How Zoho is rewriting the rules of enterprise tech

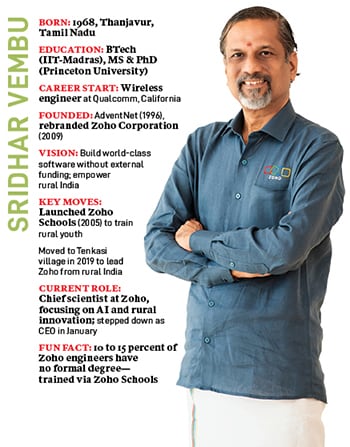

By doubling down on R&D and vertical solutions, Sridhar and Mani Vembu are ensuring Zoho’s next phase is about deepening its identity as a platform firm while embracing AI and global expansion

Three days. That’s all it took for Arattai, Zoho’s homegrown messaging app, to go from a low-key experiment to a phenomenon. In September, sign-ups shot up from 3,000 a day to 330,000—a 100-fold surge that forced the company to add infrastructure and fine-tuning code on the fly. The team had planned a big release for November—with new features and a marketing push. Instead, they found themselves in the middle of an exponential storm, working flat out to keep pace.

The trigger? A public endorsement from Union Education Minister Dharmendra Pradhan on September 24, urging citizens to adopt Indian-made apps under the Swadeshi push. Days earlier, IT Minister Ashwini Vaishnaw announced he had switched to Zoho’s productivity suite for official work. These catapulted Arattai—Tamil for ‘casual chat’—to the top of app store charts, ahead of WhatsApp and others.

Launched in 2021, Arattai now sells itself on two promises: Spyware-free and Made in India. In a market where Meta-owned WhatsApp faces scrutiny for monetising user data, Zoho pledges never to sell or mine personal information. All data stays in India, and the app remains ad-free. Its look and feel mirror WhatsApp, but with a privacy-first philosophy—and now also with end-to-end encryption for calls and direct chats.

The company has plans for a Zoho Pay integration, allowing users to make UPI payments, transfer money and pay bills within the chat interface—a move that positions Arattai as a challenger to Paytm, Google Pay and WhatsApp Pay.

Next, Zoho is embedding AI-powered features through its in-house Zia AI, offering smart replies, predictive typing and language translation. Regional language support and voice assistants are also on the roadmap to deepen adoption beyond metros. Finally, Zoho aims to integrate Arattai with its broader suite of productivity tools, creating a seamless bridge between personal and business communication.

