What is Purchasing Power Parity and why does it matter?

Learn about purchasing power parity and how it impacts the country’s economy. See the top 10 economies by GDP-PPP and where India ranks

Ever wonder why a McDonald’s burger costs much more in the US than in India? Of course, because people earn higher incomes on average in the US. But the technical term for this is purchasing power parity (PPP), which helps us compare the economic strength and living costs across different countries. It provides a clear picture of how much people can actually afford to purchase with their money.

According to the International Monetary Fund (IMF) data, India's GDP based on PPP is currently $17+ trillion, making it the third-largest economy globally, after China and the US. This difference highlights why purchasing power parity is such an important metric when analysing the Indian economy.

The recent estimates by the IMF also state that India’s GDP (PPP) accounts for almost 8.5 percent of the world economy, making it one of the most important metrics to analyse the country’s economic well-being.

In this post, we’ll discuss the basics of purchasing power parity, why it’s so important, and its impact on trade and the economy.

Purchasing power parity (PPP) is a widely used metric in macroeconomics that helps us compare currencies by examining what the same amount of money can buy in different countries. Instead of relying on market exchange rates, PPP focuses on a basket of goods purchased to measure economic growth and living standards more accurately.

PPP is beneficial for adjusting gross domestic product (GDP) figures, as it considers the price differences across economies. For instance, India’s nominal GDP places it lower in global rankings, but when adjusted for PPP, it ranks higher, reflecting the country’s lower cost of living.

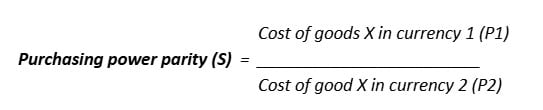

GDP-PPP is calculated using:

Using PPP, experts, investors, and policymakers can much better analyse income levels, global trade balances, and overall economic well-being.

PPP-adjusted figures provide a more balanced comparison, especially for economies like India, where nominal GDP vs. PPP tells two very different stories. Beyond economic rankings, PPP plays a key role in understanding currency value.

For a country like India, PPP-adjusted GDP places it among the top global economies. The lower cost of living means wages and services are significantly cheaper than in high-income nations. For example, a haircut in Mumbai would cost far less than in New York. This pricing gap extends to healthcare, education, and housing, among other things.

| Rank | Country | GDP-PPP (in $ trillion) | Global GDP (% share) |

| 1 | China | 41.02 | 19.29 |

| 2 | USA | 30.34 | 14.84 |

| 3 | India | 17.71 | 8.49 |

| 4 | Russia | 7.14 | 3.49 |

| 5 | Japan | 6.76 | 3.31 |

| 6 | Germany | 6.15 | 3.02 |

| 7 | Indonesia | 5.02 | 2.44 |

| 8 | Brazil | 4.97 | 2.39 |

| 9 | France | 4.53 | 2.19 |

| 10 | UK | 4.45 | 2.16 |

India ranks among the world’s largest economies, but the way its economic size is measured can vary depending on whether we look at nominal GDP or GDP-PPP.

Nominal GDP is the value of the total goods and services produced in a country at current market prices, placing India as the fifth-largest economy in the world. Indian economist and Chief Economic Advisor (CEA), VA Nageswaran, mentioned that India’s nominal GDP might cross $4 trillion in 2025. In a press release, the Ministry of Finance also estimated a 10 percent growth in nominal GDP in FY 2026.

On the other hand, GDP-PPP adjusts for price differences across countries and presents a different picture entirely. While nominal GDP matters for global trade and investment, GDP-PPP tells us about the actual purchasing power of Indian citizens and economic growth.

GDP-PPP shapes the country’s economic strategies, and here’s how it’s applied:

While purchasing power parity does offer a useful way to compare economies, it comes with several limitations:

First Published: Oct 27, 2025, 15:48

Subscribe Now