Income tax returns filing: Know which ITR you should file

Wondering which ITR to file this year? Our blog breaks down the complexities of ITR forms, helping you determine the right one for your needs.

As a taxpayer, it"s crucial (and even a legal obligation) to stay on top of your tax obligations. The Income Tax Return (ITR) is a vital document that provides the Income Tax Department with information about your income and the taxes you"ve paid.

ITR 1 or SahajITR-1, also known as Sahaj, is a simplified Income Tax Return form designed for resident individuals with a total annual income of up to Rs 50 lakh. This form is suitable for those who earn income from a salary, pension, house property, or other sources (excluding specific categories).

ITR-2 is a detailed Income Tax Return form designed for individuals and Hindu Undivided Families (HUFs) with a broader range of income sources.

ITR-3 is a specifically designed income tax return for individuals and Hindu Undivided Families (HUFs) who have income from a proprietary business or are engaged in a profession. This form is suitable for:

Sugam or ITR-4 is a simplified Income Tax Return form designed for individuals and Hindu Undivided Families (HUFs) and Partnership firms (excluding Limited Liability Partnerships) who are residents and have a total income that includes specific business and professional income sources.

ITR-5 is a versatile Income Tax Return form designed to cater to a spectrum of business entities, including firms, Limited Liability Partnerships (LLPs), Associations of Persons (AOPs), Bodies of Individuals (BOIs), Artificial Juridical Persons (AJPs), Estates of deceased individuals, Estates of insolvents, Business trusts, and Investment funds.

ITR-6 is the designated Income Tax Return form tailored for companies, excluding those eligible for exemption under section 11, to fulfil their ITR filing obligations. Companies claiming tax exemption under section 11 are those whose income is derived from property held for charitable or religious purposes.

All organisations registered under the Companies Act 2013 or the earlier Companies Act 1956 are required to file ITR-6. However, companies whose income originates from property held for religious or charitable purposes are exempt from ITR filing ITR-6.

ITR-7 is a detailed Income Tax Return form designed for specific entities, including companies, that are required to file returns under various sections of the Income Tax Act.

Entities Covered by ITR-7:

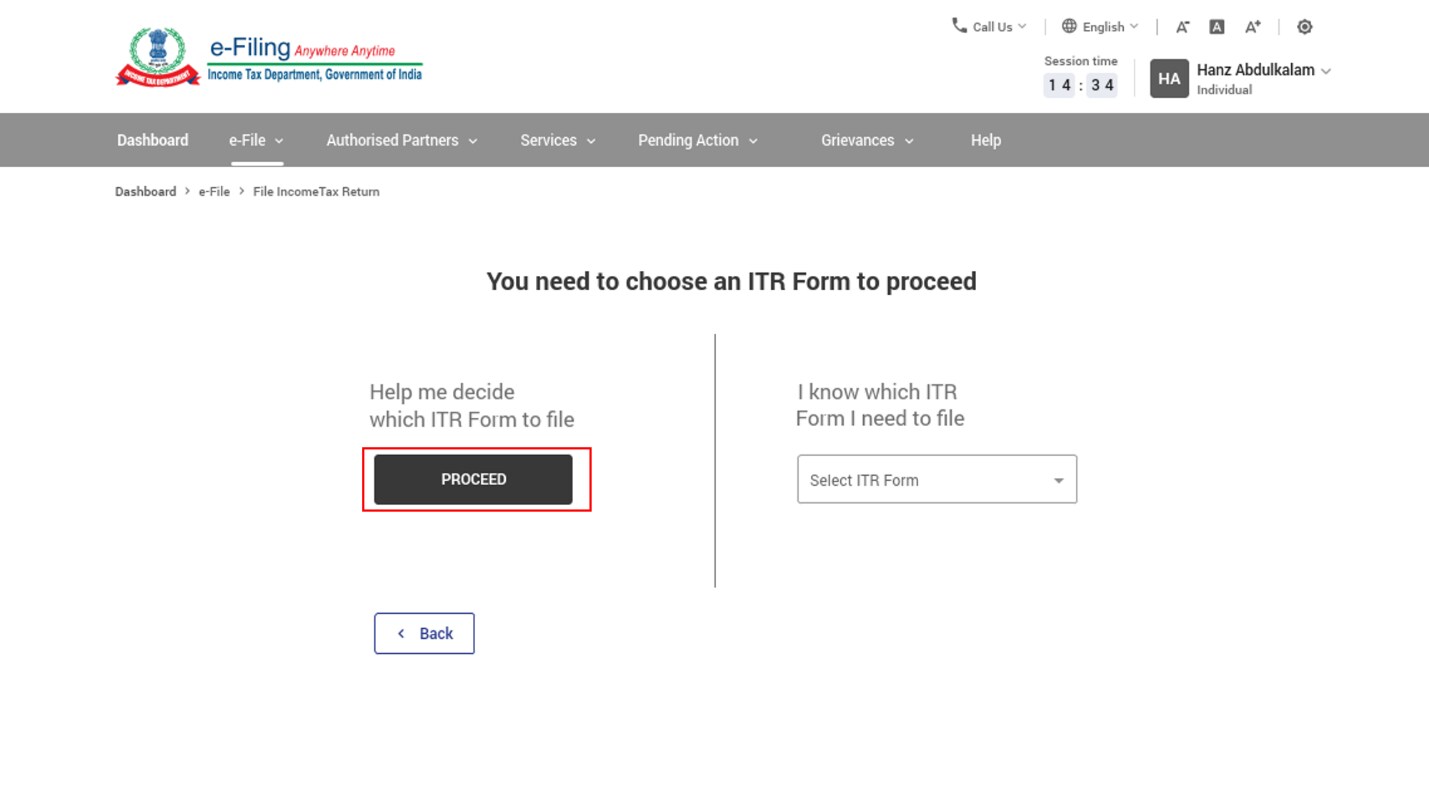

1. What is the "Help me decide which ITR form to file" service?

The "Help me decide which ITR form to file" service on the ITR website is designed to make ITR filing easier for individual taxpayers. With different ITR forms applicable to various income and residential status types, it can be challenging to determine which form is suitable for you. Until recently, taxpayers had to manually figure out which ITR forms and schedules were relevant to their situation, which could be time-consuming and prone to errors.

2. How does the "Help me decide which ITR form to file" service help me know the correct ITR form and schedules?

The "Help me decide which ITR form to file" service is designed to make ITR filing easier for individual taxpayers. This service helps you determine the correct ITR form and applicable schedules with these options:

You will see the qualifying conditions for ITR-1, ITR-2, ITR-3, and ITR-4. If you find the conditions clear and understand which ITR to file, select one of the ITRs based on the qualifying conditions (as applicable to your case), and you can proceed with ITR filing.

After reading the conditions, select this option if you are still unsure which ITR to file. Select answers to the wizard-based questions (relevant to you) to determine your ITR.

If you do not know which schedules are applicable, click Learn More and select answers to the relevant questions for that schedule. The applicable schedules are activated based on your responses to the questions.

3 What is the wizard-based selection of ITR/Schedules?

A user-friendly wizard tool is available online and offline to assist taxpayers who may be uncertain about the appropriate ITR form or schedule for a specific Assessment Year.

By presenting a series of clear and relevant questions, even individuals with limited knowledge of Income-tax laws can easily navigate the tool. The wizard then suggests a suitable ITR return form or schedule based on the taxpayer"s responses, simplifying the ITR filing process for all users.

The Central Government has the authority to exempt specific classes of individuals from filing ITR returns, in addition to existing exemptions, such as those with total income below the basic tax exemption limit, non-residents without income from India, and others. However, as of now, no such exemptions have been notified by the Central Government.

First Published: Jun 13, 2024, 16:45

Subscribe Now