Mrs Bectors Food's dream run continues

In the late 70s, Rajni Bector enchanted Ludhiana with her scrumptious ice creams, pudding and cakes. Over four decades later, Mrs Bectors Food Specialities stunned the IPO market with a sensational li

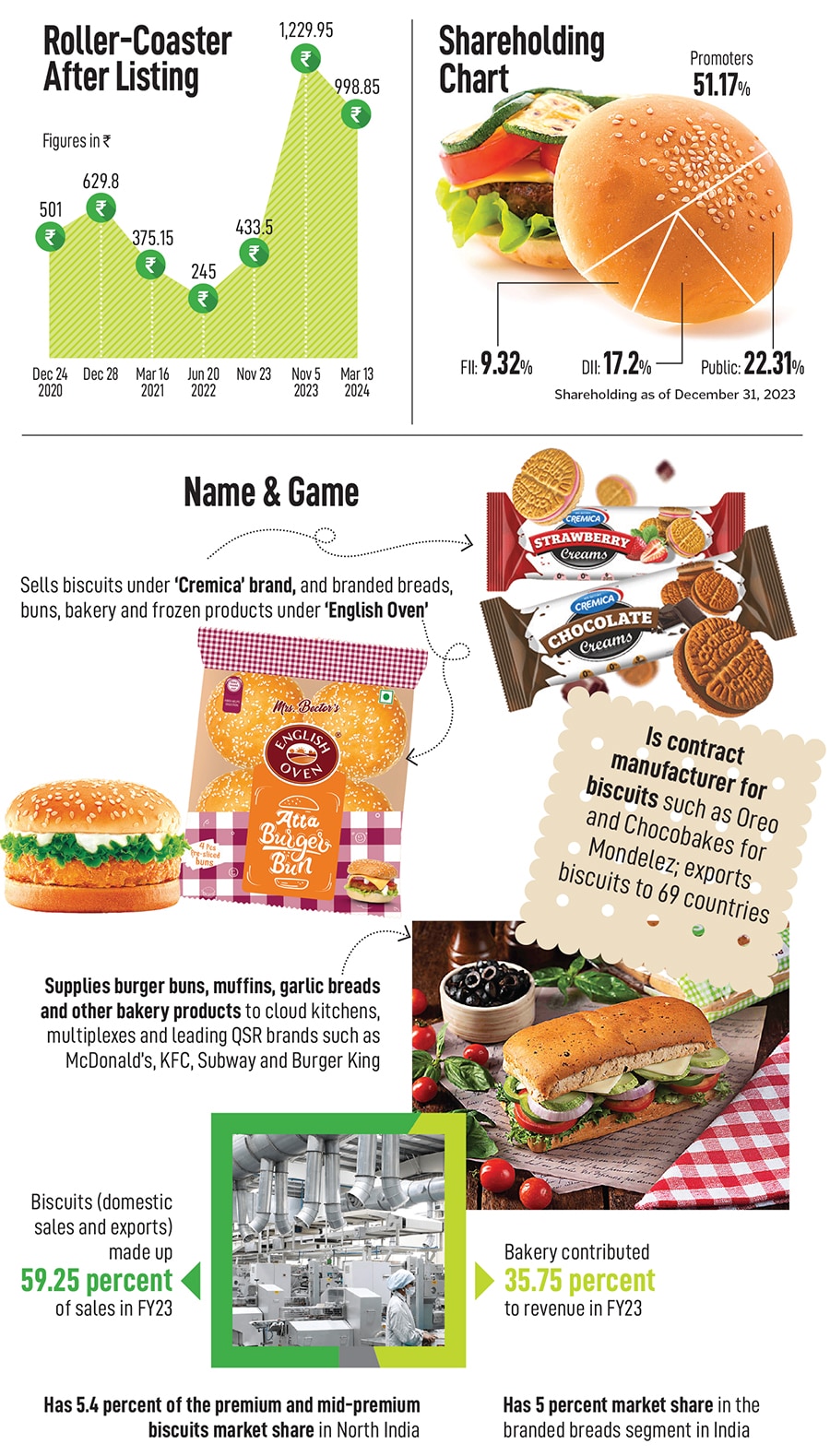

Was it an act of God?" I lobbed the first question to Anoop Bector, alluding to the blockbuster public market listing of Mrs Bectors Food Specialities on December 24, 2020. “Your Christmas Eve turned out to be Christmas Day. It was an early Merry Christmas for you," I smiled at the managing director of the premium biscuits and bread maker, which counts leading QSR brands such as KFC, Burger King and Subway among its long list of B2B customers. “We believe in God. We pray every day," reckons Bector, who joined the family business in September 1995. A year later, he started supplying buns and other products to McDonald’s, and aggressively scaled the consumer side of the business of the Ludhiana-based company with own brands—Cremica and English Oven—over the next decade.

