defence research organisation, the Defence Research and Development Organisation (DRDO), and the country was gearing up to showcase its prowess as a nuclear power.

“If nothing works, go to that Reddy company in Hyderabad," Kalam would tell his subordinates at DRDO if they needed help with some parts or equipment, recalls Srinivas Reddy, managing director of MTAR Technologies. In fact, it wasn’t just Kalam. Through the 1970s and 80s, Hyderabad-based MTAR, built by Reddy’s father, P Ravindra Reddy, had built up a stellar reputation for pulling off what others couldn’t do.

MTAR, formerly Machine Tool Aids and Reconditioning, is today one of the country’s foremost players in the precision engineering sector and counts the likes of Isro (Indian Space Research Organisation), DRDO and NPCIL (Nuclear Power Corporation of India Limited) as its clients. In fact, MTAR holds a special place in India’s space exploration and nuclear programme annals, even though the company doesn’t brag much about it. Most recently, the company partnered with Isro for its globally acclaimed Chandrayaan and Aditya L1 missions, in addition to the much-anticipated Gaganyaan mission, helping with the launch vehicle and grid fins.

“MTAR has been involved in various sectors," Reddy tells Forbes India. “One is the nuclear division where we are working on the engineering side of the nuclear reactors. We are also into space programmes and a little into defence. Now, in a big way, we are into clean energy systems. It’s not just the government that we work with. There are also numerous MNCs."

Among others, the company’s core capabilities include building the core of nuclear reactors in addition to manufacturing the cryogenic and liquid propulsion engines for Isro, that have been used in numerous launch vehicles.

![]()

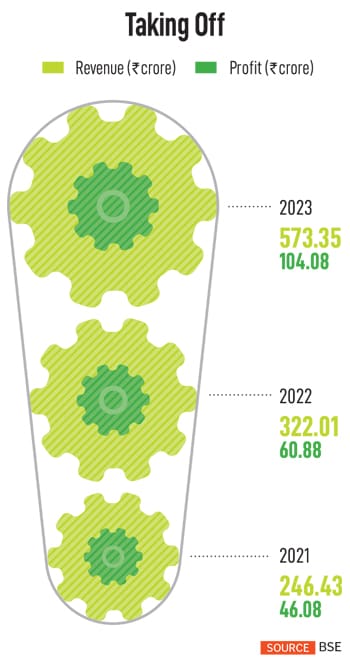

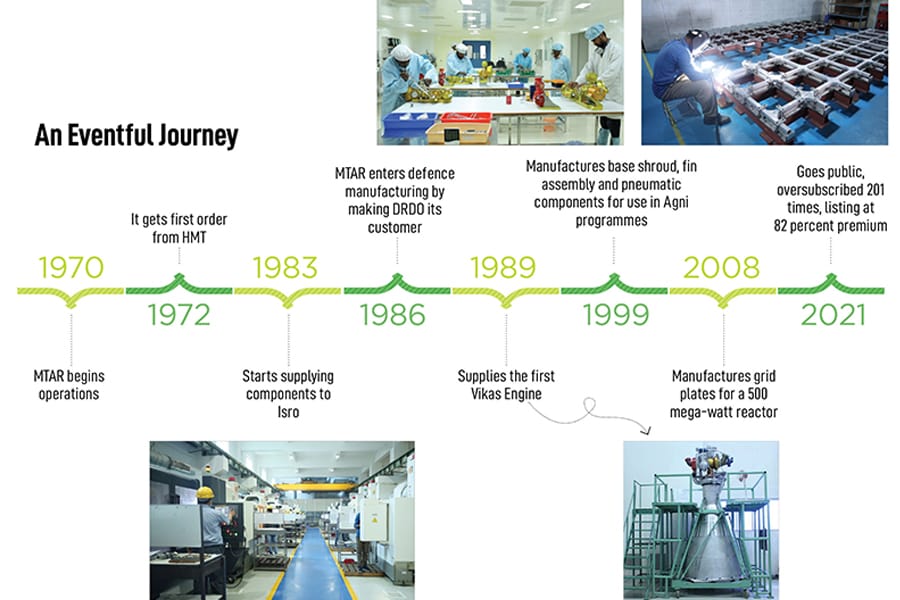

In 2021, MTAR went public, its shares being oversubscribed some 201 times and listing at an 82 percent premium to its issue price. Since then, the company’s shares have zoomed some 72 percent, with its market capitalisation at ₹5,330 crore. Benchmark Sensex has grown 46 percent in the meantime. Over the last six months, however, MTAR’s shares have slid some 36 percent.

