Three factors that put Sensex on firmer ground

Its second rally past the 40,000 mark looks like it's here to stay

Image: Shutterstock[br] The first time the Sensex scaled 40,000 in late May, it gave up 13 percent of those gains over the next three months. This time, the 40,000 mark has the makings of a more sustainable rally as the market bets on the government continuing with announcements that reduce taxes, ease regulations and put more money in the hands of people. For now the market has priced in 5-8 percent growth in earnings on account of a cut in corporate tax announced on September 28. “No one is making the case that this will be another runaway bull market, but the markets now have enough going to sustain these levels,” says Amit Khurana, head of equities at Dolat Capital.

Image: Shutterstock[br] The first time the Sensex scaled 40,000 in late May, it gave up 13 percent of those gains over the next three months. This time, the 40,000 mark has the makings of a more sustainable rally as the market bets on the government continuing with announcements that reduce taxes, ease regulations and put more money in the hands of people. For now the market has priced in 5-8 percent growth in earnings on account of a cut in corporate tax announced on September 28. “No one is making the case that this will be another runaway bull market, but the markets now have enough going to sustain these levels,” says Amit Khurana, head of equities at Dolat Capital.

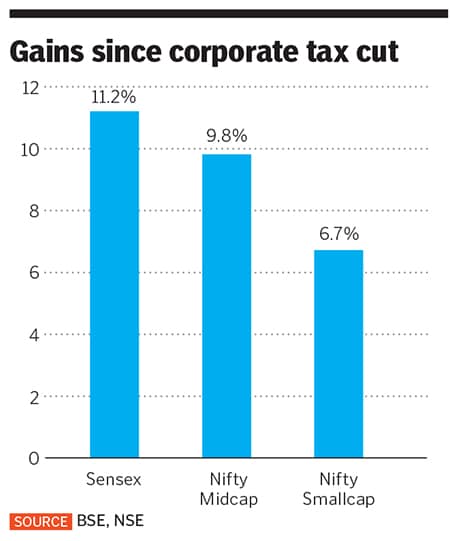

Second, FII selling which took the market down in July, August and September has stopped. FIIs sold ₹36,000 crore worth of equities in these months and bought ₹8,595 crore in October. Post the cut in corporate taxes, there has also been increased deal making with Zee Entertainment selling 11 percent to Invesco Oppenheimer, Adani Gas’s stake sale to Total and Yes Bank’s, Axis Bank’s and Piramal"s fund raise. The Sensex rally has also been supported by a 9.8 percent increase in the Nifty Midcap Index as investors are now willing to take bets on smaller companies.

Third is the expectation that the government will undertake bolder reforms. Rationalising taxes on gains from equity investing is one area being watched. Add to that a disinvestment pipeline with Air India and Bharat Petroleum being put up for sale.

First Published: Nov 05, 2019, 11:44

Subscribe Now