It’s October 3, and only a few hours since the country’s fourth largest automaker, Mahindra, opened bookings for its much-anticipated SUV, the Thar Roxx, a five-door variant of its hugely popular SUV, the Thar. The Thar, launched in 2020, came with three doors and has, in many ways, been the cornerstone of Mahindra’s automotive rebirth after a few years of scraping the bottom.

“There’s been a mass hysteria," Jejurikar, the 60-year-old executive director and CEO for auto and farm equipment at Mahindra & Mahindra, says about the response to the Thar Roxx, without divulging the booking numbers. Two years ago, the company had stunned the Indian automobile sector, amassing over a lakh bookings in half an hour for the next-generation variant of its immensely popular SUV, the Scorpio. The Thar Roxx, launched on August 15, seemed on course to set the charts on fire.

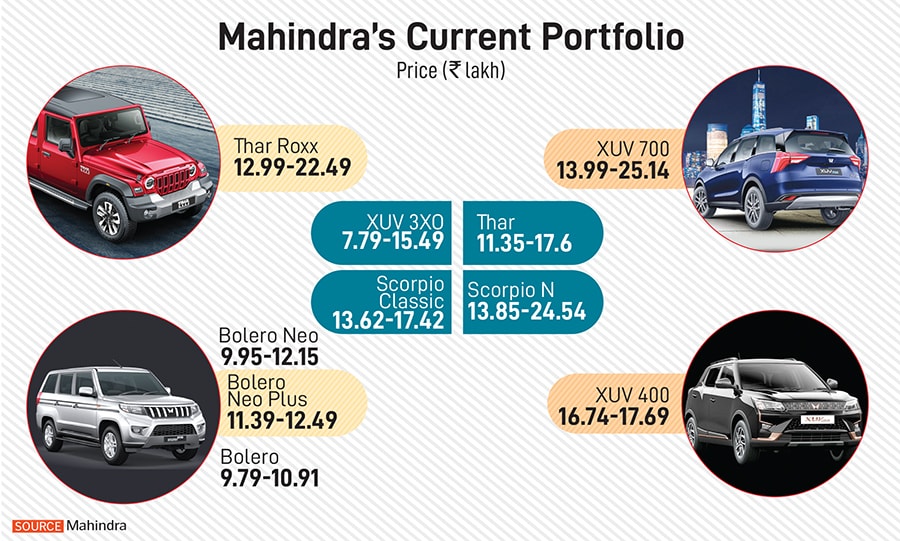

A few hours after our interaction, Mahindra once again startled the country’s automobile sector by announcing that the Thar Roxx, which carries a price tag of between ₹12.99 lakh and ₹22.49 lakh, mopped up 176,000 bookings in an hour. At an average price of ₹17.75 lakh, that means the company looks set for potential revenues of ₹31,240 crore from selling the Thar Roxx alone.

For Mahindra, the numbers are certainly a record, and perhaps even for the country’s automobile annals, with no automaker having recorded such numbers in recent history. “Excited, and humbled," Jejurikar later told Forbes India about the record-breaking booking numbers. “It puts a lot of responsibility on us."

Anand Mahindra, the chairman of the 79-year-old Mahindra Group, took to social media platform X to express his disbelief at the numbers. “Despite all my confidence, this exceeds my wildest expectations," he wrote on the microblogging site. “A big thank you to every customer we have ever had for helping us to build this brand and lodge it deep in your hearts."

![]()

