India’s auto market finds its festive spark

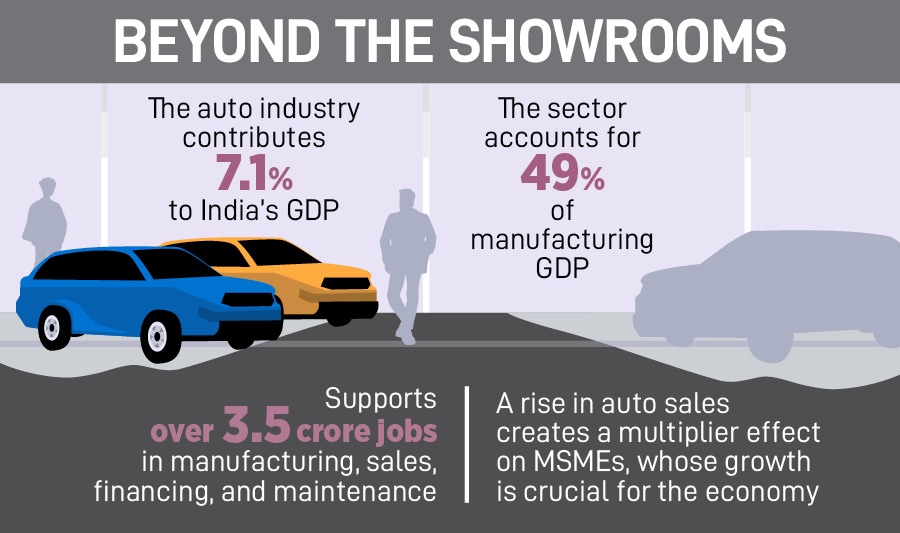

Passenger car sales have reached double digits following months of slow growth, thanks to the festive season and GST relief. Can India’s auto market keep the engine running beyond the celebrations?

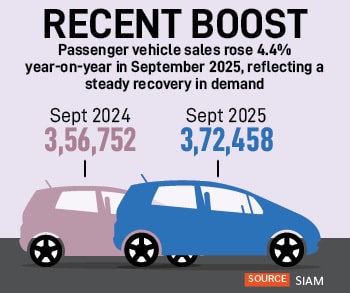

The auto industry finally has something to celebrate after a year of lull. The festive season, stretching from Navratri to Diwali, brought a rush of buyers back to showrooms, lifting sales across the country’s top automakers and providing much-needed relief to an industry that has seen sales shrinking for several months.

The Federation of Automobile Dealers Associations (FADA) expects retail sales to grow in high double digits this festive season. “We take a 42-day festive period, from Day 1 of Navratri to 15 days post-Dhanteras. The current run rate is showing 20-25 percent growth in retail (sales) over last year’s festive season,” Saharsh Damani, CEO of the dealers’ body tells Forbes India.

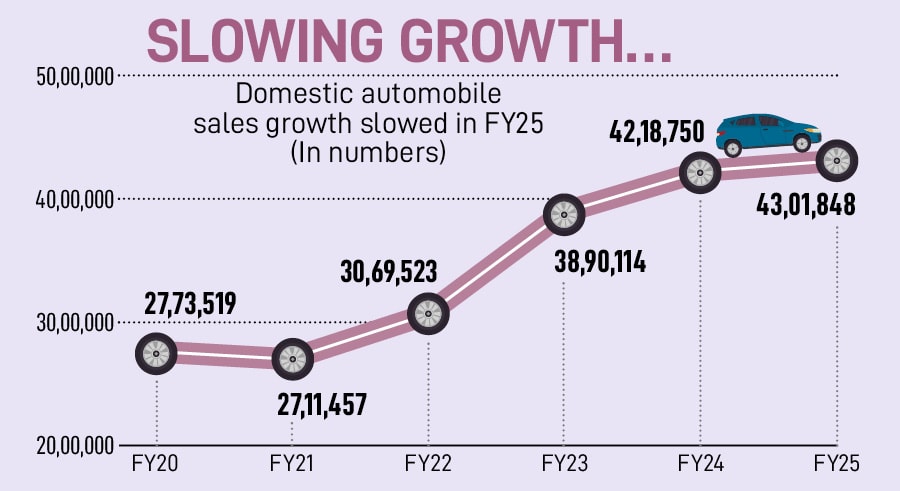

This is in sharp contrast to the story so far. In the first half of the ongoing fiscal year, passenger vehicle sales contracted by 1.4 percent to 20.5 lakh units, according to the Society of Indian Automobile Manufacturers (SIAM). Last year saw sales growth fall to a four-year low of around 2 percent.

