Chronic problems, fresh solutions: How health tech startups are reinventing care

Startups are using the latest technologies to cure the health care system of its many chronic ailments, while putting the patient first

In a small hospital in Ahilyanagar, Maharashtra, a 13-year-old boy lay barely breathing. A suspected krait bite had left his pulse precariously weak. The hospital lacked someone trained to handle such emergencies.

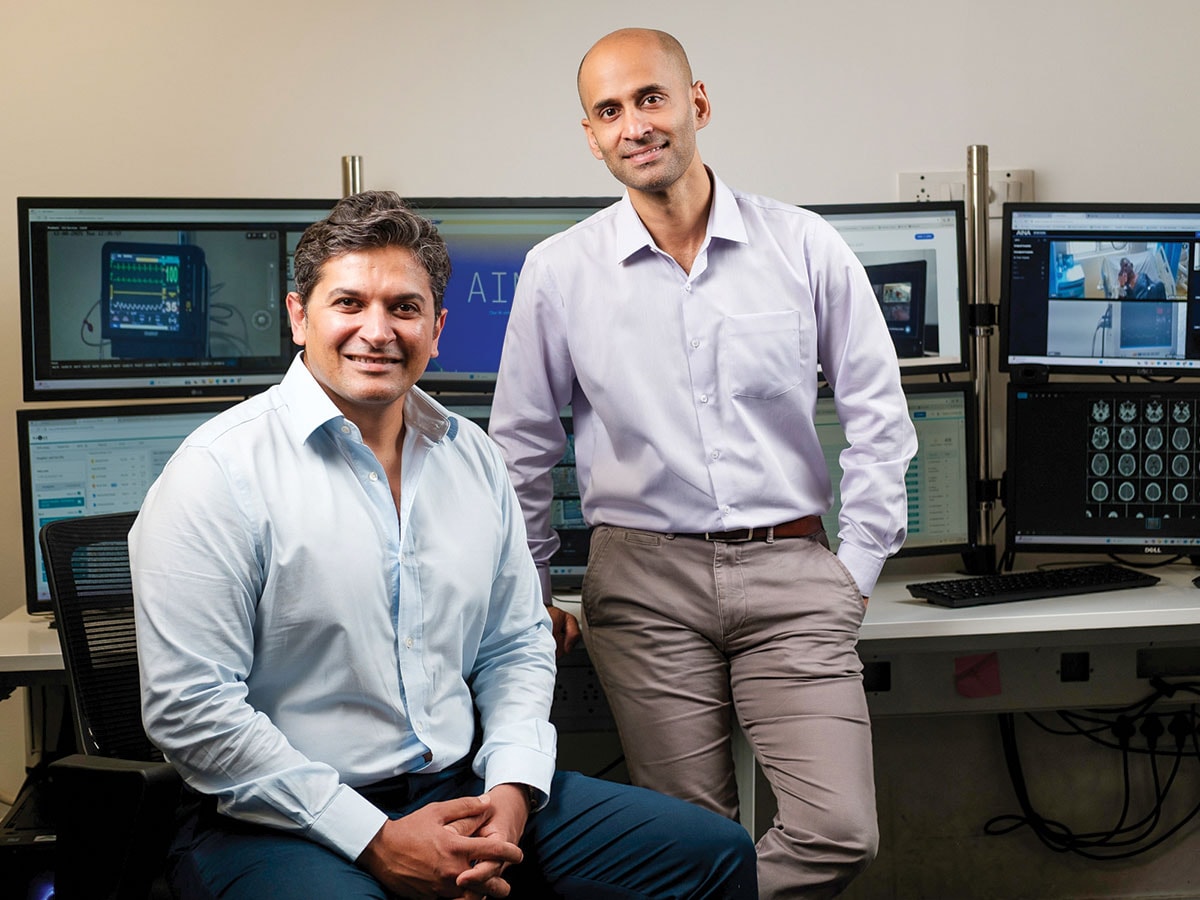

Help came from an unexpected source. Within minutes of intubation, doctors at the hospital were joined, virtually, by paediatric intensivists from healthtech startup Cloudphysician. The remote team guided the local staff through a series of interventions. After 12 days, the boy walked out of the hospital fully recovered.

