“I would like millions of women coming out of their shower in the morning, starting with wearing the Titan Amalfi Blue or Noura perfume, putting on a Taneira saree, wearing a Titan Raga watch, putting on a Tanishq pendant, taking up a Titan Irth bag, and putting a CaratLane diamond into their bag for an evening party," Venkataraman, the managing director of Titan Company tells Forbes India over a video call. That’s almost the entire bouquet of offerings from Titan that started out as a watchmaker in 1984.

That dream isn’t just limited to India, where he knows he stands a chance of making it work, especially if the company’s growth in recent years is anything to go by. “I would like this to happen in many parts of the world," Venkataraman says.

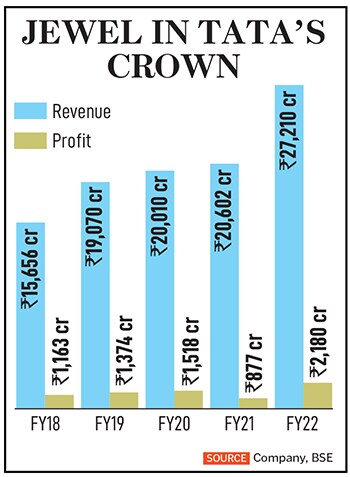

CKV, as he is commonly known on Titan’s sprawling campus, Integrity in Bangalore, has won the Forbes India Leadership Award for his ability to transform the existing business, clarity on strategy, and superior financial performance. Under his leadership, Titan’s profit grew nearly 150 percent in 2022, from ₹876 crore to ₹2,180 crore.

Since he took charge in 2019, the company’s revenues have grown from ₹19,000 crore to nearly ₹28,000 crore in 2022 and it is poised to better those numbers by the end of the current fiscal.

That’s some phenomenal numbers for what’s Tata Group’s second-largest company by market capitalisation. Titan has six divisions under it, a watches and wearables business, a jewellery division, an eyewear business, fragrances, and fashion accessories, a women’s clothing business, and an international business covering all the above categories. The company also has licensed brands such as Tommy Hilfiger and Police in India.

![]() But, even then, for Venkataraman, who took over the corner office in October 2019, after Bhaskar Bhat, the well-known former MD resigned after 17 years, the ride hasn’t been entirely smooth. Before he took charge as the CEO of the company that has over 2,100 stores across categories such as watches, eyewear, and jewellery, and brands such as Zoya, CaratLane, Mia, and Tanishq, Venkataraman had been the CEO of the jewellery arm.

But, even then, for Venkataraman, who took over the corner office in October 2019, after Bhaskar Bhat, the well-known former MD resigned after 17 years, the ride hasn’t been entirely smooth. Before he took charge as the CEO of the company that has over 2,100 stores across categories such as watches, eyewear, and jewellery, and brands such as Zoya, CaratLane, Mia, and Tanishq, Venkataraman had been the CEO of the jewellery arm.

Then, four months after he took the top job, Venkataraman was staring at chaos with the Covid-19 crisis that wreaked havoc across the global economy. “The first quarter of the first year of my new year was looking to be terrible in terms of financial performance," Venkataraman says. “But we don’t take ourselves very seriously at Titan and we were not worried about being judged by the financial performance of the year. Therefore, I didn’t need to squeeze every penny."

Instead, he knew he needed to turn his attention to those being hit hard by the pandemic, including distributors, partners, franchises, and off-roll employees. “I knew I would be judged more on my character, and I would certainly judge myself on my character and my resilience when it came to how I dealt with the more disadvantaged people," Venkataraman says. “So, we put all of them first and didn’t think of cost-cutting at all. And that’s a very gentle and compassionate way of dealing with the stakeholders."

Learning From His Mentor

In many ways, CKV likens his persona and working style to that of his predecessor, who had been instrumental in bringing in a sense of collective ownership at Titan and putting the watchmaker on the global map with its diversified portfolio ranging from jewellery to women’s wear. Bhat won the Forbes India Leadership Award 2019 Special Jury Award for helping transform Titan from just a watchmaker to the second-most valued company in the Tata stable.

