The biggest wealth creators

A billion dollars do not guarantee a spot on the list, making such success stories even more commendable

Vijay Shekhar Sharma

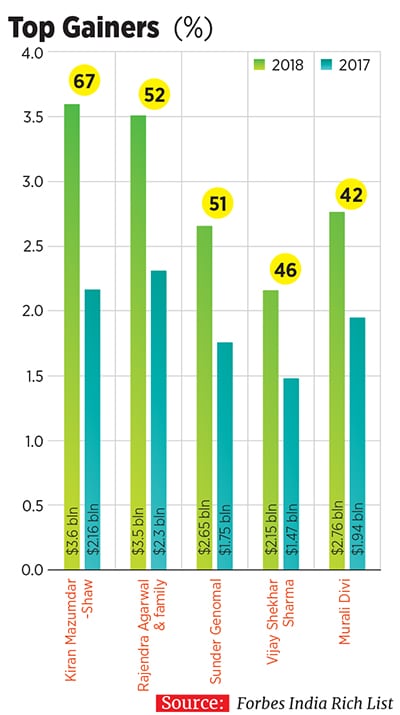

Image: Amit VermaWhile the number of India’s dollar billionaires continues to rise, the climb to the top has become more gruelling. More than 30 people with an estimated wealth of over $1 billion found themselves off the 2018 Forbes India Rich List.  Biocon’s Kiran Mazumdar-Shaw was the biggest percentage-wise gainer in 2018. Another top gainer was Rajendra Agarwal and family, promoters of privately-held family-run Macleods Pharmaceuticals. Their wealth jumped by 52 percent to $3.5 billion in 2018.

Biocon’s Kiran Mazumdar-Shaw was the biggest percentage-wise gainer in 2018. Another top gainer was Rajendra Agarwal and family, promoters of privately-held family-run Macleods Pharmaceuticals. Their wealth jumped by 52 percent to $3.5 billion in 2018.

India’s rampant growth in fintech and mobile payments is reflected in the rise of one of its youngest dollar billionaires, Paytm’s Vijay Shekhar Sharma. He has a net worth of $2.15 billion in 2018—a 46 percent jump over the previous year.

Over the 10-year period of the Rich List, the Godrej family (No 7) has seen its net worth nearly double to $14 billion in 2018, from $7.5 billion in 2010.

Among the gainers is Sun Pharma’s managing director and founder, Dilip Shanghvi, now India’s eighth richest, with a net worth of $12.6 billion. His wealth rose by 142 percent from $5.2 billion in 2010. Sun Pharma faced rough weather in recent years, but Shanghvi expects its India business to “stabilise” in the current fiscal.

First Published: Nov 19, 2018, 12:12

Subscribe Now