Nyrika Holkar: Balancing legacy with relevance

Fourth-generation scion Nyrika Holkar is overseeing a modernisation push at Godrej & Boyce to broaden its appeal to India’s aspiring young consumers

When Chandrayaan-3 touched down on the moon’s south pole in August 2023, India became the fourth country to land a spacecraft on the moon. Behind that successful mission by the Indian Space Research Organisation (Isro) was a raft of companies that had supplied critical components to the space agency. Among them was Godrej Aerospace, a unit of Godrej & Boyce Manufacturing, a part of the Mumbai-based Godrej Enterprises Group. Over four decades, Godrej Aerospace has supplied components and systems for hundreds of commercial satellite launches and India’s mission to Mars in 2014.

“We have been part of most space missions in India since our inception, which is a huge privilege,” says Nyrika Holkar, executive director of Godrej & Boyce and the fourth-generation scion of the more-than century-old conglomerate. Speaking to Forbes Asia in September at the group’s headquarters, set amid lush mangroves in the northeastern Mumbai suburb of Vikhroli, Holkar is seen as the likely successor to her uncle, group chairman and managing director Jamshyd Godrej. The 76-year-old patriarch and Holkar’s mother, Smita Godrej Crishna, 74, have a combined net worth of $11.2 billion, and they appear at No 20 on the list of India’s 100 richest.

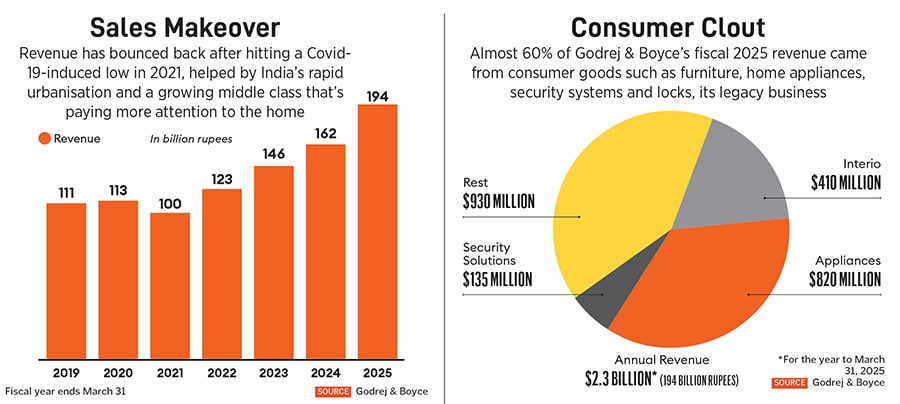

The Godrej name is widely recognised in India, not for its cutting-edge spacecraft parts but rather for a range of everyday consumer products, including locks, furniture and home appliances such as refrigerators and washing machines. For decades, Godrej’s double-door steel closets have been fixtures in middle-class households, used to store everything from clothes and crockery to jewellery and documents. These consumer goods accounted for about 60 percent of Godrej & Boyce’s fiscal 2025 revenue of $2.3 billion and it’s where Holkar is putting most of her energy these days.

“The challenge is to take a brand that has so much legacy and build a retail, customer-centric, front-facing narrative,” says the 43-year-old, whose responsibilities include brand, legal and M&A functions. The group is investing some $530 million to expand capacity at two of Godrej & Boyce’s eight factory locations, as well as in launching premium products and moving into new geographies and the upgrades. “Our focus is now on R&D, product development and digital tech,” she says. The efforts, which have been unfolding over the past three years, appear to be paying off, with annual revenue nearly doubling and after-tax profit surging fourfold in fiscal 2025 to $67 million from a Covid-induced low in fiscal 2021.

At Interio, a furniture-store chain for both homes and offices, the goal is to roughly triple revenue to $1.2 billion in fiscal 2029 from $410 million in fiscal 2025. The company is shelling out $35 million to add 500 stores, mostly across tier 2 and tier 3 cities, widening its network to 1,500. The expansion reflects a domestic

