Mazagon Dock Shipbuilders: Smooth sailing advantage for investors

How Mazagon Dock Shipbuilders, key to India's defence dreams, became an investor favourite

Sanjeev Singhal is a straight shooter. That’s also why he can’t hide his pride when he says that he can count on his fingertips companies that are as old as Mazagon Dock Shipbuilders.

“I have read that globally, companies that have survived for more than 100 years are only 0.5 percent," says Singhal, chairman and managing director of Mazagon Dock Shipbuilders. “We have survived for more than 250 years, and I believe you can count such companies on your fingers (over 250 years)."

Of course, the likes of the Mumbai-based Wadia Group, travel agency Cox & Kings, and Forbes & Company count themselves older than Mazagon Dock in India. But none of them has in the past few years enthralled investors like Mazagon Dock Shipbuilders Limited (MDL) did, since it made its debut on the bourses in 2020. In 2023 alone, shares of Mazagon Dock Shipbuilders have rallied by as much as 190 percent, while the benchmark Sensex managed to grow only 18 percent. That’s a little over 10 times.

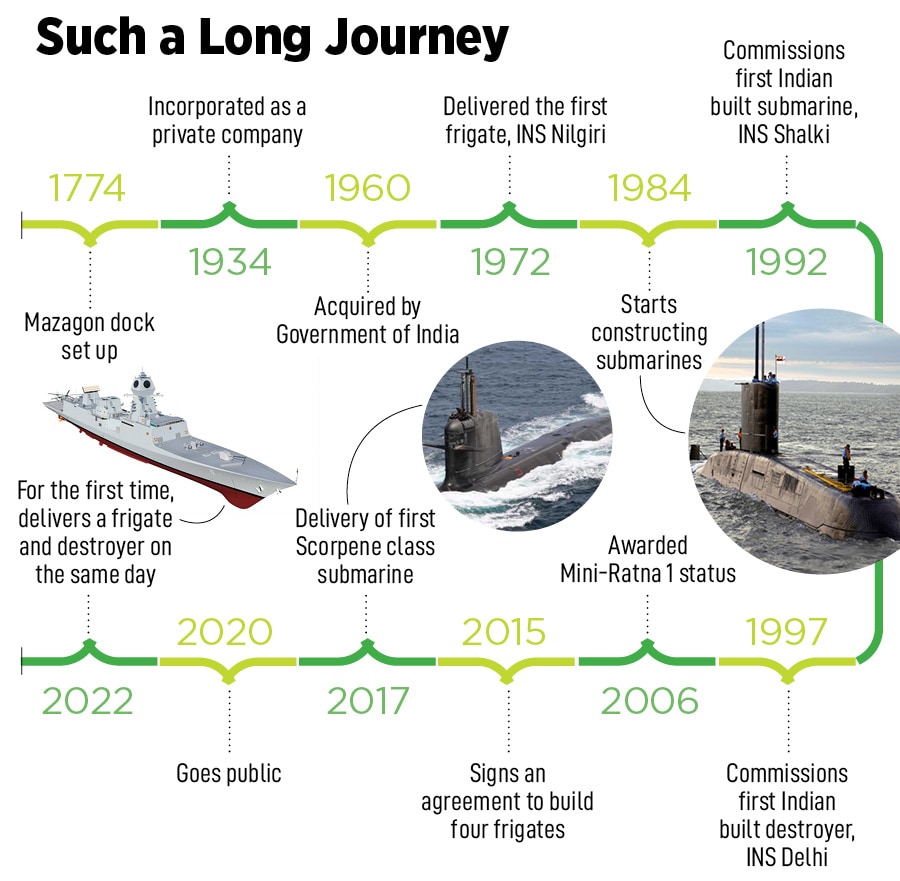

“We started with a small dry dock which was made operational in 1774 and we continue to have that dry dock in operating condition," Singhal, a bespectacled half marathoner, tells Forbes India over a Zoom call. Mazagon Dock is located at Mazagaon, the eponymous island that today makes up the city of Mumbai. “The entire company is built around that dry dock," Singhal says.

The company, owned primarily by the Indian government, makes everything from cargo vessels to offshore platforms and destroyers, frigates, corvettes and submarines. It is the country’s largest shipbuilder, both in terms of revenue and order book, and is tasked with manufacturing some of the Indian Navy’s most ambitious programmes, including its Scorpene class of submarines and the Visakhapatnam and Kolkata class destroyers.

