How Larsen & Toubro Infotech came into its own

With Sanjay Jalona at the helm, LTI is winning against bigger rivals, stepping out of its larger parent’s shadow, and forging an identity for itself

Sanjay Jalona, CEO & Managing Director, Larsen & Toubro Infotech

Sanjay Jalona, CEO & Managing Director, Larsen & Toubro Infotech

When Larsen & Toubro Infotech (LTI) listed on the stock exchanges in Mumbai in July 2016, it wasn’t the most auspicious of beginnings for Sanjay Jalona, who had quit Infosys to take over as CEO and MD of the company the previous year. The stock ended lower on debut, even though the issue had been subscribed 11 times over.

Reports from the time suggest that the fall had more to do with the overall lacklustre performance of the IT services sector at the time, and not anything specific to LTI. Not long after, Jalona proved that right as well, leading the company to the biggest order win in its history at the time—a $150 million contract to build much of the IT needed by a South African bank that was separating from its UK-based parent. At the time, LTI was not far from a billion dollars in annual revenue.

That large contract wasn’t a one-off either. The company has continued to win big contracts since then. During the three months ended December 31, 2020, LTI won two large contracts, including an enhanced partnership with Abu Dhabi-based cloud services provider Injazat, which could bring in $204 million in revenue over the next six years, and a net increase of $74 million over a five-year period from an existing global 500 customer.

“I like being an underdog,” says Jalona, speaking over a video call from his home in New Jersey, US. “I might not have the balance sheet to bid for a billion-dollar deal, but I have the capability to bid for a $200-300 million deal because now we are a $1.6 billion revenue company.”

Over the last four years, investors have bought into the LTI promise to the extent that the stock has become the most expensive among India’s IT services companies. It almost tripled from its debut to nearly Rs 2,000 by September 2018. Then, as it became apparent that the world would see a strong ‘up-cycle’ of technology spending in the post-Covid-19 recovery, LTI more than doubled from its Covid-19 low on April 3, 2020 to Rs 4,287.85 on January 15 this year. It was at Rs 4,118 at close of trading on the NSE in Mumbai on February 8.

LTI’s recent inclusion in the Morgan Stanley Capital International’s index for Indian equities also helped, according to media reports on January 20, citing analysts at brokerages. By revenue, LTI is about a third of Tech Mahindra, India’s fifth-biggest IT services provider, but by market cap it’s more than three-quarters the value of its bigger rival.

Pretty much every large contract that LTI wins today is in competition with bigger companies, Jalona says. One of the reasons is his personal commitment to do everything possible for the customer. For example, recalls CMO Peeyush Dubey, the CIO of the South African bank decided in favour of LTI after Jalona answered his midnight phone call, when the CIO couldn’t reach anyone at a larger rival of LTI that was also on the final shortlist for the contract.

After 15 years at Infosys, where he built two billion-dollar units, Jalona (51) quit to lead Larsen & Toubro Infotech in August 2015. He had met L&T Group’s Chairman AM Naik, and learnt about his ambitions for the IT subsidiary. “I was not looking for a job,” Jalona says. He was attracted, however, by the chance to leave a legacy and transform an operation that had started out as the IT unit of the better-known engineering group into a world-class tech services provider in its own right.

Cloud ready

At the time of the IPO, when a fund house called LTI a “me too company… don’t subscribe” in a report, “it really hurt,” Jalona recalls. Instead, he unearthed a hidden gem, and after its 2016 listing, rebranded the business as LTI to give it an identity of its own, and grew it faster than the industry, year after year, to its current position. “The same fund house became the biggest proponent of ours in three years.” Now, aided by the world’s transition to cloud computing and the accelerated investments in technology because of the Covid-19 pandemic, Jalona is pushing LTI, with its 34,000 software engineers, to punch above its weight, and win.

While on the one hand, the cloud-first era of business computing is prompting the world’s biggest companies to sell off entire IT units to large providers such as Tata Consultancy Services and Infosys, it is also throwing up projects in LTI’s sweet spot—orders ranging from $25 million to $200 million.

LTI’s investments and preparations over the last few years are helping it tap these opportunities. It is able to focus on new services that clients are demanding—help with their migration to the cloud, predictive data analytics, managing banking, financial services and insurance operations via software-as-a-service, and, with the onset of the pandemic, managing large business operations with people working and collaborating remotely.

“Now is the time for businesses to revisit and revamp their value-creation strategies,” says Nachiket Deshpande, LTI’s COO. “This digitalisation, coupled with the more far-reaching role businesses can play in their communities, creates the foundation for reimagining our work, workplace, and workforce.”

LTI is building strong alliances with technology specialists, beyond its partnerships with Amazon Web Services, Google, Microsoft and IBM. An example is its recent partnership with US-based Snowflake, a cloud-based data management darling of investors, whose blockbuster IPO last September couldn’t be resisted even by the IPO-wary billionaire investor Warren Buffet. LTI became the first partner for Snowcase, a programme that Snowflake is launching to develop and market industry-specific solutions to help large businesses manage their data on the cloud and use it to improve their operations.

