Luxury that Lasts: Homes that can be passed down generations

Luxury real estate is about homes that will serve generations, and the mantra is, ‘do not market’

When Prasant Bindal pitched Lodha Malabar to a top industrialist, he was asked, “Why would I want to move out of the house where I have lived for 67 years?” However, after he was shown the project and met the promoters, the industrialist came back and said he wanted to have the best apartment in the luxury residential project. He was promised the top floor.

One issue came in the way, though. At 10,000 sq feet, the apartment was too small for his needs. Undaunted, he bought an additional floor. Word of mouth spread, and sales started to take off.

“There was a connect from one client to the other,” says Bindal, chief sales officer of the Lodha Group. One dinner party with attendance from the who’s who of Mumbai apparently resulted in five sales.

Such projects are known to be marketed almost exclusively through word of mouth. At private parties, patrons talk about new ventures even before they are launched.

Friends introduce one another to builders. And Mumbai is rumoured to have no more than four or five brokers, or ‘channel partners’, with access to these clients.

Lodha is hardly alone in this approach. Ride uptown to Worli and you will see Oberoi’s 360 West using the same strategy. Proprietor Vikas Oberoi is said to meet every prospective owner. Buyers include Max Healthcare’s Abhay Son, Westbridge Capital’s Sumir Chadha, as well as actors Abhishek Bachchan and Shahid Kapur.

On the upper reaches of Mumbai’s tony Walkeshwar neighbourhood, Lodha Malabar consists of 36 apartments ranging from 3,800 to 11,600 square feet with sweeping sea-facing views. Once inside, concierge services take care of every imagined need of residents. A private members-only club is de rigueur even if there are only 14 families that own the entire building.

Few other details of the project are available simply because there aren’t any in the public domain. There is a perfunctory website with no phone number. As Bindal explains: “If there is one rule that is sacrosanct about selling luxury real estate, it is, ‘Don’t market.’” No ads, no emailers, and certainly no cold calling. Too much selling can prove to be the death knell.

In a market that is searching for homes that last generations, it is no surprise that this approach has found takers. According to a report by Sotheby’s and CRE Matrix, Mumbai alone saw ₹14,750 crore worth of luxury sales in the first half of 2025. Though this includes both primary and secondary sales data for units priced at ₹10 crore and above, the five-year average for the first half of the year has been ₹9,750 crore.

Three factors are driving this. The first is the increase in the price per square foot, the second is the demand for larger homes, and the third, the need to buy a home in an exclusive neighbourhood. “Post Covid, people realised that a home was as much about having a roof over one’s head as it was about psychological safety and creating generational wealth,” says Gaurav Pandey, chief executive of Godrej Properties.

The result of this has been developers continuing to launch projects at the upper end of the luxury spectrum in Mumbai, Gurgaon and Bengaluru. Some like DLF’s Privana North in Gurgaon’s southern peripheral road or DLF’s Westpark in Mumbai sold out on Day 1. Other builders prefer to take a more gradual approach by releasing their inventory in a phased manner. Both approaches work in this market. But to understand what the next three years hold for luxury, one needs to look at the market history as well as where it stands now.

To get a ringside view of the residential luxury market and where it is headed, look no further than DLF and the projects it has launched catering to this segment. There are the Camellias and Magnolias, with their 50,000 square feet club houses overlooking a golf course that give residents bragging rights. “We have seen buyers evolve and, as a company, we like to cater to this segment,” says Aakash Ohri, joint managing director, DLF Homes.

Also read: Luxury real estate: What are India's rich buying?

It was during the early days of Covid that Ohri saw a shift in the market. Amid the stories of gloom, he and three of his colleagues opened their offices on May 3, 2020 to deal with buyer queries. “People were asking if they could prepay for homes already booked. Some enquired for larger homes and others for second homes,” says Ohri. As a result, in 2021, DLF launched a project in Kasauli in Himachal Pradesh.

In those days Ohri noticed a clamour among professionals to upgrade their homes. While startup founders were willing to spend upwards of ₹50 crore on a property, someone with employee stock options in a company could afford, say, ₹20 crore. Remember, this was also the time when prices had not moved for at least half a decade. Thus, unit sales started moving.

By the end of 2020 Ohri was convinced this trend was here to stay. He saw a broadening of the pool of CXOs, lawyers, architects, and NRIs who could afford such properties. An amendment to the Income Tax Act, which placed a limit of only up to ₹10 crore to be deducted from capital gains while buying real estate, helped in driving sales.