The journey from Ludhiana to IPO was incredible. “It (IPO) indeed was unbelievable," recounts the beaming entrepreneur who was on a video Zoom call along with mother Rajni Bector, who started a small ice cream unit from the backyard of her Ludhiana house in 1978. “God indeed has been kind," underlines Bector. The ₹541-crore IPO generated bids worth more than a staggering ₹40,000 crore. To put things in context, for IPOs of over ₹200 crore in size, Mrs Bectors Food notched the highest-ever subscription in 2020.

The share was listed at a 73.9 percent premium over the issue price of ₹288. And, on the final day, the IPO was subscribed 199.4 times, which helped Mrs Bectors Food trump two other stellar listings of 2020—Mazagon Dock Shipbuilders and Burger King India—which drew equally big subscription numbers. Also, close to 40 months after the IPO, the stock is now trading at double the listing price (₹1,053.7, as on March 15). “You asked me if it was the act of God. It was the hand of God," reckons Bector, adding that just a little over seven months after the Covid lockdown, Mrs Bectors Food Specialities filed DRHP (draft red herring prospectus) in October 2020. The country was limping back to some sort of normalcy after the first wave of the pandemic, but a thick cloud of uncertainty was still looming over the business. “God held my arm and sailed me through the IPO," he adds.

To understand the ‘hand of God,’ one needs to decode the ‘act of man, and God’. “I tried my first IPO in 2018," says Bector. Back in August 2018, Mrs Bectors Food Specialities filed the DRHP for a ₹800-crore IPO. “Things were moving in the right direction, and we were about to list," he says. Then the markets tanked. “We decided to pull out," recalls Bector, who wanted to give his initial set of backers an exit. In September 2010, Motilal Oswal Private Equity Advisors reportedly picked up a 20 percent share in the Ludhiana-based company by buying out the stake of Jade Dragon, a unit of Goldman Sachs, which had invested in 2006.

The hands changed after five years. In 2015, CX Partners reportedly bought a stake from Motilal Oswal and made an entry into the company. For Bector, though, missing the listing bus in 2018 didn’t change the reality. Eventually, the IPO had to happen, and December 31, 2020, was the deadline. “December 31 was the last day to give an exit to my investors," recalls Bector, who didn’t have much ground to manoeuvre in terms of deciding whether going for an IPO during Covid made sense or not. The IPO just had to happen. “God blessed us," he underlines.

Mrs Bectors challenged leaders like Parle, Britannia and HUL with their brand Cremica, and also took up contract manufacturing of biscuits

Mrs Bectors challenged leaders like Parle, Britannia and HUL with their brand Cremica, and also took up contract manufacturing of biscuits

Back in 2007, God was again there to help David, who had been fearlessly taking on the Goliaths of biscuits—Parle, Britannia and HUL—with the challenger brand Cremica. Over 12 years after joining the family business, Bector decided to launch English Oven, a premium bakery brand. Market experts and analysts were quick to brand the move ‘ill-planned and brash’.

They were not exaggerated in their comments though. Bread was not biscuits, the margin was wafer-thin and the risks were manifold given the short shelf life of the product and the nature of the market. The business of bread thrives on the retail footprint and clout, and launching the product from an alien territory—Delhi NCR—was a sure-shot recipe for disaster. Bector, though, added one more ingredient which dimmed all the chances of success. “My bread will charge an extra premium of ₹5," he broke the news to his team. Charging ₹5 more than the rivals, the team said, was a blunder.