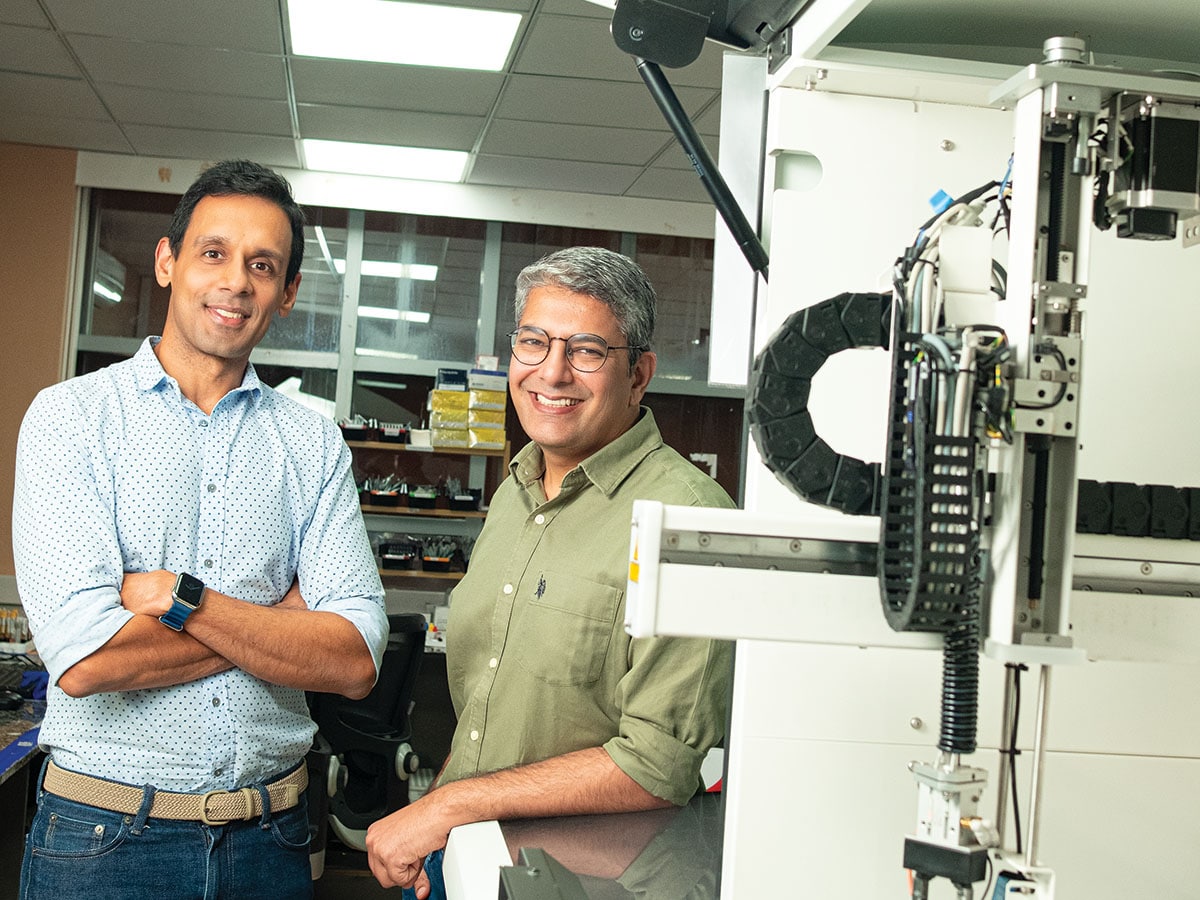

Cloudphysician’s founders, Dhruv Joshi and Dileep Raman, are both trained doctors who recognised a universal challenge in health care. “Good quality care depends on having highly trained experts physically present. That model does not scale. You simply cannot have that level of expertise available everywhere, all the time,” says Joshi.

This realisation led to the founding of Cloudphysician in 2017. The Bengaluru-based startup infuses inpatient care with artificial intelligence (AI)-powered video. Its platform, RADAR, uses real-time computer vision and clinically trained models to enhance patient safety, address workforce shortages, and improve hospital compliance. On top of that is AINA, an AI layer that analyses data to generate autonomous clinical insights.

“It had to be technology-enabled,” says Joshi. “There was no other way.”

