How Propelld is trying to solve the specialised education financing problem

Founded in 2017, the platform gives more emphasis on the future earning potential of the student. The credit bureau score is not an elimination factor

About a decade ago, Victor Senapaty, 37, chanced upon a peculiar trend. In a country where education is seen as a path to success, the quantum of education loans outside of, say the top 50 institutes, was nothing to write home about.

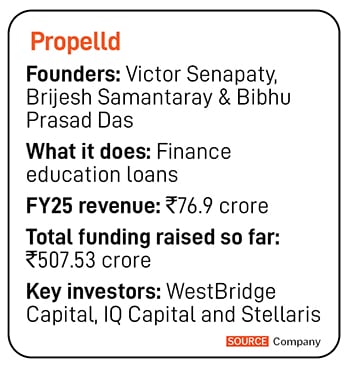

What surprised Senapaty and his co-founders Brijesh Samantaray and Bibhu Prasad Das—the three had grown up together in Bhubaneswar and then gone their own ways—was that education loans made up just 1 percent of the loan book of the State Bank of India.

A bit of research showed that while the market was large—₹41,800 crore in FY24, according to Crisil—the state-run banks hadn’t gone past the top tier colleges. Making loans of ₹1 lakh to 3 lakh and then collecting on them is a cumbersome task. Best to stick to known institutes is their philosophy.

Loans for overseas education—while more lucrative—stood at about 5 percent of the market. Compare this to the $2 trillion of outstanding education loans in the US and Senapaty and team knew they had an opportunity staring them in the face. Propelld, a specialised education financing platform, was eventually set up in 2017.

First off, the team went about identifying institutes and making a list of courses offered and their placement record. This gave them the first cut of whom to fund.

First off, the team went about identifying institutes and making a list of courses offered and their placement record. This gave them the first cut of whom to fund.

“India doesn’t have a job problem… it has a wage problem,” says Shreyans Singh, principal at WestBridge Capital, that has invested in Propelld. By that he means that underwriting someone’s education in the hope that he or she may get a job with a ₹30 lakh to ₹40 lakh per year salary is riskier than underwriting someone for a ₹1 lakh to ₹3 lakh loan in the expectation that they get a ₹5 lakh to ₹6 lakh per year job. Once Propelld discovered this sweet spot, it realised that this is a scalable opportunity.

Senapaty and team knew that the key to getting this right would be the quality of underwriting. So, while the traditional underwriting model that banks follow gives high weightage to the income of parents, Propelld gives more emphasis on the future earning potential of the student.

Also Read: Lokal wants to build internet afresh for the non-metro user

As Senapaty explains, “The (credit) bureau score is not an elimination for us. We give it lesser weightage, instead focusing more on the institute and the course.” So, while a higher score with high fees may not work, a lower score with reasonable fees would result in the loan being sanctioned.

Here Propelld has worked on going around the country and liaising with admission departments and understanding what life for students after they graduate is. The ability to get a job is key. As a result, Propelld is able to understand whether a student can afford the loan applied for.

In addition to education loans, Propelld has also entered the market for skilling loans. Senapaty says it is important to understand why the person is upskilling. “So, if a data science guy wants to become proficient in AI, the loan is likely to be repaid. But a sales guy doing an AI course may have a chance of default as future employment opportunities may not open up,” he says.

While Propelld may have mapped out the opportunity and written loans based on it, at its core, the business remains an NBFC business. Success or failure will depend on their ability to grow the book, manage costs and keep bad loans in check.

So far, Propelld has disbursed ₹4,434 crore to 401,095 students. It has partnered with over 3,000 institutes. “It is these partnerships with institutes that would help Propelld keep distribution costs low as it is not expanding through a branch-led model,” says Deepak Ramineedi, partner at WestBridge Capital.

The company has a cost of funds at about 12.5 percent, but new debt is being taken on at closer to 11 percent. Education loans are made at 15 percent while upskilling loans are at 19 percent, giving them a health spread of between 2.5 percent and 6.5 percent. (Propelld expects an upgrade in its credit rating to take its cost of funds lower.) Out of a total assets under management of ₹1,500 crore, about two-thirds are in skilling.

While the business has not yet seen multiple cycles, loan default rates have stayed steady at 1 percent, making Propelld confident of its underwriting model.

A clear moat the business can tap into is the relationships it has with various institutes as well as the data on underwriting that allows it to refine its models. If they have seen that loans for a particular institute are not doing well, they can go slow in sanctioning new loans. This is the kind of edge a new entrant may not have. Getting it right is not just a function of the funding costs but also a result of having seen enough employment data after students complete their studies.

Propelld earned its first cash profit in May, and is growing rapidly, albeit from a low base. In FY24, it made a revenue of ₹55 crore, which rose 40 percent to ₹76.9 crore in FY25. If it can keep its credit costs in check, its headstart may give it a winning edge.

First Published: Oct 27, 2025, 13:44

Subscribe Now(This story appears in the Oct 31, 2025 issue of Forbes India. To visit our Archives, Click here.)