How Mallika Srinivasan is rebuilding TAFE

After emerging from a protracted legal battle with US agricultural machine manufacturer AGCO, Srinivasan is now leading the tractor maker with renewed vigour

It’s been a fierce few months at one of the country’s largest tractor makers. But, at the end of it all, if anything, the relentless Mallika Srinivasan and her tractor company, Tractors and Farm Equipment Ltd (TAFE), have only emerged stronger.

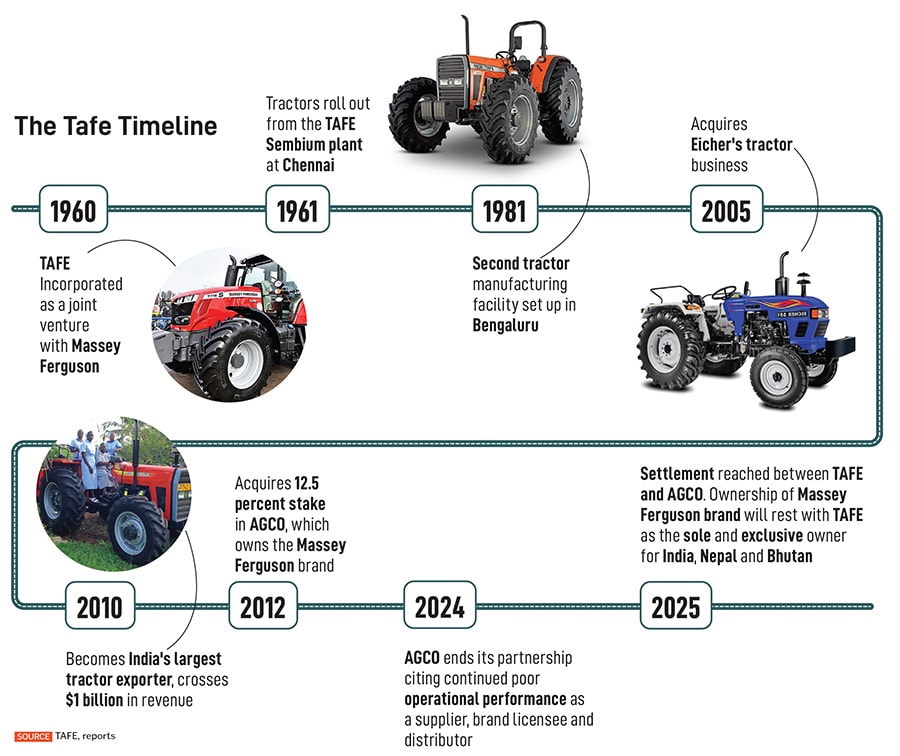

In July, after a year-long battle with American agricultural machine manufacturer AGCO, TAFE, started by Mallika’s grandfather S Anantharamakrishnan, decided that all commercial agreements between the two companies were to be terminated, with the brand ownership of the legendary Massey Ferguson tractors now firmly with TAFE for the India, Nepal and Bhutan regions.

The deal also saw all legal proceedings terminated, and TAFE agreeing to participate in future share repurchase programmes that AGCO executes, while retaining the right to maintain, but not exceed, its current ownership level of 16.3 percent. TAFE is the single largest shareholder in AGCO, the third-largest farm equipment manufacturer in the world, after Deere & Company and CNH Industrial. On the other hand, AGCO holds 21 percent of TAFE, and TAFE will now also forgo its board nomination rights, vote its AGCO shares in line with management, and abstain from activism.

In many ways, the end of the long-standing rift between the Indian tractor giant and the American agri major marks a new beginning for TAFE and Srinivasan, whose husband and son, Venu Srinivasan and Sudarshan Venu, respectively, control TVS Motors. Massey Ferguson, the brand that TAFE built and nurtured over the past six decades, contributes to 55 percent of its sales in the country. Last year, in April, AGCO announced the termination of its agreements with TAFE, including the brand licence for Massey Ferguson, leading to a legal tussle.

