Form 26AS tax credit statement: How to view and download

By Forbes India| Jul 2, 2024

Tax season got you stressed? Learn how to download, view, and understand Form 26AS Tax Credit Statement to maximise your tax savings

Form 26AS is a tax credit statement that provides a comprehensive view of all tax-related transactions linked to an individual's Permanent Account Number (PAN). It includes details such as tax deducted at source (TDS), tax collected at source (TCS), advance tax, self-assessment tax, and refunds.

This document is a consolidated record of all tax transactions between the taxpayer and the income tax department, making it essential for accurate income tax return (ITR) filing. It helps taxpayers verify tax deductions, claim tax credits, and ensure compliance with tax laws.

Form 26AS is crucial for accurate income tax return (ITR) filing. It helps you verify tax deductions, claim tax credits, and ensure compliance with tax laws. The Form 26AS credit statement is available online and can be downloaded by taxpayers on the official ITR e-filing website.

Also Read: ITR filing: Here are the documents required for income tax return filing

How to View and Download Form 26AS

- TRACES Portal

- Net Banking

Option 1: Through the TRACES Portal

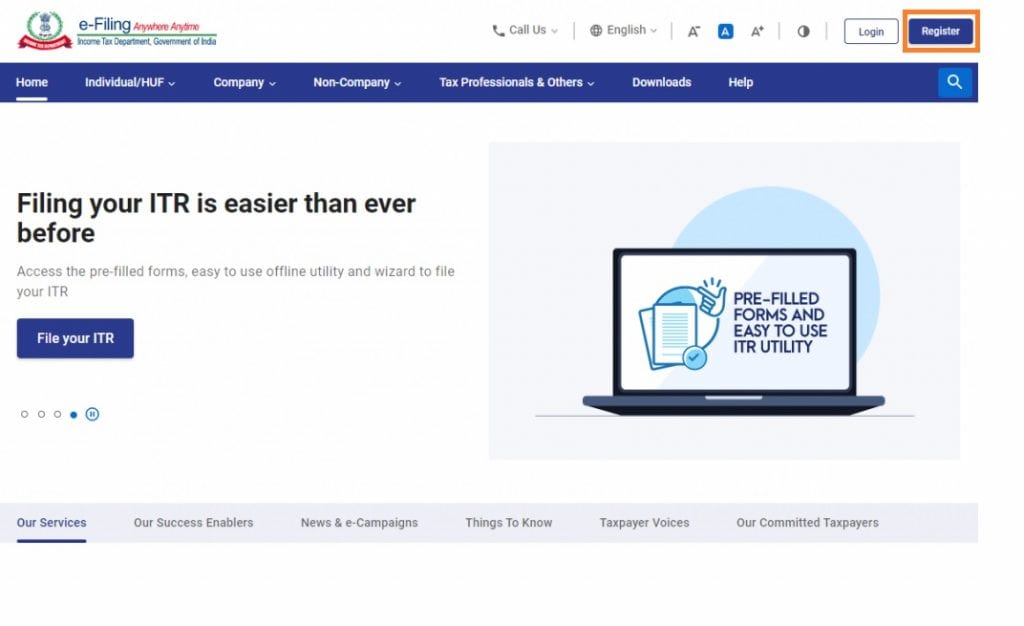

Step 01: Head to the official ITR e-filing website.