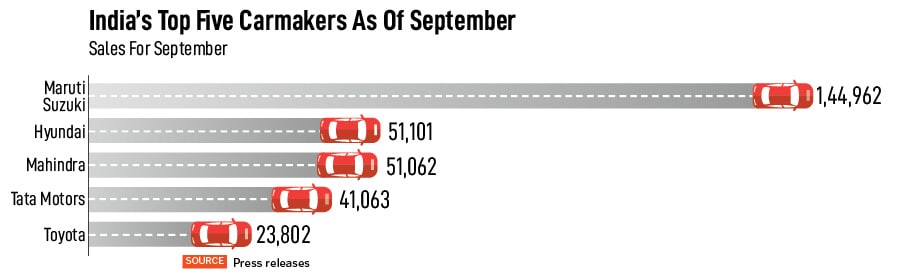

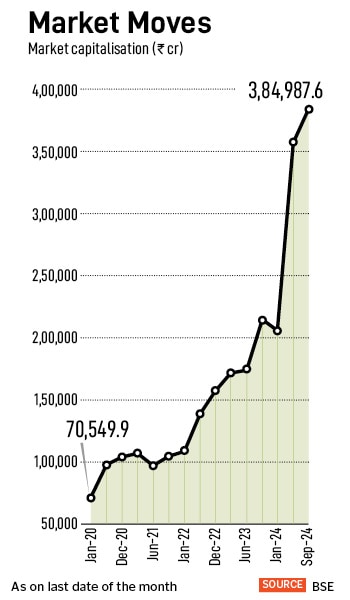

Financials aside, the recent booking numbers are almost certain to redraw the pecking order in the Indian automotive industry, where Mahindra has been closely following Tata Motors for the third position. With the record-breaking order book for the Thar Roxx, the company now has a shot at the second position in India’s automobile industry, dethroning Korean automaker Hyundai, which has for many decades remained India’s second-largest carmaker.

In September, Mahindra overtook Tata Motors for the first time during the current financial year to emerge as India’s third-largest carmaker, and significantly closed the gap to Hyundai.

“Mahindra’s products are consistently in high demand and topping the consideration list for most buyers," Puneet Gupta, director at S&P Global Mobility, says. “Their vehicles are not only popular but also dominate the respective segment. Each model has evolved into a formidable brand on its own."

“Their vehicles are like those rugged jeans," Vinay Piparsania, principal and founder at automotive consultancy firm MillenStrat Advisory & Research, says about Mahindra. “You can take it wherever you want, and it also has that machoism about it. Its rivals are more of the crossover types of vehicles, like suits that are more urbane. They have some adventure ability, but you don’t want to get them dirty."

Thar, rewriting legacy In many ways, the turnaround at Mahindra finds its roots in the Thar, a model that the company launched in 2020.

![]() A decade before that, the company had introduced the first generation of the Thar, named after the Thar desert of Rajasthan. The model took after the iconic Jeep CJ series that Mahindra had been manufacturing since 1948 but lacked numerous features, such as airbags, alloy wheels, and even anti-lock braking systems, among many others.

A decade before that, the company had introduced the first generation of the Thar, named after the Thar desert of Rajasthan. The model took after the iconic Jeep CJ series that Mahindra had been manufacturing since 1948 but lacked numerous features, such as airbags, alloy wheels, and even anti-lock braking systems, among many others.

The new Thar introduced in 2020 was a tectonic shift from the old with the company choosing to bring a contemporary and imposing design, the latest infotainment options, an automatic gearbox that appeals to an urban clientele, and refreshed engines, among a slew of changes. For the first time ever, Mahindra also packed a petrol engine in the SUV. The first Thar was sold at an auction for a staggering ₹1.1 crore, the proceeds of which went to a Covid-19 relief fund.

The model struck a chord in urban and rural India, and everybody from celebrities to youngsters began lining up to buy the Thar, with waiting periods stretching to a year. In the process, the Thar also built up a category for itself, at a time when automakers were busy developing models to fit into certain categories and segments.

“Thar represents the core of our brand," Jejurikar explains. “What had happened over time is that we had not upgraded the product for it to be mainstream. The product needed technologies, sophistication, ride quality and refinement." The Thar three-door was launched at ₹9.8 lakh, going up to ₹13.75 lakh.

Since then, the vehicle has clocked sales of nearly 200,000 units, no mean feat, considering two years were spent during the Covid-19 era and Mahindra’s own struggle with capacity constraints amidst a global semiconductor shortage. The three-door version was also a dampener of sorts for families, who were used to four-door sedans or five-door hatchbacks.