“In the deepest interiors of the country, the Massey Ferguson brand has an enormous following, and, for many, it’s an aspirational brand,” an industry veteran says on condition of anonymity. “Despite not being the largest tractor maker in the country, they command good brand equity. Now, with TAFE holding complete rights over the brand in India, they will be able to kickstart their journey with renewed vigour.”

Srinivasan, who also serves as the chairman of the Indian government’s selection board to pick heads of public sector units, sees enormous opportunity in how the company is now busy charting its own path without a foreign partner. “Our industry is a story of solutions for India by India. It’s a self-reliance story,” she tells Forbes India. “India is the largest tractor market in terms of tractor units. India’s farm mechanisation has been a unique model because we have small farms, and the rest of the world is much larger. But the developing world is not so industrialised.”

“TAFE is the second-largest tractor manufacturer in India, with a market share of 18 percent in FY24, after Mahindra & Mahindra—the market leader—with 42 percent share,” ratings agency Crisil said in a report. “The group’s market position is backed by its strong brand and presence in the lower and medium horsepower (HP) segments (30 to 50 HP), frequent model launches, and a wide market reach through a vast network spanning more than 1,600 dealers and 2,000 sales outlets across India.”

Also Read: Car, Samosa, Tractor: Carnot & its ride with Mahindra

Much of the trouble between TAFE and AGCO began brewing after a change in leadership at AGCO in 2020. Questions raised over some investments made by AGCO, in which TAFE had become the largest investor, led to frictions between Srinivasan and AGCO, which eventually led to AGCO questioning TAFE’s right to use the Massey Ferguson brand in India.

Massey Ferguson began operations in India in the 1960s, when the Chennai-based Amalgamations Group decided to manufacture these tractors locally. TAFE was founded as a joint venture between Massey Ferguson, a part of the AGCO Group, and Amalgamations in 1960. It was not until 1974 that the two companies entered into a trademark agreement for limited tractors. This deal was further expanded in 1994, granting TAFE the exclusive right to use the Massey Ferguson brand name for its tractor operations in India.

Today, TAFE operates four tractor brands—Massey Ferguson, TAFE, Eicher Tractors and IMT—and exports tractors to more than 80 countries in Asia, Africa, Europe, the Americas and Russia. “TAFE had a peak market share of over 23 percent in FY16, which declined to around 17 percent in FY20, before improving to around 18 percent in FY24, reflecting highly competitive intensity. Besides, tractor sales tend to rise sharply in certain regions in different fiscal years,” says Crisil.

Since its collaboration with Massey Ferguson, TAFE has spent lavishly on design, manufacturing and quality control in the country, and in the process, built the Massey Ferguson brand, selling from just about 300 tractors annually to over 100,000 tractors.

By April 2024, AGCO terminated a key business agreement with TAFE, triggering a legal battle over the use of the Massey Ferguson brand. TAFE, which had long held a licence to manufacture and sell the brand in India, challenged the termination in court and secured interim relief from the Madras High Court. “This decision followed extensive discussions with TAFE over multiple years concerning TAFE’s continued poor operational performance as a supplier, brand licensee and distributor to AGCO, as well as TAFE’s continued lack of focus on AGCO customers in several key markets,” AGCO had said then.

As a result of the termination notices, TAFE subsequently commenced litigation against AGCO in India. Over the next year, various court filings and statements from the leadership revealed AGCO’s discomfort with TAFE’s growing stake, making it the US firm’s largest shareholder.

TAFE acquired the shareholding in AGCO Corporation in 2012, becoming its single largest shareholder and a strategic long-term investor. “As TAFE’s strategic influence increased, rather than address issues plaguing AGCO that have repeatedly called attention to, including flaws with AGCO’s corporate governance, wholly inadequate engagement with shareholder and financial and operational performance in key areas, AGCO sought to stifle TAFE’s ability to seek changes through contentious and ill-advised moves with respect to brand usage that has for over six decades been an uncontested area,” TAFE had said in a statement.