The festive season typically accounts for 30-40 percent of annual sales in the world’s third-largest car market.

The recent surge has been driven by a mix of Goods and Services Tax (GST) cuts, pent-up demand spilling into the festive season, and an overall improvement in consumer sentiment. GST on small cars has been reduced to 18 percent from 28 percent earlier. This came into effect on 22 September, coinciding with the start of the Navratri festival.

Many buyers held off purchases until the new rates kicked in, leading to a flood of bookings once the cuts took effect.

Tata Motors Passenger Vehicles Ltd said it delivered more than 1 lakh vehicles during the festive period—a 33 percent increase from last year—with record September sales rising 60 percent year-on-year. Maruti Suzuki reported its best Dhanteras yet, expecting deliveries of 51,000 vehicles, roughly 10,000 more than a year ago.

Hyundai Motor India posted its strongest Navratri in five years, logging 11,000 dealer billings on the first day, while retail sales rose 30 percent through the season.

Automakers are also seeing consumers upgrading from two-wheelers to hatchbacks.

Maruti Suzuki says it received 4.5 lakh bookings since prices were reduced, including about 1 lakh for entry-level models. Bookings for small cars rose 70 percent in the first four weeks of the new tax regime, and their share in Maruti’s total sales climbed to 22 percent from 16.7 percent earlier.

Also Read: What's driving India's record Dhanteras car sales

Amid the cheer, a question hums in the background: can this surge sustain?

There are reasons for optimism. The income tax cuts announced in the Budget and lower interest rates have boosted disposable incomes, while the recent GST reduction has brought prices of some car models down to pre-Covid levels—all factors that could lead to a sustainable recovery in demand.

“The overall demand environment looks positive, the propensity to consume has gone up and inflation seems to be under control,” says Saket Mehra, partner and auto & EV industry leader, Grant Thornton Bharat.

“The only worrisome factor for demand in the short to medium term is the unemployment rate. If that moves up, then we would see some impact,” adds Mehra, who expects the industry to grow at around 5 percent over the long term.

The industry expects the festive momentum to sustain for some time. The wedding season begins in November—traditionally a good period for auto sales—and several carmakers have lined up new model launches for December, which could keep footfalls strong through the year-end.

Tarun Garg, whole-time director and COO, Hyundai Motor India Ltd says, “November marriage season is likely to further lift demand, while December, traditionally a strong month for retails, is expected to maintain the positive momentum.”

Hyundai forecasts India’s auto industry to grow 5.2 percent annually through 2030, while it aims to expand faster at 7 percent a year domestically.

Tata Motors, too, sees a durable recovery.

“A strong Q2 exit and early Q3 festive performance have laid a solid foundation for the rest of the fiscal,” says Shailesh Chandra, managing director and CEO, Tata Motors Passenger Vehicles Ltd. “Over the mid and long term, Tata Motors expects the passenger vehicles business to grow 1-1.2 times GDP growth.”

Industry body SIAM expects the momentum to continue into the next quarter, helped by stable macroeconomic indicators and a good Kharif harvest.

Rajesh Menon, director general, SIAM, tells Forbes India: “While the industry continues to monitor broader economic factors, the overall outlook remains optimistic with demand staying resilient across segments.”

However, some share a cautious view.

“Auto is a cyclical industry and after every 4-5 years the growth rate slows. Though this time, after the GST reduction we are anticipating a better H2 compared to H1,” says FADA’s Damani. He cautioned that an increase in vehicle prices in January, as is the norm, could hurt demand. “But if the current schemes continue to run and there is no increase, then this momentum can sustain into 2026 as well.”

First Published: Oct 27, 2025, 14:31

Subscribe Now