Two Investment Portfolios for 2014

The year 2014 is going to be a volatile year for equities. The two portfolios from Forbes India offer some interesting stocks that have the fundamental strength to manage the tide

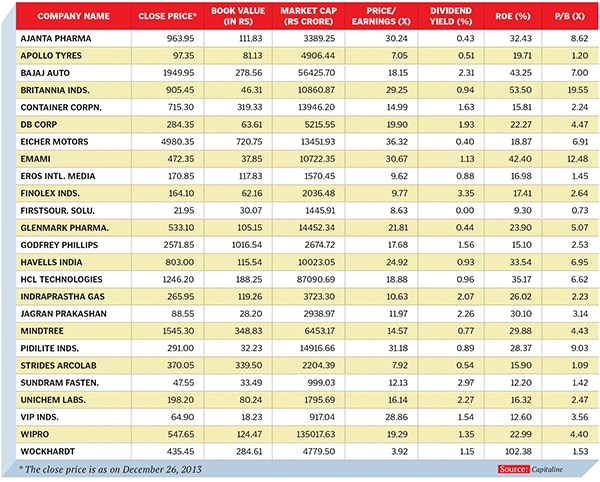

Forbes India Capital Preservation Portfolio

Forbes India Capital Preservation Portfolio

In 2012, the Forbes India Investment Special introduced two portfolios to the readers. The capital preservation portfolio was meant for the conservative investor. Two years ago, we looked at companies that were profitable through the previous decade and managed to protect shareholder wealth. Last year, we considered companies that had very low stock market risks (beta) and had been profitable for the last three years. Over the last year, this portfolio delivered a return of 11.3 percent while the Nifty was up by 4.8 percent.

For 2014, we are looking at companies that have managed to reduce their debt over the last five years, a period that has been tough on Indian corporates. But even in a volatile environment, these companies have maintained their return on capital. We have selected 25 companies that we believe are well-managed and hold the potential for growth.

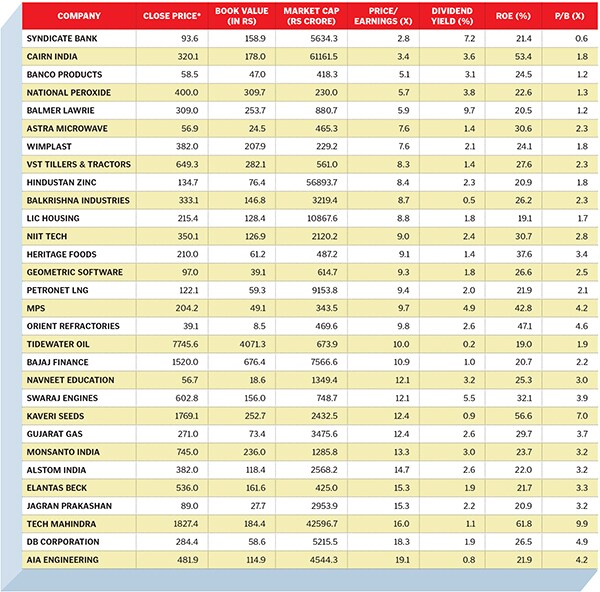

The Cheap, Cheerful and Contrarian Portfolio

The Cheap, Cheerful and Contrarian Portfolio

We introduced the Cheap, Cheerful and Contrarian portfolio in 2012 for investors who like to be contrarian. Over the last year, this portfolio has returned 15.5 percent as compared to the NSE Midcap index which delivered -6.69 percent. The portfolio is equal weighted.

Sanjoy Bhattacharyya, our consulting editor for the Investment Special, has selected a list of 25 stocks that are contrarian but are also meant for the cautious investor.

These are not large cap companies but being small, mean and lean, these are worth watching. They have a strong management and their fundamentals are intact. However, since they have been ignored by the markets, these are available at cheap valuations. Take a chance on them if you are in the mood to be ‘different’.

First Published: Jan 23, 2014, 06:38

Subscribe Now