The managing director, for his part, was confident of the gambit. “It was a masterstroke," he says. The rivals, he underlines, could never match the price and quality. Second, the journey of biscuits via Cremica gave enough confidence to the founder that he could not only take on the big boys, but also make a mark and create a large niche in the market. “The profile of Indian consumers has changed over the last decade or so," says Bector, adding that the notion of selling cheap or consumers rooting for price warriors was nothing but a well-perpetrated myth. “They want innovative, high-quality and premium products," he says. The market, he believed, was ready for English Oven. “You have to be fearless," he says.

The genes of fearlessness, though, were inherited from his mother. Back in 1978, Rajni was doing something that not many women in the small town of Ludhiana or Punjab would dare to do: Business. Her passion for cooking—it started with ice creams, pudding, salads and biscuits that got churned from the backyard kitchen of her house—got merged with her obsession to hunt for the finest ingredients to make the products. “My problem was that I could never compromise on quality," says the matriarch who became the talk of the town in the late 70s and early 80s. Her ice cream stalls started competing against biggies such as Kwality. “I never thought I would draw a huge crowd," she says flashing a warm smile and takes us back to the early years of entrepreneurship. “Hobby and passion merged, and the business started."

The beginning, though, was not easy. “I used to work for 18 hours a day," she recalls. The business lacked structure, there was no planning, and no investment. One fine day, her husband nudged her to streamline operations and think of a name for the brand. “The name Cremica," she reckons, “was rustled up in a minute," she says.

Also read: Mad Over Donuts: Lord of the glazed rings

An endearing smile, a pull of her delectable products, a never-say-die attitude, and the determination to punch much above her weight helped in the formative years of the business. In 1995, her son Anoop Bector decided to join the venture. It was a tough call, though. He explains: “There was a great opportunity. However, it was not a great business in terms of size."

The first task was to set up a factory. Money, though, was an issue. The young founder reached out to banks, there was money on the table, but loan offers also came with a flurry of unsolicited advice. “Banks charge interest and it keeps ticking even while you are asleep," cautioned one of the bankers. If the business plan doesn’t work, stressed another top public sector honcho, then you might lose out on whatever little you have gained so far. The rookie realised that he couldn’t let the cookie crack. So, he managed to raise ₹50,000 and decided to set up a small bread plant. The next year, in 1996, came the turning point or the ‘act of God’ when McDonald’s roped in Mrs Bectors as its sourcing partner for buns and other products. There has been no looking back since then.