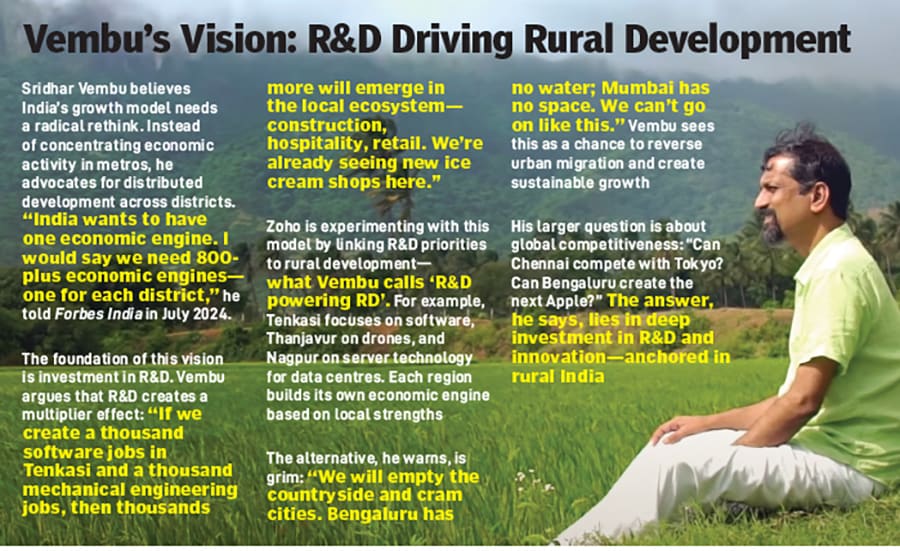

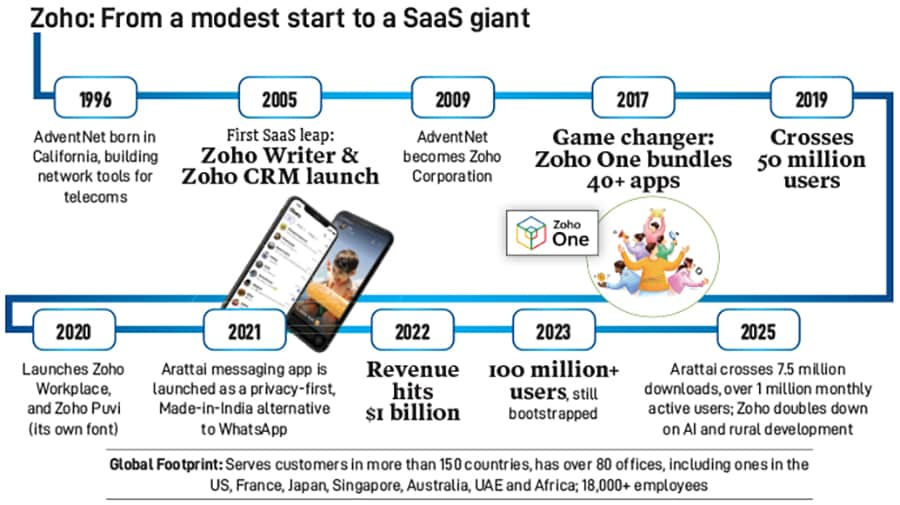

Over almost three decades, Zoho has brought to the market more than 55 products and services powering businesses globally—CRM, finance, HR, and productivity tools used by over 100 million users in close to 150 countries. With offices in 80 countries and data centres across the US, Europe, India and Australia, Zoho has built a global footprint. “We’ve been doing this for 30 years now—building in India for the world,” Vembu tells Forbes India in an exclusive interview.

The latest in this was the launch, earlier this year, of Zia LLM, Zoho’s proprietary large language model, trained in-house and tailored for specific business use cases. Zoho’s AI journey began over a decade ago, but the launch of OpenAI’s ChatGPT accelerated its push into generative AI. “About 18 months ago, internal experiments showed promising results, which led to the decision to build our own proprietary models,” says Mani Vembu, who recently took over the reins from Sridhar Vembu as CEO of Zoho.

“Most public LLMs are consumer-focussed,” says Mani. “We initially used and hosted open-source LLMs, which gave us insights into the infrastructure, investment and optimisation required. We realised that smaller models—such as 3B or 7B parameters—could be optimised for specific business use cases like summarisation across emails and support tickets without needing massive models.”

That insight led Zoho to build its own enterprise-grade LLMs. “We developed three different models—1.3B, 2.6B, and 7B parameters—each trained for specific enterprise use cases. These aren’t exposed directly to customers but are integrated into Zoho’s products via agents and prompts. This makes Zia LLM cost-efficient, power-efficient and tailored to Zoho’s ecosystem,” he says. With 32 percent year-on-year growth in India, driven largely by inbound interest from larger enterprises, Zoho is now looking to replicate its success globally.

Zoho is competing with the likes of Salesforce, Microsoft and many more in a lot of these areas. According to Mani, the key differentiator is Zoho’s no/low code tools—meaning creating apps with minimal or no traditional coding, using visual tools like drag-and-drop instead of writing complex code. He explains, “Our goal is to reduce implementation time and also decrease the learning curve. We have invested heavily in building these tools and that is helping us compete against large enterprise vendors. That is why our spend on R&D is a lot more than our spend on marketing.”

Almost all of this was B2B, shaping workflows behind the scenes. Arattai changed that—it marked Zoho’s first serious consumer-facing play, and its rise in September showed what’s possible when privacy-first tech meets a nationalistic push.

It was what happened with indigenous social media platform Koo. In early 2021, it got a massive push, including from the Indian government, and was seen as a replacement for Twitter [now x]. The company received funding from Tiger Global, Accel Partners, 3one4 Capital, Kalaari Capital and Blume Ventures. However, in July 2024, its founder Aprameya Radhakrishna announced the closure of Koo.

The platform, which once boasted 2.1 million daily active users at its peak, along with 10 million monthly active users and a significant roster of over 9,000 VIPs, including prominent personalities, faced a setback due to lack of capital that came with the funding winter.

While patriotic sentiment drives installs, sustaining engagement possibly requires more than ‘Made in India’. With Arattai too, after the initial hype came some whiplash. Downloads fell from 13.8 million in October to just about 195,000 in early November, while monthly active users dipped from 4.35 million to 4.09 million. Arattai also slipped out of the Top 100 on app stores.

Vembu is not too worried. In an interview with ANI News, he said: “Nothing went wrong, this is the normal course.” He added that “the trick to companies that survive is that they have a long term… we have a 10-15-year view.”

For Vembu, it’s about building trust over time. “Think about what ‘Made in China’ meant five or 10 years ago compared to today. Hardly anyone would say China is behind on many things now.” He points to China’s rise in electric vehicles, drones, internet platforms and smartphones as proof that transformation is a process. “Similarly, ‘Made in India’ has to become a globally trusted phenomenon. We have to work for it. It doesn’t come for free; it takes years of painstaking effort and plenty of battle scars.”

After the rise in users of Arattai, Zoho faced server overload problems which led to lags, slow message delivery, app freezes and call quality issues. Users complained about chat histories failing to load. Zoho admitted it was scaling infrastructure on an emergency basis to handle the spike. All of it, for Vembu, is part of the journey. “When you’re in the heat of battle, there will always be critics—what Americans call ‘Monday morning quarterbacking’. Some will say, ‘Oh, this is made in India, so it’s poor quality’. Often, Indians themselves say that, which simply reflects low self-esteem. I ignore it and keep marching on. Keep fighting the fight.”