A similar trend was noticed in Mumbai by K Raheja Corp, which has marketed and sold Raheja Vivarea and Raheja Artesia over the last decade. “Demand in this segment is getting consolidated among the top-tier developers,” says Vinod Rohira, MD and CEO, K Raheja Corp. He points to the steady demand primarily because he sees Mumbai emerging as a global city on account of the infrastructure projects in the pipeline. “Across India people aspire to have a home in Mumbai,” he says.

Rohira cautions that developing anything above ₹25 crore in Mumbai is not for the faint-hearted. The buyers, he says, are extremely knowledgeable and demanding. Secondly, a developer has to be prepared for a five- to seven-year haul where sales happen at launch and then near completion. A strong balance sheet is necessary to execute the project if sales are slow. Lastly, getting the right residents and building a community is key to the long-term success of such a project. K Raheja, which counts Deepak Parekh and Keki Mistry among its buyers, says it has successfully managed that process.

For luxury residential projects, the challenge does not end with the sale. Developers realise that maintenance is key if the building is to retain its value over time. “That is what really makes or breaks the long-term reputation of a developer,” says Vishal Bhargava, a real estate columnist. Mumbai and Bengaluru are dotted with buildings that started in a promising manner but lost their way. Developers who fail to invest in long-term upkeep risk eroding not only the value of their properties but also their reputation in a discerning market.

K Raheja makes sure that a cohesive community of buyers comes together to take over the project. Buildings that are maintained well tend to hold their value over generations. Maintenance extends beyond routine repairs. It encompasses aesthetic uniformity, prompt defect resolution, and lifestyle services that reinforce a sense of belonging. In well-run projects, discussions among residents focus less on infrastructure failures and more on lifestyle enhancements, such as pool temperature preferences or event planning. This prevents depreciation over time.

For instance, buildings like Samudra Mahal, Il Palazzo and Sterling Apartments in Mumbai charge members upwards of ₹10 per sq ft per month in maintenance. Newer luxury buildings like 360 West and Artesia charge as much as ₹20 per sq ft. Amounts can run from ₹30,000 to ₹50,000 per unit per month. But with members like Infosys founders Nandan Nilekani and Narayana Murthy, Raamdeo Agrawal of Motilal Oswal, and Anil Agarwal of Vedanta, owners are usually willing to pay.

Defects are promptly rectified, and homes maintain a uniform external facade. Gardens are well-maintained and building conversations revolve around first-world problems, such as “whether the pool temperature should be maintained at 26 degrees or 28 “, according to a resident of one of the buildings mentioned in this story. Ideally, a well-maintained building should not show its age.

Also read: Ultra-luxury real estate: Selling homes that last generations

There is an increased chatter among developers and buyers about where in the real estate cycle luxury sales reside. There is one camp that includes top builders like DLF, Lodha and K Raheja, and believes that this market is immune to cycles and that the slowdown in sales in the last decade is a thing of the past. The argument is that increased wealth creation for the top 1 percent of households in India should keep prices intact. “This time we will see sustained demand, but one could see pockets of oversupply in some micro markets,” says Sankey Prasad, managing director, India & Middle East at Colliers.

It would be foolhardy to bet against the cyclical nature of real estate and so for both builders and buyers it becomes crucial to understand where we are in the cycle. “We are definitely in the latter half of the cycle,” says Aditya Virwani, managing director of Embassy Group.

Virwani expects supply to catch up by 2027-28 and at that point, “it will be interesting to see how many are end-users and how many want to flip it.” The number of units that come on the market as secondary sales could result in oversupply even as he believes that demand from end-users is a lot higher than it was, say, five years ago.

Some say prices may have already peaked. “I expect prices to not move northward for the next three to four years,” says Ravishankar Singh, managing director, residential services, at Colliers.

Luxury projects are particularly tricky, as buyers are typically savvy and understand the supply-demand dynamics well. “Builders need to sell quickly, as they have taken on more projects than they have capital. In such a situation, you are dependent on buyer advances. But buyers prefer waiting due to the supply on stream. In such a situation it could get tricky for developers,” says Bhargava, the columnist.

Not all luxury projects in the past have been spectacular successes. For instance, Omkar 1973 in Worli, Mumbai, is a project of three towers of which one is still incomplete. In this case the developer was a victim of over leverage and didn’t have the required funds to complete the project.