“Primarily the yard is known for warship building," Singhal says. “We have been a backyard for the Indian Navy, and we have constructed 27 warships of which nine are destroyers." Destroyers are attack platforms used by navies across the world. Additionally, Mazagon Dock also repairs and refurbishes warships and submarines at its facilities in Mumbai and Nhava in Maharashtra.

In all, the company has an order book of some ₹39,000 crore that includes backlogs for the P-15 Bravo destroyers, P-17 Alpha frigates and P-75 submarines. The company is also awaiting approval from the Indian government for a submarine project worth ₹20,000 crore for manufacturing three more submarines, the first of which was inducted in 2017. Those submarines, commonly referred to as the Scorpene class submarines, were developed by the French government-owned Naval Group of France. In 2005, India inked a deal with France under which the French defence manufacturer agreed to a full technology transfer to MDL.

In all, the company has an order book of some ₹39,000 crore that includes backlogs for the P-15 Bravo destroyers, P-17 Alpha frigates and P-75 submarines. The company is also awaiting approval from the Indian government for a submarine project worth ₹20,000 crore for manufacturing three more submarines, the first of which was inducted in 2017. Those submarines, commonly referred to as the Scorpene class submarines, were developed by the French government-owned Naval Group of France. In 2005, India inked a deal with France under which the French defence manufacturer agreed to a full technology transfer to MDL.

“Being a government-owned PSU and working under the Ministry of Defence, Mazagon Dock Shipbuilders Limited is the designated shipyard for building naval vessels and submarines for the Indian Navy," says Abhijit Apsingikar, senior defence analyst at consultancy firm GlobalData. “As such, much of its business comes from Indian government contracts. Continued government contracts are indispensable for the financial and operational well-being of the company."

In many ways, the story of Mazagon Dock runs parallel to that of the city of Mumbai.

In 1774, a small dry dock was constructed in Mazagaon by the East India Company in Mumbai. Mazagaon, which was part of the original archipelago of seven islands that were later merged to create the city of Mumbai, offered a natural vantage for shipping activities. Before it set up a dry dock in Mazagaon, the East India Company had set up what’s commonly known today as Bombay Dockyard in 1735 as it sought to tighten its presence in the country.

By the 18th century, British India Steam Navigation Company (BI), founded by William Mackinnon, took over the operations of the dock. It was during that time that numerous vessels belonging to BI were sent to BI-owned repair facilities at Garden Reach Workshops in Kolkata and Mazagon Dock for repairs and overhauls.

In 1914, the Peninsular and Oriental Steam Navigation Company (P&O) took over the British India Steam Navigation Company, and with it, the ownership and operations of the dock, before registering the dock as a private company in 1934. In 1960, after India’s Independence and in line with the Indian government’s thinking to nationalise defence companies, the Indian government took control of Mazagon Dock.

Since then, Mazagon Dock Shipbuilders has built 801 vessels of which 27 have been warships, totalling over 40,000 dead weight tonnage capacity. Of the 27, nine ships have been destroyers. The company has also delivered seven submarines to date. “Mazgaon Dock Shipbuilders is the only shipyard in India having a unique distinction of constructing destroyers, as well as submarines," Singhal says. “No other shipyard to date has ever constructed destroyers or submarines."

India currently has six government-owned shipyards, which include Hindustan Shipyard in Visakhapatnam, Goa Shipyard in Goa, Garden Reach Shipbuilders & Engineers in Kolkata, Cochin Shipyard in Kochi, Hooghly Dock and Port Engineers Limited in Kolkata and Mazagon Dock Shipbuilders. Of this, Mazagon Dock, Garden Reach Ship, Hindustan Shipyard and Goa Shipyard Ltd are under the control of the Ministry of Defence, while the others are under the Ministry of Shipping. Among the private shipbuilders, only L&T seems to be functional currently.

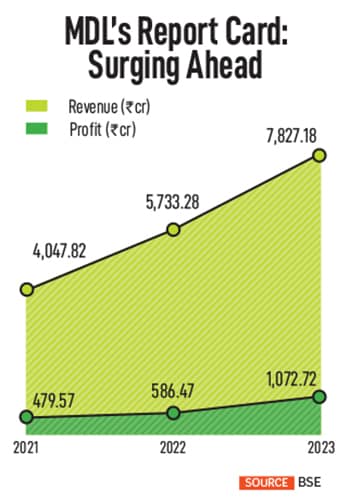

“If you look at the revenues last year, it is almost close to a billion dollars," Singhal says. “No other shipyard in India is close to that kind of revenue." In 2023, Mazagon Dock Shipbuilders posted revenues of ₹7,827.18 crore, a 37 percent growth over the year-ago period, while profits surged 83 percent in 2023 to ₹1,072.72 crore, making it India’s most profitable shipbuilder.

