How TPG helps companies make a turnaround

TPG has deployed nearly $2 billion in India, in a deal spree across verticals

Jet Airways is operationally dead following a spate of unsurmountable problems. One person had seen the writing on the wall before the airline was grounded. “Sometime it’s not a good thing when you have more knowledge and understanding [of the situation]. An airline dies slowly, but when the decline starts, it nosedives. We could almost foresee frame by frame how this [Jet] movie will play out and that is exactly how it happened," says Puneet Bhatia, co-managing partner and country head of TPG, a global private equity (PE) firm.

Bhatia is no stranger to how airline bankruptcies happen, having seen over a dozen across the world in two decades. In fact, TPG’s first ever deal was buying out the then-bankrupt Continental Airlines in 1993. It sold it for 10 times its investment value in 1998.

TPG’s India team met the stakeholders at Jet Airways last September to warn them of the airline’s precarious future. They offered pre-conditions to buy it and said if Jet did not move fast, things would go downhill. Bhatia and team spent a considerable time on the transaction, but the deal did not materialise. The lenders choked after committing nearly ₹200 crore in the now-defunct airline. Parking slots were given away and lessors started giving the planes to other airlines.

Jet was on the verge of shutting down, but the lenders believed otherwise. The airline met with a painful end in March.

Resurgence Man

Bhatia has turned around two businesses in India. In 2011, TPG acquired the debt-ridden, near-bankrupt retail chain Vishal Retail along with Shriram Group for about ₹70 crore. Three years later, after financial and strategic restructuring, the company broke even.

The other turnaround was Janalakshmi Financial, but more on that later.

“The last three to four years have been the busiest in my 15-year career in TPG in India," says Bhatia, sitting in his plush office in Bandra-Kurla Complex in Mumbai. “You are seeing the evolution of business where the teams are more empowered. Our existing India portfolio has done very well which has built confidence in the team. Once you have a track record, it gives you the confidence to do more deals."

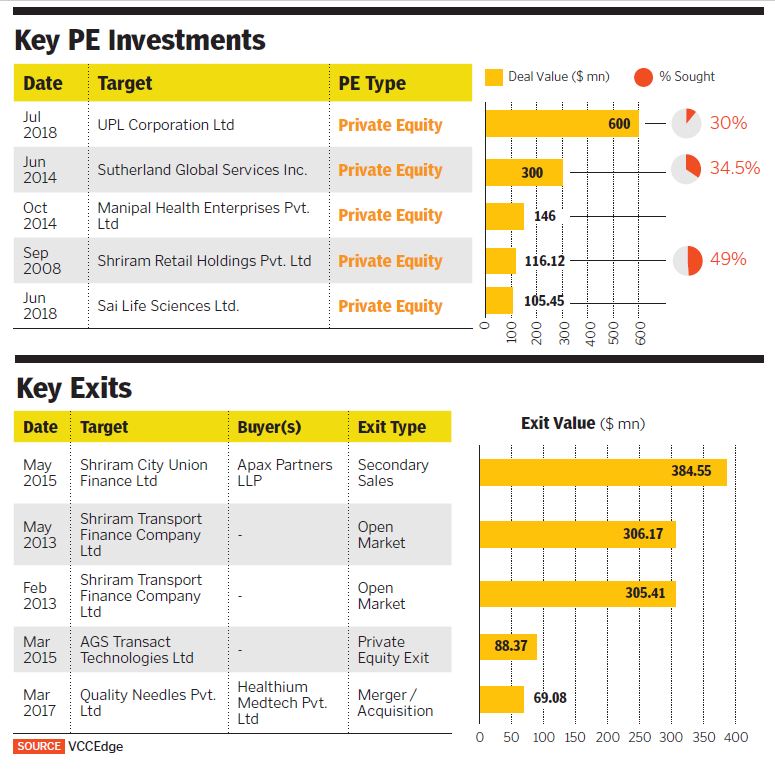

Last year, TPG cut its largest cheque when it backed an acquisition by homegrown agrochemical firm UPL Ltd. The fund deployed $600 million for an 11 percent stake. “We are focussed on a handful of sectors and consumer demand is one of them. If you consider the investment space in India, we find that reverse engineering and the unique capability that Indian founders have built to develop world-class products at a fraction of the cost is compelling," says Bhatia while explaining the rationale behind the UPL deal.