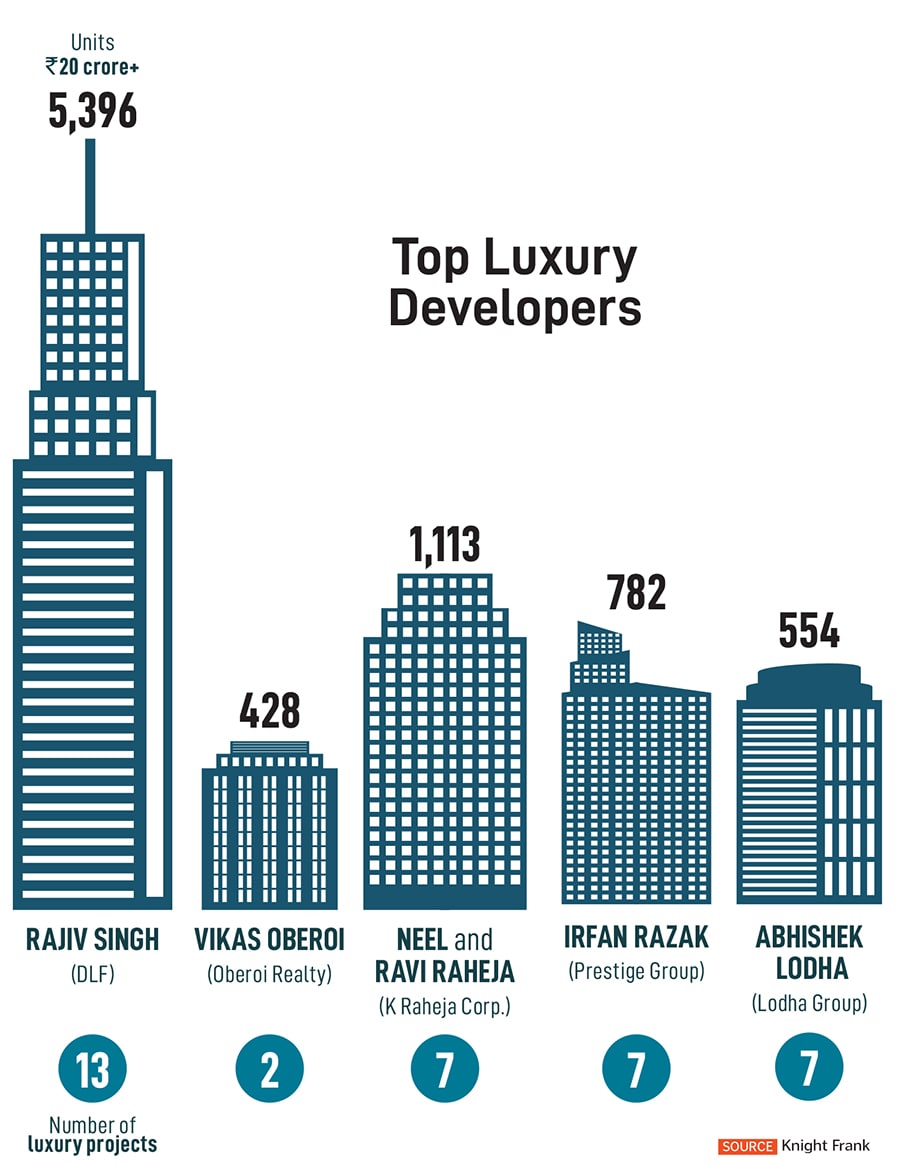

Those who have managed to make a reputation for themselves are able to close deals and deliver. Among them are big names such as Lodha, DLF, Oberoi, K Raheja Corp, and others.

“The marketing has to be through pull events. You create bespoke events and then people get interested in buying,” says Emanda Vaz, who markets luxury projects for Embassy.

Some adopt a staggered approach. K Raheja’s final deals at Raheja Artesia were at three times the price (₹100,000 per sq foot) of the initial deals. When a buyer came back to Lodha Malabar to buy another unit, the same buyer was asked to cough up 10 percent extra for the next unit. In the end he agreed, as the price of his previous property had also risen.

The trajectory of luxury real estate reflects deeper structural shifts rather than a temporary trend. High-net-worth individuals are increasingly prioritising larger homes in established enclaves, where exclusivity, long-term value, and lifestyle integration outweigh conventional investment metrics. Yet, the market’s future will depend on how developers navigate supply, pricing strategies, and community-building over the next few years.

Though data points to sustained demand in select locations, oversupply in niche segments remains a risk, especially as developers push aggressively to capture high-value clients. The affordability gap between early and late buyers, phased launches, and buyers’ preference for end-user occupancy over speculative flipping will influence pricing dynamics and absorption rates. Projects backed by financially sound developers with a long-term maintenance strategy are likely to outperform others in both retention of value and customer satisfaction.

In essence, the luxury market’s resilience lies not in unchecked expansion but in disciplined execution, trust-based networks, and a focus on post-sale experience. The coming cycle will test which developers are equipped to handle these complexities.

First Published: Oct 03, 2025, 12:41

Subscribe Now