SaaS startups: India-born, US-focussed

Strong cloud-based enterprise software product companies are emerging in India, but are quickly moving to the US, drawn by customers, ecosystem and the IPO dream

Image: Shutterstock

Image: Shutterstock

Postman started as a side project for Abhinav Asthana. He was the technical founder of an earlier startup after finishing college in India, and was grappling with the complexities of making disparate pieces of software connect with each other. The software that do that are called application programming interfaces (APIs) and they are becoming increasingly important to software development.

Eventually, the side project became the main interest, after an early piece of software that Asthana put up on the Chrome Web Store drew a lot of attention from software developers, and suggestions about features that could be added to it, and how it could be expanded. That gave birth to Postman in 2014, with backing from early stage investor Nexus Venture Partners.

By 2016, Postman had employees in the US, and Asthana himself moved to San Francisco in 2017. This year, Postman raised $150 million in its series C funding at a valuation of $2 billion.

Postman is one of a new generation of software product companies that started in India, but quickly moved to the US. Often they are companies that build software as a service (SaaS) for businesses. While they are building world-class software products and platforms, typically on the cloud, the move to the US is almost inevitable. Early-adopter customers are Americans, and the ecosystem of product development is still several years ahead in Silicon Valley.

The big change in India, however, is that the combination of talent availability and early funding, and the broader interest in software development—from ecommerce giant Flipkart to Dream 11, the fantasy cricket gaming startup—has matured to a point where software product companies are emerging that are able to make the transition to becoming global companies. In the process, not only are they attracting investor interest at an early stage in India, but are going on to successfully raise money from US backers at the growth stage, says Sameer Brij Verma, a managing director at Nexus Venture Partners.

Some of these companies have created new categories—like solving a specific set of problems within the API software space or automating how software applications talk to databases—or are among the leaders in categories. So they are attracting a lot more international capital. “With Postman we led series A series C was led by Charles River Ventures, a Silicon Valley-based fund. The same thing happened with Hasura,” Verma says.

Nexus Venture seed-funded Hasura, “nearly co-led the series A”, and the series B was led by Lightspeed Venture Partners US. The category in which Hasura has found admirers is in automating data access for software applications. “We did a seed round in India about two and a half years ago, but almost immediately after that we moved to the US,” says Tanmai Gopal, co-founder and CEO of Hasura. The startup is now based in San Francisco, but has truly gone global with about 60 employees distributed across the US, Europe, India, Vietnam, Australia and Nigeria.

Observe, another Nexus Venture portfolio company, started off in India with Nexus getting in at the series A stage. Then the startup moved to the US and went on to raise funding from Scale Ventures in 2019, and $54 million in series B investment led by Menlo Ventures this September.

“So these companies now have this playbook of internationalising and globalising out of India,” Verma says. “As these cases are getting proven out in the country, there’s also a lot of confidence that the value investors or global investors are seeing—that there"s a new crop of companies that are coming, which can compete, build out of India and go for the world.”

Growth factors

When Sridhar Vembu started Zoho some 25 years ago, or when one of his star employees, Girish Mathrubootham, stepped out to start Freshdesk (now Freshworks) in 2010, touching off an India-born SaaS revolution wouldn’t have been on their minds. But that is what is beginning to happen now.

SaaS is increasingly how businesses—especially in the more advanced economies—access software to run their operations or help their customers. SaaS allows businesses, big and small, to avoid large upfront investments in software. Instead, businesses get to rent what they want off the internet, basically, and pay for what they use, by number of users, for instance.