The first Snowcase being launched with LTI is ‘data-driven manufacturing transformation’, which highlights LTI’s Snowflake expertise from an implementation for a global manufacturer. The accelerated migration and platform simplification of the manufacturer’s existing data platform to Snowflake’s data cloud was done using LTI’s technologies such as Canvas PolarSled, an automated cloud migration and modernisation framework, and Mosaic, a data-driven decision-making tool.

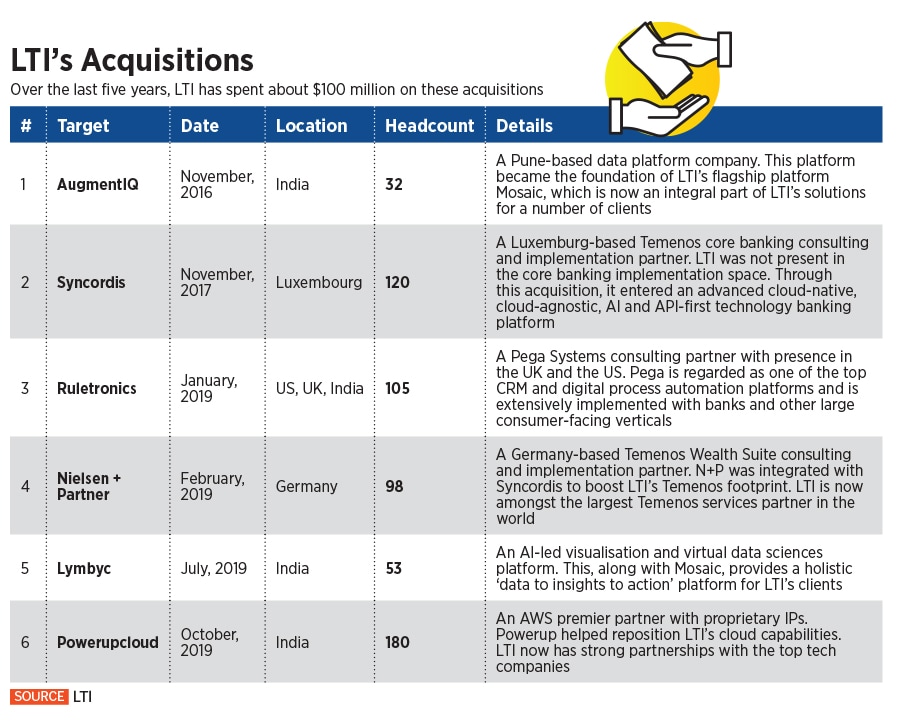

Acquisitions have also helped add some of these capabilities. Mosaic, for example, was built on intellectual property developed by a Pune-based company AugmentIQ that LTI acquired in November 2016. Syncordis, which LTI acquired a year down the line, opened up opportunities in banking software consulting and implementation—specifically, software from Switzerland-based Temenos AG. The acquisition also brought LTI the capabilities to provide banking software from Temenos in an as-a-service model and positioned LTI as a strong tech services provider around banking in the Nordic region, says CMO Dubey.

PowerupCloud, added in October 2019, brought LTI a partnership with Amazon Web Services, the world’s biggest cloud provider, and related intellectual property. Overall, Jalona has backed some six ‘tuck-in’ acquisitions at LTI, spending a total of about $100 million on them.

The company has also been able to attract senior recruits, who have helped LTI deepen its capabilities and land large contracts. A senior executive in France who came on board recently is leading the charge to start a new relationship with a global 500 company in the energy and utilities vertical, says Sudhir Chaturvedi, president and executive board member at LTI. The executive in France is positioning LTI as a strategic supplier for multi-year engagements on IT-led business transformation.

Another recent senior recruit is in the oil and gas vertical, “with decades of industry experience at companies like Accenture, IBM and Infosys,” says Chaturvedi. A third is an expert in the insurance vertical who joined LTI less than a year ago with more than two decades of insurance sector experience, including strategy and digital operations. Such hires are helping LTI win contracts, such as a $124-million engagement with a large multinational company, and a multi-million-dollar contract to provide services around cloud software for insurance companies from Duck Creek Technologies, he adds.

Change from within

While preparing LTI to meet the future needs of its clients was one aspect of Jalona’s mandate, he also needed to address the deferential culture that was a throwback to the parent organisation’s more traditional ethos. The company was started by L&T Group’s Chairman AM Naik in 1996 as L&T Information Technology Ltd to retain talented software engineers within the group. It changed its name to L&T Infotech in 2001-02, and Jalona helped rebrand it as LTI in 2017.

“When I started out here, people would call me ‘Mr Jalona’, and I would momentarily look around for my father,” he recalls. Back then, LTI had a dress code for employees, including formal wear, and ties for men on a certain day of the week. And “when I got into a lift, no one else would take it,” he remembers. “Today no one gives a damn… When people come into your room and use the choicest of words and walk out, because they feel empowered, that’s transformation.”

