Is India the next global luxury hub?

India looks set to be the luxury market's next growth driver. Here's how brands can make their mark

India’s luxury landscape is at a crucial juncture. With a booming economy, the world’s largest population and a dynamic, youthful demographic, the country has been dubbed the next luxury hub, especially at a time when luxury consumption in China is declining as spending softens.

Is the centre of the world’s luxury market shifting from China to India, as a fast-growing appetite in goods such as high-end watches suggests? And, if so, how should brands approach and win over luxury clients in this market known for its millennial craftmanship and strong culture?

Home to the world’s fifth-largest economy, India is currently seeing explosive growth in its luxury sector. At a recent event by luxury consultancy IndLux in partnership with INSEAD, IndLux CEO Franà§ois Grouiller said, “The next 100 years will be marked by the rise of India, and we believe that the Indian century can become an opportunity for all."

The country’s luxury market, currently valued at US$17 billion, is set to more than triple by 2030, growing to upwards of US$85 billion. Years of impressive GDP growth have turned India into the world’s fastest-growing major economy. This economic surge will boost the number of ultra-high-net-worth individuals – people with a net worth of at least US$30 million – by an anticipated 50 percent by 2028.

“When it comes to India, don’t take a snapshot, focus on the trajectory," said Mahi Khanna, project lead at IndLux. Indeed, the expanding middle class and their growing disposable income are propelling what will be a US$2.2 trillion retail market by 2030, which will make India the third largest globally.

Unique to India are the country’s cultural and historical ties with luxury, both older and stronger than in many other markets. As Khanna observed: “Luxury is as old as our civilisation – it is part of India’s cultural and historical DNA." Luxury has deep roots in the subcontinent, from the Maharaja of Patiala, known as the largest owner of Cartier jewellery, to the intrinsic cultural value placed on artistry, craftsmanship and opulence.

But local and foreign brands face various challenges tied to the landscape: a complex regulatory environment, inadequate luxury retail infrastructure and consumer behaviour nuances that demand a tailored approach.

Representing 40 percent of urban consumers, 377 million Indian Gen Zs (people born from around 1995 to 2010) make up the largest generational cohort in the country. They contribute to 43 percent of overall consumer spending, setting a significant economic precedent. Notably, 76 percent of Gen Zers in India are open to trying new brands, creating a ripe environment for both established luxury houses and newcomers.

However, success requires clarity in targeting distinct personas within this diverse generation. Research of key stakeholders – including wealthy Gen Zers and top influencers, whom IndLux named “the Catalyst Generation" – highlighted five major Gen Z personas with different expectations:

The evidence presented spotlighted India’s unique relationship to signalling, one of the pillars of luxury strategy: Indian Gen Z consumers, and specifically those of the Catalyst Generation, seek exclusivity, but with subtlety. The growing preference for “semi-subtle signalling" implies that luxury brands must walk a fine line between visibility and understatement. For many affluent young consumers of the Catalyst Generation, their desire is to be part of an exclusive circle while maintaining a sense of discernment that their peers recognise.

Insights from IndLux revealed that young Indian consumers have started cultivating their own #IYKYK (“If You Know, You Know") factor, where they navigate the balance between obvious recognition and understated elegance. The idea for brands is to create “the zone of coolness", a space that “whispers quality rather than screaming opulence".

An additional complexity is the deep integration of family dynamics. The concept of “independence without individualism" is crucial for understanding luxury consumption in India. Family approval and shared experiences are significant parts of the buying process. Young buyers might make decisions, but parental or family involvement remains integral. “Unlike in the West, in India, luxury is very much a family affair," Khanna emphasised.

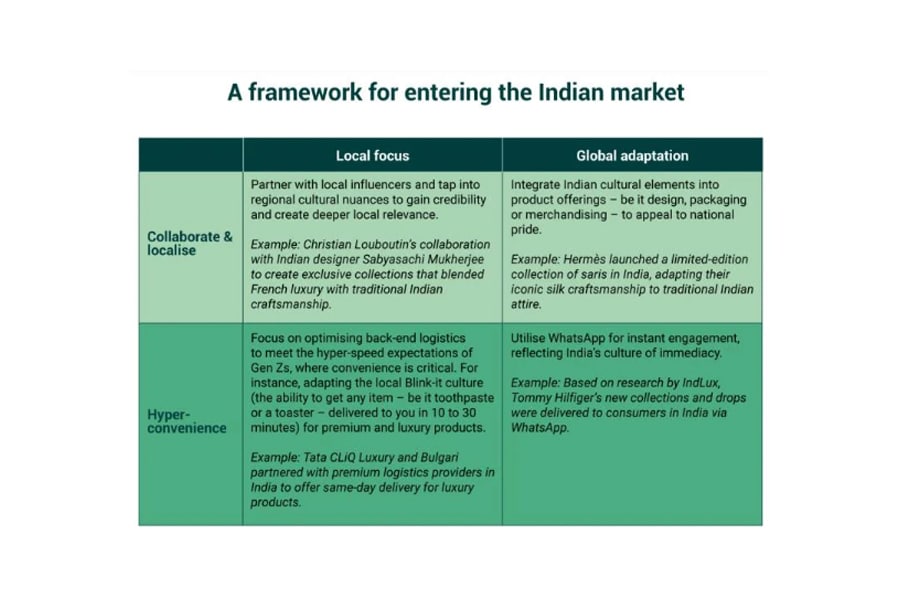

The evidence of IndLux’s research suggests that importing one-size-fits-all strategies from other markets won’t work. Instead, initial successful use cases point to four different tailored approaches, outlined in the table below:

Broadly speaking, success in the Indian market will lie in brands’ ability to balance local authenticity and global appeal – and their willingness to “learn to love and speak to India", as Grouiller noted.

The country is undeniably a luxury growth engine, but navigating its complexities requires more than mere presence. Brands need an approach steeped in local insights, sensitivity to cultural and generational shifts, and a commitment to long-term engagement rather than short-term gains. Gen Z is not just the future but the catalyst that will reshape India’s luxury market – a cohort with power, promise and the means to make or break global players in the Indian context.

First Published: Jan 20, 2025, 14:06

Subscribe Now