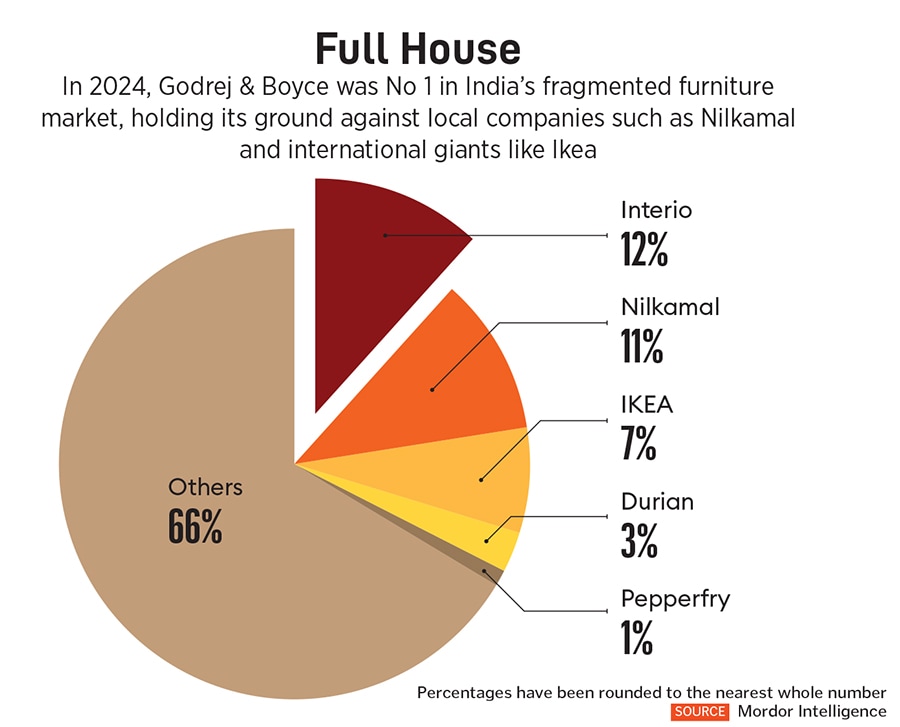

furniture market that’s expected to grow at a compound annual rate of 7.6 percent over the next five years to $43 billion in 2030, according to Hyderabad-based market advisory outfit Mordor Intelligence, boosted by India’s burgeoning middle class and rapid urbanisation.

Interio is eager to woo millennials and Gen Z, adding new lines such as ergonomic chairs for video gamers, aluminum outdoor furniture and fittings for children’s rooms. The signature steel wardrobes, which still make up about half of Interio’s sales, are no longer limited to utilitarian grey, but come in a range of finishes and colours such as ‘baked apple’ and ‘dusty rose’. To lure online shoppers, Holkar has grown the furniture chain’s e-commerce division to serve 18,000 Pin codes as of March 31, up from 4,000 in 2022. At its brick-and-mortar outlets, she has switched to styled room displays in spaces of up to nearly 1,900 sq m for its so-called flagship experience stores. “We’ve moved away from a warehouse model,” Holkar says. “We realised that people want more guidance on how to put things together,” she says.

The executive is employing high-tech tools such as eye-tracking, heatmapping and heart-rate analysis to decipher what attracts shoppers’ attention as they navigate its showrooms, but, in a more traditional approach, she has also visited homes in cities across India over the past year in an effort to understand how people use interior spaces. “Covid brought a lot of change in consumer psychology,” she explains. “Before Covid we never focussed much on our homes because we weren’t home, but post-Covid, people are worried about whether the handle matches the door.”

Interio is No 1 by sales in India’s highly fragmented furniture market, according to Mordor Intelligence, but it’s grappling with competition from thousands of unorganised players, plus the likes of Nilkamal and Durian Industries, both based in Mumbai; Netherlands-headquartered behemoth Ikea; and online stores such as Pepperfry, which Ahmedabad-based realty services firm TCC Concept agreed to acquire last month.

Holkar says Interio has an edge because it covers “the entire value chain, from design to engineering to supply chain to after-sales services.” Devarshi Mehta, a Mordor Intelligence senior research analyst, agrees. In an email, she cites Godrej’s “decades of consumer trust” as well as its “steady product quality and the scale needed for nationwide supply, supported by a massive distribution footprint.”

Holkar’s determination to modernise the brand is also seen as an advantage. Swapneel Nagarkar, business head of Interio, has worked with her for seven years and describes Holkar as “uber-focussed on the customer… she’s always looking at how we can make our products modern and contemporary.”

The factors driving furniture sales are also stoking demand for home appliances. India is the fastest-growing consumer durables market in the world, according to a joint 2024 report from the Confederation of Indian Industries and EY Parthenon, part of accounting firm EY. It predicts the market will expand at an 11 percent compound annual rate to $35 billion in fiscal 2029. Godrej & Boyce’s consumer appliances division posted $820 million in revenue for fiscal 2025 and is projecting 30 percent growth in fiscal 2026.

Godrej is one of the largest brands in the appliances market, according to a September 2025 report from Mumbai-based ratings agency ICRA, but the company is battling Korean heavyweights LG and Samsung, as well as domestic players such as Havells in refrigerators; Blue Star and Voltas, which is part of the Tata group, in air conditioners; and Whirlpool of India, the Indian subsidiary of the US company, in washing machines. “We are still playing catch up with the Korean brands,” acknowledges Holkar. “They were more effective in cornering the Indian market and going into small towns.”

Godrej & Boyce blew an early lead in refrigerators. It launched India’s first domestic refrigerator in 1958 and tied up with General Electric in the 1990s, when it had a leadership position in the market. But the joint venture ended in 1999, just as the chaebols were making inroads. “Leadership [in consumer appliances] has a lot to do with brand power, and we have a number of mighty brands with a pan-India presence,” says Ankur Bisen, senior partner at The Knowledge Company, a Gurgaon-based management consultancy.