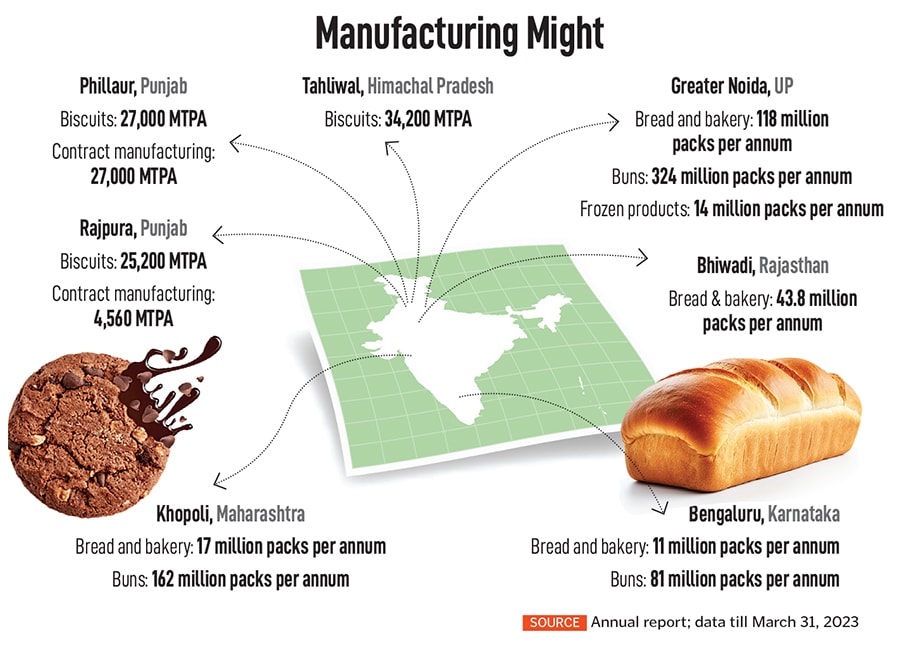

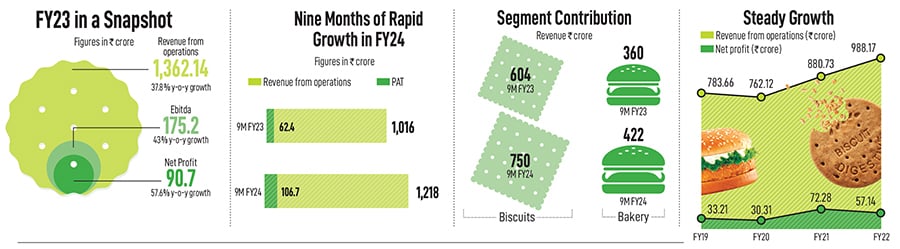

Fast forward to 2024, Mrs Bectors has become a name to reckon with. The company supplies burger buns, muffins, garlic breads and other bakery products to cloud kitchens, multiplexes and leading QSR brands such as McDonald’s, KFC, Subway and Burger King. It is the contract manufacturer of biscuits such as Oreo and Chocobakes for MondelÄ“z, and exports biscuits to over 69 countries. While biscuits (domestic sales and exports) made up 59.25 percent of sales in FY23, bakery contributed 35.75 percent to revenue. Cremica has a 5.4 percent of the premium and mid-premium biscuits market share in North India, and English Oven has a 5 percent share in the branded bread segment in North India.

The growth has come on the back of a robust manufacturing prowess. The company produces over 50 million biscuit packs every month it makes 10 million bread loaves per month around 3.5 million buns are baked per day and in FY23, and around 3.75 lakh packs of English Oven are sold every day.

The impressive run continues in FY24. For the nine months of this fiscal, the company has notched up record numbers. Revenue from operations increased to ₹1,218 crore from ₹1,016 crore during the corresponding period of the last fiscal. Profit after tax (PAT) during the same time jumped to ₹106.7 crore from ₹62.4 crore (see box).

Bector shares the secret sauce: Premiumisation. A laser-sharp focus on premiumisation of the portfolio, he underlines, in biscuits—cookies, creams, crackers and digestives—as well as the premium category of bakery products such as whole wheat, multigrain and footlong breads helped in improving margins on a sustainable basis. “We remain committed to distribution and marketing-led growth," he says, adding that the company is on track to achieve direct distribution of over three lakh outlets by the end of FY24, and is working with Walmart for one of its Christmas SKU (stock-keeping unit).

Mrs Bectors Food, reckon food and beverage analysts and industry experts, is well poised to scale aggressively over the next few years. “Mrs Bectors has built a formidable presence in the B2B business with leading domestic and international QSR chains," says KS Narayanan, an F&B expert. A long stint of working with top global QSR chains, he underlines, has done wonders for the profile of the company. First, it has helped it to churn out high volumes consistently. Second, it has equipped its manufacturing plants to meet global quality and security standards. Third, geographically well-dispersed plants help it to expand its national footprint. Lastly, B2B clients have to keep innovating at a furious pace. “This ensures that you are on top of the food trends and game," he says.

The challenge for the brand, though, would be to replicate its B2B success in B2C. A successful B2C business, he underlines, requires a consumer insights team, well-oiled marketing machinery, and an experienced sales team ensuring the availability and servicing of millions of general trade outlets. “There aren’t too many examples of companies who have managed to straddle B2B and B2C successfully," he says.

A big edge for Mrs Bectors, though, is a successful B2B business based on product innovation and customer service. “This capability, coupled with investment in a sound FMCG sales and marketing system, will help it compete in the marketplace," says Narayanan. Another challenge on the consumer retail front is ensuring and allocating aggressive marketing and advertising spending for English Oven and Cremica. “These are volume games, and visibility plays a big role along with quality in ensuring a consumer pull," reckons Ashita Aggarwal, professor (marketing), SP Jain Institute of Management and Research.

Bector, for his part, is busy ensuring that Mrs Bectors makes a seamless transformation into a bakery company. “We believe in baking consumer happiness," he smiles. The rewards—in terms of performance of the stock or profits—are just the byproducts. “A happy consumer makes a happy company," he signs off.

First Published: Mar 22, 2024, 12:40

Subscribe Now