How to file ITR online: Complete step-by-step guide

Say goodbye to tax stress! With our comprehensive guide, learn how to file your Income Tax Return (ITR) online easily and confidently

When managing your finances, filing an Income Tax Return (ITR) is a crucial step. This document allows you to accurately report your income, expenses, tax deductions, investments, and taxes to the government. The Income-tax Act of 1961 requires taxpayers to file an ITR under specific circumstances. However, there are additional reasons to file an ITR, even if you don"t have the requisite income. For instance, you may want to:

In today"s digital age, e-filing ITR has become the go-to method for filing Income Tax Returns (ITRs). This process allows you to learn how to file ITR online.

Before e-filing your tax return, ensure all required documents and information are ready. The Income Tax Department has made it easy to file your taxes, but preparation is vital for filing ITR online.

Here"s a checklist of what you"ll need:

Here is the step-by-step process of filling out ITR in India online via the official website:

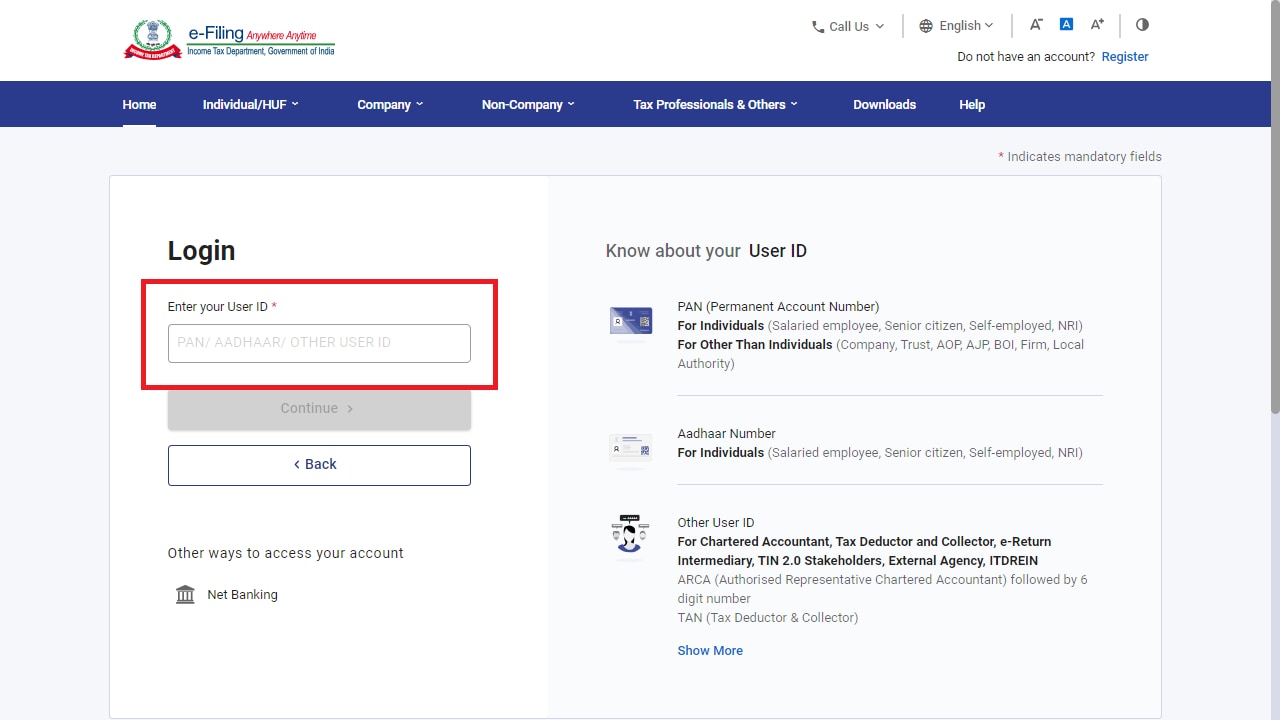

Head to the official Income Tax e-filing website and click the "Login" button.

Enter your Permanent Account Number (PAN) in the User ID section.

Check the security message in the tickbox to ensure you know the terms.

Type in your password to secure your account.

Click on the "Continue" button to proceed.

