Leadership's changing tunes at Tata Trusts

With Noel Tata as the head of Tata Trusts, there could be a realignment with the Trusts and possibly its relationship with Tata Sons

Divisions within the Tata Trusts were laid bare in September. The move came with the reappointment of trust-nominee director Vijay Singh who, at 77, had crossed the superannuation age.

According to a report in The Times of India, four nominee directors—Mehli Mistry, Darius Khambata, Pramit Jhaveri and Jehangir HC Jehangir—declined to support Singh’s nomination to the board of Tata Sons. The ostensible cause: The Trusts needed someone more forceful to voice their views. Two others, Venu Srinivasan and Noel Tata, were in favour.

While Singh was not present at the meeting, he is said to have subsequently expressed his dismay, stating that earlier matters like nomination of directors were decided by consensus. In addition, Mistry is said to have been disappointed when he failed to secure Noel Tata’s backing for a board seat at Tata Sons.

While neither Tata Sons nor the Tata Trusts have commented on the matter, the move highlights what has been seen in many corporate groups when there is a change of guard. Those who have watched and advised India Inc say these changes are common when a change occurs.

Noel Tata took over as chairman of Tata Trusts on October 11, 2024, succeeding Ratan Tata.

“Whenever there is a change in ownership within any large business group, a realignment of certain decision-making processes, interests and priorities is inevitable—and this is a global phenomenon. What we are hearing are at most some minor tremors of those realignments,” says Nitin Potdar, an independent corporate and M&A lawyer and former partner at J Sagar Associates. In the past, trustees have alleged that there have been instances of information not being shared with Tata Trusts. Tata Sons has argued that is because public companies’ information would have to be shared with all shareholders together.

While Tata Sons has thus far not been dragged into the dispute, it is clear that a rift within the Trusts could affect its functioning as well. The Trusts (with the Sir Ratan Tata Trust and Dorabji Tata Trust as the two large ones) control about 66 percent of the voting rights in Tata Sons.

In a bid to safeguard the workings of Tata Sons, the government—through Home Minister Amit Shah and Finance Minister Nirmala Sitharaman—asked the trustees to ensure that their discord did not spill over to the workings of Tata Sons. The meeting was attended by Tata Sons Chairman N Chandrasekaran as well as Noel Tata, Srinivasan and Khambata.

The divide within the Trusts also lays bare another issue that has been vexing the board at both Tata Sons and the Trusts for the last three years—its classification as a non-banking finance company. In September 2022, the Reserve Bank of India (RBI) designated Tata Sons as an upper-layer NBFC, thereby starting a three-year clock for it to go public.

Over the next two years, Tata Sons paid down its debt and became cash positive which, in the eyes of some observers, removed the need for it to get listed. In August 2024, Tata Sons applied to surrender its NBFC licence. While the September 2025 deadline to list has come and gone, there has been no action from the RBI. Tata Sons intends to stay private.

By staying private, Tata Sons has aggrieved a large shareholder—the Shapoorji Pallonji Group, which owns 18.4 percent of Tata Sons. In a press release, Shapoorji Mistry reiterated his demand that Tata Sons be publicly listed. The statement said that the listing would not only be a financial step but also a moral and social step as it would unlock value for 12 million shareholders of listed Tata companies.

Left unsaid was the fact that the Shapoorji Group has for years been trying to unlock the value of its stake in order to pare down debt in its group companies. Tata Sons has so far disallowed it from pledging its stake to take loans. As a result, it has had to resort to piecemeal measures such as the sale of Eureka Forbes to pare down debt.

As things stand, the power struggle within Tata Trusts has not spilled onto the working of Tata Sons or any of the group companies. In the past when there was a dispute over the chairmanship of Cyrus Mistry, none of the day-to-day functions of group companies were impacted—although they did have to go through the messy process of calling for extraordinary general meetings to remove Cyrus Mistry from the chairmanship of those companies.

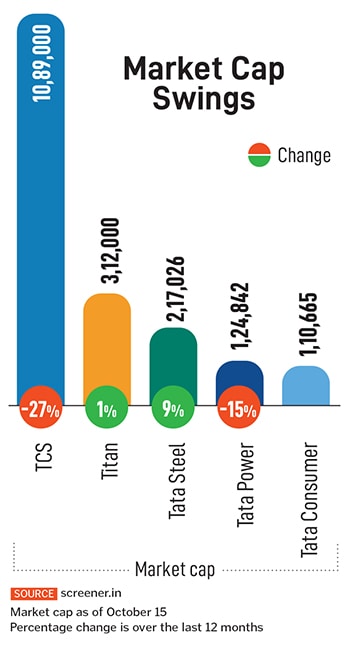

The last year has seen a fall in the overall market capitalisation of the group. This, combined with the fact that its mainstay IT services company, Tata Consultancy Services (TCS), has shown lacklustre growth. TCS, also its most valuable listed company, has seen an erosion of ₹295,000 crore. Its stock is down 27 percent in the last 12 months.

Other businesses have all seen a fall with Tata Power down 15 percent. Only Tata Steel is up 9 percent on account of a global increase in commodity prices. In this period, the Sensex has been flat with a -0.1 percent decline.

Tata Sons also faces an uphill task in getting businesses like Air India and Tata Digital on the growth and profitable path. A distraction from Tata Trusts is something it could do without.

First Published: Oct 23, 2025, 14:02

Subscribe Now(This story appears in the Oct 31, 2025 issue of Forbes India. To visit our Archives, Click here.)