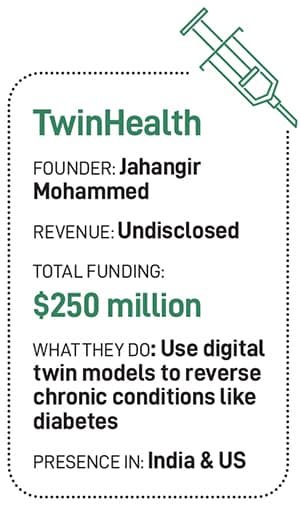

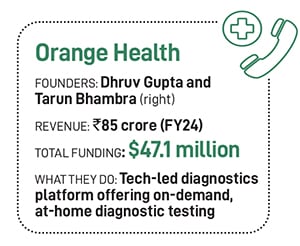

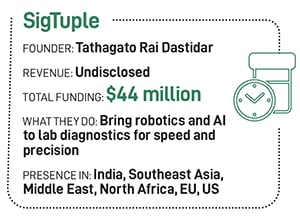

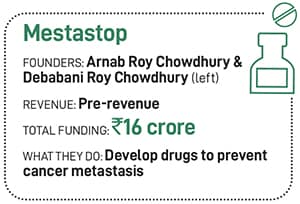

Cloudphysician is among a bevy of startups using technology to improve health care—from accessibility to drug discovery, and chronic disease management to emergency response. Orange Health is reimagining diagnostics. Twin Health is working on reversing chronic conditions such as diabetes. SigTuple brings robotics and AI to lab diagnostics. Mestastop is developing platforms to prevent cancer metastasis. StanPlus is streamlining emergency responses. And Niramai offers non-invasive, radiation-free breast cancer screening.

“Medical outcomes must be non-negotiable in the Indian market,” says Mohit Bhatnagar, managing director at Peak XV Partners, a large venture capital firm that used to be the Indian arm of Sequoia. “You can’t delay or dilute the service to make unit economics work.”