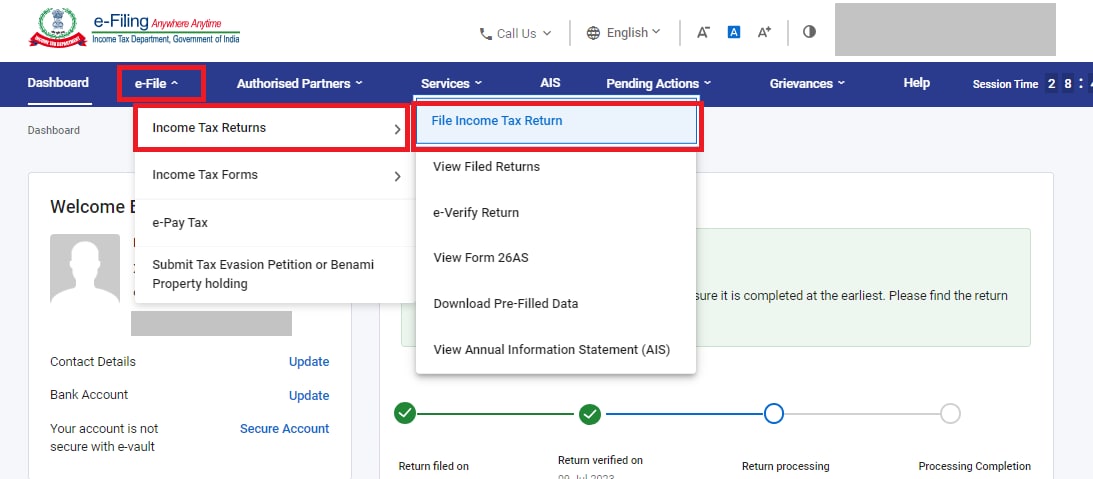

Click on the "e-File" tab at the top of the page.

Choose the "Income Tax Returns" option from the dropdown menu.

Click the "File Income Tax Return" button to begin the e-filing ITR process.

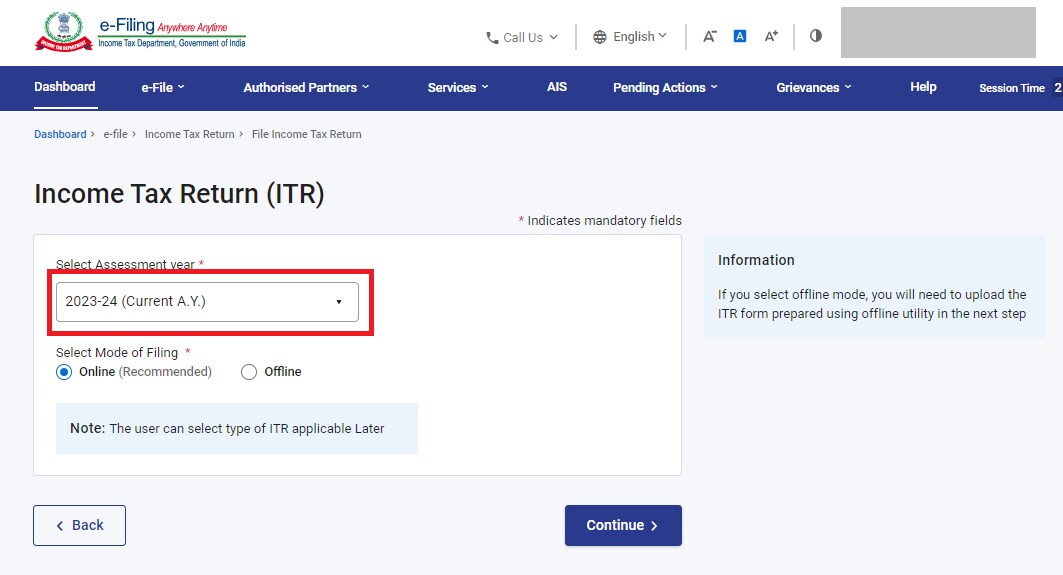

Choose the correct Assessment Year for filing ITR:

-If you"re filing for FY 2023-24, select "AY 2024-25".

-If you"re filing for FY 2022-23, select "AY 2023-24".