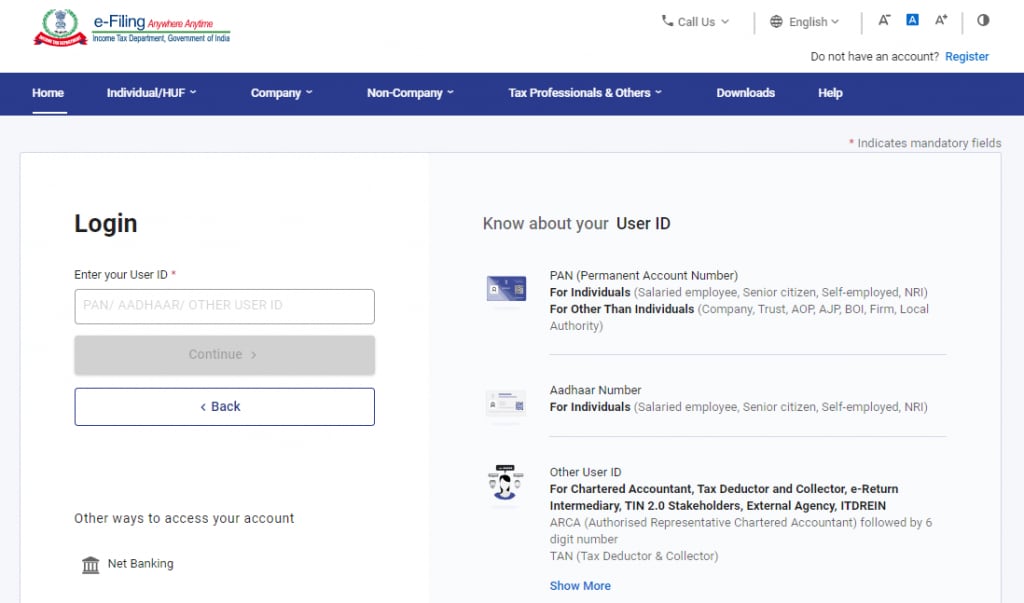

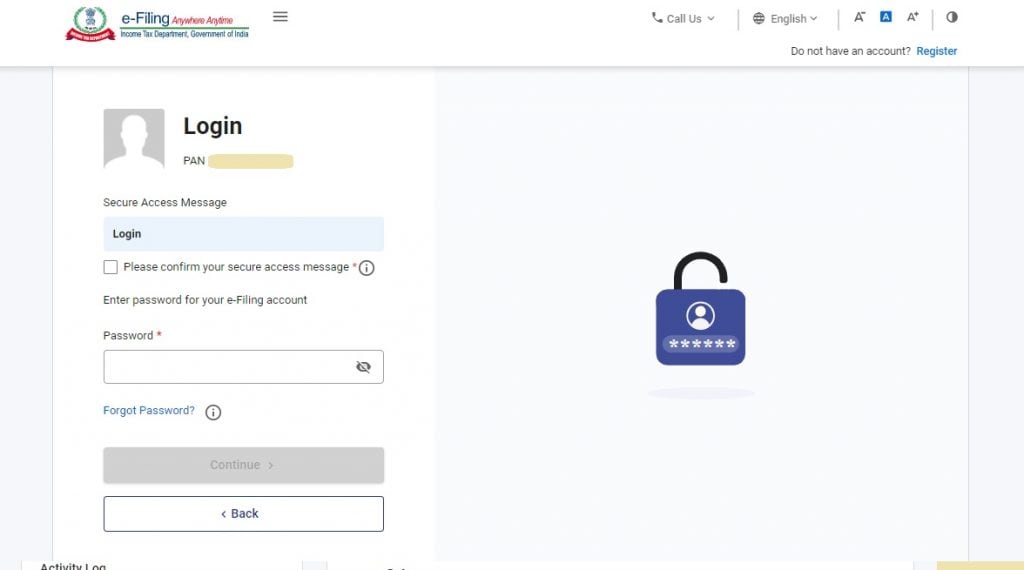

Step 02: Use your PAN or Aadhaar number to log in.

Step 03: Fill in your password to continue.

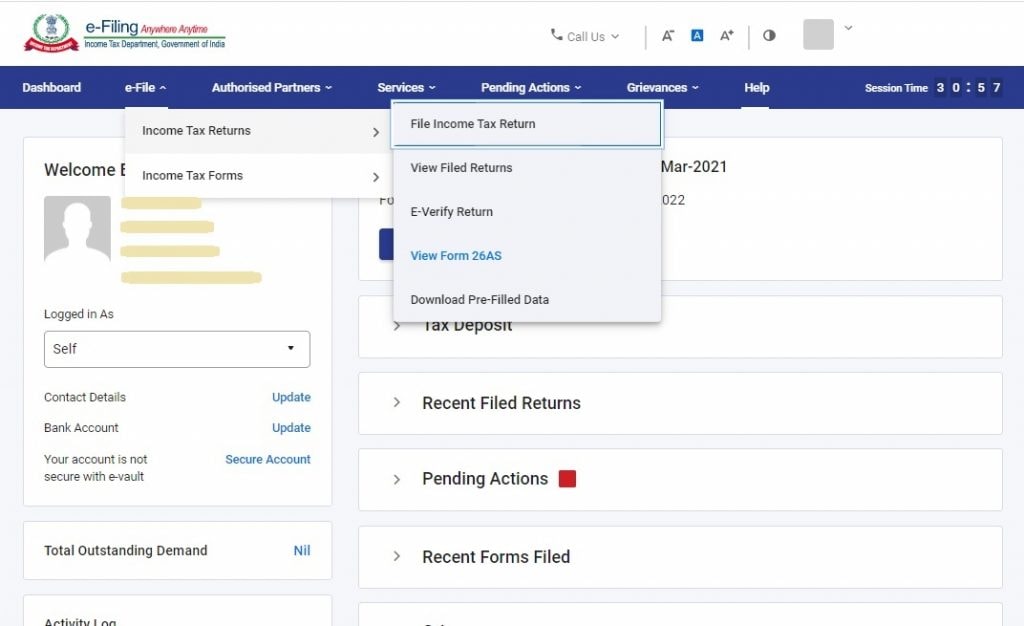

Step 04: Click on 'e-file', then 'Income Tax Returns', and finally 'View Form 26AS'.