But the company, which sells its appliances through 40,000 outlets, including wholesalers, retailers and 150 of its exclusive brand outlets called Godrej Inspire Hubs, is fighting back. “We’ve historically relied on the mass market, but when Covid hit, that part of the market just stopped buying,” says Holkar. “We had to pivot and move to a more premium offering,” she says. That means AI-enhanced products such as voice- and app-enabled air conditioning units; refrigerators that optimise cooling and power consumption; and washing machines that calculate how much water to use based on load. The approach appears to be working; a September report from ICRA shows the division’s profit margin almost doubling to 4 percent in fiscal 2025 from 2.2 percent the year before.

A key part of Holkar’s overhaul involves digital transformation, with $140 million being spent on collating customer data from all of the company’s consumer products divisions onto one platform. “We have integrated all the sales, marketing and service data so that we get a single view of the customer,” says Holkar. “We have to own [aftersales] service,” she says, “It’s an important way to build a relationship with a customer over time.”

Although the consumer product divisions are Holkar’s focus, the company is also boosting manufacturing capacity at its aerospace unit, which largely falls under her uncle’s supervision, with a new aerospace-parts making facility in Khalapur, 70 km south of Mumbai. Holkar says Godrej Aerospace is looking to partner with space startups, both for R&D and testing. This comes at a time when Isro is also planning a series of satellite launches as well as a manned space mission and a revisit to Mars.

A lawyer by training, Holkar joined Godrej & Boyce in 2015 as a senior vice president for corporate affairs and became executive director in 2018, making her the only member of the fourth generation in her family branch currently holding an executive position (her sister, Freyan Crishna Bieri, and Jamshyd’s son Navroze are non-executive directors).

Her first task was to strengthen Godrej & Boyce’s energy solutions business, which designs and builds power-distribution systems. She firmed up contracts by tightening risk-management scrutiny and negotiated favourable freight and insurance arrangements for product shipments. Then she took on the task of updating the company’s tech infrastructure. “We had a lot of custom-built technologies, which were difficult to maintain and upgrade,” she says, “so we started moving to standard, off-the-shelf solutions.”

Her biggest test came in 2024, however, when the Godrej business empire was divided between two branches of the clan after five years of talks. Holkar spearheaded the negotiations for her side of the family, helping to hammer out a settlement that resulted in two separate entities. Godrej Enterprises Group was created for the family faction led by Jamshyd Godrej and Smita Godrej Crishna and includes Godrej & Boyce, which also holds a 405-hectare parcel of developable land in Vikhroli. The group is looking to build a large, integrated township there in the coming years.

The other branch is Godrej Industries Group, led by brothers Adi Godrej, 83, and Nadir Godrej, 74, whose combined fortune totals $10.2 billion. It includes five listed entities, including Godrej Consumer Products, which makes soaps, haircare products and insecticides, and is chaired by Adi’s daughter Nisaba, 47, and Godrej Properties, overseen by his son, Pirojsha, 44.

“There were differences of opinion about how things should be run,” says Holkar, explaining the split. “But all in all, I think we achieved a fair outcome.” Srinath Sridharan, author of a book on succession planning, says the deal ensures “continuity, stability and the freedom for each business, and for each family branch, to pursue its own ambitions.”

Zia Mody, co-founder and managing partner at law firm AZB & Partners in Mumbai, where Holkar worked before joining the family business, was involved in the negotiations and recalls how clear-minded the executive was throughout the process.

“Whenever I presented two choices to her, Nyrika would take bold calls with full understanding of the repercussions,” she recalls. But while she is decisive, she is also open-minded, according to Interio’s Nagarkar. “She always listens and lets you explain your point of view,” he says, describing her working style as “participative and collaborative”.

Indeed, Holkar says she and her uncle Jamshyd work well together. “I look more strongly at the consumer-facing businesses,” says Holkar. “My uncle looks at everything, he has the experience of running this company for so many years, it’s always a learning experience to be with him.”

Holkar was raised in Mumbai, attending the prestigious Cathedral and John Connon School and excelling in academics as well as sports as a member of the school’s squash, swimming and athletics teams. She says she always wanted to study law, but, taking the advice of her parents, she first did a bachelor’s degree in philosophy and environmental economics at Colorado College in the US before earning a bachelor’s and master’s in law from University College London. Holkar started her legal career in the London office of White & Case in 2008 then joined Mumbai-based AZB in 2009, where she worked in M&A.

Holkar says she knew all along that she would join the family business, where she felt her legal studies would prove useful. “Just about everything has some legal aspect, whether it is contracts or looking at intellectual property or how we develop our portfolio of patents and copyrights or our engagements with our partners,” she says.

Growing up, weekends were spent with the extended Godrej clan at Alibag, a beach town just south of Mumbai where her maternal grandfather, Naval Pirojsha Godrej, son of Godrej co-founder Pirojsha, had a home. “There was a lot of business talk around us, with my grandparents as well as my mother and father,” says Holkar, whose dad, Vijay Crishna, 80, a renowned theater actor, previously held board seats at Godrej companies. “When you have a family business,” she says, “it never ends in the office.”

First Published: Nov 23, 2025, 10:31

Subscribe Now(This story appears in the Nov 28, 2025 issue of Forbes India. To visit our Archives, Click here.)