Professor V Kamakoti, director of IIT-Madras, says Arattai was “very good—comparable to the earlier versions of WhatsApp”. He adds that most global platforms, including Meta’s Instagram and WhatsApp or X all evolved over the years and continue to do that, basis customer feedback. “We should expect the same for our Indian tech platforms,” he says.

Zoho invested $20 million to build Zia LLM from scratch, using 256 NVIDIA GPUs. It has also opened a new R&D campus in Kerala focussed on AI and robotics, acquired Asimov Robotics, and partnered with Kerala Startup Mission to launch a Deep Tech Product Studio.

“In-house R&D is not an option, it’s a necessity to drive IP and bridge India’s long-standing gap between research and market-ready innovation,” says Vidisha Suman, partner at Kearney, a management consulting firm. But she stresses this cannot happen in isolation. The ideal model, she says, blends strong internal R&D with open interfaces, shared infrastructure, and what she calls “structured serendipity”—a system that encourages unexpected collaborations and breakthroughs.

Zoho’s strategy seems to be evolving in the right direction, and will hold it in good stead. As AI becomes integral to SaaS, companies with strong in-house R&D are better positioned to lead the next wave of innovation, says Swati Muraka, principal at Bertelsmann India Investments. “Companies like Zoho are well positioned to leverage AI in their stack since AI is a technology that SaaS companies will also use in their products to create AI features,” she says.

The edge also comes from Zoho’s commitment to building rather than buying and from its deep technical talent, which it not only acquires but also nurtures.

Vembu says he has been clear from the beginning—to focus on tapping into talent that is not widely recognised. “A lot of companies look for credentials from certain institutions, and that creates a barrier to entry. On the other hand, people complain about talent shortages. Our approach has been different—there is plenty of talent out there, and it’s our job to create and nurture it.”

Instead of filtering candidates by degrees or elite college credentials, Zoho focuses on raw potential and practical skills and nurtures it over time. That was the thought process behind setting up Zoho Schools, which are aimed at helping college graduates bridge the gap between academia and industry. Currently, about 20 percent of Zoho Corp’s talent comes from Zoho Schools.

Zoho’s next phase is about deepening its identity as a platform company while embracing AI and global expansion. “In a way, platform was the origin of Zoho. We started as a platform vendor targeting developers in the telecom space,” says Mani. Over the years, Zoho evolved from IT management to business apps, and now the focus is on making its products more extensible. This means customers can build on top of Zoho’s offerings, accelerating time to market and improving return on investment (RoI).

AI is another cornerstone of Zoho’s future. It’s embedded across its products, powering features like “best time to call” in CRM. The next step is fine-tuning integration to deliver measurable gains. “Zoho’s focus will be on ensuring customers gain actual RoI from the technology in terms of improvement in productivity and efficiency,” Mani says. Alongside AI, vertical-specific solutions will drive adoption in sectors like BFSI, automotive, and manufacturing.

Underlying all this is a principle Zoho calls continuity. “Continuity at Zoho means evolving our products to meet the changing needs of customers while staying true to our long-term values,” says Vembu. That also means prioritising human capital over financial capital—”because when people grow, products and customers thrive,” he says.

At a time when most startups are going public, the Vembu brothers are clear that an IPO is not in the pipeline. Staying private and bootstrapped has given them freedom. “We run a lot of experiments across Zoho and being bootstrapped gives us the freedom to try those experiments. Zia LLM, Arattai or Vani would not have been possible had we not remained bootstrapped,” says Mani.

Vembu adds that there is also the stress that comes with being venture-funded or public: “Many people report feeling like they’re on an endless financial treadmill. Every quarter, you have to meet the numbers. It’s drilled into you like a religious doctrine. It becomes tiresome after a while. That’s why we’ve stayed away from that treadmill. We never had to deal with that part—and I consider that a blessing.”

Over the years, was there never a temptation of wanting to sell his stake, and make money? “This is where I’m thankful to my parents and the way we were brought up. I come from a modest background. My parents always instilled in us the principle: Never covet what someone else has,” he says.

That contentment has remained with him over the years. Vembu is ranked 47th, on the 2025 Forbes India Rich List with a net worth of $6 billion—up from $5.8 billion in 2024. Despite being one of the wealthiest men in India, he has a philosophical take on wealth: “Look, I had a nice breakfast—I ate some dosas. I can’t eat 20 dosas, even if I like them. If I enjoy filter coffee, I can’t drink 50 cups. There’s a limit to everything,” he says, adding, “No matter how wealthy you are, there are only 24 hours in a day. If you can’t sleep, infinite wealth won’t help you. If your body aches, wealth isn’t the answer. Infinite wealth won’t stop my beard from turning grey.”

For him, true wealth lies in legacy: “Look at what our kings and merchants did. They built things that are still useful today—public infrastructure, temples and more. To me, that’s what wealth means: Doing something for the broader society. Build parks, dig ponds—those ponds will hold water 50 years from now. That’s the idea.”

First Published: Dec 11, 2025, 16:24

Subscribe Now