“Sanjay’s done a great job of not only transforming how LTI is run, but also doubling down on the key technologies of the future,” says Ray Wang, founder and principal analyst at Constellation Research, a business tech advisor in the US. “The recent Snowflake deal is a great example of this capability.” LTI has applied artificial intelligence (AI) to its hiring processes, streamlined internal operations, and has not been afraid to try new business models.

“Our utilisation levels are at an all-time high and we will continue to hire to support our industry-leading growth in FY22,” says Ajay Tripathi, CHRO at LTI, referring to the proportion of staff doing billable work. “We are also embracing newer ways of hiring. We leverage AI-based tools to match skills with job requirements. We have designed an enhanced talent management system that uses intelligent algorithms to retain and expand our talent pool.”

The company recently launched a comprehensive learning platform for its employees, called ‘Shoshin School’—the Japanese term means ‘beginner’s mind’ in Zen Buddhism—with an emphasis on having an open mind and avoiding preconceptions. And last year, LTI’s brand value rose 37.1 percent, the highest among the top 25 global IT services companies listed in the 2021 Brand Finance ranking, Dubey says.

“What they’ve missed is finding ways to expand or buy into the North American market. But that takes time or the right acquisitions,” says Wang of Constellation Research. LTI gets over two-thirds of its revenues from the US, the world’s biggest economy and technology market, and has made one tuck-in acquisition there. It can do much more, Wang thinks. “To succeed you need to double down on North American investments in sales and business development. That takes a long-term investment,” he adds.

In the December quarter, if adjusted for its stronger-than-usual performance in India, LTI’s growth from its largest markets would be 3.5 percent over the previous three months, compared with the overall growth of 5.8 percent, Mint reported on Jan. 20, a day after the company reported its third fiscal quarter earnings, citing an analyst from an multinational brokerage.

And the recent rush to buy not only LTI shares but also those of other small and mid-cap IT companies, including Persistent Systems and Mindtree, is “classic short-term investor behaviour, when the going seems good, because their growth prospects seem better,” says a Mumbai fund manager, not wanting to be named.

The LTI advantage

That said, LTI can continue to grow faster than the IT sector average because it has been more nimble and it “comes from a build culture,” according to Wang. Many customers are seeking new entrants and they seek the digital DNA. The more LTI enables its clients to compete with digital giants, the more it will be successful, he says.

The opportunities are quite promising for smaller service providers as they can be faster, and offer more cost efficiency compared with their bigger competitors, says DD Mishra, senior research director at Gartner, a business tech consultancy. Many of them are even able to bring decision-making closer to their customers, thereby providing a better experience, he adds. On the other hand, companies like LTI are able to offer similar capabilities and geographical presence as the larger companies. Hence on several occasions they are more preferred than their larger competitors, Mishra says.

L&T’s Group acquisition of more than 60 percent stake in Bengaluru-based IT services provider Mindtree in 2019 has raised the expectation that LTI could add over a billion dollars in revenue in one stroke. Built by former Wipro executives, Mindtree is a respected brand, with a strong portfolio of global customers. Many expect that it will be folded into LTI at some point.

For now, the two organisations operate and think a bit differently, Wang says. “They have many similar qualities in innovation spirit, and pushing the limits in terms of challenges.” However, clients often choose LTI for its more pragmatic approach, rigid discipline, and get-it-done digital projects. Whereas Mindtree tends to be more cerebral and strategic in culture, he says. “I think both will co-exist, as clients learn how they work with each other.”

“The group has stated that these companies will continue to operate independently at this point, so we remain focussed on creating value for our stakeholders,” Jalona says, reiterating L&T’s public stand on the matter. “Technology is a mega-billion-dollar opportunity, with ample room for growth for all group companies. The markets and capabilities of these companies are highly complementary and we don’t compete in the same space. Instead, we collaborate synergistically wherever needed.”

At LTI, the CEO has carved out Friday afternoons for himself to reflect on what he calls “basic things”, which translate to thinking about what more LTI can do for its customers and how well it is doing by its people. Success in the former depends on success with the latter. When he started out as CEO, he realised, talking to the staff, that people were hesitant to tell their friends and family that they worked for an IT company.

“When I was an Infoscion, I never hesitated to say I worked for Infosys… that pride is very important, and those are the kinds of things I worry about.” Being a “learning golfer”—while not always possible in New Jersey weather—is another way he gets me-time and thinks about ‘what next’.

Such reflections are what have translated to investments in cloud initiatives, data products and software-as-a-service platforms. Conversations with Naik, beginning when he was invited to meet the chairman to discuss leading L&T Infotech, have also inspired him. “The dream and the vision is, all of us together will create a highly valued, highly profitable next-generation IT company,” he says.

First Published: Feb 08, 2021, 16:13

Subscribe Now