A lifer at Titan after graduating from IIM-Ahmedabad, Venkataraman, who hails from Coimbatore, rose through the ranks to become marketing manager, head of Titan SBU (strategic business unit), and then the chief operating officer of jewellery in 2005. In 2012, he was put in charge of the jewellery business, which accounts for 80 percent of the company’s revenue, a position he held until 2019.

“Titan is a large family," Venkataraman says. “So many of us have been there for decades and when you work with them for so many years, it’s very easygoing with the rank and file of the company." While he did find it easy with a supportive board as he stepped into the top job, especially during Covid-19, and Titan having a well-established set-up in terms of manufacturing and distribution, CKV believes his biggest strengths have been twofold.

![]() One is his ability to derive joy from the simple things—CKV continues to travel by train and his last trip was a week ago—and, more importantly, his ability to not take himself seriously. That’s also quite evident when he tells Forbes India that he intends to practise singing Hindi songs immediately after his interview, much to his family’s distress.

One is his ability to derive joy from the simple things—CKV continues to travel by train and his last trip was a week ago—and, more importantly, his ability to not take himself seriously. That’s also quite evident when he tells Forbes India that he intends to practise singing Hindi songs immediately after his interview, much to his family’s distress.

“I don’t take myself seriously at all," Venkataraman says. That’s also perhaps why he makes it a point to remain accessible to everyone at Titan, so much so that he told his wife and family soon after taking charge that his time over the next six years was meant only for his employees at Titan.

Yet, at the heart of it, what drives his plans at Titan, apart from simplicity, people-centricity, integrity and ethics, and a sense of humour is his focus on multiple stakeholders. “It’s a big part of my life today," Venkataraman says. That was also something he never compromised on during the Covid-19 crisis when funds were being slashed on various activities by companies across the globe.

A Team Effort

Despite the phenomenal run of late, CKV prefers not to take all the credit and instead prefers to call it a team effort. In 2019, the company decided to rejig and restructure decision-making at the top at a time Bhaskar Bhat was leaving.

“Many new people came into their roles in the last three years," says Venkataraman. “Our CFO is two years old our CPO is two years old. The three main business CEOs are three years old or less. In fact, all six CEOs are new. So, in a way, there has been a collective change in the style." Shortly before Bhat had handed over the reins, the company had rejigged the roles for the CEOs of new businesses by getting them to directly report to the MD, including the international business of Titan. “So, we created three new verticals and brought in three new CEOs from within and from outside," adds Venkataraman.

That meant Venkataraman was working with an entirely new structure when he took over. A desire by the new teams across senior roles to outperform meant that Titan found itself on a strong footing. “Almost the top 20 people were new in their seats. That’s a huge change," Venkataraman says.

But, more importantly, it was Covid-19 that came as a blessing in disguise. Already, starting in 2017, the company had laid the groundwork and invested heavily in ramping up its online platforms by investing across multiple technologies, CRM (customer relationship management), data analytics and e-commerce.

“That really came in handy in the first quarter of FY21," Venkataraman says. “As Covid-19 happened, the public’s desire for trusted brands increased. The Tata brand became much stronger." Then, over the past year, as Covid-19 became a memory, Venkataraman reckons India’s fast-paced growth, especially amid a global slowdown, has helped the top two income segments in the country grow rapidly. “Titan’s customer segments are aligned to the top two income segments in the country. All these are sort of coming together to help us perform."

Covid-19 also gave an impetus to the group’s omnichannel play, which Venkataraman believes will now be the mainstay for the group. “We were able to really leapfrog from total brick-and-mortar to a decent omnichannel within 4-5 months," Venkataraman says. “Even though the safety-related reasons for going to stores have totally collapsed and people are loving to come to the store, what we have established in the second half of FY20 on omnichannel and related aspects, are really the foundation of our current performance and our growth."

“In many ways Titan draws similarities to ITC," says Harminder Sahni, the founder and managing director of consultancy firm Wazir Advisors. “They built up a huge distribution network and once they realised they have that, they began building other businesses that can capitalise on that. Titan has women’s mindshare, and they are building on that. But, unlike the gold and jewellery business where they have a stronghold, the other businesses have heavy competition, and numerous players, which might make scaling up not very easy."