“The core skills of MDL lie in the design and construction of large naval surface warships and building submarines," adds Apsingikar of GlobalData. “MDL is the only shipyard designated for building destroyers for the Indian Navy and is the only shipyard other than Hindustan Shipyard Limited designated for building indigenous submarines. The shipyard has virtually built all of the Indian Navy’s destroyer-category naval vessels, including the Delhi-class, Kolkata-class and Visakhapatnam-class destroyers. Similarly, MDL has also built conventional submarines such as the Shishumar-class (Type-209) and Kalvari-class (Scorpene-class) submarines."

The Shishumar class submarines were built by Mazagon Dock between 1986 and 1994 under a technology transfer agreement with Germany, while the Kalvari class or the Scorpene class is in partnership with the French government. The Delhi-class, Kolkata-class and Visakhapatnam-class destroyers, also known as Project 15, Project 15A and P-15 Bravo class, are a range of destroyers, designed by the Indian Navy’s Warship Design Bureau. Of this, Mazagon Dock Shipbuilders is expected to complete the delivery of its last Visakhapatnam-class vessel by this year.

“Between 2014 and 2023, we have delivered six destroyers," Singhal says. “That means we have delivered a destroyer every one and a half year. If you compare globally, this fares well with the advanced countries even though they are flanked by far more mature infrastructure and ancillary industries which are lacking in India."

The pace of completion also picked steam particularly during the last five years with Mazagon Dock delivering the first of its destroyers under Project 15 Bravo in October 2021, and following that up with another delivery in November 2022. A third destroyer was delivered in October 2023. The Project 15 vessels have a displacement of 7,400 tonnes and an overall length of 164 metres, with as much as 75 percent indigenisation.

The ship’s capabilities include medium range surface-to-air missiles, BrahMos surface-to-surface missiles, indigenous torpedo tube launchers, anti-submarine indigenous rocket launchers, and 76 mm super rapid gun mount. “It is for the first time that a platform of this size has been delivered within the contractual timelines," Singhal says. “The last destroyer was delivered almost five months before the contractual timelines. That is unheard of in this industry because these designs are telescopic."

Telescopic designs mean that they are not frozen on the date of the contract, and the designs, specifications and weapon requirements keep changing. “So, the contractual timelines are extremely difficult to materialise," Singhal says. “We did this during a period marked by Covid-19 and semiconductor shortage."

Today, Mazagon Dock has the capacity to build 11 submarines and 10 warships simultaneously at its facility in Mumbai, which means that the shipbuilder can simultaneously undertake work for 21 vessels in various stages of production. “The production capacity has gone up," Singhal says. “The experience has gone up. We have crossed the learning curve and whatever learnings were there with respect to execution of these complicated projects have been crossed. We have a trained manpower workforce available."

Sixth Scorpene submarine ‘Vagsheer’ at the Mazagaon dock in Mumbai. It’s named after the sandfish, a deadly deep sea predator of the Indian OceanImage: Ashish Vaishnave/SOPA IMAGES/LIGHTROCKET Via Getty Images

Sixth Scorpene submarine ‘Vagsheer’ at the Mazagaon dock in Mumbai. It’s named after the sandfish, a deadly deep sea predator of the Indian OceanImage: Ashish Vaishnave/SOPA IMAGES/LIGHTROCKET Via Getty Images

In many ways, much of the turnaround over the last few years is also a direct result of the company going public.

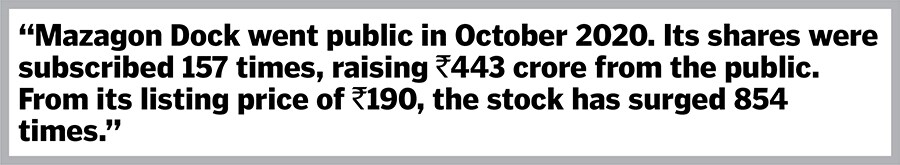

Mazagon Dock Shipbuilders went public in October 2020, its shares being subscribed 157 times, and raising ₹443 crore from the public. From its listing price of ₹190, the stock has surged 854 times. The company’s current market capitalisation stands at ₹38,000 crore.