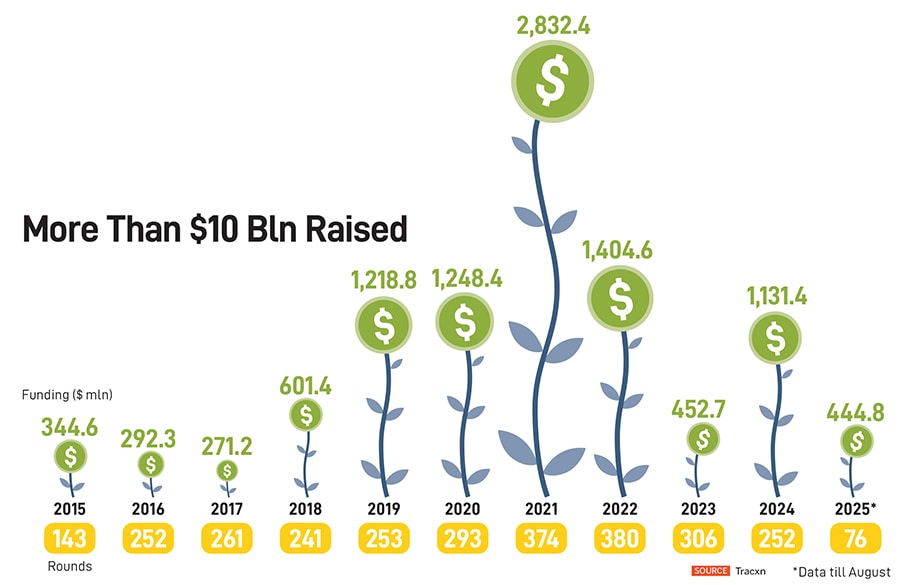

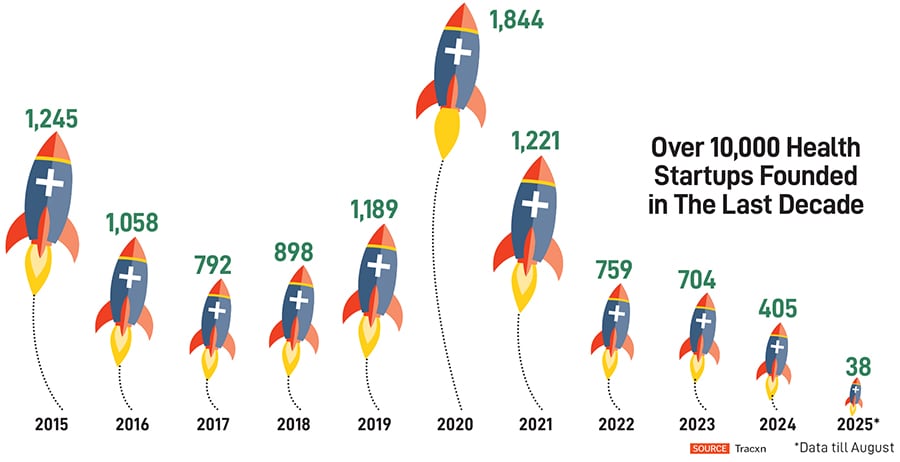

Bain & Company puts the Indian health care market at $180 billion in FY23 and projected to reach $320 billion by FY28. Healthtech accounted for roughly 25 percent of the health care innovation market in FY23, having more than doubled from $3 billion in FY20. Bajaj Finserv AMC estimates the sector to be at $638 billion by 2025, up from $110 billion in 2016.

“We are at a point of convergence, where all stakeholders recognise and embrace technology, and we have a supply side strength of talent and capital to deliver the solutions,” says Sunil Thakur, co-founder and Investment Committee Member, HealthQuad, a health care innovation fund.

When Dhruv Gupta and Tarun Bhambra set out to build Orange Health, they noticed that most startups were layering solutions on top of outdated infrastructure, without addressing the inefficiencies at the core. “Most were creating retail layers—marketplaces that followed an ecommerce approach to health care. But the underlying supply chain was not designed for efficiency. No one wanted to rebuild the base infrastructure,” recalls Bhambra.

A full-stack, vertically integrated model was the only way. Their thesis was simple but ambitious: 60-minute home sample collection, six-hour report delivery, and availability from 6 am to 10 pm. “Most labs shut by 5 or 6 pm, maybe 7 pm at the latest. After work, if you visit a doctor and they recommend tests, no lab is available. The typical response is, ‘We’ll do it tomorrow morning.’ ”

In a world where pizza arrives in 30 minutes (fans of the 2009 movie, 3 Idiots, will nod at this), this kind of delay felt archaic. “The reason reports typically take time is because samples spend a lot of time waiting—waiting to be picked up, waiting to reach the lab, waiting to be accessioned, waiting by the machine, and waiting to be reported. Our focus has been to eliminate that waiting,” Gupta says. Reducing waste speeds up reporting and improves outcomes. “Fresher blood yields better results,” adds Bhambra.

Orange Health caught the attention of Amazon, which invested in it through its Smbhav Venture Fund, leading a $12 million round in December 2024. The partnership supports the launch of Amazon Diagnostics, an at-home diagnostic service in India, with Orange Health Labs as the exclusive partner.

“When we talk about helping doctors diagnose better, what we are really talking about is enabling the measurement of human health,” says Bhambra.

