Auto sector gears up as GST slabs revised

After a weak FY26 for the automobile sector, the new GST regime may boost buying sentiment, especially in the upcoming festival season, say analysts

Just ahead of the festival season, August saw passenger vehicles (PV) sales decline as buyers stalled their purchasing decision in anticipation of the GST rate cut. Following Prime Minister Narendra Modi’s August 15 announcement on the rationalisation of GST, the wait-and-watch situation ended on September 3, when the council revised the tax slabs for various sectors, including automobiles.

FY26 started on a weak note for the industry. After the first four months of FY26, the domestic two-wheeler segment was down four percent year-on-year, while PVs were down one percent and commercial vehicles remained flat, states Aniket Mhatre, senior vice president, Institutional Research Analyst – auto and auto components, Motilal Oswal Financial Services Limited.

“Therefore, the GST cut rationalisation was a much-needed booster shot for the sector,” says Mhatre. “Given that the government has ensured that the GST rate rationalisation happens before the festive season, we expect to see a revival in sector demand from now on.”

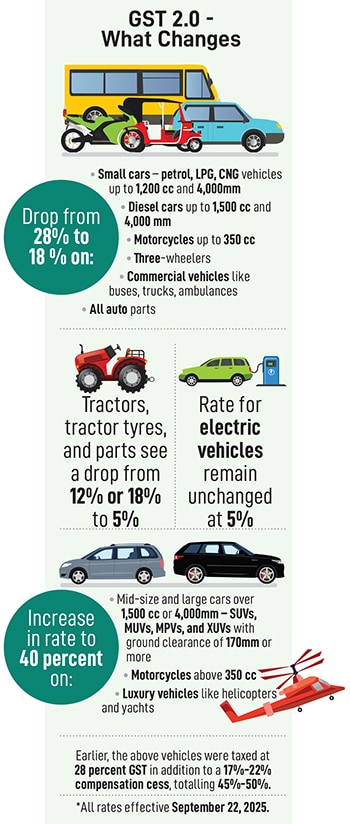

As per the announcement, effective September 22, there is a reduction in the GST from 28 percent to 18 percent on three-wheelers, ambulances, motorcycles up to 350 cc, and new pneumatic tyres. It also applies to small passenger cars, including LPG, petrol, and CNG-driven cars with an engine capacity not exceeding 1,200 cc and length not more than 4,000 mm. Even diesel cars not more than 1,500 cc and not longer than 4,000 mm are included in the same tax slab.

GST has been hiked to 40 percent from 28 percent for larger passenger cars, SUVs and high-end cars, including petrol or hybrid, and with engine capacities above 1,200 cc or length exceeding 4,000 mm. The same applies to diesel and hybrid vehicles above 1,500 cc or length exceeding 4,000 mm. Motorcycles above 350 cc, yachts, and aircraft for personal use will also fall under the same slab.

“With all parts and components now taxed at a standard 18 percent instead of a mix of 18 percent and 28 percent, vehicle manufacturing costs will come down, compliance will become simpler, and long-standing classification disputes arising from the tug of war between the two rates will be minimised,” says Sheena Kanchan, partner, Deloitte. “On the output side, reduced GST rates across most vehicle segments, barring motorcycles above 350cc, are expected to spur demand, improve affordability and give a strong sales impetus,” Kanchan adds.

Analytics firm Crisil Ratings notes that two-wheeler sales might grow by five to six percent this fiscal, while PVs may rise by up to three percent.

Given that small car sales had slowed down due to affordability issues, shortage of rare-earth minerals and deferral of purchases in anticipation of the GST rate cuts, this might provide fresh momentum for the automobile industry, especially for Maruti Suzuki and Tata Motors, according to Ashika Institutional Equities-Ashika Stock Broking, part of Ashika Group (AIE).

“In the PV segment, Maruti Suzuki and Tata Motors may emerge as clear winners, with the former seeing benefits across two-thirds of its portfolio,” stated AIE.

Maruti, the country’s largest carmaker by sales, reported an 8.2 percent year-on-year drop in dispatches to dealerships at 131,278 units, although the exports jumped 40.51 percent, according to the company’s report.

Tata Motors also reported total PV sales dipping by three percent year-on-year from 44,486 units in August 2024 to 43,315 units this year.

However, the plans to make up for the losses seem to be in place.

In a move to boost festival season buying, automobile firms, including Maruti, announced passing on the benefits to customers.

Its chairman, RC Bhargava, stated, “The 10 percent lower tax will stimulate a flagging market, and many more people will be able to buy safer and more comfortable means of mobility.” He added, “The growth of the car industry in general will also benefit from the GST system and we expect the growth rate to come back to about 7 percent a year. Manufacturing growth and employment will both benefit.”

In a similar move, Tata Motors also announced price reductions up to Rs 1.55 lakh.

“This (GST rate cuts) will make our popular range of cars and SUVs even more accessible across segments, enabling first-time buyers and accelerating the shift towards new age mobility for a wider spectrum of customers,” said Shailesh Chandra, managing director, Tata Motors Passenger Vehicles Ltd & Tata Passenger Electric Mobility Ltd, in a press statement.

Hyundai Motor India stated that 60 percent of their internal combustion engine (ICE) portfolio would now fall under the 18 percent slab rate, with the remainder at 40 percent.

“This revolutionary step will provide a strong impetus to the Indian economy, enhance buoyancy and further strengthen consumer confidence,” says Unsoo Kim, managing director.

Overall, with the GST cut fully passed on, vehicle prices are expected to drop by five percent to 10 percent (Rs 30,000 to Rs 60,000 on small PVs; Rs 3,000 to Rs 7,000 on two-wheelers, explains Anuj Sethi, senior director, Crisil Ratings.

While the GST rate cut is expected to lead to a correction in car prices and provide a much-needed fillip to the car segment, how the industry deals with compensation cess remains to be seen.

Until recently, all cars carried an additional compensation cess above the base GST—ranging from one percent for small cars to 22 percent for large SUVs. This resulted in an overall tax burden on vehicles to nearly 50 percent. With the cess now scrapped under the new regime, the total tax will be lowered considerably.

However, the dealers holding inventory, purchased under the older, higher–cess regime are facing a significant financial hit, estimated at Rs 2,500 crore, according to reports. This is because they are awaiting clarity on any mechanism for refund or adjustment for the cess already paid on unsold units.

“It remains to be seen how the industry deals with compensation cess blocked at dealer’s end along with additional credit on account of GST, which may take longer to liquidate depending upon the sales mix of low- to high-end vehicles,” says Kanchan of Deloitte.

First Published: Sep 08, 2025, 12:57

Subscribe Now