“Our endeavour has been to develop import substitutes," Reddy says. “We have been continuously doing that." Reddy is an engineer by profession and joined the company in 2008, although he did spend a fair amount of his childhood at the premises of the company founded by his father.

“MTAR has had a long-established relationship with most of its customers like the DRDO, Nuclear Power Corporation of India, Liquid Propulsion Systems Centre, and Isro spanning more than 35 to 40 years with repeat orders and a strong trust factor developed over many years of successful business relations," rating agency Crisil wrote in a report last year while reaffirming its ‘CRISIL A-/Stable/CRISIL A2+’ ratings on the bank facilities of the company. “Due to the high technical complexity and know-how, the customers have typically stayed with their preferred and established suppliers over the decades. Benefits from the promoter’s experience and their strong understanding of market dynamics should continue to support business risk profile."

Today, MTAR operates in five key areas. These include nuclear power, where it manufactures and supplies highly complex products to the core of the nuclear reactor. A space-division manufactures control components and engines, while a defence and aerospace division focuses on hi-precision components and subassemblies for strategic missile programmes. Over the last decade, the company has also made a significant foray into clean energy, supplying power units and hydrogen boxes in the export market. There is also an arm that makes high-precision shafts, components and assemblies for propulsion for ships.

“The goal is not to depend too much on companies abroad and try to be independent of those," Reddy says. Last year, the company posted annual revenues of ₹573 crore, growing 78 percent compared to the previous year, while net profits surged 71 percent to ₹104.08 crore.

Starting Small

MTAR started out largely as a response to growing supply chain constraints after the country began nurturing nuclear ambitions in the late 1960s, according to Reddy. Eventually, the Western countries, including Canada and the US, put sanctions after India completed its nuclear tests in 1974.

Canada had helped India in setting up its nuclear plants, and that meant critical components needed for the maintenance of the reactors had come to a standstill. India had six reactors and the country’s Department of Atomic Energy had approached HMT to manufacture the coolant channel for the reactor.

Given how critical the circumstances were, HMT refused to undertake the task. P Ravindra Reddy [Reddy’s brother] and K Satyanarayana Reddy, who were working with HMT and heading the design and production team respectively, saw crucial potential in manufacturing the channel. With two other employees that they hired, they set out to build their workshop in Hyderabad. The entire project, Reddy had told Forbes India earlier, cost around ₹50,000 or less, with some of it coming from the founders and the remaining from the government, which was then pushing for engineers to foray into entrepreneurship.

“They started with four machines, with the blessings of the Department of Atomic Energy, and successfully executed it," Reddy says. A year after they began operations, P Jayaprakash Reddy also joined the business as a co-founder.

![]()

Over the next few years, the company dabbled with manufacturing components for government companies, including BHEL and HMT, even as it continued to expand its capacity. “This company was built brick by brick… whatever little money they used to make, they used it to buy another machine," Reddy says. In 1983, MTAR was the first company to import computer numerical control (CNC) machines from Japan, used for efficiency and accuracy in precision engineering.

In 1983, it struck a partnership with Isro to supply precision components. By then, MTAR had already built a stellar reputation for being a company that would solve critical issues for organisations. “The general saying was that for anything that cannot be done… go to Mr Reddy’s companies and they would solve it," Reddy had told Forbes India in 2021. “They managed to solve many issues for many organisations."

In 1989, MTAR began supplying liquid propulsion engines to Isro, an arrangement that continues to this date. “We do not have a single blemish in terms of failures," Reddy says. “Subsequently we started supplying the cryogenic engines also to ISRO. It took us about eight to nine years to develop the cryogenic engines. That’s how we’re able to launch much bigger payload capacity satellites. If you see, we are in the background all the time when it comes to Isro."