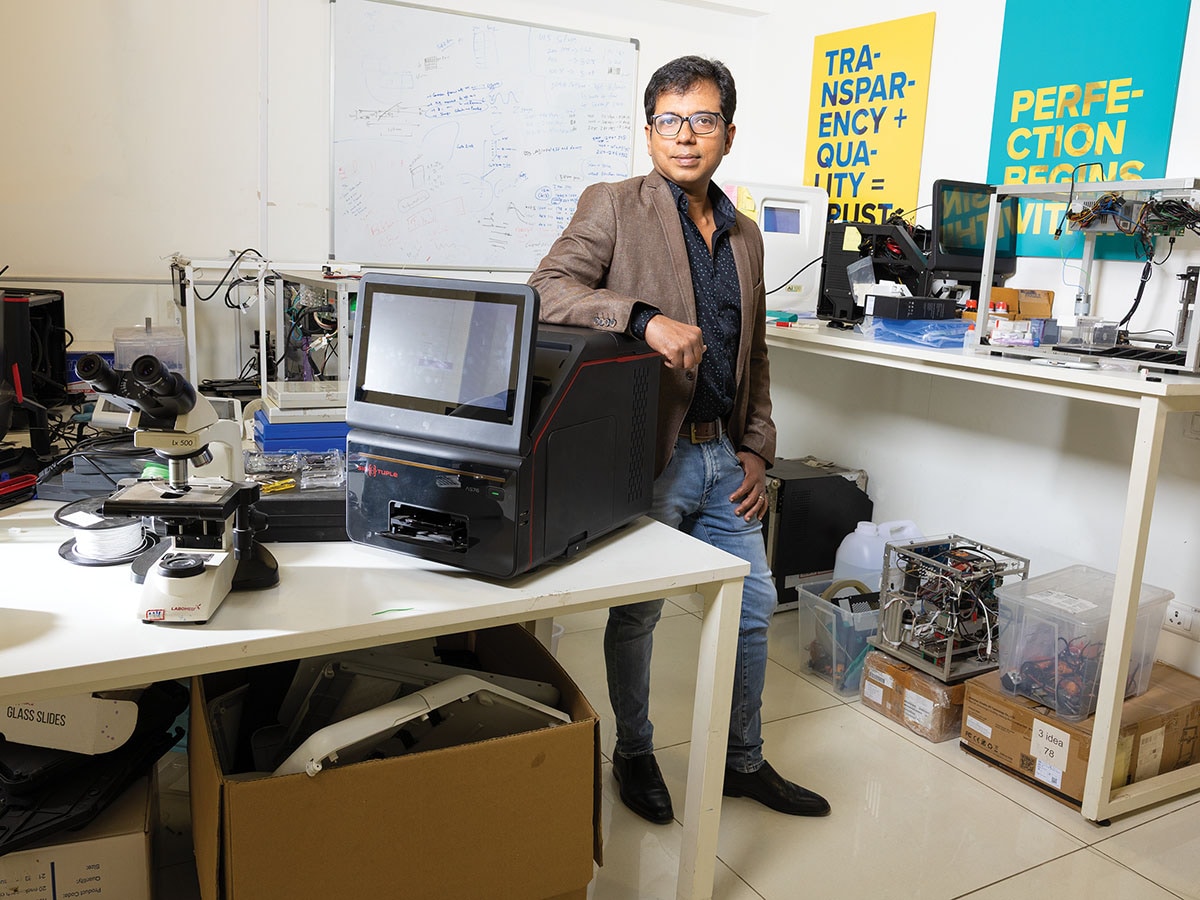

SigTuple’s journey, too, began with a simple observation: The most critical part of pathology—blood analysis—was still being done manually, even in labs equipped with advanced machines. “Analysing blood manually, even by a pathologist, could be highly error-prone. So we decided to address this issue using AI,” says founder Tathagato Rai Dastidar.

After six years of R&D, SigTuple began commercialising its flagship product, AI100, in 2021. The solution combines an automated digital microscope with AI-driven software that scans and analyses samples, presenting results to pathologists through a web browser. “We are improving the quality, turnaround time, and accessibility,” Rai Dastidar says.

SigTuple recently launched SigVet, a point-of-care device that uses microfluidics and AI to deliver a complete blood count report in under five minutes right at the doctor’s chamber. “It runs entirely offline, making it ideal for access-deprived or data-sensitive environments,” says Rai Dastidar.

The company has released an upgraded version of the AI100, built for high-throughput lab environments. It offers higher image quality and has already received European regulatory clearance. As you read this, distribution agreements are being finalised, with Europe as the launch market, followed by the US.

India’s health care system lacks outcome-based incentives. “In many countries, health care systems pay for performance—better outcomes mean better reimbursement. That is a proven way to prioritise quality care. But, in India, that model does not exist yet,” says Cloudphysician’s Raman.

His fellow founder, Joshi, underscores the urgency of this shift: “If patients are dying more often than they should, something is wrong. Technology and analytics help us identify and correct that.” Raman adds that the proof of their minimum viable product (MVP) is lives saved in the ICU. “It is not active users or a software metric,” he says. “Whether it is neonatal care, emergency departments, or inpatient care—we have consistently seen mortality reductions.”

Looking ahead, Raman anticipates a move towards accountable, quality-driven, pay-for-performance models. “It is inevitable,” he says. “But for a country like India, with 1.4 billion people, this can’t be done manually. It will require a robust, tech-enabled payer ecosystem—and that is where companies like ours come in.”