“I would certainly give some credit to the listing," Singhal says about the company’s performance. “Quarterly presentation of accounts, investor interactions, and their questions provide an environment where everybody understands the importance of timely execution, timely reporting, and putting forward the best possible performance and numbers. It does demand that you put your house in order."

Then, there is also the government’s push towards more indigenisation, and seeking faster turnaround from the public sector enterprises to meet the growing demand in the defence sector, as India looks to cement its military presence in South Asia. The role of the Navy, especially in the Indian Ocean is critical as China attempts to assert itself in the region. The Navy is reportedly looking at spending ₹2 lakh crore over the next 10 years to increase its warship strength to 175 from around 130 currently in addition to adding 500 aircraft and 24 attack submarines from 220 aircraft and 15 submarines currently.

“Our understanding is that they (Navy) have a fleet requirement of around 175 ships which includes next-generation destroyers, next-generation corvettes and some frigates," Singhal says. “We believe there is a need for eight frigates and eight destroyers. It would take a while before AoN (acceptance of necessity) is in place and RFP (requests for proposal) is issued." AoN is the first step toward procurement and means that the government recognises the need for an equipment.

Still, it’s not cast in stone that the projects will be awarded to Mazagon Dock, despite its expertise. It has to compete with other government shipyards, and lately with the privately owned L&T when it comes to new projects. Mazagon Dock and L&T are both shortlisted for the Indian Navy’s P75I project, under which six more submarines are to be manufactured with an air-independent propulsion system (AIP) and lithium-ion batteries. MDL has partnered with ThyssenKrupp Marine Systems of Germany (TKMS) for that bid. “We submitted our bids last year," Singhal says. “Currently the bid is under technical evaluation. We are positive about this order considering our significant experience in this field."

“The Ministry of Defence is in the process of approving the additional procurement of three more units of Scorpene-class submarines after the general elections of 2024," adds Apsingikar. “Being the prime contractor for building the previous six units of Scorpene submarines, MDL’s role in submarine construction cannot be understated. The company is also likely to play a pivotal role in the upcoming P-75I-class submarine programme. While the international submarine designs vying for the project have narrowed down to ThyssenKrupp Marine Systems’s (TKMS) U-214 and Navantia’s S-80 Plus submarines, these international shipbuilders will have to partner with an Indian shipyard to build these submarines, and MDL is one of the two local shipyards shortlisted for this purpose. As such, MDL will keep playing a vital role in the Make in India programme over the next few decades."

For now, though, Mazagon Dock has its hands full. The company is already manufacturing four frigates under Project 17 Alpha, with the first of the deliveries starting this year in addition to delivering the last of the Scorpene submarines. The company has also been nominated along with its partner, the Naval Group of France, to manufacture three more submarines of the Scorpene class worth ₹20,000 crore.

“Then, there are certain smaller projects such as the medium refit and life certification of an SSK submarine," Singhal says. A medium refit and live certification allow for an extension in the lifespan of a submarine. “Apart from this, we also have orders from the Coast Guard which comprise training ships, an offshore patrol vessel and a multipurpose vessel meant for export to Denmark."

“With additional orders for the P-17A Nilgiri-class frigates on the anvil, MDL’s order book is likely to be full for the next two decades," Apsingikar adds. “The company is already engaged in building the P-15B Visakhapatnam-class destroyer and four of the eight previously ordered units of the P-17A Nilgiri-class frigates."

Along the way, the company has also begun focusing on its export order, with three multi-purpose vessels now readying to be delivered to a Denmark-based client. “We are expecting a follow-on order," Singhal says. “We are open for export orders, and we are participating in the export tenders. There are certain restrictions, but at the same time we are overcoming those with respect to pricing, and expectations."

All that has meant that the shipbuilder is just not ready to rest on its laurels. In addition to expanding its capacities to undertake more warship construction, the company is also turning its attention to building capacities such as lithium-ion batteries, AUV Swarm drones, and hydrogen-powered boats, which it reckons will be crucial in the years to come, as technology and warfare evolves. Mazagon Dock is also building an indigenous submarine, commonly known as a midget submarine capable of seating six people. The submarine uses indigenous equipment, design and technology, and is expected to be ready for testing sometime in 2025.

“There is a lot of R&D going on within the organisation," Singhal says. “We expect the results to be visible as the time goes by. Many of these initiatives can be hugely beneficial for the nation."

For more than 250 years, Mazagon Dock Shipbuilders has held strong. Now, it’s time for a smooth sail.

First Published: Mar 26, 2024, 15:49

Subscribe Now