Select the mode of filing ITR as "Online".

Choose the correct filing ITR type:

-Original Return: The first income tax return is typically filed within the specified deadline.

-Revised Return: Filed to correct the errors or inaccuracies on your original tax return (Section 139(5)), typically filled within three months before the end of the assessment year.

Choose your applicable filing ITR status and continue:

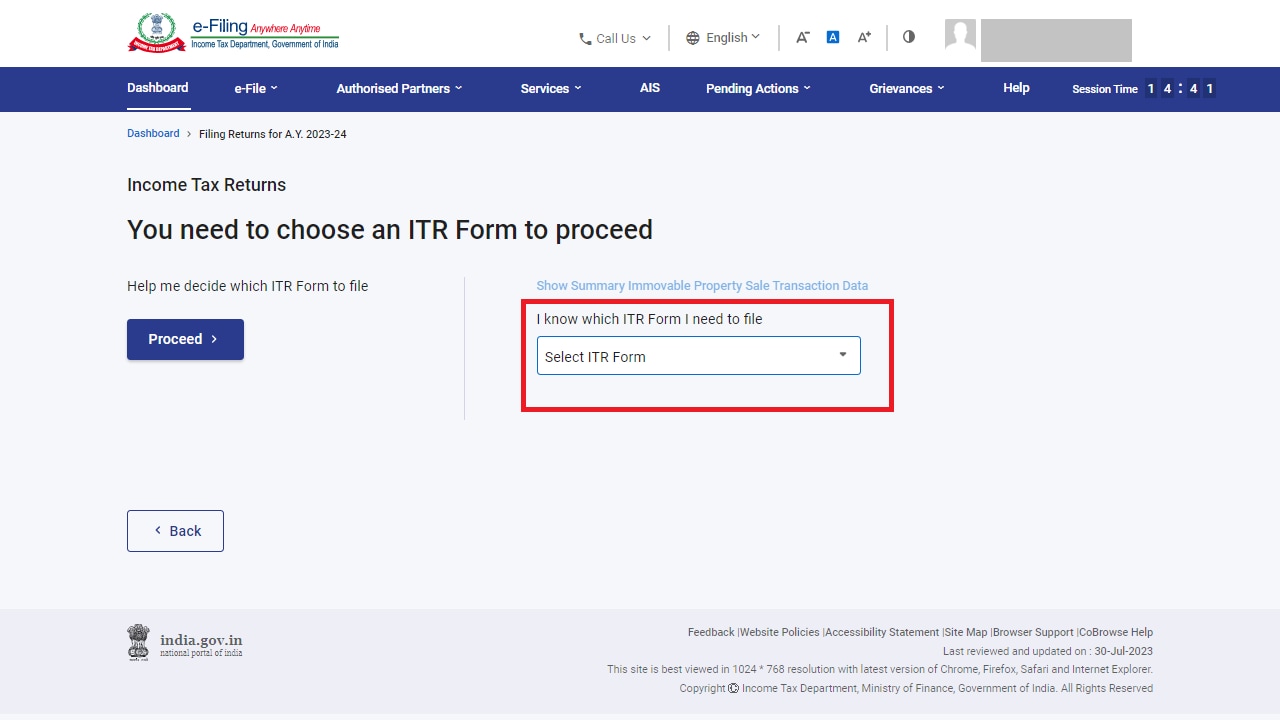

Now that you"ve selected your filing status, it"s time to choose the appropriate ITR (Income Tax Return) form. Selecting the correct ITR form based on your specific income sources and financial situation when filling out your ITR is crucial.

Take a moment to carefully review your income sources and financial situation to determine which ITR form is the most suitable for your needs. This will ensure a smooth “how to file ITR" process.