![]() It’s into this equation that the company has brought in the Thar Roxx which will feature five doors, and a host of other features such as a panoramic sunroof, twin HD screen, ventilated and powered seats, 360-degree surround view system, and Harman Kardon speakers. Its competition in the price bracket includes the likes of the Maruti Suzuki Grand Vitara, Hyundai Creta, Kia Seltos, Volkswagen Taigun and Honda Elevate, all of which don’t match the rugged-yet-urbane and chic design of the Thar or the Thar Roxx.

It’s into this equation that the company has brought in the Thar Roxx which will feature five doors, and a host of other features such as a panoramic sunroof, twin HD screen, ventilated and powered seats, 360-degree surround view system, and Harman Kardon speakers. Its competition in the price bracket includes the likes of the Maruti Suzuki Grand Vitara, Hyundai Creta, Kia Seltos, Volkswagen Taigun and Honda Elevate, all of which don’t match the rugged-yet-urbane and chic design of the Thar or the Thar Roxx.

“With the Thar three-door and now the Thar Roxx, if I can get them at the price of any other competing SUV or C-segment car, why would you buy something that is me too?" Jejurikar asks. The Thar, which calls itself a lifestyle and adventure SUV, hasn’t quite had a direct rival in its category, with the Thar Roxx’s nearest competitor being the Maruti Suzuki Jimny, which has had its own fair share of struggles since its launch. If anything, the Thar Roxx and Thar could only cannibalise themselves, something Jejurikar says is very unlikely.

“A year or two back, one of our dealers told me that you will get a very big booking when you launch the five-door," Jejurikar says. “He said for everyone who has booked or bought a Thar three-door, there are at least three people who are either friends or relatives waiting for a five-door. Because they needed the second-row space." That means, Mahindra is now positioning Thar Roxx as the only vehicle for a family, while the Thar would essentially remain a second vehicle, or for those looking for adventure.

“With sales exceeding 50,000 units within two years of launch, the Thar has revived interest in Mahindra’s SUVs among a younger, lifestyle-oriented audience," Harshvardhan Sharma, head of auto retail practice at Nomura Research Institute, says. “The vehicle’s strong off-road capability, combined with modern features makes it more appealing to urban buyers. The demand for the Thar Roxx edition reflects this ongoing trend, further solidifying Mahindra’s position as a desirable brand for personal buyers who want both functionality and a sense of adventure."

![]() The Mahindra plant in Chakan, Pune

The Mahindra plant in Chakan, Pune

Covid-19: the game changer

Apart from the Thar, Mahindra also has much to thank the Covid-19 pandemic for the turnaround. It was a time when automakers globally were hit by production constraints, poor demand, and uncertainties over powertrains.

Seven days after India went into a lockdown, on April 1, Jejurikar took charge as the executive director for auto and farm equipment as part of Mahindra’s succession planning, with Anish Shah taking over as the CEO of the group a year later.

“We had to answer for ourselves and external stakeholders on what is our right to win," Jejurikar says. “After we set out our brand purpose, we made a list of things that we would not do. We didn’t want our brand to go into fleets because we wanted to create an aspirational brand value." But staying away from fleets—a large revenue churner for automakers—was also a risky proposition for the publicly traded company.

But a pipeline of three concept vehicles, designed even before Covid-19 hit, was strong enough to push forward an aggressive new path. These included the three-door Thar, the XUV700, and the Scorpio N. “As I got into my role in 2020, the challenge was how to position these and make them aspirational and accessible," Jejurikar says.

The new design language for the pipeline included a focus on what it called SUVs with unmissable presence, and adventure capability. The company also identified six pillars on which it wanted to build future products, including turn-on design, unmissable presence, tough-yet-sophisticated, safe, and sci-fi products.

![]()

Then, there was the big gamble with the pricing strategy, striking a balance between aspiration and accessibility, leading the Mahindra veteran to create a variant strategy that could cut across wide price points. That meant the Thar would retail from under ₹10 lakh to ₹17 lakh, offering numerous variants, while the XUV 700 and Scorpio would retail from ₹13 lakh to ₹25 lakh, with multiple variants in different powertrains.

