Girish Mathrubootham's billion-dollar dream for Freshworks

The entrepreneur is taking cue from rapid growth of Silicon Valley software startups to reach scale and velocity

Girish Mathrubootham, founder and CEO of Freshworks

Girish Mathrubootham, founder and CEO of Freshworks

For a fairly long time, Girish Mathrubootham resisted the move to America with a strong belief that world-class business software can be built from India. The founder and CEO of Freshworks had established a US presence fairly early, but product development at the company, which makes cloud software for customer engagement, still happens in India. And until mid-2019 Mathrubootham was running the show from Chennai, where most of the company’s staff are based.

A few years ago, when it hit $100 million in revenue, there was celebration within the company, as also in the nascent Indian software-as-a-service ecosystem. Mathrubootham and Freshworks were feted as big, genuine successes. However, “every time I travelled to the US, I"d find that there were so many companies at $100 million, and they’re really small”, Mathrubootham said in a recent interview with Forbes India.

He also realised that companies like Salesforce, Zendesk, HubSpot, Splunk, Palo Alto Networks and others that had gone from $200 million or $300 million to a billion dollars in revenue in a matter of a few years. “That was fascinating to even think about. It can only be done in the Valley,” he said, referring to Silicon Valley. And that changed his mind.

He surprised investors—who in the early years of the startup would ask him if he wanted to move, only to be told ‘no, I want to build this from India’—and his staff by announcing he was moving. In fact, at an all-hands company meeting, ‘why are you moving to the US’ was the most asked question and the entrepreneur’s response was “I felt like an Indian athlete who had won the chance to compete in the Olympics, so should I go or not?”

“I moved to the US in 2019 on the day India lost to New Zealand in the world cup,” Mathrubootham, an avid sports and cricket fan, recalled. “When [Mahendra Singh] Dhoni got out, I changed my flight. I was going to go to London to watch the final, but changed and flew to San Francisco.”

“We may win or lose. That’s fine. I’m fine with that. But we had to go and run. We had to really see if we can take Freshworks from where we are to crack the billion-dollar-revenue mark in the next few years.” Last month, Freshworks announced it had crossed $300 million in annual recurring revenue and that the company ended 2020 with growth of more than 40 percent.

“I wanted to really learn from the leaders who had not only seen scale, but also velocity. I didn’t want to take 10, 15 years to grow. I wanted to grow fast.”

And Freshworks has already been doing that. It took the startup 18 months to get to $1 million. From $1 million to $100 million took five years and two months, and only another 18 months to double it, which was not long after Mathrubootham moved to the US. Freshworks got to $300 million in the next 14 months.

Product focus

Building products that are relevant to customers is fairly straightforward to think about, but incredibly difficult to execute and succeed at, but that is probably the main reason behind Freshworks’s success. Freshworks was founded in 2010 as Freshdesk and Mathrubootham started out with one eponymous helpdesk software. Today his venture offers a suite of products for customer engagement and employee engagement. And Covid only made companies like Freshworks more relevant because every business now needs to sell online and requires the tools to do so effectively and efficiently.

Freshworks’s products are omni-channel, helping businesses talk to their end-customers via not only the conventional methods of phone or email or texting, but through Facebook, Instagram, WhatsApp, Apple business chat and any other internet-based channel that might become popular.

The products are used by customers in 125 countries, while the US has always been its biggest market—contributing between 40 and 50 percent of its revenue. In comparison, Silicon Valley companies tend to have 80 percent or more of their revenue from the US and even as they become bigger companies, they tend to have 60 percent or more of their sales in the US, Mathrubootham says. The lower share of revenue from the US means “we have so much headroom to grow”, he adds.

“Girish understands the importance of culture in building a lasting franchise, and we agree with his approach of having been thoughtful about scaling, focussed on achieving both product-market fit and a proven distribution strategy before broadening Freshworks’s footprint,” Ravi Mehta, founder of investment firm Steadview Capital, said in an email. Steadview invested $85 million in Freshworks in January 2020, picking up a stake from existing investors. “The US expansion has been executed exceptionally well, but even now, two years later, we still see enormous upside from having a physical presence in the West,” Mehta added.

The startup serves customers ranging from small businesses with, say, 250 employees to enterprises with more than 5,000 employees. In the SaaS (software-as-a-service) world, typically, customers don’t start out as million-dollar customers. There is a ‘product-led growth’, meaning, usually, a few developers or a small team starts using a product, and it becomes popular and soon the entire company might adopt it.

“The most compelling, unique aspect of Freshworks is how well it has executed on broadening its offering to include a comprehensive suite of SaaS products,” Mehta said. While the original Freshdesk customer support product itself has a bright future, the successful expansion into modules across IT helpdesk (called FreshService), sales force automation (FreshCRM), human capital management (FreshTeam), and others—totalling more than eight products today—make investors bullish about Freshworks’s prospects, he added.

