How three founders built Scimplify to fill India's chemical supply gap

A Bengaluru-based startup is bridging the gap between Indian specialty chemicals makers and global markets with technology and trust

It began with a chance encounter in the United States (US). On a visit to the US in 2022, Sachin Santhosh struck up a conversation with a pharma company executive who was desperate for a specific chemical intermediate used in a drug. The compound itself wasn’t hard to find—a factory in Hyderabad could make it, and both men knew the manufacturer.

“But,” the American buyer asked, “can they actually make it at the right quality, scale it commercially, and supply it regularly?”

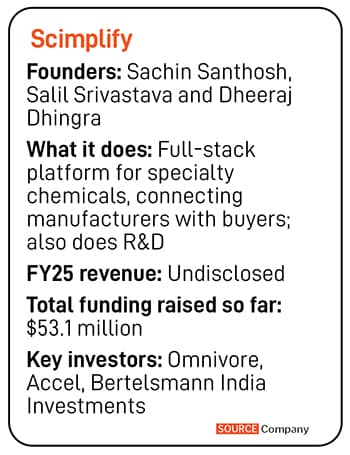

Born out of that simple question was Scimplify, a Bengaluru-based specialty chemicals platform that Santhosh co-founded with Salil Srivastava and Dheeraj Dhingra in September 2023. “There were plenty of underutilised factories in India,” Santhosh says. “The problem wasn’t supply, it was trust and scalability.”

Scimplify set out to fix exactly that. The full-stack platform connects specialty chemical manufacturers across India— more than 500 manufacturing plants currently —with buyers around the world. It also has an in-house R&D team of over 50 scientists who work on product development and process optimisation.

The three co-founders met through mutual connections. Santhosh is an alumnus of Indian Institute of Technology Madras, while Dhingra is a graduate from Indian Institute of Management Bangalore and Srivastava has an MBA from MANAGE Hyderabad.

They quickly realised they shared the same goal: To build a B2B platform that would make India’s manufacturing ecosystem smarter, not just bigger.

Each founder brings distinct strengths to the business. Srivastava, who comes from a strong manufacturing and operations background, oversees customer relationships in India. He previously launched and scaled a chemicals vertical at Zetwerk to $20 million in revenue.

Santhosh leads the US and Japan markets along with R&D. Before Scimplify, he cut his teeth at OfBusiness, where he worked across polymers, textiles, and packaging, gave him a ground-level understanding of Indian manufacturing’s inefficiencies, and also its potential.

Dhingra, who gained experience across the Middle East and Southeast Asia during his tenure at Zetwerk, drives Scimplify’s international expansion. Collectively, the trio brings nearly three decades of experience in building and scaling B2B operations.

“We joke internally that there is a certain tuition fee that you have to pay to learn the B2B side of things, and we have done that for a decade now,” Santhosh says.

The timing, too, worked in their favour, the founders believe.

According to Investment Information and Credit Rating Agency (ICRA), the specialty chemicals industry was valued at around $36 billion when Scimplify launched and is expected to reach $61 billion by CY28. “India only has a 3–4 percent market share globally, so there’s a huge export opportunity,” says Prashant Vasisht, senior vice president and co-group head, corporate ratings, ICRA.

Like most industries, the Covid-19 pandemic upended supply chains in specialty chemicals, prompting global players to diversify and shift production to India.

“India’s share in the global specialty chemicals market has increased from less than 1 percent in 2000 to 4 percent as of 2024,” says Jignesh Shah, investment banking partner at Ernst & Young (EY).

Specialty chemicals now account for more than 50 percent of the chemical exports, with the sector’s growth fuelled by innovation, sustainability, and export opportunities, he adds. This global shift in supply chains has indeed directly benefited Scimplify.

“When I was in the US three years ago, companies weren’t even looking at India as an option,” Santhosh says. “Now, after all the supply chain shocks, they’re looking to diversify, and India is the only country after China that can provide that kind of scale. So now India has a seat at the table.”

One of Scimplify’s first major tests came last year, when a flame-retardant chemical—used in electronics and fire-resistant materials—was suddenly cut off from US supply chains after China restricted exports. Scimplify sourced the raw material, developed a new production technology, and partnered with an existing factory to scale manufacturing —all within three months. “Normally, shifting production like that would take at least two years,” Santhosh says.

At first glance, a chemicals startup might not seem like it has much to do with artificial intelligence (AI). Scimplify thinks otherwise. “AI has become a buzzword and an investor favourite,” Santhosh admits, “but chemicals is one of the few industries where most of the processes still operate like it’s the 90s.”

When Scimplify launched, AI was still in its early post-ChatGPT wave. “One investor told me, ‘I only want to invest in two kinds of companies—AI-first or AI-proof.’ We were the latter,” Santhosh says. “You’ll still need your medicines and agrochemicals. The question is how to make them better.”

Scimplify now uses AI to make R&D and manufacturing faster, more cost-efficient, and sustainable. “We are also using it to predict which materials could substitute others in the future.”

That flexibility—the ability to move fast and adapt—has become one of Scimplify’s biggest advantages, reflected in its growing investor interest.

The startup began with $3.6 million in seed funding and has raised a total of $53.1 million to date. It secured $9.5 million in Series A in August 2024, led by Omnivore and Bertelsmann India Investments, followed six months later by a $40 million Series B round co-led by Accel and Bertelsmann, with participation from UMI, Omnivore, 3one4 Capital, and Beenext. The company ended FY24 with a revenue of ₹18.3 crore, according to Tracxn (although it was operational only since September of the fiscal).

Vasisht of ICRA points to geopolitical and macroeconomic risks as some of the key challenges for the sector. In agrochemicals, for instance, “the raw material dependence on China is quite high, so is dumping by that country”. “There’s also a lot of vulnerability to container shipping rates,” Vasisht adds.

EY’s Shah says new-age ventures like Scimplify, Mstack, and Distil are “redefining chemical manufacturing through innovation and digitisation”. He adds, “The platform-led approach is bridging the gap between enterprise buyers and a fragmented network of specialty chemical manufacturers, unlocking efficiency, transparency, and speed at scale.”

Pointing to PE/VC funding from Lightspeed, Alpha Wave, Accel, and others, he notes this reflects growing interest in the model. “But the business model comes with its own set of challenges, which broadly include limited manufacturing control, supply chain vulnerabilities, and concerns around intellectual property protection, which will test how resilient and scalable these business models can be,” Shah says.

However, for the founders, the bet is simple—India’s base of chemical manufacturers has the talent and technology to be competitive globally. It just needs a bridge of trust and efficiency. And that’s what Scimplify is creating.

First Published: Oct 28, 2025, 13:08

Subscribe Now