“They’ve made significant strides in product innovation, features, and supply network," adds Gupta of S&P. “In recent years, they’ve also capitalised on the made in India bandwagon and rising purchasing power in the country. However, the real challenge ahead is to expand their offerings in the sub-₹15 lakh segment, which is critical for driving future growth as the India average car price is around ₹12.5 lakh."

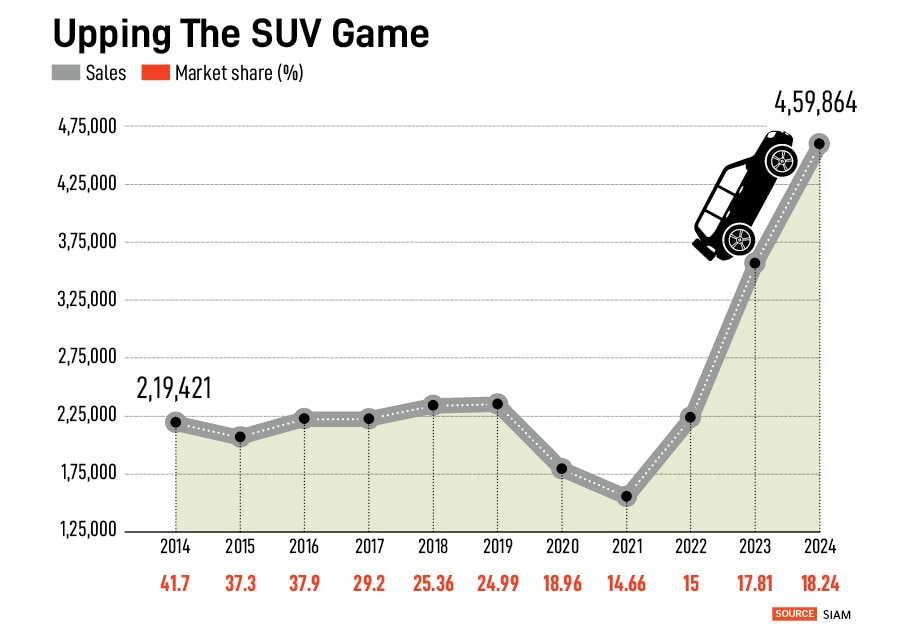

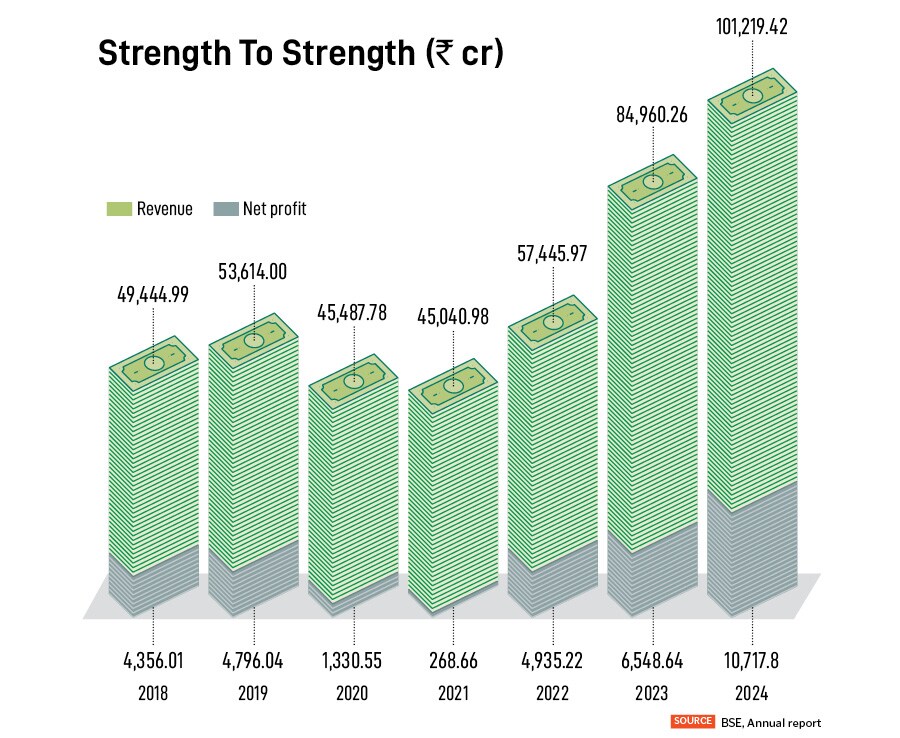

Today, Mahindra is the market leader by revenue market share in the SUV category at 21 percent. The company’s revenues in the SUV business in the last fiscal stood at ₹72,109.5 crore compared to Hyundai at ₹50,421 crore, according to UK-based consultancy Jato Dynamics. Maruti Suzuki, which had unleashed numerous SUVs through the past few years, clocked in revenues of ₹47,706 crore in FY24. For Mahindra, the weighted average per unit stood at ₹15.7 lakh compared to ₹13 lakh for Hyundai, Maruti’s ₹10.7 lakh and Tata Motors’ ₹11.7 lakh.

Models few, sales flourishing

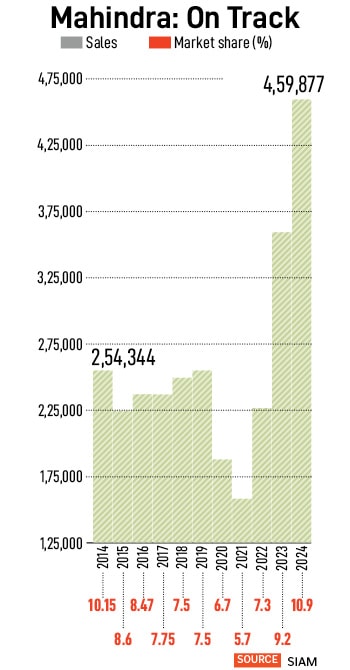

Now, with the Thar, XUV 700, Bolero and Scorpio having achieved something of a cult status in urban and rural markets, Jejurikar and Mahindra seem to be on a firm footing compared to three years ago, when it all looked quite bleak for the automaker. At that time, the company’s market share had fallen to about 5.7 percent. “The question that was being asked was what is our right to win," Jejurikar says. “We had lost share. We had a few launches, which were not as successful."