In July 2018, UPL Corporation Ltd, the international arm of UPL, bought Arysta LifeScience Inc for $4.2 billion. Although UPL has grown on the back of over a dozen acquisitions, its management opened up to raise PE capital for the first time. It raised $1.2 billion collectively from Abu Dhabi Investment Authority and TPG, and $3 billion in debt to fund the acquisition. It was the time that UPL was trying to buy the asset.

“It’s a problem if you are small and want to buy something twice your size. But if you buy something similar in size and have tracked it for years, it makes it interesting. We had an eight-week diligence in which we convinced ourselves that this M&A [merger and acquisition] will be game-changing. The management capability of UPL to acquire, integrate and consummate is solid," says Bhatia.

UPL catapulted to the number four spot globally (in the agrochemicals business) with the deal. It is expected to drive annual synergies of $200 million. UPL is focussed on low-cost manufacturing and reverse engineering products while Arysta is a maker of compounds and combinations with a heritage in research and development.

“What’s probably not widely known is Arysta was a combination of three assets. So we see the benefit of this deal as two-fold: You integrate Arysta’s three assets and then you have the UPL-Arysta combination that drives strong value creation," says Bhatia.

Deal SpreeApart from the UPL acquisition, TPG continued its deal spree across its other verticals. TPG in India deploys capital across categories: TPG Capital, which takes care of majority transactions and buyouts TPG Growth, the middle market and growth equity investment platform, and TPG Rise, the social impact platform which backs growing companies across the world, and its health care platform, Asia Healthcare Holdings, led by Vishal Bali. TPG is focussed on health care, consumer, financial services and technology, and media and telecommunications sectors for investments. It isn’t even shying away from deals in the non-banking financial sector where the liquidity crunch has brought companies to their knees. In February, it raised its seventh Asia fund called TPG Capital Asia VII which raised $4.6 billion. It committed 40 percent of the capital across 12 companies, including UPL.

TPG is focussed on health care, consumer, financial services and technology, and media and telecommunications sectors for investments. It isn’t even shying away from deals in the non-banking financial sector where the liquidity crunch has brought companies to their knees. In February, it raised its seventh Asia fund called TPG Capital Asia VII which raised $4.6 billion. It committed 40 percent of the capital across 12 companies, including UPL.

While TPG Capital goes after big deals, the TPG Growth team stitches smaller deals one after the other. This year, the latter closed two investments by deploying nearly $45 million. It invested $30 million in Solara Active Pharma and ₹100 crore ($14.7 million) in beauty retailing commerce platform Nykaa.

Since Shailesh Rao joined the firm as partner and head for India and Southeast Asia, TPG Growth and The Rise Fund, last September, the firm has been focusing on commerce technology deals. In the past 12 months, the firm has invested $100 million in entertainment ticketing firm BookMyShow apart from leading a $70 million investment in online home design and furnishing firm Livspace along with Goldman Sachs. It was also an early investor in eyeware startup Lenskart in 2015.

Rao, who led Twitter and Google India in his previous stints, says they are looking for firms that can provide high quality products and services in categories which are not only led by price considerations, but also driven by demand. The growth fund’s investment isn’t based on sales price alone, but also other factors like quality, durability and services that the company offers. “For example, Lenskart offers eyeware, something a consumer does not choose on the basis of price alone, but also the lens quality and durability. This is the case with our other platforms as well," says Rao.

The growth fund’s investment isn’t based on sales price alone, but also other factors like quality, durability and services that the company offers. “For example, Lenskart offers eyeware, something a consumer does not choose on the basis of price alone, but also the lens quality and durability. This is the case with our other platforms as well," says Rao.

Rao and Bhatia are clear that they won’t jump for companies that burn cash to be category leaders. “Horizontal ecommerce companies are overly reliant on the sale of commodity goods like mobiles, so they suffer from never-ending competition and are increasingly dependent on discounts, which is not the best way to build robust consumer businesses," says Rao, who is also busy deploying capital from the Rise Fund.