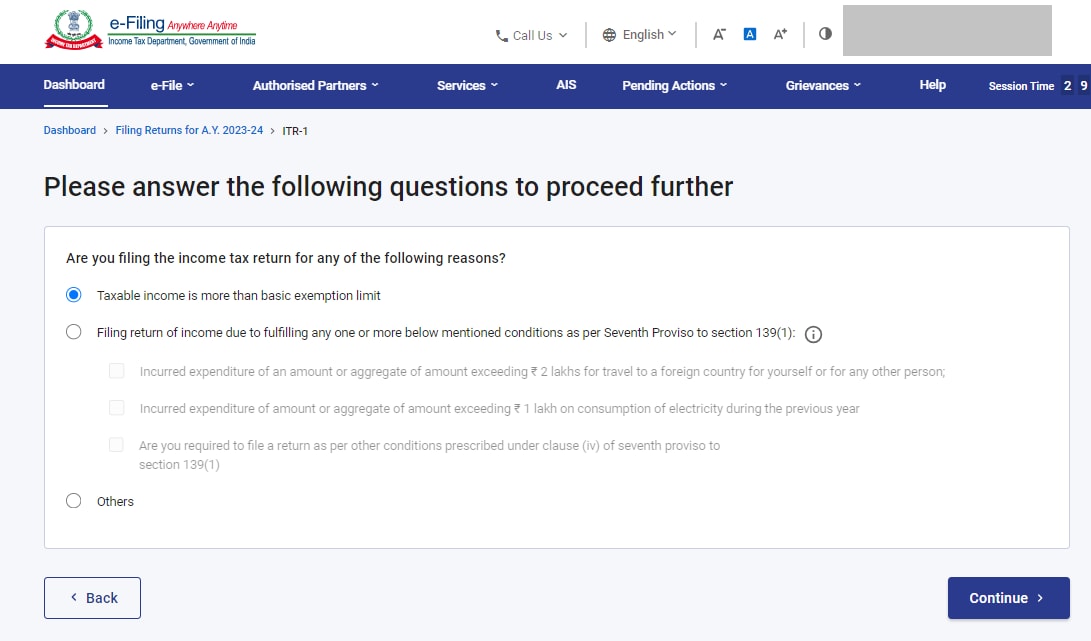

Now that you"ve chosen your ITR form, it"s time to specify the reason for filing your returns. Follow the steps below to ensure you select the correct option:

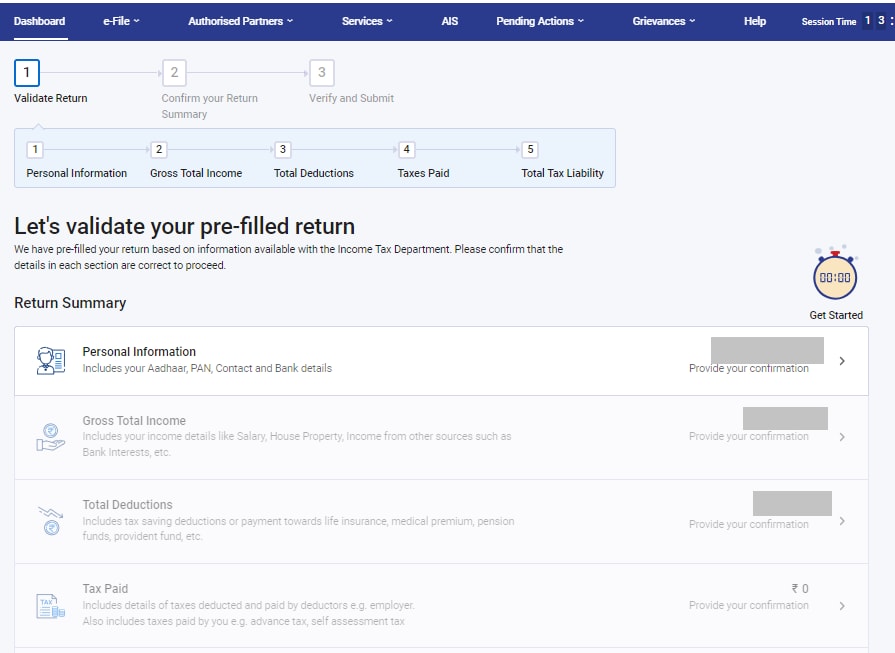

Now it"s time to review and confirm your details. Follow the below-mentioned steps to ensure accuracy and completeness:

The final and crucial step in the e-filing ITR process is to verify your tax return within 30 days. Failing to verify your ITR is equivalent to not filing it, so completing this step is essential.

You have several options to e-verify your return:

First Published: Jul 04, 2024, 17:45

Subscribe Now