Still, despite the promise of innovation, health care remains one of the slowest industries to adopt technology. “It is a global phenomenon. That inertia presents both a challenge and an opportunity. There is a wide open space for innovation, but we are constantly up against the status quo,” says Joshi. For Gupta and Bhambra, their biggest competition is not another company but the mindset that says, “This is how it has always been done.”

Companies like Twin Health are out to do it differently.

Twin Health is not just about counting steps or heart rate, it is about building a real-time, doctor-led model of human biology. The idea was born during a family gathering in Chennai, where founder Jahangir Mohammed noticed that four out of the 10 present had diabetes. “They were comparing their blood sugar levels like cricket scores,” he recalls.

That sparked a deeper inquiry into chronic illness and the realisation that diabetes rarely exists in isolation; it usually comes bundled with obesity, fatty liver, kidney disease, and hypertension. “All these conditions stem from one root cause—metabolic dysfunction,” says Mohammed.

Despite its central role in chronic disease, metabolism remains poorly understood. “What if we could use AI to build a digital twin of human metabolism?” Mohammed wondered. The result is Digital Twin, an AI-powered model that monitors, models, and improves metabolic health in real time.

Twin Health integrates a suite of smart devices: A patch that tracks blood glucose, a smartwatch for activity and heart rate, and a smart scale that measures weight, body fat, protein, and water composition. Quarterly lab tests add clinical depth.

Users interact with their Digital Twin through a mobile app, logging meals manually or through photos. The system decodes nutritional content and models how diet, sleep, activity, and medications affect metabolism. “Once the Digital Twin is fully synced with a person’s metabolic data, it begins to understand the root causes of dysfunction and provides daily, personalised recommendations,” says Mohammed.

He talks about seeing outcomes already, including a reversal of diabetes, weight loss, and normalisation of multiple chronic conditions like high blood pressure, cholesterol, fatty liver, and chronic kidney disease.

While Twin Health focuses on the intersection of AI and metabolic health, Mestastop is rethinking the approach to cancer. Founded by biologist Arnab Roy Chowdhury, Mestastop is built on the insight that cancer is not just a disease of growth but of movement. And it is movement—metastasis—that causes nine out of 10 cancer deaths.

“Most treatments today target the rapidly growing rogue cells,” Chowdhury says. “But when you speak to patients, you realise that death is often caused by the spread of cancer, not the primary tumour.”

Traditional approaches try to block metastasis by preventing cells from leaving the primary site. These efforts have largely failed in clinical trials. Mestastop’s targets the adaptation phase, when cancer cells settle into new environments and begin to thrive. “We broke metastasis into three biological phases: Dissemination, travel, and adaptation. Surprisingly, 55 percent of the weightage came from adaptation biology. That is where current treatments fail; they ignore adaptation,” says Chowdhury.

Mestastop began with drug repurposing: Testing safe, non-cancer drugs like those for hypertension and diabetes. One such molecule, previously untested for cancer, showed strong results both in lab assays and in retrospective patient data. “It was so compelling that we filed for CDSCO approval and are preparing for a Phase 2 clinical trial in colorectal cancer,” adds Chowdhury.

Beyond repurposing, Mestastop is pursuing novel drug discovery focussed on solid tumours, with emphasis on colon cancer, triple-negative breast cancer, and oral cancer. It is also developing companion diagnostics to identify patients at high risk of metastasis. “Among 100 patients, only 40 may develop metastasis. We don’t want to burden the other 60 with unnecessary treatment. Our diagnostics help stratify patients and personalise care,” adds Chowdhury.

To improve access, a chronic ailment of health care in India, RED.Health is not reinventing the hospital but reengineering how patients get there. Its founder, Prabhdeep Singh, set out to build an Uber for ambulances. After multiple pivots, the company—earlier StanPlus, now RED.Health—has come to offer a comprehensive medical assistance platform, providing everything from emergency response to recovery. “We are not just an ambulance company anymore; we are a pre-hospital system,” says Singh.

RED.Health now manages emergency response for more than 100 hospitals. It claims to dispatch ambulances in under two minutes and reach patients in under 20. It also manages non-emergency transport—discharges, inter-city referrals, and assisted transfers. It continues to grapple with lack of regulation, high cost of capital for ambulances, and the fact that insurance does not cover emergency transport, leaving patients to pay out of pocket. “We need insurers to start covering critical transport—air ambulances, neonatal care—so the quality can go up,” Singh says.