“Titan’s regionalisation strategy in key focus markets (regions where it has a lower market share than its national average) is bearing fruit with market share gains in regions such as South and East," ICICI Direct Research said in a report in February 2023. “Titan continues to be one the fastest growing discretionary companies in our retail coverage universe. Robust performance in challenging times reaffirms our thesis of long-term market share gains for Titan. It has, over the years, withstood challenges and emerged as a resilient player. We believe Titan is a structural growth story and appears to be a key beneficiary of the unorganised to organised shift in the Indian jewellery market."

Gold Remains Gold

Today, as much as 80 percent of the company’s revenues come from its gold business, comprising Tanishq, Zoya, Mia, and CaratLane. “In terms of growth, all the businesses have done exceedingly well, especially in FY23," Venkataraman says. “Over the next 3 to 5 years, I do see them growing at a much faster clip than the jewellery business. But because the jewellery business is so large, the drop in share won’t be much."

Currently, Titan accounts for about five percent of the country’s organised jewellery industry in India with rivals such as Joyalukkas, Kalyan Jewellers, Malabar Gold, and Senco, among others. The gold business contributed ₹23,000 crore to the company’s total revenues in 2022.

![]() India consumes the second-largest amount of gold at some 611 tonnes of jewellery per year, second only to China at 673 tonnes, according to the World Gold Council. That’s why the company is gunning for more when it comes to the metal. “We are opening stores in a big way outside India with Tanishq," Venkataraman says. “While it is an international business, it is a jewellery business. Jewellery will continue to be very, very large. It may drop a few percentage points from its current high, but it will remain the mainstay."

India consumes the second-largest amount of gold at some 611 tonnes of jewellery per year, second only to China at 673 tonnes, according to the World Gold Council. That’s why the company is gunning for more when it comes to the metal. “We are opening stores in a big way outside India with Tanishq," Venkataraman says. “While it is an international business, it is a jewellery business. Jewellery will continue to be very, very large. It may drop a few percentage points from its current high, but it will remain the mainstay."

The company operates in the jewellery business with a bouquet of offerings from CaratLane, Mia, Zoya, and Tanishq. While the three (CaratLane, Mia, and Zoya) have been growing faster than Tanishq, on a much lower base, Tanishq will continue to be the lead brand when it comes to the jewellery business. “We are quite satisfied with the growth in our jewellery business and also with the growth in our market share," adds Venkataraman. “As we press our WIMI (Winning In Many Indias) strategy much more, we see the potential for accelerating our market share growth even further. The increasing desire for all our brands across all parts of India is also aiding this. We have really covered the category comprehensively with our brand portfolio."

“The gold business is only expected to get better from here," adds Sahni of Wazir. “It remains a profitable business, and the real margins are in designs where making charges come into play."

Going All Out

The company also has serious ambitions for its non-core business and wants to ramp up across segments into a multi-category outfit. For instance, in the watches and smart wearables business, where new and incumbent players have been making a beeline to tap into the growing market, the company has set an ambition to grow into a ₹10,000 crore business by 2026.

India’s wearables market grew 46 percent in 2022 as shipments reached 100 million units, according to recent data from the International Data Corporation (IDC). “Over the next two years, there will be a lot of solution-based, customer benefit-based innovation that Titan will bring in in the smart wearables business and it will grow at a very rapid pace," Venkataraman says.

Titan has also been steadily building up its clothes business under Taneira, to become a woman’s brand of choice while also focusing on the fragmented eyecare industry where it competes with the likes of Lenskart. The eyewear industry is expected to be worth $9.69 billion by 2027. Titan already has stores in 400 cities in the country and opened its first eye care store in Dubai last month.

“The Taneira business is doing exceedingly well," Venkataraman says. “It’s a very large industry and category and we have brought in a lot of freshness into that category on multiple fronts. The eyecare industry is something that will never have any substitute. Titan is clearly the leader in that part of the serious eyecare solutions business in the country, with a strong combination of expertise and empathy. And we have a lot of future riding on that as well."

