Road to recovery: Time taken to close an insolvency process inches up

Despite enduring lengthy delays, payoff for creditors remains modest

India"s Insolvency and Bankruptcy Code (IBC) was designed to streamline the resolution of corporate distress. However, procedural delays and lower recovery for creditors pose some challenges.

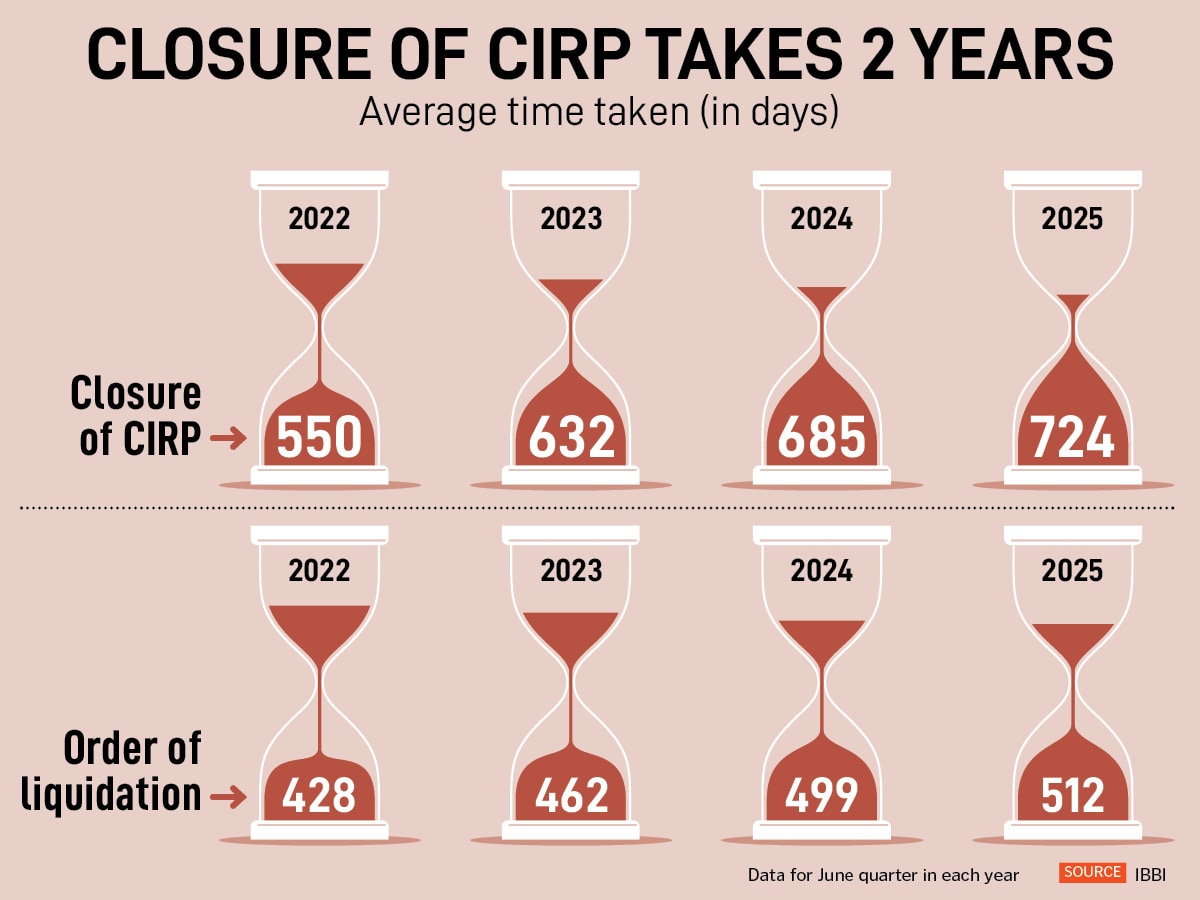

Data from the Insolvency and Bankruptcy Board of India (IBBI) suggests the average time taken to close a Corporate Insolvency Resolution Process (CIRP) has climbed steadily, from an average of 550 days in 2022 to 724 days in 2025, over double the maximum time prescribed. The analysis considers data for the June quarter of each year. This trend points towards a significant slowdown in a process designed for speed. According to the Insolvency and Bankruptcy Code, a CIRP is to be completed within a maximum time of 330 days, including extension or litigation.