That’s why the Thar’s resounding success was critical in new launches. “If the Thar had not succeeded, it would have been very hard to say that you can create volumes in this strategy," Jejurikar says. “Niche allows you to create differentiation and, we were not going to build an ‘x’ killer or ‘x’ fighter." Jejurikar’s obvious reference was to vehicles such as Hyundai Creta and Kia Sonet among others, which have long ruled the SUV and mini-SUV category.

![]()

Today, the Mahindra portfolio only comprises SUVs such as the Thar, Thar Roxx, Scorpio and Scorpio N, XUV 700, XUV 3XO, Bolero and Bolero Neo. The company now plans to have as many as 23 new vehicles over the next seven years, spending a staggering ₹37,000 crore over the next three years. These include nine internal combustion engine (ICE) SUVs, seven battery electric vehicles (BEV), and seven light commercial vehicles.

“Mahindra’s product portfolio is smartly positioned around SUVs, which is the fastest-growing segment in India. SUVs accounted for nearly 42 percent of total passenger vehicle sales in FY23, up from 29 percent in FY18, highlighting Mahindra’s foresight in focusing on this category," says Sharma of Nomura. “The XUV 700 and Scorpio have seen impressive demand, with the XUV 700 booking over 100,000 units within the first few months of its launch."

“We continue to have an aggressive approach," Jejurikar says. “We believe that we need to increase capacities, a strong ICE portfolio while also building the electric strategy." In 2025, the company intends to launch three new electric vehicles (EV) that the company reckons will reshape the Indian EV ecosystem.

Alongside, it’s also not shying away from hybrids, if need be, even though the focus largely remains on EVs. There too, much like its success with Thar, the company will focus on building a category for itself than go after existing products. “It’s not going to be sold as an economical solution to buy electric," Jejurikar adds.