Also Read: Section 80D of income tax act: Deductions, eligibility and benefits

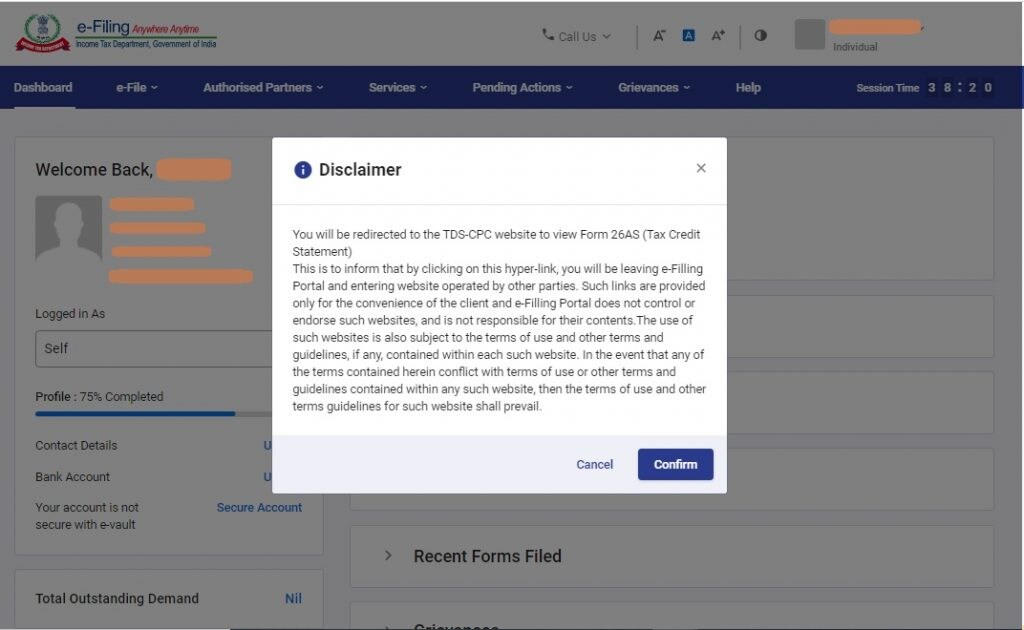

Step 05: Click 'Confirm' to move to the TRACES website.

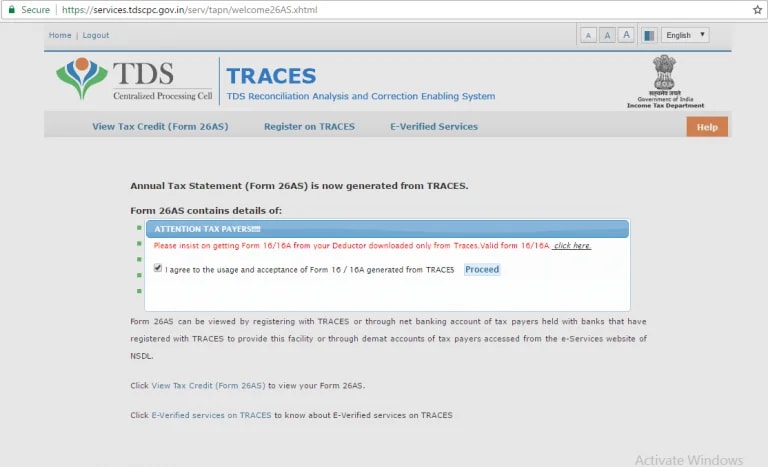

Step 06: Select the box and click 'Proceed.' You're now on the TRACES website.