Taneira was launched in 2017 and is looking at revenues of ₹1,000 crore by FY2027 with over 125 stores across the country. “We are setting up a lot of stores across the country and will continue that rapid expansion for the next few years," adds Venkataraman.

“Many of the segments Titan has forayed into are a natural extension for the brand," says Devangshu Dutta, the chief executive of Third Eyesight, a specialist management consulting firm. “Titan has been able to bank on the goodwill of the Tata Group, and each of the brands has been able to stand on their own. They have also been able to build themselves as an aspiration brand."

But it is the big international business that remains a focus for Ventakataraman and Titan these days. That’s also being led largely by the push on the jewellery business globally. The company hopes to have 20 Tanishq stores across the Gulf Cooperation Council countries and North America by FY24 end.

“Gold is an addiction in India, just like tobacco, and the Tatas knew that was the best way to go forward," says an industry veteran on condition of anonymity. “But even then, it’s an entirely fragmented business and they have competition from small players in the country. Yet, none of them has been able to challenge Tanishq’s distinct brand in India."

![]()

Miles To Go

For now, Venkataraman, who loves running and cooking, apart from his penchant for Hindi songs, has his hands full at work.

While expansion across categories remains the prime focus, CKV is also leading a formidable push towards inclusivity and diversity at work. “We’ve been a socially conscious company from the beginning," Venkataraman says. “But much more action, and much more work to be done on diversity and equity. And I’m personally at the centre of the company programmes around ESG and DEI."

That apart, ramping up international operations, in addition to multiple stakeholder focus and creating newer categories, will likely keep the 62-year-old busy in the years to come. So, will Titan soon be selling crop tops and tank tops for women? “Who knows?" Venkataraman quips as he dashes off for his evening session of Hindi songs.

But, even then, for Venkataraman, who took over the corner office in October 2019, after Bhaskar Bhat, the well-known former MD resigned after 17 years, the ride hasn’t been entirely smooth. Before he took charge as the CEO of the company that has over 2,100 stores across categories such as watches, eyewear, and jewellery, and brands such as Zoya, CaratLane, Mia, and Tanishq, Venkataraman had been the CEO of the jewellery arm.

But, even then, for Venkataraman, who took over the corner office in October 2019, after Bhaskar Bhat, the well-known former MD resigned after 17 years, the ride hasn’t been entirely smooth. Before he took charge as the CEO of the company that has over 2,100 stores across categories such as watches, eyewear, and jewellery, and brands such as Zoya, CaratLane, Mia, and Tanishq, Venkataraman had been the CEO of the jewellery arm. One is his ability to derive joy from the simple things—CKV continues to travel by train and his last trip was a week ago—and, more importantly, his ability to not take himself seriously. That’s also quite evident when he tells Forbes India that he intends to practise singing Hindi songs immediately after his interview, much to his family’s distress.

One is his ability to derive joy from the simple things—CKV continues to travel by train and his last trip was a week ago—and, more importantly, his ability to not take himself seriously. That’s also quite evident when he tells Forbes India that he intends to practise singing Hindi songs immediately after his interview, much to his family’s distress. India consumes the second-largest amount of gold at some 611 tonnes of jewellery per year, second only to China at 673 tonnes, according to the World Gold Council. That’s why the company is gunning for more when it comes to the metal. “We are opening stores in a big way outside India with Tanishq," Venkataraman says. “While it is an international business, it is a jewellery business. Jewellery will continue to be very, very large. It may drop a few percentage points from its current high, but it will remain the mainstay."

India consumes the second-largest amount of gold at some 611 tonnes of jewellery per year, second only to China at 673 tonnes, according to the World Gold Council. That’s why the company is gunning for more when it comes to the metal. “We are opening stores in a big way outside India with Tanishq," Venkataraman says. “While it is an international business, it is a jewellery business. Jewellery will continue to be very, very large. It may drop a few percentage points from its current high, but it will remain the mainstay."