The Rise and Fall of Educomp

His company Educomp set out to prove that there was money in school education. But in the last five years, he's burnt his fingers badly

Ankur Rudra, a stock analyst at Ambit Capital, knows how to call it like it is. In January 2011, the then 29-year-old stuck his neck out by putting a ‘sell’ rating on Infosys, a company that had been the blue-eyed baby of the Indian stock market for nearly two decades.

It would take nearly a year-and-a-half for the rest of the analyst and investor community to come round to Rudra’s point of view, that Infosys was being valued too highly in the context of its growth potential. Of course, by then its stock had shed nearly a third of its value, so everyone had the benefit of hindsight as well.

In February last year, Rudra stopped tracking Educomp Solutions, the largest education services firm in the country. “I’d been pessimistic about the company since 2009, but by 2012 there just wasn’t enough trading in the stock for it to be of commercial interest to any stock broking firm,” says Rudra.

Sangeeta Gulati too had been bearish on the stock. Of the 35 transactions she undertook in Educomp between 2007 and 2012, nearly two-thirds were sales, and in almost all cases undertaken within a fortnight of acquiring the shares.

But Gulati wasn’t a star fund manager. She was the chief financial officer (CFO) of Educomp. Most of the stock she sold was allotted to her through Educomp’s ESOP (employee stock ownership plan). In April 2012, Gulati resigned, a week after making her two final share sales.

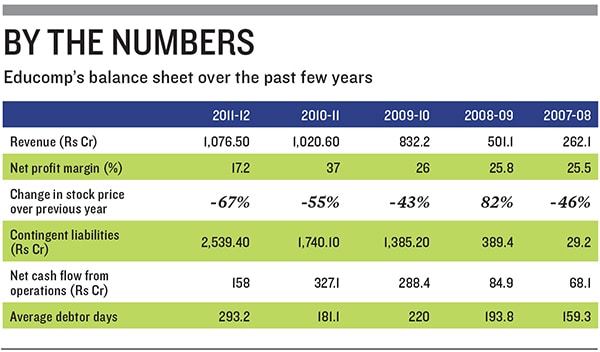

Today, Gulati’s pessimism on Educomp’s stock makes perfect sense. For a company that almost single-handedly created the hype around money-making opportunities in school education, its stock is down 67 percent over the previous year 84 percent over two years 91 percent over three years. Its market capitalisation has fallen from Rs 7,000 crore in November 2009 when Forbes India did a profile on the company to just Rs 771 crore as of March 23.

Things have been bleak internally as well during the last two years, with even employee salaries being held up at both Educomp and IndiaCan, its joint venture with Pearson Plc.

Of the $150 million in new funding it raised in July 2012 from three foreign investors, two-thirds would go to pay back a five-year-old foreign currency loan it couldn’t repay on its own, given the debt and liabilities on its stressed balance sheet.

Surely there are some lessons that Educomp and its founder Shantanu Prakash have learnt during the rollercoaster ride of the last five years?

“It is not right to say that anything went wrong with Educomp,” Prakash avers. “From 2006 when we went public to 2012, our revenue has grown from Rs 51 crore to Rs 1,500 crore profits from around Rs 6 crore to Rs 180 crore school customers from 75 to 15,000. Plus we have 250 preschools, 47 schools with 22,000 students and 350 vocational training centres. This is ‘Wow!’ This is fantastic growth! How companies fare in the capital markets doesn’t tell the full story of how they’re doing in terms of their social impact.”What Prakash doesn’t talk about is that Educomp’s net profit margin has fallen 61 percent during the last four years the net cash generated by its operations has been falling significantly for the last three years the time taken to collect its money from customers almost doubled in the last four years and most importantly, its overall liabilities in 2012 were over twice its revenues.

Prakash is also cool about some high-profile exits from his company.

Four months after CFO Gulati’s resignation in 2012, Mohit Maheshwari, Educomp’s company secretary and the person who led its compliance and corporate governance functions, resigned too.

Meanwhile, that very year, four consecutive company secretaries would resign in Edusmart, a three-year-old company whose sole purpose was to convert nearly two-thirds of Educomp’s annuity revenue from schools into large chunks of discounted loans from banks.

An uninformed, lay investor would think there was a pattern. “There is no pattern and no inference from these resignations. They are 500 percent irrelevant. Edusmart is a really small company and Educomp has had several management changes over the years,” Prakash says.

A good place to see how the Educomp story developed chinks would be at the Sanskaar School in Hubli, Karnataka.

EDUCATION’S SUB-PRIME CRISIS

Flanked by acres of red earth-topped bare fields and demarcated plots on all four sides, the six-year-old Sanskaar English Medium School sits a few hundred metres off the Gulbarga-Bijapur highway in Hubli.