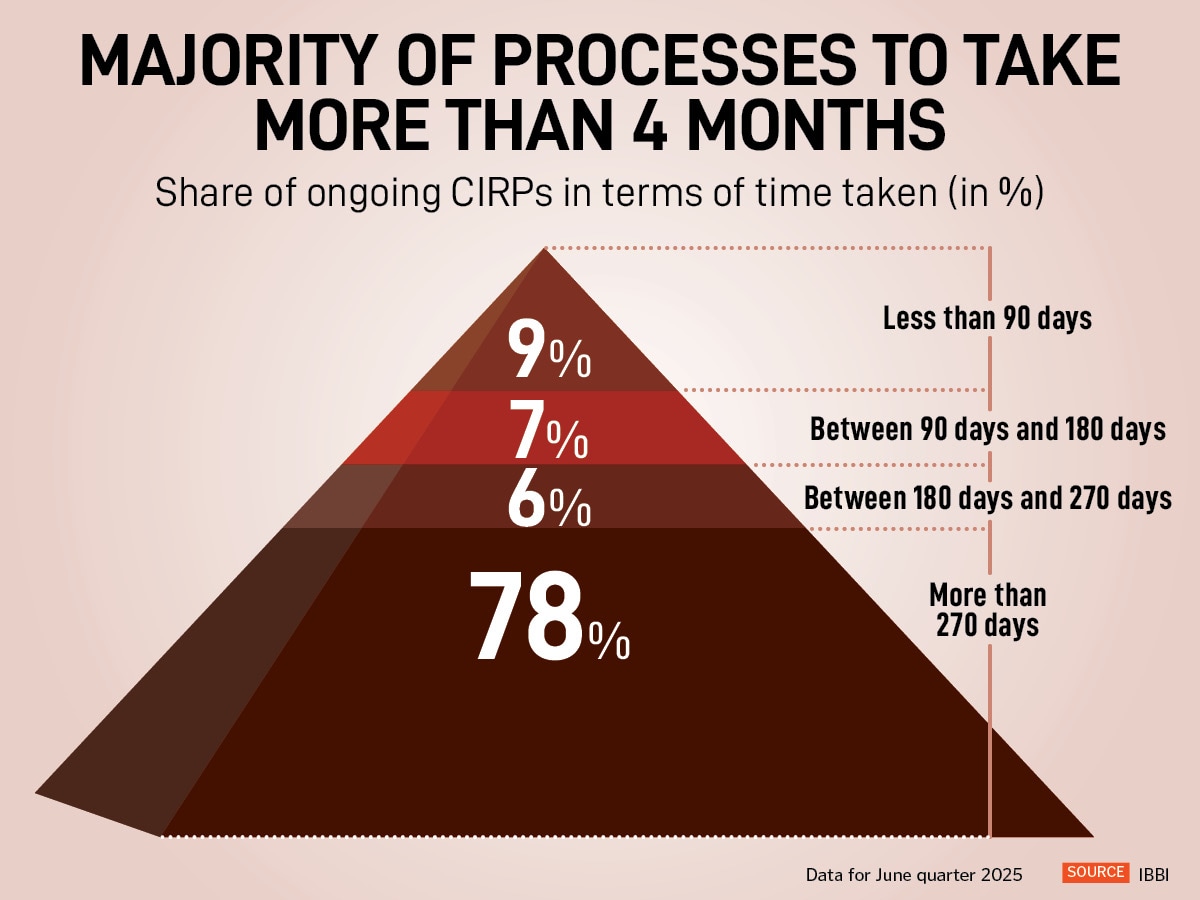

The data on ongoing cases further underscores this challenge, with 78 percent of CIRPs taking more than 270 days to conclude. About 8,500 new CIRP cases were admitted in the 2025 June quarter compared to 8,300 cases in the previous quarter.

Last week, Finance Minister Nirmala Sitharaman introduced the Bankruptcy Code Amendment Bill 2025, with a specific focus on speeding up the insolvency proceedings in the country. The Bill, which has been referred to a Select Committee of the House, among other amendments, also empowers creditors to consider out-of-court settlements in cases of genuine business failures.