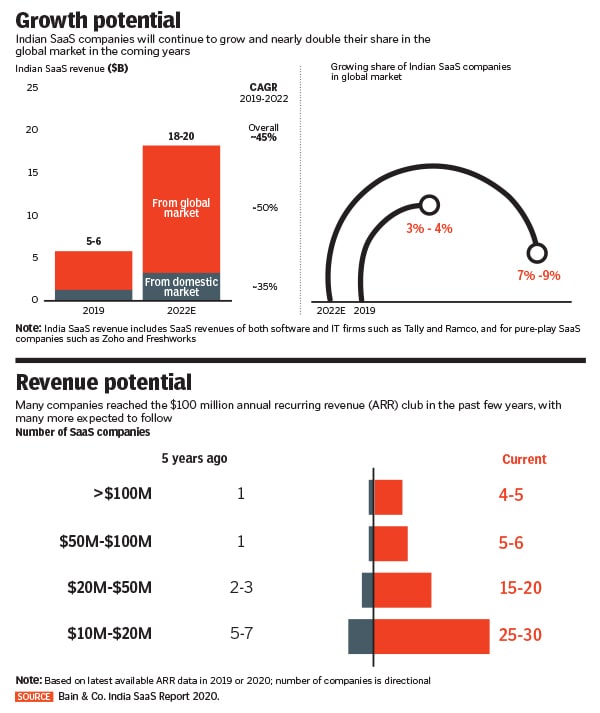

Indian companies offering software for a variety of uses on the SaaS model are on the cusp of a transformation, according to Bain and Co, a consultancy. And this transformation is backed by rising investor interest. Over the last five years, the number of funded SaaS companies has more than doubled, and the number of SaaS companies drawing series C or later stage capital has quadrupled, representing significant traction, says Bain in its report, India SaaS Report 2020, released in December.

“In the last five years an enabling ecosystem has been built up,” says Lalit Reddy, co-author of the report, who is a partner and leader in Bain India’s private equity and digital delivery practices. One way this happened is, as Zoho and later Freshworks, grew, several of their employees stepped out to start their own ventures. Bain estimates that over 65 such ventures were started just by former Zoho and Freshworks employees who turned entrepreneurs.

These early entrepreneurs took several initiatives to grow the SaaS ecosystem in India. For example, they started SaaSBOOMi, which became a very popular conference where entrepreneurs who had built successful SaaS companies would share their experiences. And “like the Paypal mafia in Silicon Valley, these founders in India founded or invested in other companies,” says Reddy.

India now has a growing ecosystem of enablers comprising domestic and global SaaS investors over a hundred SaaS angels with four or more investments incubators and accelerators such as xto10x and Flipkart Leap and SaaS development events and initiatives sponsored by communities such as SaasBOOMi, says the Bain report.

There is also a critical mass of people who were product managers in the US, who have come back to India and have become involved in SaaS startups. “In the US and Western markets, there is now an acceptance of Indian SaaS companies that are selling world class products with high quality customer service,” Reddy said.

Another factor is that, in general, interest in software development has grown substantially in India, says Gopal at Hasura, as companies across the spectrum—from new-age startups like Swiggy to traditional government-run banks—plugged into India’s mobile internet revolution to reach millions of customers.

As digital penetration increases among Indian consumers, the digital products from businesses that serve them need to match ever-higher expectations of convenience, user experience and security. Which in turn is creating an environment for a whole host of software companies to grow. Such as Locus, which offers logistics intelligence to ecommerce businesses, or Yellow Messenger, which builds artificial intelligence (AI)-based bots that large businesses across sectors can use to offer new channels of customer support.

Money matters

There is now a pool of investors actively investing in Indian SaaS companies. Funding for Indian SaaS startups crossed $1.3 billion in 2019, Bain estimates. Horizontal business software was the largest sub-segment, accounting for two-thirds of all SaaS investments, and vertical-specific SaaS grew the fastest, albeit on a small base. Even amidst the Covid-19 pandemic, SaaS has been a prominent investment theme.

SaaS investments rose to 20 percent of venture capital and growth equity funding in the first half of 2020, versus 15 percent in the same period in 2019. SaaS also emerged as the top priority technology sub-sector of focus in an investor survey that Bain conducted in 2019, says Reddy.

Indian SaaS companies are poised to reach between $18 billion and $20 billion in revenue by 2022, with the potential to capture 7 percent to 9 percent of the global SaaS market, according to Bain’s report. Over the last decade, SaaS companies started by Indian founders have grown from a handful of ventures to a multi-billion dollar industry. In addition to Zoho and Freshworks, companies such as Druva and Icertis have breached the $100-million annual recurring revenue mark, with a healthy pipeline of companies well placed to follow over the next 12 to 18 months, according to Bain.

Zoho has bases in Chennai and California, and offers office productivity and business management software on the cloud. Freshworks, headquartered in San Mateo, California, started with helpdesk software but now offers a broader suite of software for businesses to manage their operations. Druva offers cloud data protection and management technology. It was started in Pune in 2008, and by 2012 had moved to Silicon Valley. Icertis was started in 2009 and has an engineering centre in Pune. Based in Bellevue, Washington, it provides sophisticated enterprise contract management software.

Today all of them are unicorns—ventures that are valued at $1 billion or more—among India-born SaaS companies. Vembu at Zoho has never taken outside investor money, so Freshworks is the best known. Icertis, Druva, Postman and HighRadius, which makes AI-based fintech software, are some of the others.