Mathrubootham has also made 12 tuck-in acquisitions for talent and technology. For example, AnsweriQ, which was purchased in 2020, helps businesses tap existing customer data to build self-service experiences and automate complex customer workflows. Another acquisition, Flint, provides intelligent automation and cloud computing capabilities so that IT organisations can quickly adapt to the needs of an increasingly remote workforce.

Over time, there is potential for Freshworks to overlay an intelligence layer across its products, supporting novel, data-enabled use cases for its customers—making its products more valuable to its customers. That will contribute to a “durable long-term growth outlook,” Mehta said.

Net dollar retention

Another factor that continues to help Freshworks’s growth is the compounding effect of the SaaS model, where customers don’t make large upfront investments in buying and installing software, but tap affordable subscriptions and rent the software off the internet. In the older, on-premises world, if a company sells $100 million worth of software one year, it will need to sell $120 million to grown 20 percent the next year.

In the SaaS world, it’s a recurring revenue model. Taking into account that some customers may leave or reduce their usage, while others may expand, SaaS companies aim for a healthy positive growth in a metric they track seriously, called dollar-based net retention or net dollar retention. And when a product is successful, typically, there is an expansion of the existing customer base. A 20 percent expansion is doable, Mathrubootham says. If on top of that, the company adds another $20 million in new sales (in the $100 million example), a growth of 40 percent is achievable, he points out.

That’s what helps successful SaaS companies in the Valley to go from $200 million or $300 million to a billion dollars in a matter of a few years, he said. The really difficult part of this process is, of course, actually engineering it—figuring out what will make the products ever more indispensable for the existing customers so that they will use more of it, while attracting new users.

This is what Mathrubootham set out to learn from those who had “been-there done that”. Including how to build a strong pipeline of sales, how to ensure the company is closing enough deals, how to hire the right people and ramp up operations, how to divide customer segments into different categories and so on.

“My mission now is to try and marry the art of Indian entrepreneurship and the science of Valley scaling,” says Mathrubootham. In India, people lack experience but work from the heart, he says, so entrepreneurs tend to hire young, smart recruits willing to learn by doing. While the success of Freshworks, Zoho and a handful of other Indian-founder-led US startups is slowly making the ecosystem in India a bit more mature, there is still a dearth of the “been-there-done-that” experience. Therefore, when a tech entrepreneur dreams of going from $300 million to a billion dollars, he or she has to necessarily turn to Silicon Valley.

Valley hires

In Silicon Valley, there is just the advantage of being able to hire people who have already seen this product-led growth journey in other companies like Google or Facebook or Salesforce or Walmart labs—in multiple disciplines, be it marketing, engineering or cybersecurity. Ditto for human resources management or finance.

Mathrubootham now wants to “keep the heartbeat in India, but the brain in the Valley”. His sense of urgency in wanting to grow fast is palpable, and the people who can help him do that are in the US, even though about half the sales are still closed from India.

CFO Tyler Sloat is an example. Sloat, an MBA from Stanford University, joined Freshworks in April 2020 from Zuora, a public company today that makes subscription billing software. He had spent 10 years with Zuora and helped take it public Sloat has also previously held board member positions at different business tech companies in the US.

In October 2020, Mathrubootham hired Jose Morales as chief revenue officer. Morales was head of global field operations at Atlassian, which he had joined when it was a $60 million company some 10 years ago. Today the company, which provides team collaboration and productivity software, has $1.6 billion in revenue.

A new chief marketing officer has just joined Freshworks and “she is a great leader”, says Mathrubootham. But he wasn’t yet ready to name her as certain formalities were yet to be finalised. And in Prakash Ramamurthy, Mathrubootham found someone who could take over the product development reins from him—a role very close to his heart.

“I was very wary of giving it to someone who didn’t understand our culture and DNA of building products,” he says. “I finally found somebody I was confident about, whom I could hand over building products and I can focus on building the company.” Ramamurthy joined Freshworks in October 2019 from Oracle, where he was a senior vice president and general manager for a $2 billion business comprising systems management and security products at Oracle Cloud.

“Girish is a product visionary who can execute,” Puneet Kumar, a vice president at Steadview, said in an email. “His imagination and development of a comprehensive B2B SaaS suite is ultimately at the heart of what makes Freshworks special.” This takes enormous customer empathy in understanding current and potential pain points, and, to that end, Mathrubootham is among the best entrepreneurs the investment firm has worked with, Kumar said.

Kumar adds: “Of course, he didn’t do this alone, but supported by a remarkable team both in India and abroad, which speaks to his ability to inspire people to join him in pursuing a shared vision.”