By 2007, global PE giant Blackstone invested $65 million for a 26 percent stake in the company, a move that eventually led to MTAR going public. Blackstone sold their stake to Florintree Advisors, run by former Blackstone India co-head Mathew Cyriac in 2017. In 2021, when MTAR went public, Cyriac went on to make a 1,400 percent return on his investment. “The company was growing and diversifying into various areas," Reddy says about MTAR’s decision to go public. “We felt that going public was important for our growth. The proceeds from the IPO were used for various working capital requirements, and for building additional facilities."

No turning back

Since then, MTAR has grown to employ over 2,500 employees across eight manufacturing units. About 40 percent of the company’s revenues come from its space and nuclear programmes. “Today we manufacture most of the core of the nuclear reactor on the engineering side," Reddy says. Among others, MTAR’s product portfolio in nuclear technology includes complex assemblies such as fuel machining heads, drive mechanisms, bridge and column, and coolant channel assemblies, among others. These products are supplied not just for the new pressurised heavy-water reactors (PHWR), but also for the refurbishment of the existing reactors.

In its space arm, apart from engines for PSLV and GSLV, the company also manufactures components such as command system modules and high-pressure regulator modules. The company has also tied up with Isro for the development of a small satellite launch vehicle project powered by semi-cryogenic technology with a 100-tonne engine in the first stage and a 10-tonne engine in the second stage. Last year, the company also helped in fabricating the engine for the globally renowned Chandrayaan-III mission in addition to partnering with Isro for the Mangalyaan and Chandrayan-II missions in the past.

“The entry barriers are tough in these areas because there is no second chance for you," says Reddy about the growing competition from the private sector in the space technology sector. “So, in terms of manufacturing, quality control and various other aspects, if one launch fails, then it’s a big issue. It’s not about competition. It’s about the competency of the company’s capabilities which have been built over the years in terms of R&D and various other aspects."

![]()

India’s space economy is currently estimated at around $8.4 billion and is expected to grow to $44 billion by 2033. Earlier this year, India also relaxed rules to allow 100 percent foreign direct investment (FDI) in the space sector in a move aimed at promoting investment in the segment.

Meanwhile, even as it continues its focus on space and nuclear programmes, a significant chunk of the company’s revenues now come from its clean energy business. That segment constitutes 50 percent of its revenue, and the company is expecting a compounded growth of between 30 and 35 percent over the next decade. “We are working with MNCs in building projects for them, mostly for exports, in fuel cell technology," Reddy says. “We’re also talking about hydel and wind projects, in addition to waste to energy. It was a new segment which we took up to build exports."

Primarily, MTAR’s clean energy division looks at manufacturing hydrogen electrolysers, a device that uses electricity to split water into hydrogen and oxygen and hydrogen boxes to generate power from hydrogen. The company also supplies fuel cells to Bloom Energy USA, a market leader in the stationary fuel cell segment. “We manufacture the entire systems for the fuel cells," Reddy says. “The fuel cells are manufactured in the US, but the complete system is manufactured in India, and we export it to the US."

Last year, the company also received a defence industrial licence (DIL) for production of various mechanical and electronic subsystems in the defence sector. A DIL makes it easier to partner with MNCs, and cater to both domestic and export markets by taking up projects under Buy (Indian)’, ‘Buy & Make (Indian)’ & ‘Make’ categories.

India is expected to spend a staggering $130 billion over the next seven years as part of its plan to modernise its military, which has long suffered for reasons ranging from poor planning, allegations of corruption and a serious mismatch between strategic objectives and purchasing technology. In the current year alone, the capital outlay for defence modernisation and infrastructure development is pegged at ₹1.62 lakh crore with indigenisation and domestic manufacturing at the heart of it.

Ready for the long run

Today, much of Reddy’s endeavour is to build MTAR into an institution with a well-focussed approach to business.

“This is a 50-year-old company," Reddy says. “The shareholders are well diversified and most of them are not involved in the business. The company is moving to be more of an institution in the long run. It’s not about promoters, and more about the company and the way it is run."

Along the way, MTAR, Reddy says, remains steadfast on its focus on indigenising various components needed for the defence and space sector. “We develop various products, and we indigenise them," Reddy says. “So, our import constituent comes down drastically because we faced this problem many years back in terms of not being able to import because of various restrictions."

For many years, MTAR has remained in the background in India’s space, nuclear and defence plans. Now, it’s all about playing on the front foot.