The American dream

The Indian SaaS story is also one in which local challenges pushed entrepreneurs to find global markets. “There are components of the ecosystem [in India] that I think are still a bit lagging when you compare it with the Bay Area,” says Postman’s Asthana. “Our best customers are early adopters—people who are on the cusp of wanting to pay for the problems that Postman is solving—who are all based in the Bay Area or the West Coast or the East Coast of the US.”

And companies like Postman and Hasura are very developer-focussed and that’s how their products get adopted as well—first developers get excited about them, typically use open-source versions for free, then teams of developers adopt them, and then the companies that those teams work for see value in paying for enterprise versions that offer more features, customisations and so on. Some 13 million developers and over 500,000 companies use Postman, while not all those companies are paying customers. Hasura isn’t a pure-play SaaS company and straddles the cloud and the on-premises world, with some 100 million downloads of its software.

A more conventional reason for Indian-born SaaS entrepreneurs to head to the US is also of course the ultimate dream of a blockbuster IPO, one day. That is still something way more likely to become a reality in the US than in India. And for software product IPO inspiration, there is really no place like the US, as the September listing of Snowflake, a cloud-based data warehousing provider, showed.

The eight-year old American company raised $3.6 billion via its public listing and was valued at over $30 billion after the stock price jumped 111 percent on listing day. And the icing on the cake was that the listing drew investments from the notoriously IPO-shy Warren Buffet.

“I mean, things like, you know, Berkshire Hathaway participating in Snowflake’s IPO gives a boost to the entire segment,” says Nishith Rastogi, co-founder and CEO of Locus, another India-to-US software startup. Rastogi and co-founder Geet Garg quit their jobs at Amazon Web Services to start Locus in 2014, building software that provided logistics intelligence. Locus is headquartered in Delaware, but still does much of its research and development in Bengaluru, where Garg, also the CTO, is based. This is something that many of the SaaS companies that moved to the US continue to do and that has helped build the ecosystem here. There is “cross pollination,” Asthana says.

On home ground

And even as Indian startups expand to the US, the growing interest in software product development in India is attracting US companies in the space to set up operations in India. An example is New York-based Stack Overflow (its parent company is called Stack Exchange), which provides a collaboration platform for developers. Through a partnership with investment firm Times Bridge, Stack Overflow is bringing its enterprise product Stack Overflow for Teams to India.

“Stack Overflow’s public platforms have long been embraced by developers across India,” says Rishi Jaitly, CEO of Times Bridge. Now, Times Bridge will help Stack Overflow sell its flagship enterprise edition to technical teams across India. It enables transparent, secure and efficient collaboration among and across teams of technologists, while assuring mission-critical knowledge-management needs are well served, adds Jaitly.

Times Bridge, a division of the Times Group in India, also invested in Stack Overflow in July, when the software company raised its series E funding. “The company’s presence in India will further energise, and strengthen the community in the Indian SaaS ecosystem,” Jaitly says.

Prashanth Chandrasekar, Stack Overflow’s CEO, echos the idea. “India is among our largest and most vibrant user markets, but remains largely untapped in the context of our Teams SaaS product,” he said in a press release on December 1. Tapping the Times Bridge partnership, Stack Overflow will aim to “empower developers and technologists in every corner of the country to collaborate and innovate together.”

The entry of such companies is timely. Today there are hundreds of SaaS companies in India. They range from companies that have annual recurring revenue of $100 million or more to those in the $50 million to $100 million range, to startups in the $10 million to $50 million stage, to those that are at sub-$10 million.

To be sure, the larger ones are those with strong bases in the US, while the vast majority of SaaS startups based in India are in the sub-$10 million revenue category. However, five years ago, there were perhaps 10 companies in the $10 million to $50 million range, whereas today there are about 50 such companies, says Aditya Shukla, co-author of the Bain report, who is a partner and leader in Bain India’s private equity practice. At the $10-million revenue mark, it becomes clear that a company has found a good product-market fit and that “it’s got its bearings right and figured out what to sell and whom to sell to,” he adds. And many of these companies are growing at 100 percent-plus annually.

On the whole, the ecosystem is still relatively small. “The sheer number of people who have been-there-done-that is still small—certainly compared with Silicon Valley,” Reddy says. Getting more people who have the experience of founding, building and exiting startups is what the Indian ecosystem needs.

First Published: Dec 15, 2020, 14:52

Subscribe Now