Still, the company’s business is heavily reliant on diesel engines, with as much as 54 percent of its total sales in diesel powertrains, a sharp contrast to the domestic market which has moved to petrol or hybrids. “Mahindra’s strong reliance on diesel engines poses a serious risk if government policies or the consumer turn against diesel," cautions Gupta of S&P.

![]() Last year, the company had said that Singapore-based sovereign fund Temasek had invested $145 million (₹1,200 crore) in Mahindra Electric Automobile Limited, the four-wheeler passenger EV company of the automaker, valuing the arm, set up in October 2022, at a staggering $9.8 billion. That had made the arm India’s most valuable EV company.

Last year, the company had said that Singapore-based sovereign fund Temasek had invested $145 million (₹1,200 crore) in Mahindra Electric Automobile Limited, the four-wheeler passenger EV company of the automaker, valuing the arm, set up in October 2022, at a staggering $9.8 billion. That had made the arm India’s most valuable EV company.

“Although Mahindra has lagged in the EV race compared to Tata Motors, which holds a 71 percent market share in the Indian electric passenger vehicle segment, it has the potential to catch up quickly with its five upcoming EV models," says Sharma of Nomura.

Mahindra’s new range of electric offerings includes the e XUV.e8 and Born Electric (BE) range, which are set to launch in late 2024 and 2025. Last year, Mahindra showcased its production-ready version of the BE 05, which derives almost 90 percent from its concept version, which when launched could shake up the domestic electric market if Mahindra prices it well.

![]()

Currently, Mahindra’s only EV is the XUV400, with a claimed maximum driving range of 456 km, and which sells less than 500 units a month. The vehicle was launched in January last year. Rival Tata Motors has had a head start and is currently selling more than 4,000 units a month with its portfolio, comprising the Nexon, Tiago and Tigor, cornering nearly 65 percent of the market.

“Mahindra’s focus on larger electric SUVs will be key, as this segment is less crowded and offers higher margins," adds Sharma. By 2030, about 40 to 45 percent of all two-wheelers and 15 to 20 percent of all four-wheelers (passenger vehicles) sold in India will likely be electric, according to a report by Bain & Co, while the government wants EV penetration to hit 40 percent for buses, 30 percent for private cars, 70 percent for commercial vehicles, and 80 percent for two-wheelers. Still, affordability remains a key constraint when it comes to mass adoption in a market that’s well-known for being price sensitive.

Partnership pro

Critical to its success in the electric vehicles space is also a partnership that the company has stitched with the world’s second-largest automaker, Volkswagen.

According to the agreement, Volkswagen will supply components of its EV platform, MEB, for Mahindra’s EV platform INGLO. The supply agreement will run over several years and has a total volume of about 50 GWh over its lifetime. The VW Group is currently building three giga factories in Germany, China, and Spain.

![]()

Since then, rumours are rife that Mahindra could possibly purchase as much as a 50 percent stake in Volkswagen’s India business, Skoda Auto Volkswagen India, valuing the deal at $1 billion. There are also reports that the groups are in advanced stages of forming a 50:50 joint venture to share costs, technology and vehicle platforms for future product development.

“At that time (supply chain agreement with Volkswagen), we also said that we would explore other opportunities for synergy or collaboration with the VW Group and that is a conversation that we’ve said is on, and there’s no meaningful outcome of that," Jejurikar says.

In 2021, Mahindra had called off a deal with American automotive giant Ford to set up a joint venture for future development. Soon after, Ford left India, after running deep into losses. But with Suzuki and Toyota stitching a global partnership, Mahindra believes that the future of mobility now centres around partnerships. Since Toyota and Suzuki signed a partnership, the India arm of Toyota has had a phenomenal turnaround in its business, with new models and multiple powertrains.

“Partnerships in the automotive space are going to be a thing," Jejurikar adds. “Every OEM (original equipment manufacturer) will have to explore this very seriously. Because there’s such rapid change in technology, every OEM will need a partnership of some kind to be able to create a large portfolio for the customers."