As in the case of most health-tech startups, RED.Health, too, has AI at the heart of its ambition. It is investing in AI-powered triage, auto-dispatch systems, and hardware integrations that will make emergency response faster and more predictive.

“In the next 10 years, machines are going to call machines in emergencies,” Singh says. “Most of the emergencies will become predictive or, at the point of incidence, there will be a sensor that will be able to detect. When they call, we pick up the call, we understand what has happened, we get all the contextual information, and the nearest hospital’s ambulance system is also operated by us.”

Similarly, Niramai’s journey shows how AI can drive innovation in health care. Founded by Geetha Manjunath, its Thermalytix uses AI to analyse thermal images for early detection of breast cancer in a non-invasive and radiation-free manner that is sensitive to issues of privacy. “Nobody needs to die from breast cancer if only they are able to catch it early,” says Manjunath.

So far, Niramai has screened 280,000 women and its technology has received regulatory clearances in both the US and Europe. “Interpreting thermal images is complex,” Manjunath says. “But our proprietary AI algorithms make it possible to detect subtle abnormalities that even trained eyes might miss.”

Niramai plans to expand to 35 to 40 countries, deepen its presence in its existing markets, and scale manufacturing through local partnerships. Manjunath is extending the platform’s capabilities to diagnose other conditions, including whole-body screening and fever detection.

Challenges persist. “The foremost hurdle is the motivation or, in some cases, compulsion to adopt healthtech models across diverse groups. This is compounded by the difficulty of monetisation in a predominantly out-of-pocket, price-sensitive market like India,” says Thakur of HealthQuad.

A more universal challenge is the shortage of skilled talent. “You simply can’t expect highly trained professionals to be available everywhere all the time for everyone. In India, our doctor-patient ratios are far below countries like those in Scandinavia, and even they face challenges. We are unlikely to ever reach those ratios,” says Joshi of Cloudphysician.

Traditionally, the response has been to build more medical colleges and train more professionals. “Yes, we still need more people,” Joshi acknowledges, “but that can’t be the only solution.”

Raman adds: “Do we want to spend 20 percent of our GDP on health care? No. We already have examples of systems that are expensive and inefficient. Instead, we have a chance to reinvent care delivery and sidestep those problems.”

Joshi points out that the US spends $4 trillion annually on health care for a population of 300 million and still struggles with outcomes and workforce shortages. “That $4 trillion is India’s entire economy. We can’t afford to follow that path,” he says.

Instead, Raman and Joshi believe, India has a unique opportunity to lead. “We should be asking: ‘Can we find a better way?’ And we think that better way—tech-enabled, autonomous care—is something India can actually export. If any country can do it, it is us,” says Raman.

While many Indian healthtech startups continue to build for the US—the world’s largest health care market—there’s growing recognition that addressing India’s unique challenges could unlock even greater long-term value.

“The US is our largest market, but India is an extraordinary opportunity in terms of sheer volume. However, the Indian market is much more price-sensitive and driven by affordability, making it a high-volume, low-price game,” says Mohammed of TwinHealth, which is currently based in San Francisco.

Startups like Cloudphysician, which has trained its AI models on 170,000 critically ill patients in India, are now expanding to the Bhatnagar of Peak XV points out that India’s health care system is almost a consumer proposition. “Unlike the US, where insurance intermediaries dominate, here, if you deliver a medical or preventive outcome, the consumer decides whether it is worth paying for, and spreads the word.”

This allows Indian healthtech startups to test, iterate, and scale quickly, gathering real-world feedback and rich anonymised data—critical for training AI models. In the US, you need FDA approvals and insurance buy-in before you even reach a customer.

Though global expansion is exciting, Bhatnagar is equally bullish on bridging India’s access gaps, especially in rural areas. “The real opportunity is building for the 200 to 500 million Indians who consume in sachets of Rs200–250,” he says. “It is about delivering reliable health care at scale, using tech to drive down costs.”

Infographic research by Samreen Wani

First Published: Sep 03, 2025, 13:24

Subscribe Now(This story appears in the Sep 05, 2025 issue of Forbes India. To visit our Archives, Click here.)