Manufacturing: Too much slack again

A fall in manufacturing should take capacity utilisation to levels last seen in 2014-15

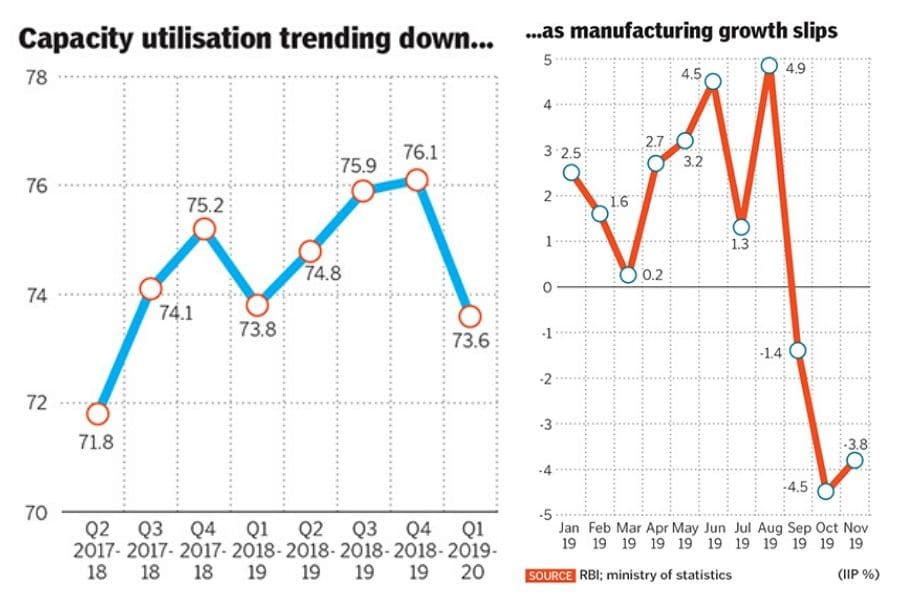

Image: Shutterstock A sharp drop in India’s industrial production numbers is likely to lead to a further delay in capital spending by companies. Manufacturing growth that has fallen every month since September has also dragged with it capacity utilisation numbers across a host of industries.

Image: Shutterstock A sharp drop in India’s industrial production numbers is likely to lead to a further delay in capital spending by companies. Manufacturing growth that has fallen every month since September has also dragged with it capacity utilisation numbers across a host of industries.

With consumer spending and exports stagnant, a delayed capex cycle would result in the economy being overly reliant on government spending to boost growth.According to data from the Reserve Bank’s Order Books, Inventories and Capacity Utilisation Survey, capacity utilisation in the first quarter of 2019-20 stood at 73.6 percent, broadly tracking the decline in IIP. In the three months since September, growth has declined by 1.4, 4.5 and 3.8 percent, pointing to capacity utilisation numbers last seen in 2014-15. (Capacity utilisation data for the last quarter has not yet been released.)

The fall in IIP numbers has been accompanied by higher consumer price inflation, making it harder for the RBI to justify a cut in lending rates at its next monetary policy meet in February.

There are also signs of the manufacturing slowdown becoming broad-based. “Nearly 78 percent of manufacturing sectors reported a decline in October indicting that the pessimism was at a rampage,” said Emkay Global in a note. So far, there are few signs of a pick-up in manufacturing, resulting in a number of brokerages reducing 2019-20 GDP growth forecasts to 4.5–5.4 percent.

First Published: Dec 18, 2019, 09:21

Subscribe Now