TPG’s Rise Fund counts Anand Mahindra as one of its global board members. It works as a special purpose growth equity fund which helps accelerate progress of UN sustainable development goals. It focuses mainly on companies in the products and services category that have the ability to amplify social benefits through their reach. Last year, it invested in Dodla Dairy and Chennai-based rooftop solar company Fourth Partner Energy. “In India, the transition from fossil fuel energy to renewables is a potent market that we want to participate in and support," says Rao.

He adds: “India has the potential to be a role model, from The Rise Fund perspective, because it demonstrates how you can create profitable growth that also drives social impact at massive scale." The returns expected from the fund are similar to those from the Growth Fund, he says.

Globally, TPG Growth has assets under management of $13.5 billion and has done 13 deals in India. An investment banking head of a large firm says, “They have been focusing largely on growth deals because that component is driving the new age deals. Although the fund has returned capital, it will be interesting to see the kind of exits they clock in the coming year as the buyout unit is planning to put some portfolio for churn."

Challenges Galore

In 1992, David Bonderman and Jim Coulter, who previously worked together at Bass Family Office, opened the first TPG office in Mill Valley, California. “India continues to be a leader in supporting robust economic growth, especially as various sectors mature across the country. That growth makes it a great target for investment and a fit for our model of working closely with businesses to help them succeed," says Coulter, co-CEO of TPG.

The firm may have closed deals last year, but it also lost some despite fighting till the end. For example, the Fortis Healthcare transaction was a certainty till IHH Healthcare bagged it. Or even the closely contested Kirloskar Oil Engines deal. “There were a lot of meaningful deals that we chased down, but did not close for various reasons. The moment we realised that the competition was going to outbid us, we decided to back out. The discipline of backing away is important," says Bhatia.

Every deal, says Bhatia, is preceded by months of building relationships with the promoter family. A classic case is TPG’s investment in Shriram Group. It took Bhatia several meetings before his convincing skills bore fruit. TPG’s first deal with Shriram Transport turned out to be a multi-bagger when it exited its stake to Piramal Group in 2013.

“Our focus in India has been on doing these meaningful deals. We are selective about our partners… we did one with Shriram and then four other deals with them. In Manipal Health, we completed a deal and are building on it. The second aspect is working with these companies to bring in management teams and deepening the board to get global expertise for expansion," says Bhatia.

It isn’t easy though.

“These are traditional families. For them to embrace a US PE firm and then for five years, force changes in the company in a conducive manner while maintaining their relationship is important," says Bhatia.

This year the fund is in the process of exiting its investments from other entities—general and life insurance (unlisted entities) and Shriram City Union Finance (listed). While Bhatia likes to stick to the DPI (distribution to paid-in) ratio where you try to balance how much you are investing with how much you are exiting, the fund likes to maintain a high portion. It means it continuously exits and adds companies to the portfolio. In India, the firm has deployed nearly $2 billion to date.

Another firm that will be up for listing in the next 18 months is Janalakshmi Financial which turned around in March. Since demonetisation, Janalakshmi had found it difficult to grow, like its peers in the microfinance sector. Now that the company is crawling back to profitability, the fund expects a listing as per Reserve Bank of India norms.

First Published: Aug 19, 2019, 12:27

Subscribe Now In May 2018, TPG and Shriram Group sold Vishal Mega Mart (formerly Vishal Retail) for an undisclosed sum to Manish Kejriwal-led Kedaara Capital and Switzerland-based Partners Group. Reports suggest the enterprise valuation of the deal was ₹5,000 crore. Bhatia laughed his way to the bank while TPG experienced one of its biggest year of investments in India in 2018. According to VCCEdge, the data providing platform of VCCircle, the fund invested over $800 million in India across nine deals.

In May 2018, TPG and Shriram Group sold Vishal Mega Mart (formerly Vishal Retail) for an undisclosed sum to Manish Kejriwal-led Kedaara Capital and Switzerland-based Partners Group. Reports suggest the enterprise valuation of the deal was ₹5,000 crore. Bhatia laughed his way to the bank while TPG experienced one of its biggest year of investments in India in 2018. According to VCCEdge, the data providing platform of VCCircle, the fund invested over $800 million in India across nine deals.