The 19 classrooms from Montessori to Class 10 brim with the chatter of nearly 800 students. Each of the classrooms is fitted with an interactive digital ‘board’ that teachers use to mix multimedia content with their regular teaching.

In early 2011, Educomp inked a deal with Sanskaar to equip all its classrooms with its Smart Class range of digital classroom aids that allowed teachers to use interactive multimedia content to supplement the standard textbook-and-blackboard approach. Instead of paying roughly Rs 37 lakh to Educomp for the hardware and content, the school would pay it a monthly fee per class over a contract period of five years. In turn, the school would pass on the cost as a monthly fee increase of Rs 150 to Rs 200 per student.

Given India’s population, paucity of good schools and love for all things technology-enabled, the potential market for such a service was seen as a few hundred thousand schools. Smart Class itself grew like weed, from less than 100 schools in 2006 to over 6,550 schools by 2011.

By May 2011, Educomp had delivered all the hardware to Sanskaar, ready to be installed and configured.

And there it would lie, for nearly two years. Under lock-and-key. In a storeroom.

A senior representative from the school says it cancelled the order back in May itself because Educomp missed contractual deadlines for installation and commissioning. Instead, it chose to place a new order with one of Educomp’s smaller competitors.

Meaning, Educomp received no further payments from the school and lots of letters asking for the equipment to be taken away. Yet it was only when the school threatened to auction the ageing hardware that Educomp decided to finally take it back just a few weeks ago.

Divya Lal, the head of Educomp’s academic services, says Sanskaar acted with malafide intent and such cases represent less than 1 percent of Educomp’s 15,000-plus base of school customers.

The reason Educomp did not pick up the hardware in spite of the school terminating the contract was, according to Lal, to avoid creating a perverse incentive for other schools too. She also adds that Educomp recognised no revenue from Sanskaar, and wrote off the value of the contract in its books.

While Educomp may claim that such cases are too miniscule to matter, what was too big to ignore was the fact that many schools across the country weren’t paying it in time.

“The risk is that this technology sales model becomes akin to the sub-prime mortgage scenario that caused the credit crisis in the US. Like in the US where loans were given to people who did not have the repayment capacity, there is some danger that ambitious schools looking for a magic bullet are buying hardware and software they ultimately can’t afford,” says Karan Khemka, a partner with Parthenon, a strategic advisory firm with a special focus on education.

“It is the job of a financing institution, not an educational services vendor, to finance a school. Otherwise you end up bearing business risk, execution risk and financing risk. That’s too much to bear,” says TV Mohandas Pai, the chairman of Manipal Global Education (a group that competes with Educomp in various spaces) and erstwhile Infosys board member.

FROM BOOM TO BUST

This risk troika wasn’t apparent to many investors who bought the stock in 2009. Educomp then was supposed to be this ‘asset-light’ education software company that would scale with lightning speed.

Kenneth Andrade, the head of investments at IDFC Asset Management, says, “We bought the Educomp stock during its IPO and continued to hold a significant percentage of it over the years. But in 2010, we exited the stock completely because I felt they were straying from their original promise of being an ‘asset-light’ education services player into being a balance-sheet player.”

Why did Prakash move to this business model which would take in more capital and where the money would not come in quickly?

The short answer: The lure of a high valuation. In January 2008, it’s price-earnings multiple was 27.8 (today it is just a fraction of that at 6.71).

Buoyed by Educomp’s rosy growth numbers, between 2008 and 2009 investment banks and broking firms started putting out fat reports on the massive pot of gold at the end of the education rainbow.

The potential market was estimated at $30-35 billion across various education segments like multimedia-in-classrooms, privately run K-12 schools, vocational training, preschools, coaching classes and higher education.

Under Prakash, who apart from being Educomp’s founder and CEO also owned over 50 percent of its stock, the company set out to plant its flag in every conceivable sector in education using every conceivable strategic tool.

There were joint ventures—IndiaCan with Pearson Plc in the vocational training space Raffles Millenium colleges with Raffles Education Topper TV with Network 18 (the parent company of Forbes India) in the TV space. There were investments and acquisitions—PurpleLeap in vocational training Vidya Mandir and Gateforum in test preparation Eurokids in preschools. And of course there were numerous new subsidiaries of which its own brand of K-12 schools was the most significant one.

Educomp’s annual report for 2009-10 listed 15 directly held subsidiaries, 28 indirectly held ones, five joint ventures and 14 associate companies spread across India, Singapore, Canada, USA and the British Virgin Islands.

One particularly innovative technique Educomp adopted even ended up making its debt disappear for a while.

That magic bullet was Edusmart, an ‘unrelated’ company headed by one of Educomp’s senior executives. The new company took over all of Educomp’s newer five-year school contracts, pledged the receivables with banks in return for roughly 75 percent of the amount as a lump sum, most of which it meekly handed over to Educomp.