A partnership with Volkswagen also strengthens Mahindra’s ambitions to ramp up its global play, with markets such as South Africa, Australia and the US now emerging as potential markets for the automaker. The company currently exports its products to 30 countries and had last year launched a Scorpio-based pickup truck targeting the global markets.

![]()

Still, capacity continues to be a problem, even though the automaker has been steadily ramping it up. “In 2021, we were selling between 18,000 and 20,000 SUV units a month," Jejurikar says. “In September, we crossed 50,000 units. So, we’ve seen significant growth and that’s come out of creating capacity and bringing down waiting periods."

Even then. Mahindra knows that the overwhelming demand for the Thar Roxx will once again put pressure on supply and highlight the production constraints of the automaker. Mahindra currently has three manufacturing facilities for its automobile business, with one more in Bengaluru for its EVs. “The Thar Roxx demand may be way beyond that capacity, and that’s something we’ll have to address as we go forward," Jejurikar adds. The company is currently in the midst of raising its production capacity to 64,000 units per month by March 2025, before scaling it up to 72,000 in the year after.

“There have been significant waiting periods for models like the XUV 700 due to supply chain issues," says Sharma of Nomura. “ Addressing this is crucial for customer satisfaction." That’s also perhaps why Mahindra has been paying significant attention to their dealers, the crucial link to customers. Last year, the company had emerged second on the list of automotive dealer satisfaction according to a study by the Federation of Automobile Dealers Association. Mahindra stood second only to JSW MG Motors.

All that means, for now, Jejurikar and Mahindra will continue to push forward with a strategy that’s close to their heart: To wow the Indian consumer with products, power-packed with features and thrill to drive. “If we are going to create wow products for customers, the rest of the business strategy will follow," Jejurikar says.

So far, that strategy has reaped rich dividends. And in that, the top step for the automaker may not be very far away, in India’s rapidly changing automotive landscape.

A decade before that, the company had introduced the first generation of the Thar, named after the Thar desert of Rajasthan. The model took after the iconic Jeep CJ series that Mahindra had been manufacturing since 1948 but lacked numerous features, such as airbags, alloy wheels, and even anti-lock braking systems, among many others.

A decade before that, the company had introduced the first generation of the Thar, named after the Thar desert of Rajasthan. The model took after the iconic Jeep CJ series that Mahindra had been manufacturing since 1948 but lacked numerous features, such as airbags, alloy wheels, and even anti-lock braking systems, among many others. It’s into this equation that the company has brought in the Thar Roxx which will feature five doors, and a host of other features such as a panoramic sunroof, twin HD screen, ventilated and powered seats, 360-degree surround view system, and Harman Kardon speakers. Its competition in the price bracket includes the likes of the Maruti Suzuki Grand Vitara, Hyundai Creta, Kia Seltos, Volkswagen Taigun and Honda Elevate, all of which don’t match the rugged-yet-urbane and chic design of the Thar or the Thar Roxx.

It’s into this equation that the company has brought in the Thar Roxx which will feature five doors, and a host of other features such as a panoramic sunroof, twin HD screen, ventilated and powered seats, 360-degree surround view system, and Harman Kardon speakers. Its competition in the price bracket includes the likes of the Maruti Suzuki Grand Vitara, Hyundai Creta, Kia Seltos, Volkswagen Taigun and Honda Elevate, all of which don’t match the rugged-yet-urbane and chic design of the Thar or the Thar Roxx.

Last year, the company had said that Singapore-based sovereign fund Temasek had invested $145 million (₹1,200 crore) in Mahindra Electric Automobile Limited, the four-wheeler passenger EV company of the automaker, valuing the arm, set up in October 2022, at a staggering $9.8 billion. That had made the arm India’s most valuable EV company.

Last year, the company had said that Singapore-based sovereign fund Temasek had invested $145 million (₹1,200 crore) in Mahindra Electric Automobile Limited, the four-wheeler passenger EV company of the automaker, valuing the arm, set up in October 2022, at a staggering $9.8 billion. That had made the arm India’s most valuable EV company.