US IPO

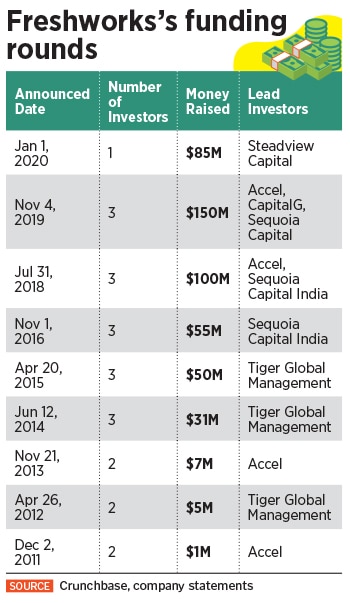

Freshworks has raised about $400 million in eight rounds of funding, according to data from Crunchbase and the company (Steadview’s investment was a secondary purchase). In November 2019, when Freshworks announced a $150 million funding round (Series-H) led by existing investors Sequoia Capital, Google’s CapitalG and the startup’s first VC investor Accel, it was valued at $3.5 billion after the investment.

These lead one to ask if Mathrubootham is also preparing to take his venture public, but he has a slightly different view. “See, we don"t have a definite timeframe,” he said. “But we are a VC-funded company and every VC-funded company knows that at some point when the timing is right, you have to consider what are the possible options.”

Mathrubootham points out that Freshworks is well-capitalised for now and doesn’t really need to raise more money. “We haven’t even touched the last round of funding … so if you look at the scale and growth, like we can be public today,” he said.

Many companies go public even sooner. Today, in this market, there are companies with $100 million or $200 million in revenues that are already public. “So we can go, and we are carefully evaluating all our options. When we decide to go, let me tell you, it will be a proud moment for all of us as probably the first Indian SaaS company or SaaS startup to go public here in the US I think. It is a matter of pride and we wouldn"t shy away from talking about it. We would, in fact, celebrate it. So we are looking at our options carefully and I think we are in a good spot in terms of being able to choose,” says Mathrubootham.

He adds: “We are aware that the markets are now super hot, it"s a great time to go public, but we believe that great companies can go public at any time. You don"t have to try and time the market.” He acknowledges that within the company he and his top executives and investors are talking about it. “We are talking about these things. We don"t have a definite timeline, but at some point we will think and take a call on what is the right option.”

During the Covid pandemic, a lot of expenses such as on travel were cut, which meant Freshworks was actually cashflow positive for a few quarters, but, on the whole, the company is still investing in its products and growth. Therefore, it isn’t far from breakeven, but it’s not yet profitable either.

In the meantime, there is no dearth of challenges. One of them is getting experienced and talented people to come work for Freshworks. The tech talent market is “super hot” and everybody is hiring, Mathrubootham said. He also worries about fatigue from the Covid pandemic. While work-from-home provides flexibility to his 3,500 staff, “how long can you jump from Zoom call to Zoom call”, he asks. “I draw energy from meeting people and there are many others like me.” Like businesses world over, Freshworks too must figure out if it will ever return to having offices large enough to have thousands of people, or if a hybrid model has to be adopted.

A more serious concern is an ongoing lawsuit brought by competitor Zoho Corp, in a court in California. Zoho has alleged that Freshworks stole trade secrets from it. Mathrubootham and Freshworks’s co-founder Shan Krishnasamy are both former employees of Zoho, started by entrepreneur Sridhar Vembu some 25 years ago. Mathrubootham worked at Zoho for nine years and rose to become a vice president before quitting to start Freshworks.

“While we can’t get into specifics on the pending litigation we are pleased with the judge’s ruling to date which has limited the claim to a single instance by a former employee (of Freshworks). We look forward to a speedy resolution,” Mathrubootham said in an email.

Vembu and Zoho are seen as the original pioneers of SaaS startups in India and in Chennai, in particular. In more recent years, Zoho and Freshworks have created a cascading effect, with at least 65 new SaaS ventures started by former employees of the two companies, consultancy Bain and Co noted in a report in December 2020. Icertis and Druva are other examples of Indian-founder led SaaS startups that found success in the US.

Mathrubootham is betting the future of Freshworks on the belief that an “iPhone moment” is imminent in the world of business software. Just as consumers ditched multiple gadgets—from mp3 players to cameras—and took to the smartphone, businesses are looking for that one solution that will help them manage every customer interaction at every stage, he says.

Today, typically, businesses have to buy or rent separate software to manage different activities such as marketing, sales and support and even something for integration, and hire a systems-integrator company to get the different products to talk to each other.

“Our bet is that the world is moving towards ‘customer 360,’ where businesses want to understand everything about their customer,” Mathrubootham says. And Freshworks is building its products around the idea of unified customer records—unifying interactions and data from marketing, sales and support. “That is what will help us go to a billion dollars and beyond.”

First Published: Mar 11, 2021, 18:04

Subscribe Now