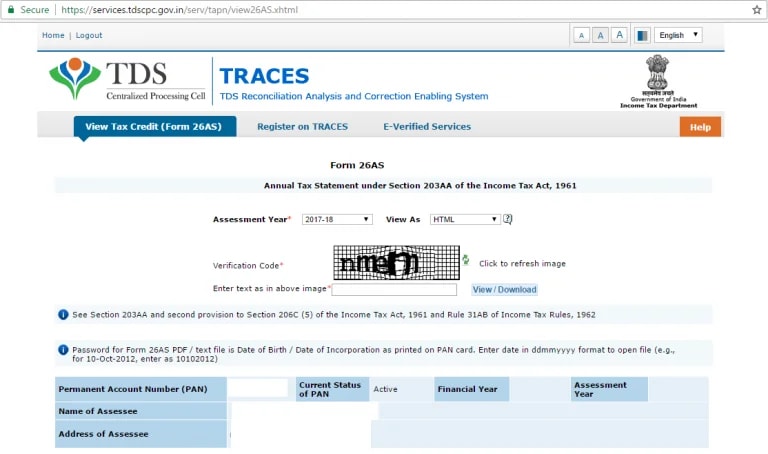

Step 07: Click on the link at the bottom of the webpage - 'View Tax Credit (Form 26AS)' - to see your Form 26AS

Step 08: Select the Assessment Year and the format in which you want to view Form 26AS. Enter the 'Verification Code' and click 'View/Download'. Then, you can download Form 26AS.

Step 09: After downloading Form 26AS, open the file to view your document.

Also Read: Income tax slabs in India 2024-25: Old vs new tax regime, deductions and more

Option 2: Through Net Banking Facility.

Step 01: Access your bank's net banking facility.

Step 02: Look for the 'Tax Credit' option and click on it.

Step 03: Confirm your details to download Form 26AS.

Information Available on Form 26AS

Form 26AS is like a financial report card that gives you a comprehensive view of your tax transactions required for filing ITR. Here's what you can expect to find:

Also Read: Income tax returns filing: Know which ITR you should file

Tax Deductions and Payments

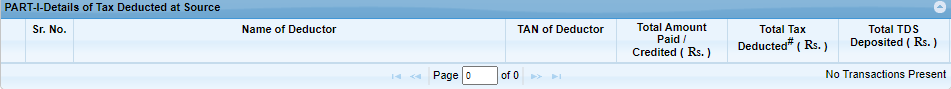

- TDS: Displays details of TDS by each deductor who made a payment to you. This includes the deductor's name and TAN, the section under which the deduction was made, the payment date, the amount paid or credited, and the tax deducted from payments and deposited in the bank.

- TCS: Displays information about tax collected at the source (TCS) by vendors of selected products when they are sold to you. This includes details about the vendor and the tax collected.

- Advance Tax: Displays details of income tax directly paid by you, including advance tax, self-assessment tax, and regular assessment tax. This includes the challan details and the tax deposited in the bank.

Refunds and Defaults

Refunds: Details of income tax refunds received during the financial year.

TDS Defaults: Details of TDS defaults after processing TDS returns.

Financial Transactions

High-Value Transactions: Displays details of any specified financial transactions, such as high-value transactions involving shares, mutual funds, etc.

Property Transactions: Details of tax deducted on the sale of immovable property.

Also Read: ITR filing: How to switch between old and new tax regimes

Additional Insights

GSTR-3B Turnover: Details of turnover reported in GSTR-3B.

AIS Updates: The new AIS, effective June 2020, includes information on specified financial transactions, pending and completed assessment proceedings, tax demands, refunds, and existing data.

Structure and Parts of Form 26AS (From FY 2022-23 and onwards)

- PART-I

This part includes details of tax deducted at source (TDS) from various income sources such as salary, business, and interest income.

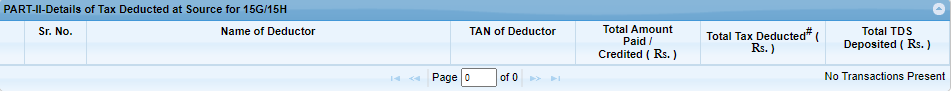

- PART-II

This part includes details of TDS on income below the basic exemption limit, mainly applicable to senior citizen taxpayers who have filed Form 15G/15H.

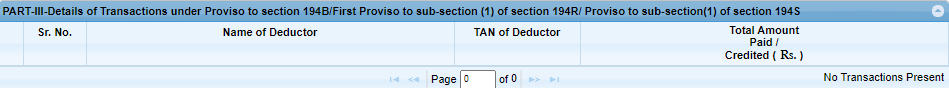

- PART-III

This part includes details of TDS on payments made in kind, such as cars in a lottery or foreign trips to meet sales targets.