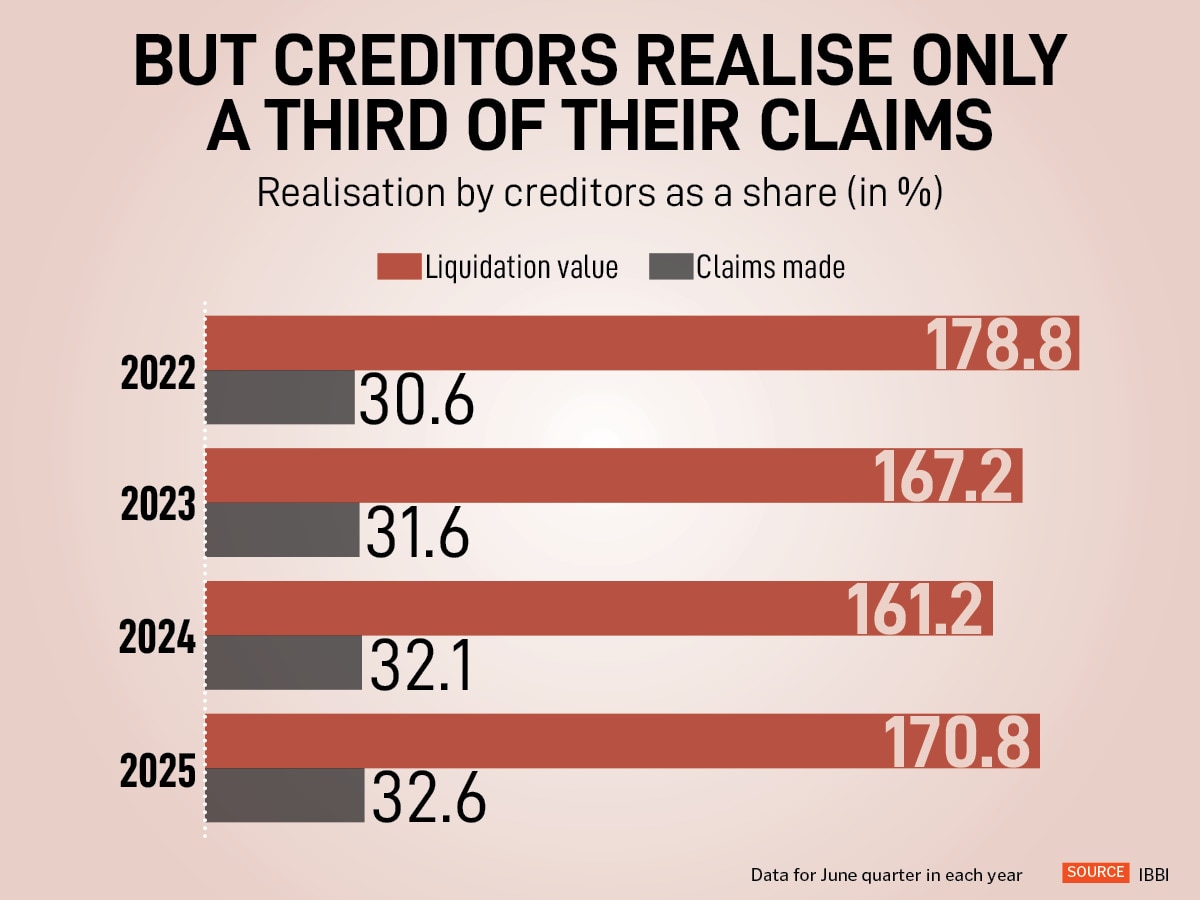

Meanwhile, despite enduring lengthy delays, the payoff for creditors remains modest. The IBBI data shows that creditors realise just about a third of their claims, a steady trend over the last four years.

In the June quarter of 2025, creditors could expect to recover just 32.6 percent of their total claims. This contrasts sharply with the liquidation value, which stood at 170.8 percent in the same year. The data shows that while the insolvency process is better than liquidation, it still does not lead to a high recovery rate for the creditors" initial claims.

A Creditor-Initiated Insolvency Resolution Process (CIIRP) has been introduced in the new proposed legislation to speed up resolution and protect asset value.

First Published: Aug 18, 2025, 13:32

Subscribe Now