The friction extended beyond shareholding. TAFE had also pushed for governance reforms at AGCO, including a proposal to split the roles of chairman and chief executive officer—both held by Eric Hansotia. TAFE’s concerns were also detailed in a letter to AGCO shareholders dated September 30, 2024, in which the Indian firm criticised AGCO’s strategic direction, citing missed market opportunities, failed acquisitions and rising costs.

By February 2025, the Madras High Court had decided to maintain the status quo, permitting TAFE’s interim use of the Massey Ferguson brand in India until the issue of brand ownership in India was finally decided. In July, both companies came to an amicable settlement.

With the Massey Ferguson brand firmly under its control, Srinivasan has now set big ambitions for TAFE.

“I have to build value for the future generations, and I have to make sure the company has enough avenues for growth and not get stifled for growth,” she says. “Today, the export market is growing faster than the domestic market. We’re expected to double our growth in three years. This year, we will end up doing about 2,00,000 tractors in domestic and export together.”

The absence of a joint venture and licence with AGCO also means the company is now free to offer its own technology. “Now we are free to offer whatever technology we can,” Srinivasan says. “Our cab tractors are doing very well with guidance systems, we have auto steer tractors, and we’ve got farm management systems that we are partnering with.”

India’s tractor segment has seen a robust performance, with wholesale volumes reporting a significant 28.2 percent year-on-year growth in August. According to ratings agency ICRA, tractor volumes are estimated to grow at a moderate pace of 4 to 7 percent in FY26. “This growth is firmly backed by above-normal monsoon, which is expected to support agricultural production,” ICRA said in a report. “The early onset of monsoon has led to the country receiving rainfall at 108 percent of the long-period average until September 17. Consequently, tractor demand remained strong in August, with retail volumes rising by 30.1 percent year-on-year, driven by positive farmer sentiments and adequate rainfall.”

It has also helped that the government has reduced GST on tractors by 5 percent, giving an impetus to sales. “From the Indian manufacturing base, India is cost competitive today,” Srinivasan says. “We are playing in the right segment, with the right technology, and with our own market initiatives.”

This also means a focus on newer frontiers, such as rice transplanters and track harvesters. The company has a strong presence in the western region, and Srinivasan is actively seeking to expand. Besides tractors, TAFE and its subsidiaries have diverse business interests in areas such as farm machinery, diesel engines and generators, agro-industrial engines, engineering plastics, gears and transmission components, hydraulic pumps and cylinders, vehicle franchises, and plantations.

In 2005, TAFE had also acquired Eicher’s tractors, gears, transmission components and engines business through a wholly owned subsidiary, TAFE Motors and Tractors Limited. This year, Srinivasan’s daughter, Lakshmi Venu, was appointed the vice chairman of the company, signalling a clear succession plan. Earlier, Srinivasan and her husband Venu, along with Lakshmi and son Sudarshan, had drawn up a succession plan that would see Sudarshan look after TVS and Lakshmi TAFE.

Between them, the family had signed a Memorandum of Understanding under which Sudarshan and entities under his control will not use specific trademarks, including ‘TVS’ for businesses related to aluminum and magnesium die casting and agricultural machinery. Likewise, Srinivasan and Lakshmi had agreed not to use the ‘TVS’ trademark in the two-wheeler and three-wheeler businesses, financial services, and real estate. Lakshmi and Mallika are to also stay out of the two-wheeler and three-wheeler vehicle sectors for a specified period.

All that means Srinivasan is now firmly in total control of TAFE, and the plan is to push through as hard as possible, growing its revenues significantly from ₹13,700 crore annually. “In the overall tractor market, consolidation is complete now,” Srinivasan adds. “At the moment, I think it’s a stable composition. I don’t know what the future holds, but we are ready for a good, exciting journey, which can be both organic and inorganic.”

First Published: Oct 14, 2025, 10:00

Subscribe Now(This story appears in the Oct 17, 2025 issue of Forbes India. To visit our Archives, Click here.)