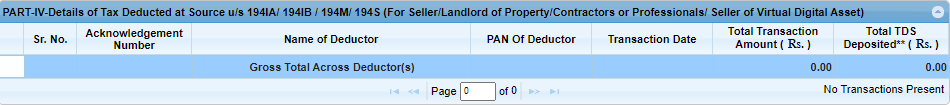

- PART-IV

This part includes details of TDS on the sale of house property, rent payments exceeding Rs50,000 per month, payments to contractors or professionals exceeding Rs50 lakhs, and the sale of virtual digital assets (crypto).

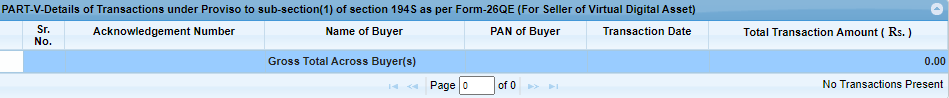

PART-V

This part includes details of TDS on selling virtual digital assets (crypto) under the provison to section 194S.

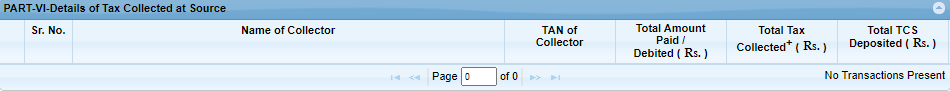

- PART-VI

This part includes details of Tax Collected at Source (TCS) made under various sections of 206C.

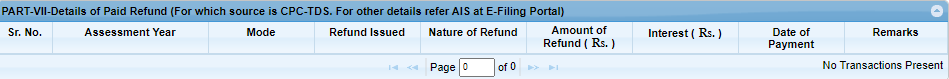

- PART-VII

This part includes details of refunds paid by the Central Processing Centre (CPC) TDS.

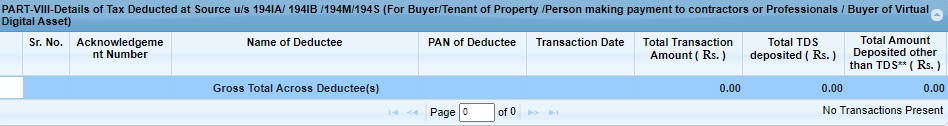

- PART-VIII

This part includes details of TDS made by buyers, tenants, and virtual digital asset buyers on purchasing house property, rent payments exceeding Rs50,000 per month, payments to contractors or professionals exceeding Rs50 lakhs, and the purchase of virtual digital assets (cryptocurrency).

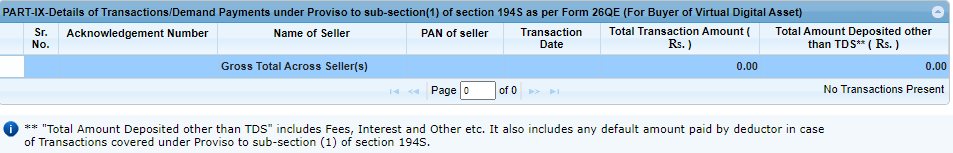

- PART-IX

This part includes details of transactions and demand payments under the proviso to section 194S for virtual digital asset buyers.

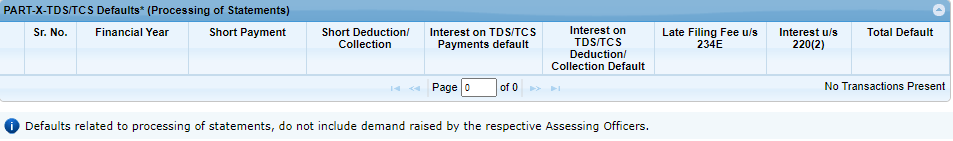

- PART-X

This part includes details of TDS and TCS defaults after processing TDS returns, excluding demands raised by the assessing officer.

Benefits of Form 26AS

- Enhanced Tax Compliance: With all your tax information in one place, Form 26AS helps you stay on top of your tax obligations and fully comply with the law.

- Streamlined Income Reporting: By consolidating your tax-related information, Form 26AS makes it easy to compute your taxable income accurately and claim the rightful tax credits when filing your Income Tax Return (ITR).

- Convenient Access: You can access your Form 26AS through the TRACES portal or your bank's net banking facility, making it readily available whenever needed.

- Refund Verification: Easily confirm the status of any tax refunds you're entitled to during the relevant financial or assessment year by cross-checking the details in Form 26AS needed for e-filing ITR.

- Detailed Tax Transactions: Form 26AS provides a complete record of all tax deductions (TDS) and collections (TCS) made by authorised entities on your behalf. This gives you a clear picture of your tax obligations and payments.