Tata Motors: Moving on from the Nano

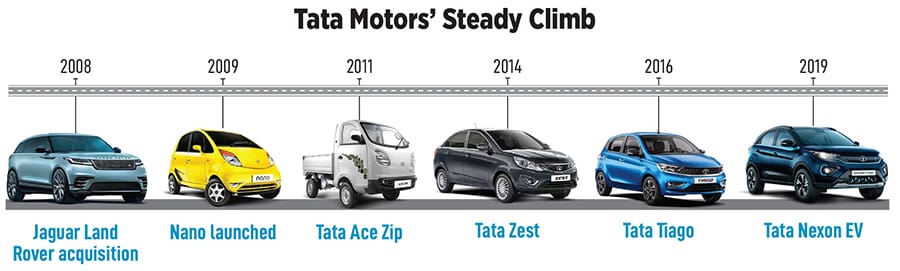

The failure of the 'people's car'—launched in 2009—was a tiny blip in Tata Motors' successful journey to becoming a global auto company

At the March 2009 launch of the Tata Nano, the number of people who expected the car to bomb stood at zero. Instead, concern for India’s leading auto company was centred around the expensive Jaguar Land Rover acquisition and the global financial crisis that had caused sales to crater. The Nano was widely expected to act as a ballast to cyclical truck sales.

The launch party at Mumbai’s Taj Mahal Palace Hotel gave further credence to the view that the company’s time had arrived. Despite its global footprint, Ratan Tata saw the company for the Indian consumer first. Later that evening, Ravi Kant, the then-managing director, announced the Nano’s price at ₹100,000 ex-factory. (The car was to be initially made at their facility at Pantnagar in Uttarakhand.) Initial bookings got off to a flying start and stood at 200,000 units. Tata Motors collected ₹2,500 crore and it was a clear case of ‘well begun is half done’.

But the initial boost proved to be short-lived. According to Hormazd Sorabjee, an auto expert who tracked it, the car was a marketing failure. “It should have been marketed as a smart entry-level car and not as an upgrade to a scooter." The car was spacious and had a lot going for it, but people didn’t want to be seen associated with something that sold for its price alone. After a few years of desultory sales, the company announced plans to stop production in 2019. The last car was delivered in 2020.

In hindsight, the loss of the Nano proved to be a blessing in disguise and allowed the company to focus on its two most profitable franchises—the truck business in India and Jaguar Land Rover. Both were run independently and allowed Tata Motors to post stellar results in the last 15 years. As a result, its stock price has compounded at 41 percent a year over the last five years taking its market cap to ₹383,000 crore. The business is now the second-most valuable in the group behind Tata Consultancy Services, but ahead of Tata Steel and Titan.

A large part of the turnaround is on account of the focus on quality that was put in place during the tenure of Guenter Butschek. The business went through a round of restructuring between 2016 and 2020, and lost money between 2019 and 2022. This was also the period when truck sales were subdued. More recently, sales of entry-level cars like the Alto have taken a hit with consumers preferring to buy mid-size cars. It is in this range that Tata Motors has a large set of offerings—from the Tiago to Altoz and Tigor.

The current market enthusiasm is also on account of the strides the company has made in the electric vehicles (EV) space. Its Nexon EV is the top-selling car in India. Its early-mover advantage has given the company a 70 percent share of the Indian EV market.

The EV business is valued at about a fourth of its total market cap with TPG Rise and ADQ investing $1 billion for 11 to 15 percent stake in the company at a valuation of $9.1 billion. Clearly, investors are assigning a higher multiple for the fact that the company has a strong start in a technology of the future.

At Jaguar Land Rover also, work on getting ready for the EV age is moving fast with the Jaguar iPace and the Range Rover electric versions making initial strides in

a competitive international market. On the other hand, sales in China, a key market for Jaguar Land Rover, have slowed.

In the end, the demise of the Nano didn’t hurt Tata Motors. If anything, the company benefited from an increased focus on its core of trucks and passenger vehicles. And the Sanand plant: That was repurposed for making their popular hatchbacks like the Tigor and Tiago as well as a range of cars from the EV offerings.

First Published: May 28, 2024, 11:06

Subscribe Now