Gold prices down post-Diwali, but metal still retains its sheen

Despite recent volatility in prices, demand for gold loans expected to be strong as interest rates weaken and geopolitical tensions lead to an uncertain macroeconomic environment

The rally in international gold prices has finally lost a bit of steam, with gold prices down over five percent—its steepest daily decline since the year 2020—on profit taking, even as equity markets remained sluggish.

In recent months, gold prices, both international and domestic, were bullish due to strong demand, Gold prices in India had risen near 64 percent year-on-year to ₹131, 425 per 10 grams. International gold prices had also firmed in the first half of 2025, up 26 percent in dollar terms, before the current decline.

But the volatility in gold prices is neither puzzling nor worrisome, just distinctive. A range of factors has kept gold prices firm but volatile and analysts say that though there could be some moderation in returns in the coming months, there is little cause for concern.

A weaker US dollar (the US dollar index is down nearly eight percent year-to-date) and an uncertain global economic outlook have raised the investment demand for gold.

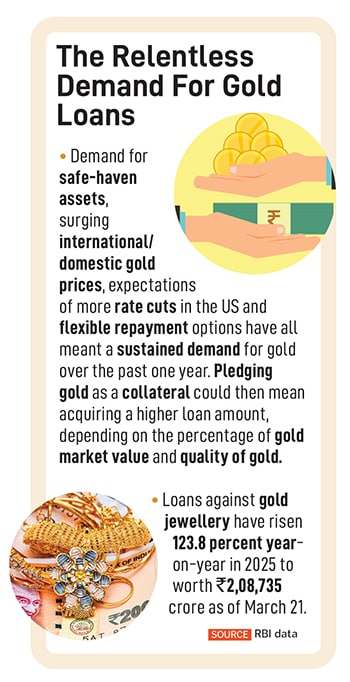

The distinctive part is that the demand for gold and rise in prices of the yellow metal have resulted in booming business for several of India’s banks, non-banking financial companies (NBFCs) and startups, which offer gold loans. A higher price for gold means a customer who wishes to avail of a gold loan can pledge a smaller amount of gold jewellery and obtain a higher loan amount, depending on the current market value and quality of gold offered as collateral.

Data from the Reserve Bank of India (RBI) reflects the extent to which customers are taking loans against gold. The RBI’s September bulletin shows that loan against gold jewellery has risen to ₹2.94 lakh crore (as on July 25), up 122 percent year-on-year. The central bank has been sending a clear signal to banks to lower their exposure to unsecured lending, which includes microfinance loans. Usually a favourite of low-income borrowers, microfinance loans have seen a drop in borrowings and a rise in bad loans.

“Now more people continue to come forward to avail of these loans, not just because it is quick and easy finance. People don’t have inhibitions pledging their gold,” says George Alexander Muthoot, managing director of the Muthoot Group of companies. The NBFC Muthoot Finance (colloquially called Muthoot Red group after a family split in 1979), which offers gold loans, personal and small business loans, claims to be India’s largest gold loan NBFC, based on gold loan AUM (assets under management). Muthoot Finance gold loan AUM in Q1FY26 stood at ₹1.13 lakh crore.

The caveat here is that the AUM of a gold-focussed NBFC is dependent on the market value of gold. Higher gold price means the value of the gold pledged with the NBFC increases, allowing it to disburse larger amount of loans against the same quantity of gold, which boosts their AUM.

George Muthoot sees the latest GST (Goods & Services Tax) moves from the government as steps that have put more income in the hands of people. This would create demand for products, including gold loans, he says.

But lending against gold—in the unorganised sector—as a practice has been devoid of governance and compliance. Lenders could charge upwards of 35 percent interest for loans against gold. As with several other segments of the economy, the gold loans business has been moving to the organised sector such as banks and NBFCs, which are keen to increase their footprint and cross-sell more financial products to new or existing customers.

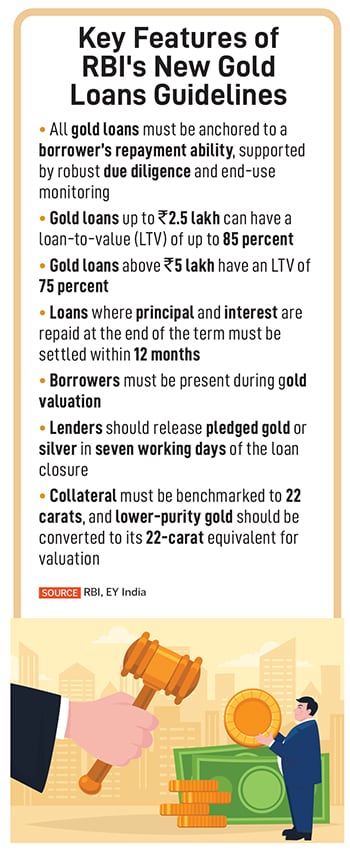

As newer players enter the organised sector, including fintechs, microfinance firms and smaller NBFCs, the RBI has been keen that lenders maintain fair business practices and improve risk assessment. EY India’s partner and head, transaction diligence, Kuldeep Tikkha, says this “framework emphasises borrower-friendly reforms, stricter conduct rules and disciplined growth”.