Why would banks lend to a new and unknown company? Because Educomp stood guarantee on those loans, even though Edusmart was neither a subsidiary nor a related party on its books.

Analysts and investors were aghast: The model’s sole purpose seemed to allow Educomp to book three-fourths of a school’s five-year annuity revenue right upfront, thus inflating revenue and profits.

Prakash says the decision to do this was “merely technical” and “not relevant in 2013”.

Raman Bajaj, vice president, business transformation and corporate affairs at Educomp, is candid enough to admit the real reason: “We did it to keep the securitised debt off our books as contingent liability, otherwise our higher leverage ratio would have meant banks wouldn’t lend money to us for our K-12 schools business.”

This is why Educomp’s total debt as of March 2012 is just Rs 337 crore, while its total liabilities were Rs 2,148 crore.

“That was the beginning of the downfall of their stock. When Educomp saw growth slowing down because they’d penetrated most premium ICSE and CBSE schools, a better way would have been to educate the market and make itself more sustainable instead of changing their accounting model by using a private company to book revenue upfront,” says Rudra.

For some this was a clear example of a promoter who was pursuing an unsustainable path. “It was the duty of the company’s board to counterbalance the dominant shareholder and CEO who thinks he’s a superstar. On that count I think the Educomp board has clearly failed,” says Pai.

One would think that having burnt its fingers so badly by turning its primary business into a capital-intensive operation, Educomp would be smarter in the K-12 schools business. Yet it curiously chose to make that into an even more capital-intensive setup by deciding to buy the land on which to put up its schools instead of long-term leases like most competitors.

“Schools are valued on the basis of their cash flows, not land banks. Because whatever the land’s real value, on the school’s books it can only be notional because it can’t ever be de-linked and sold,” says K Ganesh, the erstwhile CEO and founder of TutorVista, a company now fully owned by Pearson.

Today, the 47 schools run by Educomp have nearly 50,000 seats between them, filled with only 22,000 students.

BACK TO BASICS

“In India any educational services company should be a private and not public listed business,” says Pai. “While listing might bring capital, it will inevitably also force businesses to take unsustainable steps to drive higher growth and valuation. In Educomp’s case I think it was a combination of poor execution, lack of adequate planning and oversight, and overreach as its businesses grew at a faster pace than its management capability.”

De-listing may not be an immediate option for Educomp (though Prakash doesn’t rule it out either), it does appear that the company is belatedly trying to refocus itself towards a more sustainable business model.

The starting point for that transformation was July 2012 when three knights in shining armour—the World Bank-owned International Finance Corporation, French development finance institution Proparco and distressed assets fund Mount Kellett—put up $155 million.

“Educomp was lucky to get IFC funding, because the fund is usually savvy, conservative and concerned with issues around corporate governance and reputation. I was amazed and felt it was a coup of sorts,” says one of Educomp’s competitors.

IFC did not respond to a Forbes India email questionnaire sent to Ved Prakash, one of its directors in India, by the time this story went to press. Mount Kellett too did not respond.

Though IFC may have disregarded some of Educomp’s past at the time of investment due to building deployment pressure, it seems intent on being the new change driver. Sources say that the fund was behind the decision to drop one of Educomp’s two auditors, Anupam Bansal & Co (the other one being Haribhakti & Co).

Over the years, many analysts and investors have wondered why the company never appointed one of the ‘big four’ accounting firms to audit its books, when even young VC-funded startups are doing so.

In 2009, after a cloud of rumours and suspicion about its finances, Educomp announced that it had appointed Grant Thornton as its internal auditor.

Educomp’s new investors are also behind a transformation plan that seeks to focus the company’s attention on two primary businesses: The content-based Smart Class and the asset-backed K-12 schools. Most other businesses will be sold off progressively.

Since July last year Educomp has sold off its stake in Eurokids, a pre-school chain and raised Rs 22 crore for its online learning subsidiary authorGen in a funding round led by private equity firm Kaizen. Pearson is likely to acquire its entire stake in the loss making IndiaCan venture imminently. Also up for sale are Educomp’s majority stake in coaching firm Vidyamandir Classes and test preparation company Gateforum.

Prakash insists the decisions to hive off these stakes isn’t a function of Educomp’s financial situation. “These were only investments, which we are now divesting while making great returns and unlocking value for our shareholders. On that count I think we’ve outperformed even private equity funds like Tiger Management, Matrix and Sequoia,” he says.

But is that enough?

An executive with a large fund that was a significant investor in Educomp for many years before exiting it, puts it best: “The question ‘Can Educomp regain its past glory?’ has two answers to it: A business [strategy] and a financial one. Thing is, even if they manage to pull out all stops on the business front, they still have a mountain of debt to cross. And then there’s investor trust, which may very well take many years to get back.”

(Additional reporting by Shishir Prasad and Pravin Palande.)

First Published: Apr 08, 2013, 07:19

Subscribe Now