Is there a further rate pause from RBI?

Bond markets had been signalling a pause in the interest rate cycle. With economic uncertainties, RBI can now get the time to evaluate the impact of GST cuts on consumption

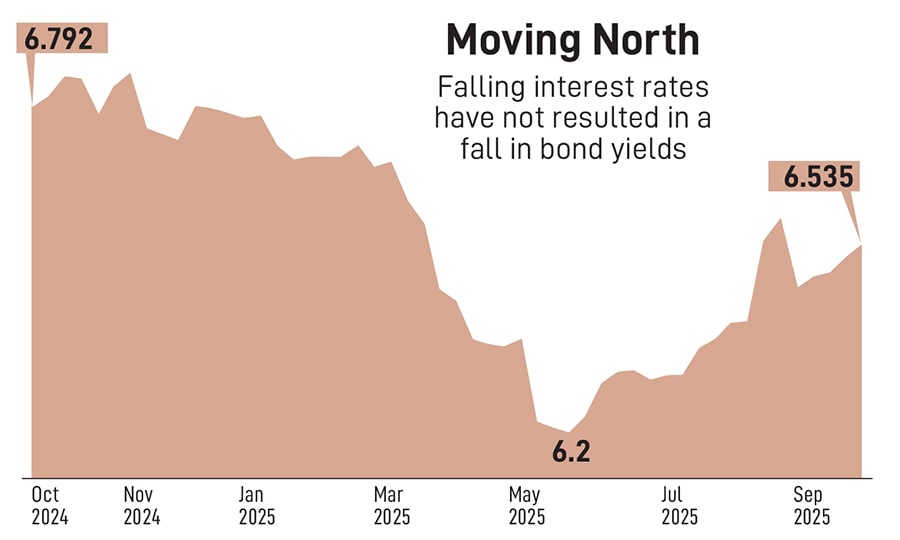

In the October 1 monetary policy announcement, the Reserve Bank of India (RBI) held rates steady, and yields of government bonds remained steady as well. This masked the movements of the last two months, where bond yields that had been falling in line with a cut in interest rates by the RBI have moved upwards since July, prompting investors to question the divergence.

The unusual signal by the bond market may point to the conclusion that the best is probably behind us as far as the rate cycle is concerned. The 10-year government bond yield, considered the benchmark, has risen 25 basis points since the central bank’s last rate cut in June. It now stands at 6.55 percent.

While in the short term the move could reflect market nervousness over lower-than-expected tax collections, lower expectations of collections on account of a Goods and Services Tax (GST) cut and the nervousness on account of no trade deal with the US, longer term issues are also at play.

But first, a look at the here and now. With Consumer Price Index (CPI) inflation at a benign 2.07 percent in August 2025, there is room for the RBI to cut interest rates. But a consensus that is slowly emerging is that the RBI will most likely wait and not rush.

RBI Governor Sanjay Malhotra, addressing the decision to hold rates, said, “Not just monetary policy, there are other government policies which have been announced and their impact is still unfolding. But there are also uncertainties, we see developments every day and responses to these also. That is why the MPC felt that we should pause [on rates].”

Also Read: Will RBI lower interest rates, or will it wait and watch?

On the transmission to government bonds, Malhotra said, “There was a good transmission of 46 basis points and after that there has been a hardening. So, the net impact thereof is around 30 basis points in government yields.”

Sakshi Gupta, principal economist at HDFC Bank, says, “Where we are in the rate cycle depends on what happens to growth.” Her concern is not GDP growth but the “broader understanding to growth momentum”, she tells Forbes India.

With rates unchanged, the RBI will now be better placed in an uncertain global economic environment to use the ammunition it has to deal with evolving situations and use it more judiciously. India’s GDP growth is likely to range between 6.3 percent and 6.9 percent for FY26; the RBI’s own forecast is 6.5 percent. India’s better-than-expected 7.8 percent growth in the June-ended quarter pushed some institutions to revise their growth forecast upwards.

Gupta of HDFC Bank says more clarity should emerge on how long the trade tariffs by the United States against India will continue and the “durability of the consumption boost” from the new GST rates. The GST cut is also symptomatic of the fact that boosting consumption will require the government to lower taxes and revenue collections. Combined with the income tax cut, the total boost to consumption has cost the government ₹148,000 crore so far. “There is a realisation that we have given up on the 3 percent deficit target,” says R Sivakumar, who heads products and strategy at Axis AMC.

In addition, state deficits have also become more structural, and so the combined shortfall in the bond market is of the order of ₹100,000 crore. Lately, there has also been a rethink of bonds that foreign investors can purchase under the fully accessible route (FAR) quota. “The number of bonds under this quota has reduced at a time when overseas investors are in any case wary of buying due to a falling rupee,” says a dealer who tracks this market; he declined to be named.

Madan Sabnavis, chief economist of Bank of Baroda, argues that signals of a consumption boost from the GST rate cuts have not taken place. “It is too early to judge this; the buying has not happened,” he says. Sabnavis, however, assesses that the rate cut cycle is over and the RBI does not need to be too worried about India’s growth rate in the short term.

Growth rates may also be dragged down on account of the trade war that has resulted in the imposition of 50 percent tariff on India’s exports. For now market watchers expect the outstanding issues to be resolved but with each passing day the rupee has been reacting negatively. It has depreciated 5 percent against the US dollar and stands at 88.78. This is unusual as the dollar itself has depreciated about 10 percent against a basket of currencies.

At some point the RBI may step in to defend the rupee and hold rates (even if the economy slows). “If there is a tussle between the currency and interest rates, it is usually the currency that wins,” says Sivakumar. One positive has been the upgrade of India’s credit rating from BBB- to BBB by S&P Global.

For now, the RBI’s management of liquidity is ensuring that it is conducive for the transmission of rate cuts—three in the year so far—to be faster and effective. Economists said the transmission of the rate cuts is already being seen. The RBI is estimated to have injected near ₹5 lakh crore of durable liquidity into the system, with another near ₹2 lakh crore set to come through CRR into the system by the year end.

Sabnavis had indicated a pause in rates at the October 1 policy announcement, but there will be more clarity in future monetary policy meetings on whether a relief package is required to assist exporters and whether more relief will be needed, through banks, to deal with assistance to farmers plagued by crop failure this year.

Activity momentum will provide that perspective to economists in Q3. “If things don’t seem to be picking up in line with expectations and if we don’t get favourable announcements on an India-US trade deal, then we could return to rate cuts,” Gupta says. “We don’t have enough answers right now.”

First Published: Oct 16, 2025, 16:10

Subscribe Now