As per the new norms, gold loans of up to ₹2.5 lakh can have a maximum LTV (loan-to-value) ratio of 85 percent, loans between ₹2.5lakh and ₹5 lakh would have an LTV of 80 percent and above ₹5 lakh, the LTV is at 75 percent. The LTV calculation shall take into account the total amount repayable at maturity and not the disbursed amount. Tikkha says these changes aim to prevent LTV breaches and enforce consistent adherence throughout the loan tenure, in an assessment on the EY India website.

“While small-ticket loans benefit from higher LTVs, large-ticket loans may see constrained growth, particularly under the bullet repayment model,” adds Tikkha.

The RBI guidelines also define ‘bullet repayment loans’ as loans where both principal and interest are due for payment at the maturity of the loan. “The customer can accumulate the interest and pay the amount at the end of the contract,” says Shaji Varghese, CEO of Muthoot Fincorp, colloquially called Muthoot Blue group.

Gold loans compare favourably to other financial products such as personal loans, which are based on structured EMI repayments. The customer has to pay every month on a pre-decided date.

Muthoot Fincorp, like other NBFCs, has also diversified its business beyond gold loans, though gold loans continue to be the major revenue generator. “Three years ago, 98 percent of our revenue was from gold loans. We aimed to increase non-gold revenue to 15 percent in the next three years while continuing to grow our gold loan business,” Varghese tells Forbes India.

Muthoot Fincorp has achieved this and expects that, in three to five years, the 15 percent non-gold portfolio will rise to 20 to 25 percent. It hopes that its flagship business of gold loans will also continue to grow. It also offers loans against property to small businesses to either acquire a shop or for a trade modernisation or for a capital investment requirement. Digital loans is also a fast growing business.

In FY25, Muthoot Fincorp’s AUM for gold loans grew by 46 percent to ₹32,055 crore. In FY25, it made disbursements worth ₹66,277 crore, generating a growth of 32 percent. Net profit also grew by 39 percent to ₹787 crore.

In the same period, Muthoot Finance reported a standalone gold loan AUM of ₹1.08 lakh crore, a 43 percent year-on-year jump. For Q1FY26, its gold loan AUM touched a record level of ₹1.13 lakh crore. The standalone profit after tax for FY25 was ₹5,201 crore, a 28 percent year-on-year rise.

Rival Manappuram Finance reported a standalone gold loan AUM of ₹24,658 crore, up 19.3 percent. Net profit before other comprehensive income was at ₹1,783.3 crore, up 7.6 percent from levels a year earlier.

Investors have cheered the performance of gold loan companies. In the case of Muthoot Finance, its market capitalisation crossed ₹1 trillion and the stock has gained near 48 percent year-on-year to ₹3,017 at the BSE. Manappuram Finance’s market cap is now at ₹23,446 crore, the stock having gained 36 percent to Rs277 at the BSE.

The two organised gold loans giants in their conversations said they are bullish about the growth in gold loans in the coming quarters and even their non-gold portfolios. For new-age companies such as Indiagold, the business model will now need to be tweaked.

This company founded by two ex-Paytm employees-turned-co-founders Deepak Abbot and Nitin Misra had revolutionised the gold loans business by bringing the loans to customers’ homes. But, with the new RBI guidelines, after the pre-KYC onboarding and soft approval, the customer will have to visit the bank to complete the procedure, so that assaying the collateral at the time of sanctioning the loan is done in the presence of the customer at the bank.

Abbot, which has a tie-up with Shivalik Bank, has expanded its network, with partnerships with HDFC Bank, ICICI Bank, Unity SFB, Bandhan Bank and RBL Bank. Indiagold awaits a certificate of registration from the RBI, after which it will be able to create its lending book in the future.

Abbot did not want to talk about their new business model as they are still transitioning, post the new guidelines. Indiagold has completed three fundraising rounds, having cumulatively raised $23.8 million from the time of its launch of operations in 2020.

“Earlier, we were operating out of the large cities such as Hyderabad, Chennai, Delhi, Mumbai and Pune. In the last two months, we launched operations in Dehradun, Jaipur, Meerut, Rohtak, Roorkee. We’re now moving more towards smaller cities,” he says. Some of its investors include AWI (Alpha Wave Incubation), 3one4 Capital, Titan Capital, Leo Capital and Rainmatter Capital.

In terms of international gold prices, since US inflation data has come in as expected, it is increasing chances that the US Federal Reserve may continue with interest rate cuts in the coming months, which is keeping gold prices firm. Gold prices touched $3,780 per ounce intraday on September 22.

“Globally, investment demand and central bank buying are pushing gold prices higher. Festival demand for gold in India might be lower, but value-wise it will be higher than last year,” says Kaynat Chainwala, associate vice president, commodity research, Kotak Securities.

She argues that gold prices have “risen too much and too fast” over the past year. “There could be a period of consolidation, though it is not visible at this stage,” she adds. “Return expectations need to be moderated.”

That may not spell great news for local customers who may continue to scout for higher returns for the gold they pledge. But the demand for gold loans is likely to continue to be strong over the next 12 to 15 months, as interest rates weaken, and the global geopolitical tensions are enough for macroeconomic conditions to be uncertain. It is just that the tearaway returns seen last year may slacken a bit. There is still enough good news then for both traditional and new-age NBFCs and banks to build their gold loans portfolio.

First Published: Oct 22, 2025, 16:06

Subscribe Now(This story appears in the Oct 17, 2025 issue of Forbes India. To visit our Archives, Click here.)